Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

Are you surprised?rick_chasey said:Don't worry about your kid's A levels, guys.

Nowadays by far the biggest predictor of success is inherited wealth, not performance at school!

School alma mater, work nepotism etc have been prevalent for as long as I know of.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

When you assess candidates how much weight do you place on their inheritance?rick_chasey said:Don't worry about your kid's A levels, guys.

Nowadays by far the biggest predictor of success is inherited wealth, not performance at school!0 -

Yeah, that's a real modern day phenomenonrick_chasey said:Don't worry about your kid's A levels, guys.

Nowadays by far the biggest predictor of success is inherited wealth, not performance at school!1 -

I posted the chart a while back, but it's become something like twice as important as it had in the 80s.Pross said:

Yeah, that's a real modern day phenomenonrick_chasey said:Don't worry about your kid's A levels, guys.

Nowadays by far the biggest predictor of success is inherited wealth, not performance at school!0 -

Going back pre-90s most people from a poorer background would have had to go off to work directly from school irrespective of whether they had the intelligence to go into higher education that then leads to more sucessful careers. Inherited wealth gave more opportunity for better education. Inherited wealth has always put you in more influencial circles that improve the chances of success.rick_chasey said:

I posted the chart a while back, but it's become something like twice as important as it had in the 80s.Pross said:

Yeah, that's a real modern day phenomenonrick_chasey said:Don't worry about your kid's A levels, guys.

Nowadays by far the biggest predictor of success is inherited wealth, not performance at school!2 -

It has, but the degree of influence has varied over time. It increasing again is not a good thing.Pross said:

Going back pre-90s most people from a poorer background would have had to go off to work directly from school irrespective of whether they had the intelligence to go into higher education that then leads to more sucessful careers. Inherited wealth gave more opportunity for better education. Inherited wealth has always put you in more influencial circles that improve the chances of success.rick_chasey said:

I posted the chart a while back, but it's become something like twice as important as it had in the 80s.Pross said:

Yeah, that's a real modern day phenomenonrick_chasey said:Don't worry about your kid's A levels, guys.

Nowadays by far the biggest predictor of success is inherited wealth, not performance at school!1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Given that most people inherit nearer retirement age than the start of their careers, I'm not entirely sure I agree with "inherited wealth" as a predictor of success. Most people have forged their successful careers, if they're going to do so, long before they inherit.rick_chasey said:Don't worry about your kid's A levels, guys.

Nowadays by far the biggest predictor of success is inherited wealth, not performance at school!

I think you're really just flagging up that most folk who do well in life have parents with sizeable pensions and significant equity in their houses (the majority of wealth in the UK being pensions and residential property) which is hardly an earth-shattering revelation. I think what's most likely changed in recent years is the amount of equity that middle class folk build up.

That's not to say that as a society we shouldn't do more to improve the quality of education provided to those in deprived areas or to increase the opportunities for bright kids from such areas to do traditional academic subjects and quality Unis.

0 -

"William the Conquerer's descendants are still doing well out of a land grab that created the unequal England we know today"

https://www.theguardian.com/commentisfree/2012/dec/17/high-house-prices-inequality-normans

Garlic stinky man came, took everything, still here.BASI Nordic Ski Instructor

Instagramme0 -

I find the notion that England was ever equal very funny.

Bear in mind England was not unified until the 10th century.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

I've only read the first couple of paragraphs and already I have spotted half a dozen things that are just plain wrong.davidof said:"William the Conquerer's descendants are still doing well out of a land grab that created the unequal England we know today"

https://www.theguardian.com/commentisfree/2012/dec/17/high-house-prices-inequality-normans

Garlic stinky man came, took everything, still here.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

https://www.bikeradar.com/reviews/bikes/road-bikes/trek-madone-slr-9-etap-2023-review/

Fvckitydoodar, THIRTEEN THOUSAND EIGHT HUNDRED SQUID!0 -

That frame wouldn't withstand the combination of my weight and a pothole. 🤣The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

That hole and glorified coal messin must be worth about five grand then.

