Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

Clearly you wouldn't have chosen Brexit, but what was your alternative approach for Covid? I don't think there was a pain free approach.surrey_commuter said:

My argument was that at that level of debt when servicing costs turned against us it would already be too late.rick_chasey said:Yikes you only see this through one lens don’t you?

The sell off is about the appalling retail & spending figures and all round lack of competitiveness. It’s unusually exposed to the energy crisis because of the unusual reliance on gas and the unusual lack of gas storage (courtesy of a Truss decision in 2017)

My arguments about borrowing with you are originally from the austerity days and I’ve been proven right that austerity was a terrible policy mistake. I also argued borrowing should be considered in the context of the cost of servicing rather than big numbers.

The data coming out of China suggests the underlying non-energy inflation is coming down quite quickly and the supply chain restrictions are easing.

So that should help.

UK is in a tricky spot for the reasons above and the Fed is tightening exceptionally quickly which adds to inflationary pressures here so either you choke off the spluttering uncompetitive, Brexit addled gas starved economy, or you double down on inflation and erode everyone’s standard of living even more.

I’m curious about your views of the govt sponsored energy price cap.

You also argued that a good dose of inflation would erode the value of the debt. Now you are arguing that are debt problems are debt lead.

We are in a tricky situation because we are going into an economic crisis with a high level of debt. I have not been proved right yet but the speed with which everybody is so concerned about the markets would suggest that I will be out by a decade or so.0 -

Especially seeing as a significant increase in the number of people on long term sick leave is now one of things that seems to be putting. break on productivity.TheBigBean said:

Clearly you wouldn't have chosen Brexit, but what was your alternative approach for Covid? I don't think there was a pain free approach.surrey_commuter said:

My argument was that at that level of debt when servicing costs turned against us it would already be too late.rick_chasey said:Yikes you only see this through one lens don’t you?

The sell off is about the appalling retail & spending figures and all round lack of competitiveness. It’s unusually exposed to the energy crisis because of the unusual reliance on gas and the unusual lack of gas storage (courtesy of a Truss decision in 2017)

My arguments about borrowing with you are originally from the austerity days and I’ve been proven right that austerity was a terrible policy mistake. I also argued borrowing should be considered in the context of the cost of servicing rather than big numbers.

The data coming out of China suggests the underlying non-energy inflation is coming down quite quickly and the supply chain restrictions are easing.

So that should help.

UK is in a tricky spot for the reasons above and the Fed is tightening exceptionally quickly which adds to inflationary pressures here so either you choke off the spluttering uncompetitive, Brexit addled gas starved economy, or you double down on inflation and erode everyone’s standard of living even more.

I’m curious about your views of the govt sponsored energy price cap.

You also argued that a good dose of inflation would erode the value of the debt. Now you are arguing that are debt problems are debt lead.

We are in a tricky situation because we are going into an economic crisis with a high level of debt. I have not been proved right yet but the speed with which everybody is so concerned about the markets would suggest that I will be out by a decade or so.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Like Rick you can not stop asking me about the crises.TheBigBean said:

Clearly you wouldn't have chosen Brexit, but what was your alternative approach for Covid? I don't think there was a pain free approach.surrey_commuter said:

My argument was that at that level of debt when servicing costs turned against us it would already be too late.rick_chasey said:Yikes you only see this through one lens don’t you?

The sell off is about the appalling retail & spending figures and all round lack of competitiveness. It’s unusually exposed to the energy crisis because of the unusual reliance on gas and the unusual lack of gas storage (courtesy of a Truss decision in 2017)

My arguments about borrowing with you are originally from the austerity days and I’ve been proven right that austerity was a terrible policy mistake. I also argued borrowing should be considered in the context of the cost of servicing rather than big numbers.

The data coming out of China suggests the underlying non-energy inflation is coming down quite quickly and the supply chain restrictions are easing.

So that should help.

UK is in a tricky spot for the reasons above and the Fed is tightening exceptionally quickly which adds to inflationary pressures here so either you choke off the spluttering uncompetitive, Brexit addled gas starved economy, or you double down on inflation and erode everyone’s standard of living even more.

