Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

I'm sure the massive increase in money supply is having no impact.rick_chasey said:

I have been banging the drum about the stagflation risk and lo and behold.1 -

If that was the case it would be the same problem across the developed world.TheBigBean said:

I'm sure the massive increase in money supply is having no impact.rick_chasey said:

I have been banging the drum about the stagflation risk and lo and behold.0 -

https://www.cnbc.com/2021/09/10/investing-for-stagflation-bank-of-americas-hartnett-says-we-are-in-the-first-phase-.htmlrick_chasey said:

If that was the case it would be the same problem across the developed world.TheBigBean said:

I'm sure the massive increase in money supply is having no impact.rick_chasey said:

I have been banging the drum about the stagflation risk and lo and behold.

https://www.cnbc.com/2021/09/04/mario-monti-stagflation-is-the-greatest-risk-to-europes-recovery.html

etc.0 -

The BofA Analyst who is making a contrarian call (hence it ending up in the newspaper) and a former italian prime minister isn't the same as the market saying Britain, relative to other countries, has a poorer outlook, which is what the sell off is implying.TheBigBean said:

https://www.cnbc.com/2021/09/10/investing-for-stagflation-bank-of-americas-hartnett-says-we-are-in-the-first-phase-.htmlrick_chasey said:

If that was the case it would be the same problem across the developed world.TheBigBean said:

I'm sure the massive increase in money supply is having no impact.rick_chasey said:

I have been banging the drum about the stagflation risk and lo and behold.

https://www.cnbc.com/2021/09/04/mario-monti-stagflation-is-the-greatest-risk-to-europes-recovery.html

etc.

Right? If all the DMs were running the same risk, there wouldn't be a sell off specifically against Sterling, as FX is a zero sum game.0 -

The UK is doing worse at the moment, but high power prices, increased money supply and supply chain distruption are worldwide problems.rick_chasey said:

The BofA Analyst who is making a contrarian call (hence it ending up in the newspaper) and a former italian prime minister isn't the same as the market saying Britain, relative to other countries, has a poorer outlook, which is what the sell off is implying.TheBigBean said:

https://www.cnbc.com/2021/09/10/investing-for-stagflation-bank-of-americas-hartnett-says-we-are-in-the-first-phase-.htmlrick_chasey said:

If that was the case it would be the same problem across the developed world.TheBigBean said:

I'm sure the massive increase in money supply is having no impact.rick_chasey said:

I have been banging the drum about the stagflation risk and lo and behold.

https://www.cnbc.com/2021/09/04/mario-monti-stagflation-is-the-greatest-risk-to-europes-recovery.html

etc.

Right? If all the DMs were running the same risk, there wouldn't be a sell off specifically against Sterling, as FX is a zero sum game.0 -

‘Sunak planning £2bn in cuts and the UK’s highest peacetime tax rate’

https://www.theguardian.com/uk-news/2021/oct/12/sunak-planning-2bn-in-cuts-and-the-uks-highest-peacetime-tax-rate

SC will be happy.

Though a note buried in the thing.Analysis from Citi estimated the UK economy would be between 2% and 3% smaller in 2024-25 than before the pandemic, with Brexit causing a deeper scarring effect than Covid.

“The scarring just because of the pandemic may not be as large as we thought last year. The scarring due to Brexit may actually be larger,” said Christian Schulz, the bank’s director of European economics. “Brexit is casting a long shadow over the economy.”0 -

Best estimate was always to be 0.5% lower growth. Add that up since 2015 and boost for bad years around the ref and actually leaving and you have a staggeringly big number.rick_chasey said:‘Sunak planning £2bn in cuts and the UK’s highest peacetime tax rate’

https://www.theguardian.com/uk-news/2021/oct/12/sunak-planning-2bn-in-cuts-and-the-uks-highest-peacetime-tax-rate

SC will be happy.

Though a note buried in the thing.Analysis from Citi estimated the UK economy would be between 2% and 3% smaller in 2024-25 than before the pandemic, with Brexit causing a deeper scarring effect than Covid.