0 -

The great and the good of the central banking world gather Thursday for the annual Federal Reserve Symposium at Jackson Hole, Wyoming. The snappily-titled theme is “Reassessing Constraints on the Economy and Policy.” There needs to be an honest reflection on the causes of the rampant inflation most of the world finds itself battling. The track record of central bank economic forecasting is in tatters, as is confidence that our monetary overlords know what they are doing. Missteps this week risk triggering market dislocations.https://www.washingtonpost.com/business/jackson-hole-should-be-a-mea-culpa-for-central-bankers/2022/08/25/97578676-2433-11ed-a72f-1e7149072fbc_story.html

It doesn’t help that the concept of forward guidance on interest-rate policy is being discarded in favor of meeting-by-meeting data dependency. Something needs to fill this vacuum, so Fed Chair Jerome Powell’s keynote address on Friday needs to clarify how much risk the US central bank is prepared to take with the economy to slay the inflation beast. It’s simplistic to say there’s a trade-off between growth and rising consumer prices, but any response to the current situation that doesn’t at least attempt to square that circle won’t hold.

At the European Central Bank’s forum in Sintra, Portugal in June, Powell admitted that ”we now understand better how little we understand about inflation.” More candor is needed now on how the inflationary monster was so underestimated, and how far policy makers are willing to go in sacrificing growth — and jobs — to tame it.

The global central bank reaction to the pandemic prevented a major recession, but the stimulus was left in place for far too long. Super-relaxed financial conditions, roaring stock markets and asset prices ought to have given enough clues. To put it in military terms, mission creep combined with a lack of post-invasion withdrawal planning has led us here.

ECB President Christine Lagarde is not attending Jackson Hole again this year, so eyes will be on her fellow executive board member Isabel Schnabel’s participation in a panel discussion on Saturday. In a hawkish interview with Reuters last week, Schnabel emphasized the risk of de-anchored inflation expectations, even if the euro area enters recession. She also mentioned the possibility of the ECB soon discussing a runoff of its 5 trillion-euro QE programs. This comes as Italian 10-year yields are again around 3.7%, close to the danger zone where its debt burden becomes less sustainable.

The Bank of England is in a similar predicament to the ECB, with inflation already into double digits and the added complication of fiscal policy having been tightened earlier this year but likely to be far looser in the coming months. Governor Andrew Bailey will be attending Jackson Hole but is not scheduled to speak. As the BOE is about to embark on active sales of its near $1 trillion of QE holdings, hopefully he will use his time to confer with his Fed counterparts on their experiences of raising borrowing costs at the same time as running down the balance sheet.

Like I said, The Russia Ukraine situations have just made matters worse.

Oh yeah, and Andrew Bailey should have taken a pay cut to lead by example.0 -

0

0 -

0 -

It was negligent to assume zero percent interest rates were the new norm.

Casino Economics.0 -

Andrew Bailey should never have been appointed in the first place. Utter moron and a total failure at the FCA.focuszing723 said:The great and the good of the central banking world gather Thursday for the annual Federal Reserve Symposium at Jackson Hole, Wyoming. The snappily-titled theme is “Reassessing Constraints on the Economy and Policy.” There needs to be an honest reflection on the causes of the rampant inflation most of the world finds itself battling. The track record of central bank economic forecasting is in tatters, as is confidence that our monetary overlords know what they are doing. Missteps this week risk triggering market dislocations.https://www.washingtonpost.com/business/jackson-hole-should-be-a-mea-culpa-for-central-bankers/2022/08/25/97578676-2433-11ed-a72f-1e7149072fbc_story.html

It doesn’t help that the concept of forward guidance on interest-rate policy is being discarded in favor of meeting-by-meeting data dependency. Something needs to fill this vacuum, so Fed Chair Jerome Powell’s keynote address on Friday needs to clarify how much risk the US central bank is prepared to take with the economy to slay the inflation beast. It’s simplistic to say there’s a trade-off between growth and rising consumer prices, but any response to the current situation that doesn’t at least attempt to square that circle won’t hold.