I’m curious about your views of the govt sponsored energy price cap.

You also argued that a good dose of inflation would erode the value of the debt. Now you are arguing that are debt problems are debt lead.

We are in a tricky situation because we are going into an economic crisis with a high level of debt. I have not been proved right yet but the speed with which everybody is so concerned about the markets would suggest that I will be out by a decade or so.

In the good times I would be running a surplus so that we were in good shape when we hit the next crisis.

This is what we did 15 years ago to keep the markets happy.

So what would I do? I would not have planned for a £60bn deficit in the pre-Covid budget0 -

It's been a while since a surplus.

0 -

0

-

The reason people don’t rate Britain isn’t the amount of debt - it’s the systemic problems that stop its economy growing and the absolute absence of any sensible people in government doing anything about it.surrey_commuter said:

Like Rick you can not stop asking me about the crises.TheBigBean said:

Clearly you wouldn't have chosen Brexit, but what was your alternative approach for Covid? I don't think there was a pain free approach.surrey_commuter said:

My argument was that at that level of debt when servicing costs turned against us it would already be too late.rick_chasey said:Yikes you only see this through one lens don’t you?

The sell off is about the appalling retail & spending figures and all round lack of competitiveness. It’s unusually exposed to the energy crisis because of the unusual reliance on gas and the unusual lack of gas storage (courtesy of a Truss decision in 2017)

My arguments about borrowing with you are originally from the austerity days and I’ve been proven right that austerity was a terrible policy mistake. I also argued borrowing should be considered in the context of the cost of servicing rather than big numbers.

The data coming out of China suggests the underlying non-energy inflation is coming down quite quickly and the supply chain restrictions are easing.

So that should help.

UK is in a tricky spot for the reasons above and the Fed is tightening exceptionally quickly which adds to inflationary pressures here so either you choke off the spluttering uncompetitive, Brexit addled gas starved economy, or you double down on inflation and erode everyone’s standard of living even more.

I’m curious about your views of the govt sponsored energy price cap.

You also argued that a good dose of inflation would erode the value of the debt. Now you are arguing that are debt problems are debt lead.

We are in a tricky situation because we are going into an economic crisis with a high level of debt. I have not been proved right yet but the speed with which everybody is so concerned about the markets would suggest that I will be out by a decade or so.

In the good times I would be running a surplus so that we were in good shape when we hit the next crisis.

This is what we did 15 years ago to keep the markets happy.

So what would I do? I would not have planned for a £60bn deficit in the pre-Covid budget0 -

Both fair points but you can’t seriously suggest the level of debt doesn’t also act as a huge deterrent?rick_chasey said:

The reason people don’t rate Britain isn’t the amount of debt - it’s the systemic problems that stop its economy growing and the absolute absence of any sensible people in government doing anything about it.surrey_commuter said:

Like Rick you can not stop asking me about the crises.TheBigBean said:

Clearly you wouldn't have chosen Brexit, but what was your alternative approach for Covid? I don't think there was a pain free approach.surrey_commuter said:

My argument was that at that level of debt when servicing costs turned against us it would already be too late.rick_chasey said:Yikes you only see this through one lens don’t you?

The sell off is about the appalling retail & spending figures and all round lack of competitiveness. It’s unusually exposed to the energy crisis because of the unusual reliance on gas and the unusual lack of gas storage (courtesy of a Truss decision in 2017)

My arguments about borrowing with you are originally from the austerity days and I’ve been proven right that austerity was a terrible policy mistake. I also argued borrowing should be considered in the context of the cost of servicing rather than big numbers.

The data coming out of China suggests the underlying non-energy inflation is coming down quite quickly and the supply chain restrictions are easing.

So that should help.

UK is in a tricky spot for the reasons above and the Fed is tightening exceptionally quickly which adds to inflationary pressures here so either you choke off the spluttering uncompetitive, Brexit addled gas starved economy, or you double down on inflation and erode everyone’s standard of living even more.

I’m curious about your views of the govt sponsored energy price cap.