“The scarring just because of the pandemic may not be as large as we thought last year. The scarring due to Brexit may actually be larger,” said Christian Schulz, the bank’s director of European economics. “Brexit is casting a long shadow over the economy.”

Even if you go optimistic the economy will be 5% smaller which is about £40bn a year in forgone taxation.0 -

From the "that's insane, but it might just work" list comes:

https://www.theguardian.com/commentisfree/2021/oct/15/the-case-for-minting-a-1tn-coin-to-deal-with-americas-debt-ceiling

Can the Treasury really mint $1 trillion coin and stick in the bank?0 -

There is a £100m note, but for different reasons.

https://en.wikipedia.org/wiki/Bank_of_England_£100,000,000_note0 -

The article also mentions that there are other £1,000,000 notes that they print internally rather than commercial printers for security reasons, as if in the case one was ever stolen or counterfeited they'd be able to spend it anywhere or the Bank wouldn't know the serial number and location of all those notes.TheBigBean said:There is a £100m note, but for different reasons.

https://en.wikipedia.org/wiki/Bank_of_England_£100,000,000_note0 -

0

0 -

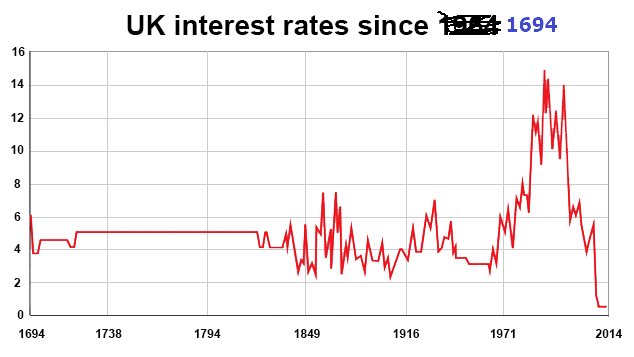

All eyes turn to the Bank of England which will consider next week whether to raise the base rate.

Some mortgage lenders have raised their interest rates slightly, after a period of intense competition and ultra-low costs for borrowers.

Official forecasters say the biggest mortgage rate rises will be in 2023.

The Office for Budget Responsibility (OBR) - the government's official, independent forecaster - said inflation (which measures the cost of living) was likely to speed up to 4% next year.

In response, it predicted a rise in the Bank rate next year, and the year after, from its current record low of 0.1%. It said the Bank rate would not be expected to breach the 1% mark, although it could go as high as 3.5% if inflation went above 5%.

https://www.bbc.co.uk/news/business-590910030 -

I'm about to take out a new mortgage later this year. Unsure if to go 2 or 5y fixed. I guess it depends on a) whether my property will go up in value (possibly) and b) how much rates will go up by.0

-

Not sure about the relevance of (a) but other factors are the size of the fee, likelihood of you selling and the exit costs.shirley_basso said:I'm about to take out a new mortgage later this year. Unsure if to go 2 or 5y fixed. I guess it depends on a) whether my property will go up in value (possibly) and b) how much rates will go up by.

Strangely we could end up in a world where the Govt is continuing it’s inflationary policies whilst the BofE is raising rates to reign it in. There is of course no reason why Boris Corbyn can not take away the Bank’s independence.

Personally I would fix for as long as possible0 -

Me too. I think that boat will have sailed as banks will probably have factored rises in already. However, it's better to catch a late boat than none. 😉surrey_commuter said:

Personally I would fix for as long as possible

Edit - It appears that there are still long term relatively low rate deals available, if higher than the current rate, obviously.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Isn't a) relevant because in 2 years the house could have gone up enough to knock the mortgage into a new LTV band at a better rate?surrey_commuter said:

Not sure about the relevance of (a) but other factors are the size of the fee, likelihood of you selling and the exit costs.shirley_basso said:I'm about to take out a new mortgage later this year. Unsure if to go 2 or 5y fixed. I guess it depends on a) whether my property will go up in value (possibly) and b) how much rates will go up by.