At the European Central Bank’s forum in Sintra, Portugal in June, Powell admitted that ”we now understand better how little we understand about inflation.” More candor is needed now on how the inflationary monster was so underestimated, and how far policy makers are willing to go in sacrificing growth — and jobs — to tame it.

The global central bank reaction to the pandemic prevented a major recession, but the stimulus was left in place for far too long. Super-relaxed financial conditions, roaring stock markets and asset prices ought to have given enough clues. To put it in military terms, mission creep combined with a lack of post-invasion withdrawal planning has led us here.

ECB President Christine Lagarde is not attending Jackson Hole again this year, so eyes will be on her fellow executive board member Isabel Schnabel’s participation in a panel discussion on Saturday. In a hawkish interview with Reuters last week, Schnabel emphasized the risk of de-anchored inflation expectations, even if the euro area enters recession. She also mentioned the possibility of the ECB soon discussing a runoff of its 5 trillion-euro QE programs. This comes as Italian 10-year yields are again around 3.7%, close to the danger zone where its debt burden becomes less sustainable.

The Bank of England is in a similar predicament to the ECB, with inflation already into double digits and the added complication of fiscal policy having been tightened earlier this year but likely to be far looser in the coming months. Governor Andrew Bailey will be attending Jackson Hole but is not scheduled to speak. As the BOE is about to embark on active sales of its near $1 trillion of QE holdings, hopefully he will use his time to confer with his Fed counterparts on their experiences of raising borrowing costs at the same time as running down the balance sheet.

Like I said, The Russia Ukraine situations have just made matters worse.

Oh yeah, and Andrew Bailey should have taken a pay cut to lead by example.

0 -

In a nut shell. Utterly inept. I wouldn't trust him looking after raffle ticket money.Dorset_Boy said:

Andrew Bailey should never have been appointed in the first place. Utter moron and a total failure at the FCA.focuszing723 said:The great and the good of the central banking world gather Thursday for the annual Federal Reserve Symposium at Jackson Hole, Wyoming. The snappily-titled theme is “Reassessing Constraints on the Economy and Policy.” There needs to be an honest reflection on the causes of the rampant inflation most of the world finds itself battling. The track record of central bank economic forecasting is in tatters, as is confidence that our monetary overlords know what they are doing. Missteps this week risk triggering market dislocations.https://www.washingtonpost.com/business/jackson-hole-should-be-a-mea-culpa-for-central-bankers/2022/08/25/97578676-2433-11ed-a72f-1e7149072fbc_story.html

It doesn’t help that the concept of forward guidance on interest-rate policy is being discarded in favor of meeting-by-meeting data dependency. Something needs to fill this vacuum, so Fed Chair Jerome Powell’s keynote address on Friday needs to clarify how much risk the US central bank is prepared to take with the economy to slay the inflation beast. It’s simplistic to say there’s a trade-off between growth and rising consumer prices, but any response to the current situation that doesn’t at least attempt to square that circle won’t hold.

At the European Central Bank’s forum in Sintra, Portugal in June, Powell admitted that ”we now understand better how little we understand about inflation.” More candor is needed now on how the inflationary monster was so underestimated, and how far policy makers are willing to go in sacrificing growth — and jobs — to tame it.

The global central bank reaction to the pandemic prevented a major recession, but the stimulus was left in place for far too long. Super-relaxed financial conditions, roaring stock markets and asset prices ought to have given enough clues. To put it in military terms, mission creep combined with a lack of post-invasion withdrawal planning has led us here.

ECB President Christine Lagarde is not attending Jackson Hole again this year, so eyes will be on her fellow executive board member Isabel Schnabel’s participation in a panel discussion on Saturday. In a hawkish interview with Reuters last week, Schnabel emphasized the risk of de-anchored inflation expectations, even if the euro area enters recession. She also mentioned the possibility of the ECB soon discussing a runoff of its 5 trillion-euro QE programs. This comes as Italian 10-year yields are again around 3.7%, close to the danger zone where its debt burden becomes less sustainable.

