Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

kind of.rick_chasey said:

I see your concerns as a symptom of the problem. You see them as a cause.surrey_commuter said:

I disagree that the economy is up the swanny. The problem is that our self inflicted wounds have reduced the markets perceptions of our future potential.

It's just a cause or effect argument.

The market takes a long term view as that is the lifetime of the debt, or investment. The UK's reputation for good decision making has taken a hammering in the last 6 but the economy is not currently up the swanny.0 -

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

0 -

Seeing the real time price rises of the same lunch in places near the office is quite eye opening.0

-

the bigger the better was the inflation mantrakingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

0 -

Nope.surrey_commuter said:

the bigger the better was the inflation mantrakingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

0 -

Fuel also coming down - I live near a petrol station and it's gone down 1 or 2 pence every 3-4 days for the last few weeks. Now at 179.9rick_chasey said:Seeing the real time price rises of the same lunch in places near the office is quite eye opening.

0 -

Rick was definitely in favour of inflating away the problemkingstongraham said:

Nope.surrey_commuter said:

the bigger the better was the inflation mantrakingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

0 -

Demand side inflation was something I thought was worth tolerating if it was boosting demand, investment, etc.surrey_commuter said:

Rick was definitely in favour of inflating away the problemkingstongraham said:

Nope.surrey_commuter said:

the bigger the better was the inflation mantrakingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

Supply side inflation/stagflation is clearly not ever good0 -

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

0 -

Fair play for predicting Chinese Zero Covid strategy and the biggest war in Europe for 80 yearsTheBigBean said:

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

0

0 -

Seeing the wood through the trees you mean.rick_chasey said:

Fair play for predicting Chinese Zero Covid strategy and the biggest war in Europe for 80 yearsTheBigBean said:

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

0

0 -

If you spot the wrong cause of inflation and inflation happens, that's not good analysis.TheBigBean said:

Seeing the wood through the trees you mean.rick_chasey said:

Fair play for predicting Chinese Zero Covid strategy and the biggest war in Europe for 80 yearsTheBigBean said:

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

It is clear that supply side problems in China and the war in Ukraine are by far the main drivers of inflation.

0 -

I’ve been boringly banging on about Chinese supply side problems and carriage increases for a few years. It hasn’t happened over night. If I could see what was coming then the BoE and government definitely should have.rick_chasey said:

If you spot the wrong cause of inflation and inflation happens, that's not good analysis.TheBigBean said:

Seeing the wood through the trees you mean.rick_chasey said:

Fair play for predicting Chinese Zero Covid strategy and the biggest war in Europe for 80 yearsTheBigBean said:

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

It is clear that supply side problems in China and the war in Ukraine are by far the main drivers of inflation.

0 -

Doesn't the first post on this thread have a prediction of inflation not going above 4.5%?

Edited - those are linked graphs, so that's the current prediction for one year onwards.0 -

Sure but surely the Zero Covid process has compounded the problem? That's what I read anyway.skyblueamateur said:

I’ve been boringly banging on about Chinese supply side problems and carriage increases for a few years. It hasn’t happened over night. If I could see what was coming then the BoE and government definitely should have.rick_chasey said:

If you spot the wrong cause of inflation and inflation happens, that's not good analysis.TheBigBean said:

Seeing the wood through the trees you mean.rick_chasey said:

Fair play for predicting Chinese Zero Covid strategy and the biggest war in Europe for 80 yearsTheBigBean said:

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

It is clear that supply side problems in China and the war in Ukraine are by far the main drivers of inflation.1 -

There was also a drought in summer which impacted on hydro power and lowered river levels stopping shipping. That's what I read anyway.rick_chasey said:

Sure but surely the Zero Covid process has compounded the problem? That's what I read anyway.skyblueamateur said:

I’ve been boringly banging on about Chinese supply side problems and carriage increases for a few years. It hasn’t happened over night. If I could see what was coming then the BoE and government definitely should have.rick_chasey said:

If you spot the wrong cause of inflation and inflation happens, that's not good analysis.TheBigBean said:

Seeing the wood through the trees you mean.rick_chasey said:

Fair play for predicting Chinese Zero Covid strategy and the biggest war in Europe for 80 yearsTheBigBean said:

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

It is clear that supply side problems in China and the war in Ukraine are by far the main drivers of inflation.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

