Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

Ha! Go on, take your victory lapTheBigBean said:RPI is 7.1%.

No one could have foreseen this.

(although it's not wage led...)0 -

focuszing723 said:

0

0 -

0

-

I feel this might be trolling SC but presumably he has spotted it already.0 -

-

Should the government just welch on its contracts?rick_chasey said:

I feel this might be trolling SC but presumably he has spotted it already.0 -

-

Your tweet implies that the government shouldn't have RPI linked debt after a decade of knowing the flaws in RPI, but many of the index-linked gilts were issued far more than a decade ago, so what should the government do?rick_chasey said:Not sure what you mean?

As it happens they going to change the calculation, but not the name in 2030. This is quite underhand and will no doubt be challenged in the courts.0 -

Ah gotcha. It's been a Chris Giles hobby horse for about 15 years, tbf. He's just point scoring, not me.TheBigBean said:

Your tweet implies that the government shouldn't have RPI linked debt after a decade of knowing the flaws in RPI, but many of the index-linked gilts were issued far more than a decade ago, so what should the government do?rick_chasey said:Not sure what you mean?

As it happens they going to change the calculation, but not the name in 2030. This is quite underhand and will no doubt be challenged in the courts.

I know SC gets upset about cost of debt servicing (and i disagree with him), so it's only fair for me to flag this stuff.0 -

Just classic FT journalism.rick_chasey said:

Ah gotcha. It's been a Chris Giles hobby horse for about 15 years, tbf. He's just point scoring, not me.TheBigBean said:

Your tweet implies that the government shouldn't have RPI linked debt after a decade of knowing the flaws in RPI, but many of the index-linked gilts were issued far more than a decade ago, so what should the government do?rick_chasey said:Not sure what you mean?

As it happens they going to change the calculation, but not the name in 2030. This is quite underhand and will no doubt be challenged in the courts.

I know SC gets upset about cost of debt servicing (and i disagree with him), so it's only fair for me to flag this stuff.0 -

Why do you keep posting this?focuszing723 said:focuszing723 said: 0

0 -

-

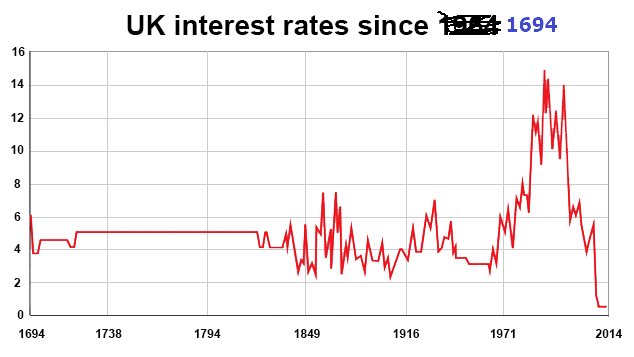

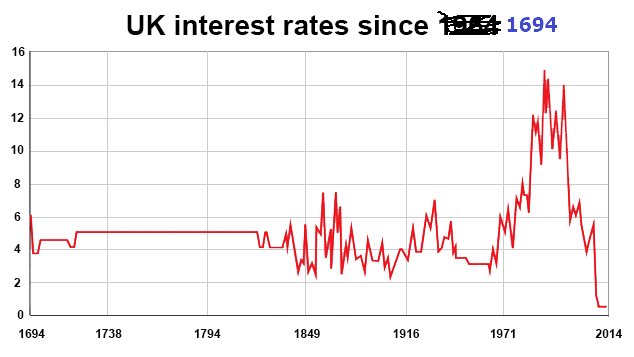

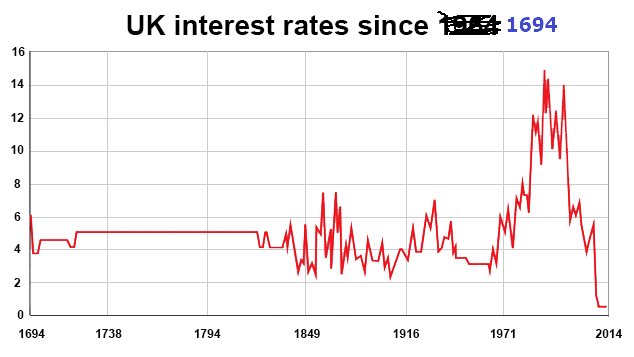

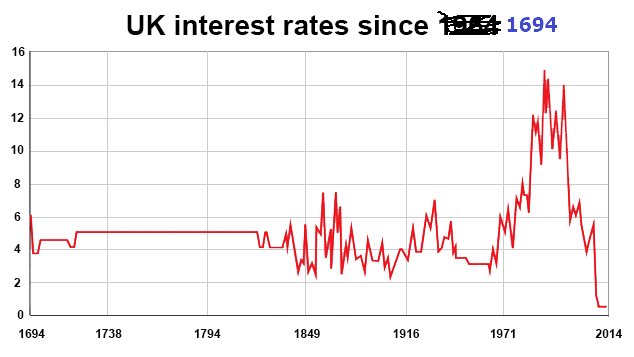

To remind myself near zero interest rates are not the historic norm.TheBigBean said:

