Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

0

-

On a side note, I wonder how his surname came about?morstar said:

This.

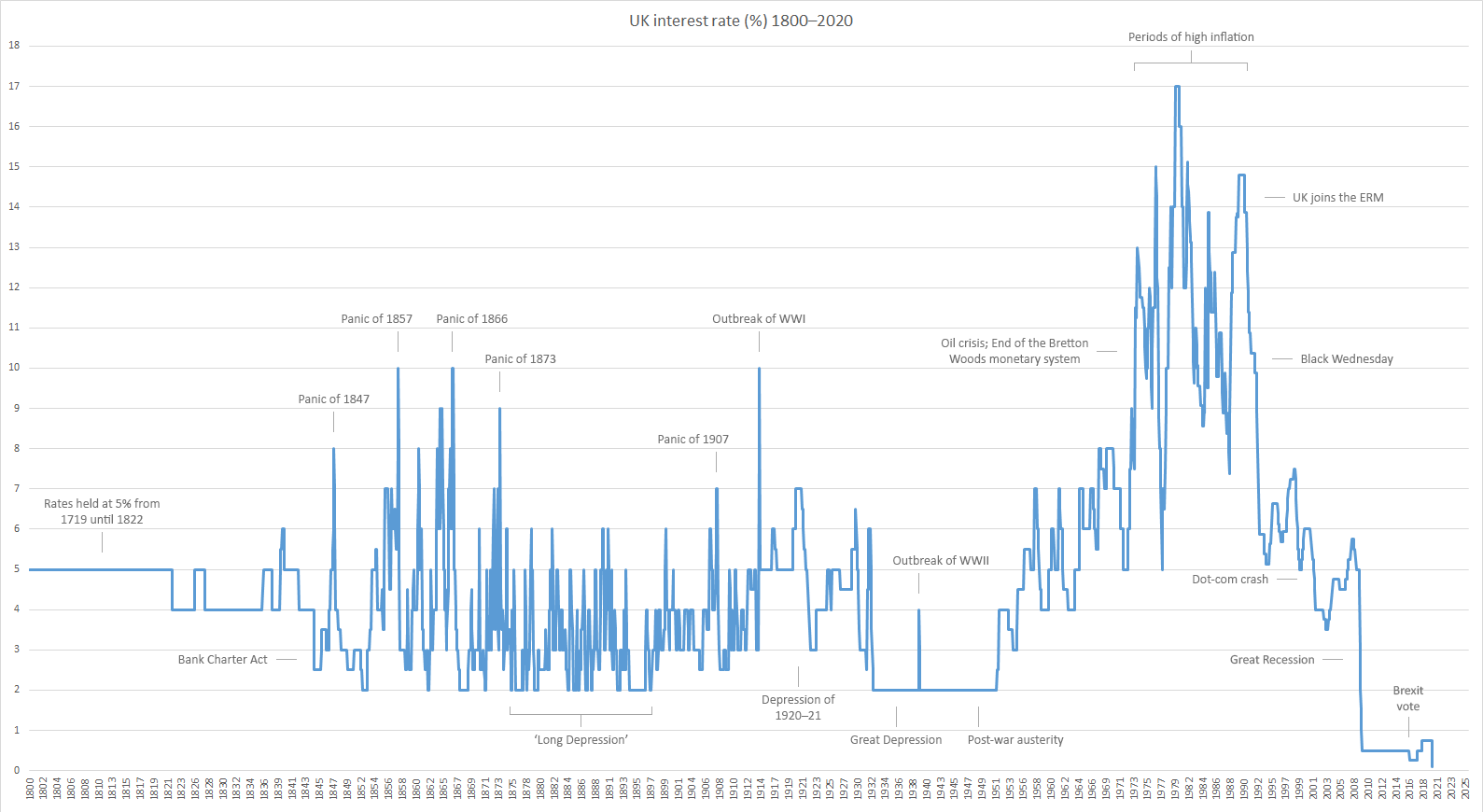

The graph says far more about 1958 than what has happened since.