You can admit to getting it wrong.rick_chasey said:

If you spot the wrong cause of inflation and inflation happens, that's not good analysis.TheBigBean said:

Seeing the wood through the trees you mean.rick_chasey said:

Fair play for predicting Chinese Zero Covid strategy and the biggest war in Europe for 80 yearsTheBigBean said:

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

It is clear that supply side problems in China and the war in Ukraine are by far the main drivers of inflation.1 -

Of course it hasn’t helped but I would argue (possibly incorrectly) that it is negligible. The damage had already been done.rick_chasey said:

Sure but surely the Zero Covid process has compounded the problem? That's what I read anyway.skyblueamateur said:

I’ve been boringly banging on about Chinese supply side problems and carriage increases for a few years. It hasn’t happened over night. If I could see what was coming then the BoE and government definitely should have.rick_chasey said:

If you spot the wrong cause of inflation and inflation happens, that's not good analysis.TheBigBean said:

Seeing the wood through the trees you mean.rick_chasey said:

Fair play for predicting Chinese Zero Covid strategy and the biggest war in Europe for 80 yearsTheBigBean said:

Indeed. My comments on this were the reason this thread was started.kingstongraham said:

And inflation.rjsterry said:

Nobody said it 'wasn't an issue'. The argument was over what the constraints on borrowing are. Pretty sure lender confidence was discussed.surrey_commuter said:For those who supported the theory that borrowing was not an issue because we had a sovereign currency can they explain why it has seemingly imploded so abruptly?

It is clear that supply side problems in China and the war in Ukraine are by far the main drivers of inflation.

We’ve found cost prices in USD stay roughly the same. Carriage charges killed things initially.

All of this has been compounded by the run on sterling. It has made products 20% more expensive. Tied in with carriage charges that were 4-5 times more expensive which now have the added bonus of the currency burden on top.

The run on the pound has come due to bad economic decisions and the ridiculous amount of QE that occurred. I make SC bang on with his predictions from the last 18 months.

1 -

Saying an F1 car won’t finish because the engine blows up and the F1 car doesn’t finish because the driver crashed it into a wall, that is not a good prediction0

-

I said a historically unprecedented increase in money supply combined with pent-up demand and recovery issues would lead to inflation. I stand by that. Ukraine has added to this, but it doesn't make my initial assertion wrong.rick_chasey said:Saying an F1 car won’t finish because the engine blows up and the F1 car doesn’t finish because the driver crashed it into a wall, that is not a good prediction

2 -

I think it does, unless you can prove the money supply increase with the increase in demand has caused the majority of inflation.TheBigBean said:

I said a historically unprecedented increase in money supply combined with pent-up demand and recovery issues would lead to inflation. I stand by that. Ukraine has added to this, but it doesn't make my initial assertion wrong.rick_chasey said:Saying an F1 car won’t finish because the engine blows up and the F1 car doesn’t finish because the driver crashed it into a wall, that is not a good prediction

The money supply has increased lots of times over the past 10 years and it hasn't impacted inflation at all, so there isn't even that much correlation, let alone proof of causation.0 -

I've provided graphs to evidence that this isn't the case at M4 level.rick_chasey said:

I think it does, unless you can prove the money supply increase with the increase in demand has caused the majority of inflation.TheBigBean said:

I said a historically unprecedented increase in money supply combined with pent-up demand and recovery issues would lead to inflation. I stand by that. Ukraine has added to this, but it doesn't make my initial assertion wrong.rick_chasey said:Saying an F1 car won’t finish because the engine blows up and the F1 car doesn’t finish because the driver crashed it into a wall, that is not a good prediction

The money supply has increased lots of times over the past 10 years and it hasn't impacted inflation at all, so there isn't even that much correlation, let alone proof of causation.

