Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

I saw Margaret Heffernan interviewed on Hard Talk about her book on a similar subject. The message was that the world isn't predictable and forecasts rarely consider the uncertainty.0

-

-

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic0 -

lolsurrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic0 -

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.

0 -

I am sure they did the analysis. To give an example we were looking at an investment product that effectively insured against falls in the stock exchange, the premium was a cap on the upside. When we asked why they were not showing us models to insure for falls of 50% plus they calmly pointed out that none of us would be sat there.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

Sounds like a banker selling a product which guarantees them a big fee.surrey_commuter said:

I am sure they did the analysis. To give an example we were looking at an investment product that effectively insured against falls in the stock exchange, the premium was a cap on the upside. When we asked why they were not showing us models to insure for falls of 50% plus they calmly pointed out that none of us would be sat there.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

Part of me feels that when future generations find out that those very clever people modelled that stuff, they will wonder why the very clever people weren't doing more worthwhile things.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

Not sure if it is more worthwhile, but clever people often go to the tech companies now rather than banking.Jezyboy said:

Part of me feels that when future generations find out that those very clever people modelled that stuff, they will wonder why the very clever people weren't doing more worthwhile things.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

We were talking to the provider and the ongoing charge was remarkably low.TheBigBean said:

Sounds like a banker selling a product which guarantees them a big fee.surrey_commuter said:

I am sure they did the analysis. To give an example we were looking at an investment product that effectively insured against falls in the stock exchange, the premium was a cap on the upside. When we asked why they were not showing us models to insure for falls of 50% plus they calmly pointed out that none of us would be sat there.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

Surely the cost is in the strike rates for the collar? I'd expect those to favour the provider.surrey_commuter said:

We were talking to the provider and the ongoing charge was remarkably low.TheBigBean said:

Sounds like a banker selling a product which guarantees them a big fee.surrey_commuter said:

I am sure they did the analysis. To give an example we were looking at an investment product that effectively insured against falls in the stock exchange, the premium was a cap on the upside. When we asked why they were not showing us models to insure for falls of 50% plus they calmly pointed out that none of us would be sat there.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

The cap pays the premium on your downside insuranceTheBigBean said:

Surely the cost is in the strike rates for the collar? I'd expect those to favour the provider.surrey_commuter said:

We were talking to the provider and the ongoing charge was remarkably low.TheBigBean said:

Sounds like a banker selling a product which guarantees them a big fee.surrey_commuter said:

I am sure they did the analysis. To give an example we were looking at an investment product that effectively insured against falls in the stock exchange, the premium was a cap on the upside. When we asked why they were not showing us models to insure for falls of 50% plus they calmly pointed out that none of us would be sat there.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

The point I'm making is that the cap can pay for the floor and a healthy profit. For example, if you were hedging the sum of two dice rolls, the floor may prevent a 2, but the cap may prevent a 12 and and 11.surrey_commuter said:

The cap pays the premium on your downside insuranceTheBigBean said:

Surely the cost is in the strike rates for the collar? I'd expect those to favour the provider.surrey_commuter said:

We were talking to the provider and the ongoing charge was remarkably low.TheBigBean said:

Sounds like a banker selling a product which guarantees them a big fee.surrey_commuter said:

I am sure they did the analysis. To give an example we were looking at an investment product that effectively insured against falls in the stock exchange, the premium was a cap on the upside. When we asked why they were not showing us models to insure for falls of 50% plus they calmly pointed out that none of us would be sat there.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

Right, I get what you are saying, you can move the line around to accomodate your level of risk and the cost on the upside. We assume our advisors would not put something in front of us that was a crock.TheBigBean said:

The point I'm making is that the cap can pay for the floor and a healthy profit. For example, if you were hedging the sum of two dice rolls, the floor may prevent a 2, but the cap may prevent a 12 and and 11.surrey_commuter said:

The cap pays the premium on your downside insuranceTheBigBean said:

Surely the cost is in the strike rates for the collar? I'd expect those to favour the provider.surrey_commuter said:

We were talking to the provider and the ongoing charge was remarkably low.TheBigBean said:

Sounds like a banker selling a product which guarantees them a big fee.surrey_commuter said:

I am sure they did the analysis. To give an example we were looking at an investment product that effectively insured against falls in the stock exchange, the premium was a cap on the upside. When we asked why they were not showing us models to insure for falls of 50% plus they calmly pointed out that none of us would be sat there.TheBigBean said:

I think they should do downside analysis to at least know how exposed they are to some events. So, for example, if you are forecasting profits from just in time manufacturing, then it would seem sensible to understand the impact of things arriving late.surrey_commuter said:

and some people pay £100 for a 3 year extended warranty on a product worth £150.TheBigBean said:

People buy insurance despite properties burning down less than once every 100 years. It really depends on what the cost is of building in some resilience.surrey_commuter said:

would be a brave management team that built resilience around a once in a hundred year eventTheBigBean said:This is something of a rant by Ryan Petersen who is the CEO of Flexport. It is an interesting point.

Do you think UK businesses should have built in resilience to cope with leaving the CU/SM at the same tim eas a global pandemic

Another example is MBSs. Some very clever people modelled the change in default rate of mortgages with underlying changes in interest rates. They completely neglected to consider the possibility of widespread defaults and the impact that would have on the underlying asset values.0 -

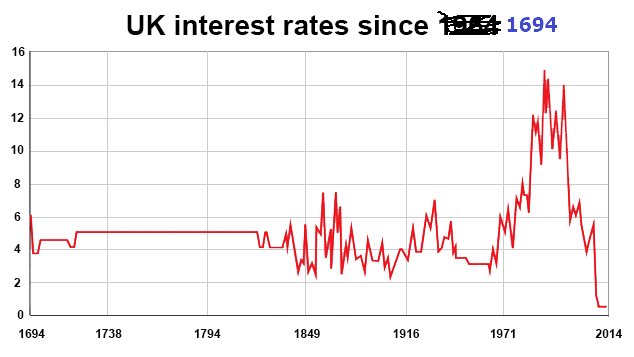

In Oct UK debt costs rose £1.8bn from £3.8bn to £5.6bn.

That means that debt costs are set to cost an extra £20bn a year. For context that is nearly double the amount raised to pretend to fix social care.

On an annual basis debt costs will be circa £70bn0 -

Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.0 -

Gone up from when? How much of it is the treasury paying to itself via the BoE?surrey_commuter said:In Oct UK debt costs rose £1.8bn from £3.8bn to £5.6bn.

That means that debt costs are set to cost an extra £20bn a year. For context that is nearly double the amount raised to pretend to fix social care.

On an annual basis debt costs will be circa £70bn0 -

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.0 -

Google reckons 68.5 bill for the cost of furlough?surrey_commuter said:

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.

Ultimately all these numbers are too big to conceptualise (for me at least). % of gdp and government spending would seem to be a much better way of looking at things.0 -

More than the cost of furloughJezyboy said:

Google reckons 68.5 bill for the cost of furlough?surrey_commuter said:

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.

Ultimately all these numbers are too big to conceptualise (for me at least). % of gdp and government spending would seem to be a much better way of looking at things.

3% of GDP

7% of all Govt spending

Half of NHS budget

Only other departments bigger are pensions, other benefits and education.

Demographics will make it hard to overtake NHS and pensions but rising interest rates should see it nail down 3rd place in the spending charts.0 -

Pfft not all that much. Though the impact of rona on the coffers is clearly bigger than the mere expenditure. How much tax was lost in the pandemic?surrey_commuter said:

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.

Did you think the pandemic was a good time to reduce the debt burden?0 -

do you really not get my point?rick_chasey said:

Pfft not all that much. Though the impact of rona on the coffers is clearly bigger than the mere expenditure. How much tax was lost in the pandemic?surrey_commuter said:

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.

Did you think the pandemic was a good time to reduce the debt burden?

0 -

That the cost of debt servicing has gone up by as much as the whole apparently mega expensive furloughing set up?surrey_commuter said:

do you really not get my point?rick_chasey said:

Pfft not all that much. Though the impact of rona on the coffers is clearly bigger than the mere expenditure. How much tax was lost in the pandemic?surrey_commuter said:

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.