0 -

@rick_chasey with debt servicing cost nudging £20bn a month are you still comfortable with debt levels?

Whilst this is what I forecast I am staggered at how fast it is unraveling0 -

It really is. I agree with Sunak that the country needs to be put on a ‘crisis footing’ but am pretty certain it’s only a sound bite without any substance.surrey_commuter said:@rick_chasey with debt servicing cost nudging £20bn a month are you still comfortable with debt levels?

Whilst this is what I forecast I am staggered at how fast it is unraveling

We need a serious figure in the country to spell out how much trouble we’re in but also offer hope for the future.

Don’t see anyone in the HoC’s capable of that unfortunately

0 -

Depends on where growth is.surrey_commuter said:@rick_chasey with debt servicing cost nudging £20bn a month are you still comfortable with debt levels?

Whilst this is what I forecast I am staggered at how fast it is unraveling

If debt is growing faster than gdp we’re not in a good place.

As ever the problem with debt isn’t the debt it’s the lack of growth.0 -

Ummm, no.

The problem is not being prudent enough to factor in a historic average interest rates, in case the $h1t hit the fan.

"Ahh, don't worry interest rates will be low for the foreseeable future".

Well it turns out it isn't and it's pushing back to historic norms.

It's throwing money away which could be used to fund services which we know are under pressure.

It's akin to putting all your Spondulix on Pog to win the TDF.

1 -

-

I bet you 20 billion* you wouldn't risk that yourself!rick_chasey said:Doesn’t matter if you’re growing faster

*In the cake filled virtual world.0 -

That's half the problem it's all p1ss1ng around with other people's money with no responsibility, they will still be able to retire to Chipping Norton. Meanwhile the public services keep getting trashed and the message to the general public is debt is fine, again it won't be for some.

You're on a good Salary Rick, but you drive a Polo. Why don't you get some credit and get a Ferrari (GT4Lusso, for the room)?

Don't answer, because you know that would be fvck1ng stupid!!!

0 -

You know that is nonsensical so why write it.rick_chasey said:Doesn’t matter if you’re growing faster

Being thrown off a ship in the middle of the ocean is fine so long as you can swim1 -

And you don't know what the future holds next. Who predicted a financial crisis, brexit, covid, Putin, Vingegaard?

1 -

I think sometimes Rick is blinded by the City lights n' swagger.0

-

Growth is the aim. All problems fade to noting with growth.surrey_commuter said:

You know that is nonsensical so why write it.rick_chasey said:Doesn’t matter if you’re growing faster

Being thrown off a ship in the middle of the ocean is fine so long as you can swim0 -

If the Uk debt grows by 5% each year but the economy grows by 7% each year why is it a problem?focuszing723 said:I think sometimes Rick is blinded by the City lights n' swagger.

0 -

Get the Lusso then Rick and hope you can pay off the interest payments.rick_chasey said:

If the Uk debt grows by 5% each year but the economy grows by 7% each year why is it a problem?focuszing723 said:I think sometimes Rick is blinded by the City lights n' swagger.

0 -

Gdp growth rate is remarkably steady over the long term. Somewhere between 2 and 3%.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

-

Which surely weakens your argument even further?rick_chasey said:

Not over last 15 yearsrjsterry said:Gdp growth rate is remarkably steady over the long term. Somewhere between 2 and 3%.

0 -

A Ferrari goes quicker and is more swanky than a Polo, why don't you practice what you preach?rick_chasey said:Doesn’t matter if you’re growing faster

0 -

What, that the problem is lack of growth?Pross said:

Which surely weakens your argument even further?rick_chasey said:

Not over last 15 yearsrjsterry said:Gdp growth rate is remarkably steady over the long term. Somewhere between 2 and 3%.