Strangely we could end up in a world where the Govt is continuing it’s inflationary policies whilst the BofE is raising rates to reign it in. There is of course no reason why Boris Corbyn can not take away the Bank’s independence.

Personally I would fix for as long as possible- Genesis Croix de Fer

- Dolan Tuono0 -

-

I can afford the higher rate but I am wondering, if I can get down an LTV bracket in the next 2y with some fairly modest spend, so will the LTV offset the interest rate rise....0

-

Got it. You need to do the sums as another round of valuation/mortgage fees will put a serious dent in any savings to be made.shirley_basso said:I can afford the higher rate but I am wondering, if I can get down an LTV bracket in the next 2y with some fairly modest spend, so will the LTV offset the interest rate rise....

Anyway based upon current expectations it would be highly unlikely that mortgages rates won’t be higher in two years and quite possibly a lot higher.

Of course the vast bulk of your monthly payments are repaying the capital so even if the interest rate goes up 1% it should not have a huge impact.0 -

-

LOL - just saw that and thought the article would trigger you.rick_chasey said:

It is bizarre that a set of policies can make both of us so angry but for the opposite reasons1 -

The bolded bit isn't completely true. Yield curve is below.surrey_commuter said:

Got it. You need to do the sums as another round of valuation/mortgage fees will put a serious dent in any savings to be made.shirley_basso said:I can afford the higher rate but I am wondering, if I can get down an LTV bracket in the next 2y with some fairly modest spend, so will the LTV offset the interest rate rise....

Anyway based upon current expectations it would be highly unlikely that mortgages rates won’t be higher in two years and quite possibly a lot higher.

Of course the vast bulk of your monthly payments are repaying the capital so even if the interest rate goes up 1% it should not have a huge impact.

0 -

Unfortunately I am basically a first time buyer as I lost all my equity when selling my last house - so LTV is very high. Monthly payments are actually about 50-50 split interest and capital.surrey_commuter said:

Got it. You need to do the sums as another round of valuation/mortgage fees will put a serious dent in any savings to be made.shirley_basso said:I can afford the higher rate but I am wondering, if I can get down an LTV bracket in the next 2y with some fairly modest spend, so will the LTV offset the interest rate rise....

Anyway based upon current expectations it would be highly unlikely that mortgages rates won’t be higher in two years and quite possibly a lot higher.

Of course the vast bulk of your monthly payments are repaying the capital so even if the interest rate goes up 1% it should not have a huge impact.

0 -

I don’t know how they price mortgages but does that not imply that rates will be approx 0.75% higher in 2 years time?TheBigBean said:

The bolded bit isn't completely true. Yield curve is below.surrey_commuter said:

Got it. You need to do the sums as another round of valuation/mortgage fees will put a serious dent in any savings to be made.shirley_basso said:I can afford the higher rate but I am wondering, if I can get down an LTV bracket in the next 2y with some fairly modest spend, so will the LTV offset the interest rate rise....

Anyway based upon current expectations it would be highly unlikely that mortgages rates won’t be higher in two years and quite possibly a lot higher.

Of course the vast bulk of your monthly payments are repaying the capital so even if the interest rate goes up 1% it should not have a huge impact. 0

0 -

The rates are priced over a period of time e.g. a two year mortgage, so you need to look at the average over that period and therefore, potentially, would benefit from the dropping rates in years 3 and 4 if you took out a mortgage at the of year 2.surrey_commuter said:

I don’t know how they price mortgages but does that not imply that rates will be approx 0.75% higher in 2 years time?TheBigBean said:

The bolded bit isn't completely true. Yield curve is below.surrey_commuter said:

Got it. You need to do the sums as another round of valuation/mortgage fees will put a serious dent in any savings to be made.shirley_basso said:I can afford the higher rate but I am wondering, if I can get down an LTV bracket in the next 2y with some fairly modest spend, so will the LTV offset the interest rate rise....