The Bank of England is in a similar predicament to the ECB, with inflation already into double digits and the added complication of fiscal policy having been tightened earlier this year but likely to be far looser in the coming months. Governor Andrew Bailey will be attending Jackson Hole but is not scheduled to speak. As the BOE is about to embark on active sales of its near $1 trillion of QE holdings, hopefully he will use his time to confer with his Fed counterparts on their experiences of raising borrowing costs at the same time as running down the balance sheet.

Like I said, The Russia Ukraine situations have just made matters worse.

Oh yeah, and Andrew Bailey should have taken a pay cut to lead by example.0 -

does not matter as he supported Brexitskyblueamateur said:

In a nut shell. Utterly inept. I wouldn't trust him looking after raffle ticket money.Dorset_Boy said:

Andrew Bailey should never have been appointed in the first place. Utter moron and a total failure at the FCA.focuszing723 said:The great and the good of the central banking world gather Thursday for the annual Federal Reserve Symposium at Jackson Hole, Wyoming. The snappily-titled theme is “Reassessing Constraints on the Economy and Policy.” There needs to be an honest reflection on the causes of the rampant inflation most of the world finds itself battling. The track record of central bank economic forecasting is in tatters, as is confidence that our monetary overlords know what they are doing. Missteps this week risk triggering market dislocations.https://www.washingtonpost.com/business/jackson-hole-should-be-a-mea-culpa-for-central-bankers/2022/08/25/97578676-2433-11ed-a72f-1e7149072fbc_story.html

It doesn’t help that the concept of forward guidance on interest-rate policy is being discarded in favor of meeting-by-meeting data dependency. Something needs to fill this vacuum, so Fed Chair Jerome Powell’s keynote address on Friday needs to clarify how much risk the US central bank is prepared to take with the economy to slay the inflation beast. It’s simplistic to say there’s a trade-off between growth and rising consumer prices, but any response to the current situation that doesn’t at least attempt to square that circle won’t hold.

At the European Central Bank’s forum in Sintra, Portugal in June, Powell admitted that ”we now understand better how little we understand about inflation.” More candor is needed now on how the inflationary monster was so underestimated, and how far policy makers are willing to go in sacrificing growth — and jobs — to tame it.

The global central bank reaction to the pandemic prevented a major recession, but the stimulus was left in place for far too long. Super-relaxed financial conditions, roaring stock markets and asset prices ought to have given enough clues. To put it in military terms, mission creep combined with a lack of post-invasion withdrawal planning has led us here.

ECB President Christine Lagarde is not attending Jackson Hole again this year, so eyes will be on her fellow executive board member Isabel Schnabel’s participation in a panel discussion on Saturday. In a hawkish interview with Reuters last week, Schnabel emphasized the risk of de-anchored inflation expectations, even if the euro area enters recession. She also mentioned the possibility of the ECB soon discussing a runoff of its 5 trillion-euro QE programs. This comes as Italian 10-year yields are again around 3.7%, close to the danger zone where its debt burden becomes less sustainable.

The Bank of England is in a similar predicament to the ECB, with inflation already into double digits and the added complication of fiscal policy having been tightened earlier this year but likely to be far looser in the coming months. Governor Andrew Bailey will be attending Jackson Hole but is not scheduled to speak. As the BOE is about to embark on active sales of its near $1 trillion of QE holdings, hopefully he will use his time to confer with his Fed counterparts on their experiences of raising borrowing costs at the same time as running down the balance sheet.

Like I said, The Russia Ukraine situations have just made matters worse.

Oh yeah, and Andrew Bailey should have taken a pay cut to lead by example.0 -

-

Ed Davey, the new Lib Dem leader, has warned his party that it was “diverted and distracted” by Brexit and must now refocus on voters’ more urgent concerns, as he faces mounting internal demands to formally back rejoining the European Union.https://www.theguardian.com/politics/2020/sep/26/we-lost-the-brexit-fight-now-we-must-listen-to-voters-ed-davey-urges-lib-dems

Davey said that three poor election results in the last five years demonstrated the party needed to listen to voters again, warning that the Lib Dems had “forgotten that we serve the community, we serve the people”.