0 -

If I’m focused on becoming rich, then a Ferrari can be an option.focuszing723 said:

A Ferrari goes quicker and is more swanky than a Polo, why don't you practice what you preach?rick_chasey said:Doesn’t matter if you’re growing faster

If I focus on cost saving I’ll never have a Ferrari as I’ll only be able to afford a polo. Right?0 -

https://www.macrotrends.net/countries/GBR/united-kingdom/gdp-growth-raterick_chasey said:

Not over last 15 yearsrjsterry said:Gdp growth rate is remarkably steady over the long term. Somewhere between 2 and 3%.

Not sure there is that much difference, really. More fluctuation in the '80s1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Gawd, you've just kicked yourself in the b0ll0cks with that. So you don't get into debt yourself, but you want others too?rick_chasey said:

If I’m focused on becoming rich, then a Ferrari can be an option.focuszing723 said:

A Ferrari goes quicker and is more swanky than a Polo, why don't you practice what you preach?rick_chasey said:Doesn’t matter if you’re growing faster

If I focus on cost saving I’ll never have a Ferrari as I’ll only be able to afford a polo. Right?

Top of the pyramid stuff.0 -

Please stop muddling government borrowing with personal debt. They are not the same thing at all.focuszing723 said:

Gawd, you've just kicked yourself in the b0ll0cks with that. So you don't get into debt yourself, but you want others too?rick_chasey said:

If I’m focused on becoming rich, then a Ferrari can be an option.focuszing723 said:

A Ferrari goes quicker and is more swanky than a Polo, why don't you practice what you preach?rick_chasey said:Doesn’t matter if you’re growing faster

If I focus on cost saving I’ll never have a Ferrari as I’ll only be able to afford a polo. Right?

Top of the pyramid stuff.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

That we should be borrowing at a time when growth isn't keeping up with likely interest rates.rick_chasey said:

What, that the problem is lack of growth?Pross said:

Which surely weakens your argument even further?rick_chasey said:

Not over last 15 yearsrjsterry said:Gdp growth rate is remarkably steady over the long term. Somewhere between 2 and 3%.

0 -

Please stop forgetting the example it sets.rjsterry said:

Please stop muddling government borrowing with personal debt. They are not the same thing at all.focuszing723 said:

Gawd, you've just kicked yourself in the b0ll0cks with that. So you don't get into debt yourself, but you want others too?rick_chasey said:

If I’m focused on becoming rich, then a Ferrari can be an option.focuszing723 said:

A Ferrari goes quicker and is more swanky than a Polo, why don't you practice what you preach?rick_chasey said:Doesn’t matter if you’re growing faster

If I focus on cost saving I’ll never have a Ferrari as I’ll only be able to afford a polo. Right?

Top of the pyramid stuff.0 -

Yep 5% would pay the interest but you are just plucking numbers out of the air. When was growth 5% let alone 7%?rick_chasey said:

If the Uk debt grows by 5% each year but the economy grows by 7% each year why is it a problem?focuszing723 said:I think sometimes Rick is blinded by the City lights n' swagger.

Pre Covid Budget was 3%, when did we have growth that high?0 -

Per head however https://www.macrotrends.net/countries/GBR/united-kingdom/gdp-per-capitarjsterry said:

https://www.macrotrends.net/countries/GBR/united-kingdom/gdp-growth-raterick_chasey said:

Not over last 15 yearsrjsterry said:Gdp growth rate is remarkably steady over the long term. Somewhere between 2 and 3%.

Not sure there is that much difference, really. More fluctuation in the '80s0 -

If interest rates are low it encourages people to take on debt rather than save, isn't that obvious!?rjsterry said:

Please stop muddling government borrowing with personal debt. They are not the same thing at all.focuszing723 said:

Gawd, you've just kicked yourself in the b0ll0cks with that. So you don't get into debt yourself, but you want others too?rick_chasey said:

If I’m focused on becoming rich, then a Ferrari can be an option.focuszing723 said:

A Ferrari goes quicker and is more swanky than a Polo, why don't you practice what you preach?rick_chasey said:Doesn’t matter if you’re growing faster

If I focus on cost saving I’ll never have a Ferrari as I’ll only be able to afford a polo. Right?

Top of the pyramid stuff.0