0 -

0

-

A better analogy would be us saying that if he keeps driving like a tvvat he will kill somebody. He has now driven into a wall and killed himself and you are arguing we were wrong.rick_chasey said:Saying an F1 car won’t finish because the engine blows up and the F1 car doesn’t finish because the driver crashed it into a wall, that is not a good prediction

Anyway we all kept saying that with that level of debt if conditions changed against us then it would be uncontrollable.0 -

We all knew the conditions would change against us the only question was when. I think within 5 years was ballpark. How is irrelevant, what was needed was a plan of action.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

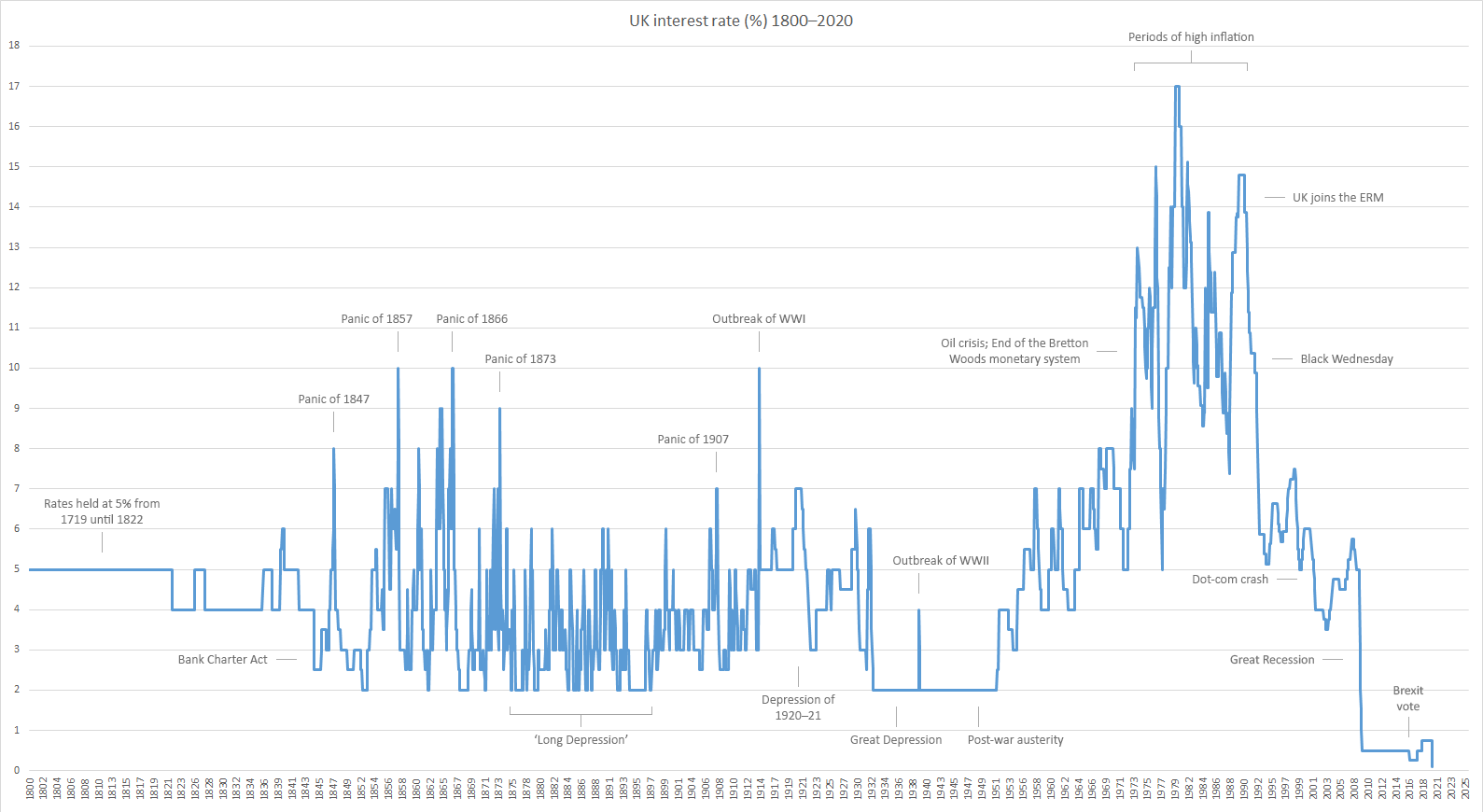

I warned all you c0ckn0ckers about historic interest rates, quad percent now. I said it was wrong to assume near zero rates was the new norm.

Look, all I want it at least twenty likes. It's not asking much.5 -

Thank you Secretsqirrel. Come on, where's the rest of them?2

-

Well, the fact my greatness can be disparaged in such a way makes me feel sad. I'm going back to the $h1tness of reality and it's all your faults.0

-

Hope you're all happy!0