Incompetence is also having your head in the sand.0 -

I would exclude people who supported it for personal gain. You may not like their motives but it does not make them incompetent/an idiotrick_chasey said:Using Brexit support as a shortcut to evaluate someone as incompetent has not failed me yet.

0 -

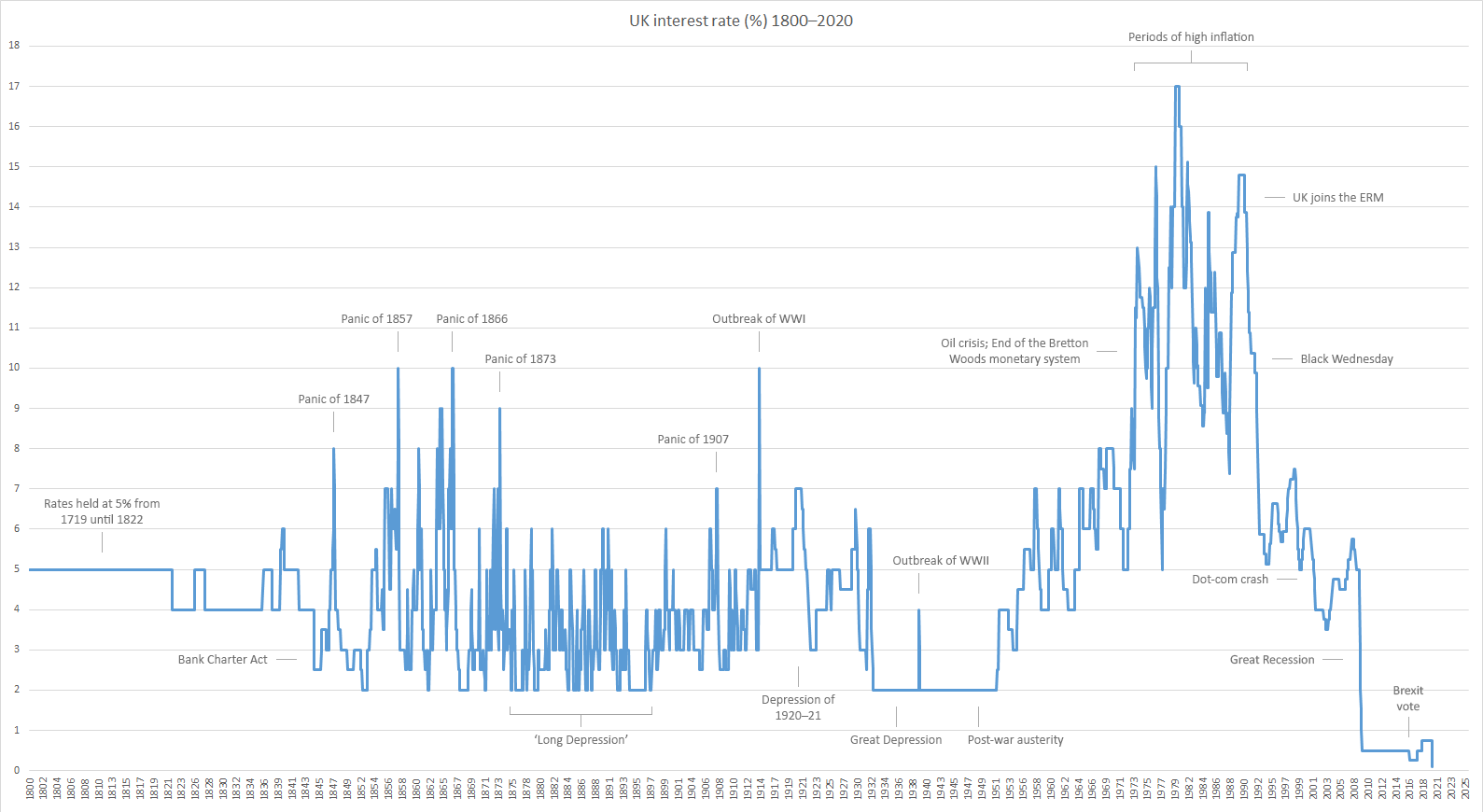

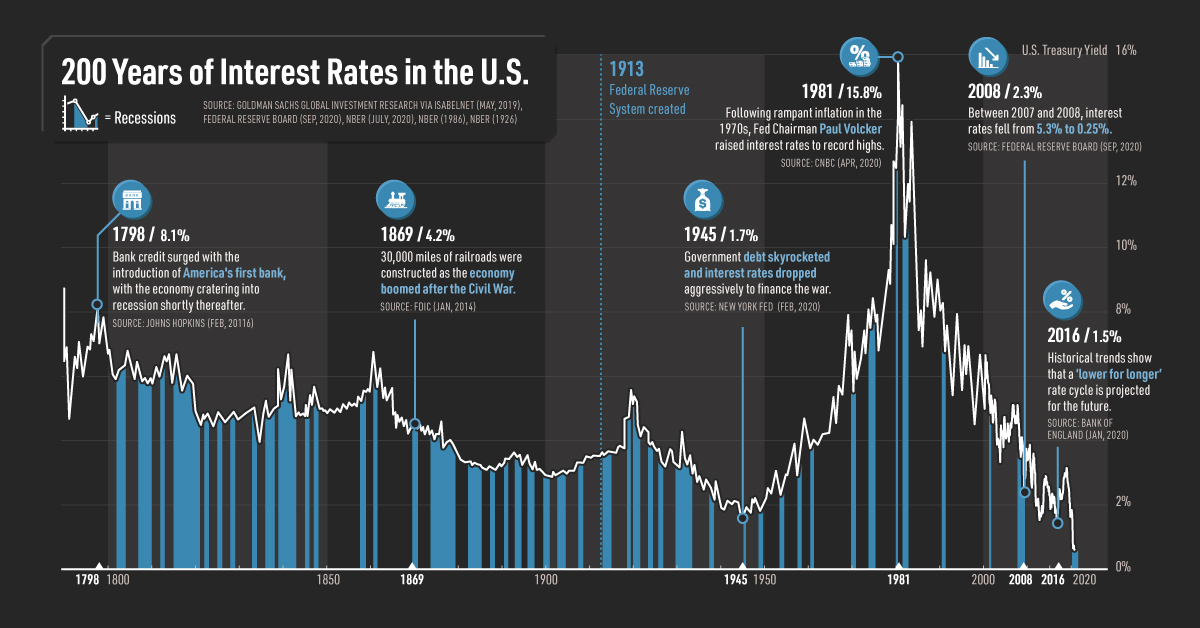

That one shows a steady downward trend interrupted by the spike around the 70s and 80s, too.focuszing723 said: 1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Is this your love-in with Gove coming into play?surrey_commuter said:

I would exclude people who supported it for personal gain. You may not like their motives but it does not make them incompetent/an idiotrick_chasey said:Using Brexit support as a shortcut to evaluate someone as incompetent has not failed me yet.

0 -

yesterday's man unfortunatelyrick_chasey said:

Is this your love-in with Gove coming into play?surrey_commuter said:

I would exclude people who supported it for personal gain. You may not like their motives but it does not make them incompetent/an idiotrick_chasey said:Using Brexit support as a shortcut to evaluate someone as incompetent has not failed me yet.

0 -

Not sure why he’s so rated. Just because he passes the bar of taking the job seriously.surrey_commuter said:

yesterday's man unfortunatelyrick_chasey said:

Is this your love-in with Gove coming into play?surrey_commuter said:

I would exclude people who supported it for personal gain. You may not like their motives but it does not make them incompetent/an idiotrick_chasey said:Using Brexit support as a shortcut to evaluate someone as incompetent has not failed me yet.

His time as education secretary made thing worse.

His time at DEFRA was overshadowed by the Brexit he helped to bring in.

He oversaw a tonne of cuts as justice secretary, something we’re still struggling to deal with that fallout from.

And what did he do as housing secretary?0 -

Anyway, here’s the health secretary getting interrupted about ambulance waiting times:

0 -

In historic news, here's Nick Clegg making promises he can't keep.0