You also argued that a good dose of inflation would erode the value of the debt. Now you are arguing that are debt problems are debt lead.

We are in a tricky situation because we are going into an economic crisis with a high level of debt. I have not been proved right yet but the speed with which everybody is so concerned about the markets would suggest that I will be out by a decade or so.

In the good times I would be running a surplus so that we were in good shape when we hit the next crisis.

This is what we did 15 years ago to keep the markets happy.

So what would I do? I would not have planned for a £60bn deficit in the pre-Covid budget

0 -

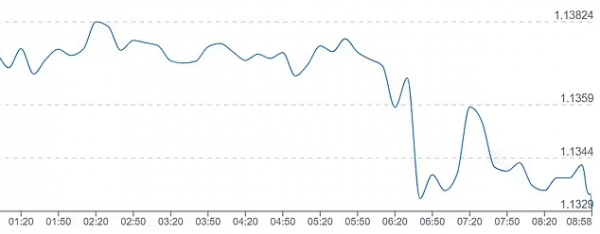

That just makes my eyes blurrybriantrumpet said:Just thought that @surrey_commuter would enjoy the up-to-the-minute £/€ graph

0

0 -

This 3D graph show the state of the global economy in the next N period when subjectiveness is taken into consideration.0 -

you guys are going to love this chart

0 -

-

GBP against the dollar I assumerick_chasey said:What is it, and what happened at 6:30?

EUR GBP?0 -

-

Sterling continues its slide. Down to $1.12. Looks like the forecasts of $1.06 weren’t too far off. It is an utter, utter sh1tshow.0

-

skyblueamateur said:

Sterling continues its slide. Down to $1.12. Looks like the forecasts of $1.06 weren’t too far off. It is an utter, utter sh1tshow.

How long before Truss says "From now the pound abroad is worth 14% or so less in terms of other currencies. It does not mean, of course, that the pound here in Britain, in your pocket or purse or in your bank, has been devalued.”

0 -

if anybody wants to get really worried then this slide is because of the markets taking a less positive view of the UK economy. This will be reflected in the debt markets and make things more expensive for new issues.

Rishi is looking like a very lucky man in being able to use QE to fund new borrowing whilst pretending not to.

Truss needs to find a way of turning QE back o and all of her problems will go away0 -

The same IFS who championed “expansionary austerity” now referring to the “stagnant austerity years”

0 -

Seems like they are diving head first into a recession. Increasing interest rates to reduce inflation at a time when spending is already being reduced? 🤔

When will it dawn on them that the inflation is being caused by worldwide factors?The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

-

Have to stabilise Sterling or inflation will be even more out of control. The horse has already bolted though unfortunately.pblakeney said:Seems like they are diving head first into a recession. Increasing interest rates to reduce inflation at a time when spending is already being reduced? 🤔

When will it dawn on them that the inflation is being caused by worldwide factors?

Interest rates are the only stabiliser the BoE has. All a bit futile though when the markets look at what Truss is proposing and think it’s not financially viable I. The slightest. The magic money tree is considerably larger than what even Corbyn proposed.

Strong and stable they said…..0 -

For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?2

-

*because the economy is up the swanny*surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

It's the equivalent of taking out a big cheap mortgage - house prices are rising, all is good.

You then get told you have a 30% paycut and your house price is falling. Bank is not gonna be as happy.

The analogy falls over because the money borrowed isn't just to buy a house it's to get the economy going or to stop it falling over, but you get the idea.

The worry is the drop in real GDP. If growth was at 10%, no-one would be remotely worried about the borrowing.0 -

True, but the only result will be a harder recession. May as well whistle Dixie into a hurricane, all while increasing spending and reducing taxes. No coherent plan.rick_chasey said:

Gotta follow the fed. Look at Sterling.pblakeney said:Seems like they are diving head first into a recession. Increasing interest rates to reduce inflation at a time when spending is already being reduced? 🤔

When will it dawn on them that the inflation is being caused by worldwide factors?The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Inflation won't be caused by "worldwide factors" if they don't follow the fed.pblakeney said:

True, but the only result will be a harder recession. May as well whistle Dixie into a hurricane, all while increasing spending and reducing taxes. No coherent plan.rick_chasey said:

Gotta follow the fed. Look at Sterling.pblakeney said:Seems like they are diving head first into a recession. Increasing interest rates to reduce inflation at a time when spending is already being reduced? 🤔

When will it dawn on them that the inflation is being caused by worldwide factors?