Did you think the pandemic was a good time to reduce the debt burden?0 -

try and think bigger picturerick_chasey said:

That the cost of debt servicing has gone up by as much as the whole apparently mega expensive furloughing set up?surrey_commuter said:

do you really not get my point?rick_chasey said:

Pfft not all that much. Though the impact of rona on the coffers is clearly bigger than the mere expenditure. How much tax was lost in the pandemic?surrey_commuter said:

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.

Did you think the pandemic was a good time to reduce the debt burden?

My point is that you can have too much debt and you should not max out each year because there will be consequences. One canary down the mine is the amount of govt spending that goes on servicing that debt.

You always point to borrowing that is needed for essential spending. I am pointing out that they come up with creative ways to justify a higher lever of borrowing each and every year.1 -

No, I get that. I don't think you are able to come up with a credible specific point at which too much is too much. What's your take on the Japanese debt-to-GDP situation?surrey_commuter said:

try and think bigger picturerick_chasey said:

That the cost of debt servicing has gone up by as much as the whole apparently mega expensive furloughing set up?surrey_commuter said:

do you really not get my point?rick_chasey said:

Pfft not all that much. Though the impact of rona on the coffers is clearly bigger than the mere expenditure. How much tax was lost in the pandemic?surrey_commuter said:

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.

Did you think the pandemic was a good time to reduce the debt burden?

My point is that you can have too much debt and you should not max out each year because there will be consequences. One canary down the mine is the amount of govt spending that goes on servicing that debt.

You always point to borrowing that is needed for essential spending. I am pointing out that they come up with creative ways to justify a higher lever of borrowing each and every year.

I do also think you ignore the alternative scenario. What would the state of the economy be in *without* the borrowing?

0 -

focuszing723 said:focuszing723 said:

0

0 -

I think we will only know "too much" after we have passed the point of no return, by that I think things will spiral out of control.rick_chasey said:

No, I get that. I don't think you are able to come up with a credible specific point at which too much is too much. What's your take on the Japanese debt-to-GDP situation?surrey_commuter said:

try and think bigger picturerick_chasey said:

That the cost of debt servicing has gone up by as much as the whole apparently mega expensive furloughing set up?surrey_commuter said:

do you really not get my point?rick_chasey said:

Pfft not all that much. Though the impact of rona on the coffers is clearly bigger than the mere expenditure. How much tax was lost in the pandemic?surrey_commuter said:

So of the £2trn how much was furlough?rick_chasey said:Imma not let you complain about that unless you admit how successful furloughing was.

I’m all for giving the govt sh!t, but given how economically catastrophic corona was (really hard to exaggerate quite how bad) the economy is is remarkably good shape, especially once you factor Brexit headwinds too.

I get that it was roughly the same response across the west but that doesn’t mean it wasn’t amazingly effective.

Economics got a lot of sh!t after the GFC but it saved a lot of heartache and money this time round and everyone pretends like it was nothing.

Did you think the pandemic was a good time to reduce the debt burden?

My point is that you can have too much debt and you should not max out each year because there will be consequences. One canary down the mine is the amount of govt spending that goes on servicing that debt.

You always point to borrowing that is needed for essential spending. I am pointing out that they come up with creative ways to justify a higher lever of borrowing each and every year.

I do also think you ignore the alternative scenario. What would the state of the economy be in *without* the borrowing?

I don't think that borrowing to hide the effects of Brexit is a good idea because I don't think govt spending has a long term impact, ie you trun off the tap and you revert to where you were.0 -

Do you not think a more likely scenario is Britain ends up in a sort of economic purgatory like the Japanese economy?

Rather than panicking about sovereign default.0 -

more worried about an ever increasing amount of govt expenditure going on servicing debt.rick_chasey said:Do you not think a more likely scenario is Britain ends up in a sort of economic purgatory like the Japanese economy?

Rather than panicking about sovereign default.

In a similar vein I think there is trouble ahead when punters figure out how much of their council tax is used to fund pensions.1 -

It's less than the historic average on debt servicing.surrey_commuter said:

more worried about an ever increasing amount of govt expenditure going on servicing debt.rick_chasey said:Do you not think a more likely scenario is Britain ends up in a sort of economic purgatory like the Japanese economy?

Rather than panicking about sovereign default.

In a similar vein I think there is trouble ahead when punters figure out how much of their council tax is used to fund pensions.0