Anyway based upon current expectations it would be highly unlikely that mortgages rates won’t be higher in two years and quite possibly a lot higher.

Of course the vast bulk of your monthly payments are repaying the capital so even if the interest rate goes up 1% it should not have a huge impact.

But mortgages are brought to you by the same people that introduced lifetime tracker mortgages at rates lower than gilts.0 -

Having been accepted in principle for a mortgage available at 95% LTV with 2.4% fixed for 5 years it came as a surprise when I actually applied that neither the 2.4% or 95% LTV were available to me.

A very mad scramble followed to avoid the house falling through. 0

0 -

Eek. Good luck.mully79 said:Having been accepted in principle for a mortgage available at 95% LTV with 2.4% fixed for 5 years it came as a surprise when I actually applied that neither the 2.4% or 95% LTV were available to me.

A very mad scramble followed to avoid the house falling through. 1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Thanks for the explanation but it seems the problem was that my mind did not process that bright bright pink line... ie SMIDSY, I must have seen it but did not register or react to it.TheBigBean said:

The rates are priced over a period of time e.g. a two year mortgage, so you need to look at the average over that period and therefore, potentially, would benefit from the dropping rates in years 3 and 4 if you took out a mortgage at the of year 2.surrey_commuter said:

I don’t know how they price mortgages but does that not imply that rates will be approx 0.75% higher in 2 years time?TheBigBean said:

The bolded bit isn't completely true. Yield curve is below.surrey_commuter said:

Got it. You need to do the sums as another round of valuation/mortgage fees will put a serious dent in any savings to be made.shirley_basso said:I can afford the higher rate but I am wondering, if I can get down an LTV bracket in the next 2y with some fairly modest spend, so will the LTV offset the interest rate rise....

Anyway based upon current expectations it would be highly unlikely that mortgages rates won’t be higher in two years and quite possibly a lot higher.

Of course the vast bulk of your monthly payments are repaying the capital so even if the interest rate goes up 1% it should not have a huge impact.

But mortgages are brought to you by the same people that introduced lifetime tracker mortgages at rates lower than gilts.

It is both worrying and fascinating and I can only assume it is because I only look at these curves in reports prepared by actuaries who won’t have that colour in their palette.0 -

There's a bit of background to the rates change here

https://validusrm.com/wp-content/uploads/2021/10/Validus-Rates-Insight-29102021-ME.pdfWith inflation continuing to run hot in the UK, the Bank of England feel duty bound to adapt monetary policy rhetoric to deal with the issue, which the markets are interpreting as the start of an aggressive rate hike cycle. This is the textbook solution to an inflation problem.

The wrinkle this time around is that much of the inflation we are experiencing is supply-side driven and hiking interest rates does not solve the issue. Moreover, with the BoE yetto receive a single post-furlough employment data point, and with Rishi Sunak’s tightening of fiscal policy, the Bank’s position becomes increasingly fraught.0 -

So it has gone bustrick_chasey said:https://www.theguardian.com/world/2021/sep/09/china-property-market-evergrande-300bn-debt-share-slump

https://www.reuters.com/business/china-evergrande-selloffs-default-worries-onshore-bond-temporarily-suspended-2021-09-09/

worth keeping an eye on.

In summary for those who do not follow, Evergrade is one of, if not the, biggest real estate developers in China.

It's also extremely indebted - to the point that even the chinese regulators went public that it was in a dodgy situation 2 years ago.

Things have accelerated since then as it's become clear the developer has been struggling to sell off assets required to reduce the debt burden.

That has created a bit of a vicious cycle, as they are dramatically reducing the prices of their assets to get the properties to sell, plus a bigger concern that the firm is in trouble , so the banks increase the cost of borrowing to compensate for the added perceived risk, and so they have to sell more assets etc.

The concern is that it is so large and so indebted it is a problem for the entire system, and so this sudden collapse and likely default (it's currently rated by Fitch as "default imminent") will cause a crisis in the Chinese financial system.0