Trivial example, the price of Iphones now is eye-watering, and a big chunk of it is the exchange rate. Iphone 14: $799 or £845. Can't let that get much worse.0 -

That does not stack up as an explanation as the argument was specifically that this would happen and we were reassured that it did not matter.rick_chasey said:

*because the economy is up the swanny*surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

It's the equivalent of taking out a big cheap mortgage - house prices are rising, all is good.

You then get told you have a 30% paycut and your house price is falling. Bank is not gonna be as happy.

The analogy falls over because the money borrowed isn't just to buy a house it's to get the economy going or to stop it falling over, but you get the idea.

The worry is the drop in real GDP. If growth was at 10%, no-one would be remotely worried about the borrowing.

I disagree that the economy is up the swanny. The problem is that our self inflicted wounds have reduced the markets perceptions of our future potential.1 -

The vast majority of commodities and products are traded in dollars. If we don’t stabilise Sterling inflation is going to run even further out of control.

I’m caught at the short end of this and as containers are also paid for in dollars it’s a double whammy.

This should be the governments primary concern.0 -

I’d agree on no coherent plan. I actually agree with the cut in CT as I believe that will stimulate growth and make it more attractive to invest in the UK which is desperately needed.pblakeney said:

True, but the only result will be a harder recession. May as well whistle Dixie into a hurricane, all while increasing spending and reducing taxes. No coherent plan.rick_chasey said:

Gotta follow the fed. Look at Sterling.pblakeney said:Seems like they are diving head first into a recession. Increasing interest rates to reduce inflation at a time when spending is already being reduced? 🤔

When will it dawn on them that the inflation is being caused by worldwide factors?

Although I’d be a net beneficiary of the reversal of NI and cut in tax it’s neither here nor there really and eye-wateringly expensive. Purely playing to the core base.

0 -

Inflation would normally be caused by too much demand the policy medicine for which would be increased interest rates to make people poorer.pblakeney said:

True, but the only result will be a harder recession. May as well whistle Dixie into a hurricane, all while increasing spending and reducing taxes. No coherent plan.rick_chasey said:

Gotta follow the fed. Look at Sterling.pblakeney said:Seems like they are diving head first into a recession. Increasing interest rates to reduce inflation at a time when spending is already being reduced? 🤔

When will it dawn on them that the inflation is being caused by worldwide factors?

Brexit has broken the equilibrium of our economy and so we have conflicting economic signals and no obvious policy medicine.

Truss has one half of an economic policy we just have to hope that she quickly fills in the holes on how she is going to drastically reduce the size of the state to get spending under control0 -

I see your concerns as a symptom of the problem. You see them as a cause.surrey_commuter said:

I disagree that the economy is up the swanny. The problem is that our self inflicted wounds have reduced the markets perceptions of our future potential.

It's just a cause or effect argument.0 -

If you say so.rick_chasey said:

Inflation won't be caused by "worldwide factors" if they don't follow the fed.pblakeney said:

True, but the only result will be a harder recession. May as well whistle Dixie into a hurricane, all while increasing spending and reducing taxes. No coherent plan.rick_chasey said:

Gotta follow the fed. Look at Sterling.pblakeney said:Seems like they are diving head first into a recession. Increasing interest rates to reduce inflation at a time when spending is already being reduced? 🤔

When will it dawn on them that the inflation is being caused by worldwide factors?

Trivial example, the price of Iphones now is eye-watering, and a big chunk of it is the exchange rate. Iphone 14: $799 or £845. Can't let that get much worse.

I cannot discount energy costs or supply issues increasing costs and therefore inflationThe above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0