Why do you keep posting this?focuszing723 said:focuszing723 said: 0

0 -

Are you quite forgetful by nature?focuszing723 said:

To remind myself near zero interest rates are not the historic norm.TheBigBean said:

Why do you keep posting this?focuszing723 said:focuszing723 said: 0

0 -

I don't want to see normal people who just want a home get caught up in negative equity.0

-

we discussed this a few pages back, in summaryspending on debt is aboutthe 3rd biggest category of Govt spending and you are happy with that.rick_chasey said:

I feel this might be trolling SC but presumably he has spotted it already.

As TBB suggests the switch from RPI to CPI is not easy.

The interesting thing about that chart is that the gap beween the two indices has drastically shifted from the traditional circa 1%0 -

That certainly won't stop a journalist tweeting.surrey_commuter said:

we discussed this a few pages back, in summaryspending on debt is aboutthe 3rdbiggest category of Govt spending and you are happy with that.rick_chasey said:

I feel this might be trolling SC but presumably he has spotted it already.

As TBB suggests the switch from RPI to CPI is not easy.

The interesting thing about that chart is that the gap beween the two indices has drastically shifted from the traditional circa 1%

0 -

BoE rate up to 0.25%.0

-

people are about to find out how small a % of their monthly mortgage payment is interestTheBigBean said:BoE rate up to 0.25%.

0 -

10% are.surrey_commuter said:

people are about to find out how small a % of their monthly mortgage payment is interestTheBigBean said:BoE rate up to 0.25%.

Your comment actually made me go off and do some analysis. Traditionally, by which I mean pre-2008, interest was always higher than repayments for the first few years of a 25 year deal, but that is no longer true. The crossover point is 2.81% for the first year. My 0.91% mortgage is quite a long way below that.0 -

Not sure I follow the logic of the BoE here. What about the inflation is caused by demand side pressures, especially as we head into another wave of reduced economic activity because of omicron? It is a stagflationary supply-side issue.TheBigBean said:BoE rate up to 0.25%.

0 -

Rising inflation makes them want to raise the interest rates.

Wobbly economy makes the want to reduce interest rates. Rock and a hard place.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

hang on!!! you were all in favour of QE when we had a covid driven recession rather than the traditional lack of demand due to lack of money recessionrick_chasey said:

Not sure I follow the logic of the BoE here. What about the inflation is caused by demand side pressures, especially as we head into another wave of reduced economic activity because of omicron? It is a stagflationary supply-side issue.TheBigBean said:BoE rate up to 0.25%.

1 -

-

your previous solution is the inverse of the solution you advocated for the inverse problem.rick_chasey said:How is that relevant?

ie your solution to a covid driven recession was loosening of monetary policy.0 -

I'm not following. What's wrong with opening fiscal and monetary taps when there economic trouble?surrey_commuter said:

your previous solution is the inverse of the solution you advocated for the inverse problem.rick_chasey said:How is that relevant?

ie your solution to a covid driven recession was loosening of monetary policy.

We've only stopped banging on about monetary policy because they've been at full throttle since 2009 and they can't really push the accelerator any harder on that.

I don't really understand why heading into another covid inspired recession it helps raising rates?0 -

(also, @shortfall , grow some balls. Either write out your criticism or keep shtum - the relentless liking of anything critical of me regardless of merit or otherwise is very pathetic.)0

-

Sir Douglas Flint has first-hand experience of meltdowns in the mortgage market. The former chairman of HSBC steered the British lender back on track after the global financial crisis left it reeling in 2008.https://www.thisismoney.co.uk/money/mortgageshome/article-10342289/Ex-HSBC-bosss-stark-warning-young-people-property-debt.html

The crash in US sub-prime mortgages hit HSBC particularly hard as it owned a $118billion book of American loans. Now, the City grandee, 66, is warning that households should once again be wary of racking up giant debts to buy a home just as interest rates begin to rise.

'I personally don't think this is the time to encourage people to over-leverage [borrow too much] in the housing market,' he told The Mail on Sunday. 'House prices, as a multiple of average income, are at an all-time high.'0 -

Inflation soars to 5.4% - highest rate in almost 30 years as cost of living squeeze intensifieshttps://news.sky.com/story/inflation-soars-to-5-4-highest-rate-in-almost-30-years-as-cost-of-living-squeeze-intensifies-12519674

I won't post any charts.0 -

Are you blaming the BoE for keeping rates too low?focuszing723 said:Inflation soars to 5.4% - highest rate in almost 30 years as cost of living squeeze intensifieshttps://news.sky.com/story/inflation-soars-to-5-4-highest-rate-in-almost-30-years-as-cost-of-living-squeeze-intensifies-12519674

I won't post any charts.0