Today's discussion about the news

Comments

-

-

That Baltimore bridge collapse is horrendous. This, just gone.

https://twitter.com/guywalters/status/1772568132822950003?t=GJYuK2qfgbyKGG9tdhdu8g&s=19

0 -

So I watch quite a few morbid history type videos and boat/bridge collisions seem to crop up quite often. The solution is always the same - put something in front to the bridge for boats to hit that isn't the actual bridge. I can't understand why, once it has happened in one state, this precaution wasn't taken elsewhere.

0 -

I'm also confused about whether there was pilot and why it was travelling that fast (or maybe any speed was enough given its size). In some ports the ships are towed by tug boats because the passage is difficult and it doesn't seem that easy in Baltimore.

0 -

Loss of power while moving. Apparently.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

-

Yes, I read that, but it still seems a bit strange given the high risk nature of going under the bridge.

0 -

This was the one I had in mind. Also there was a box girder rail bridge hit by a barge in Louisiana I watched one about. It is bound to be a result of giving individual states the power to mandate something, or not.

They have a similar issue brewing with dams, I've heard. As in, lots are in about the same state as the Oriville dam that has already failed.

0 -

-

'I'm In Love With Margaret Thatcher' but then I'm 'Not Sensible' 😉

0 -

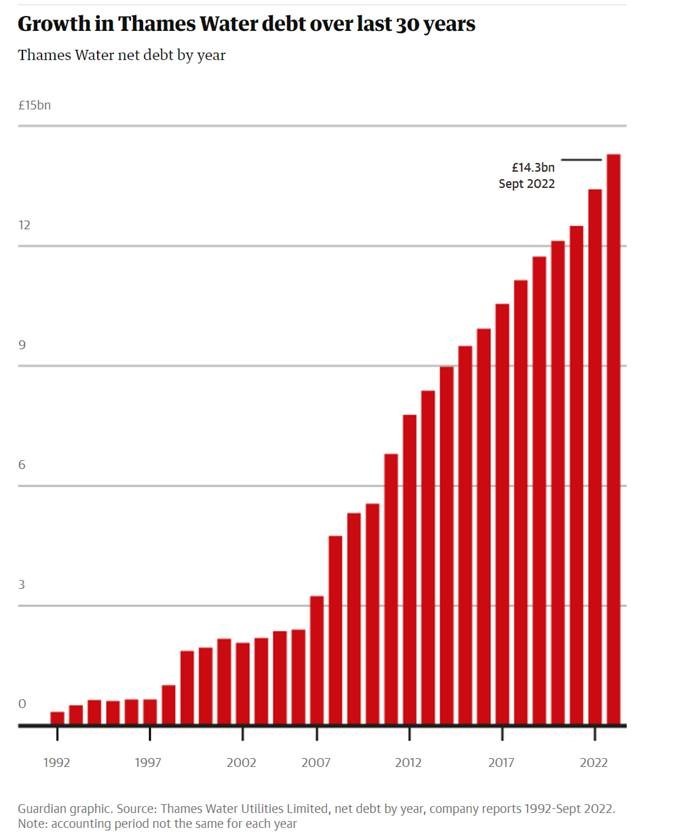

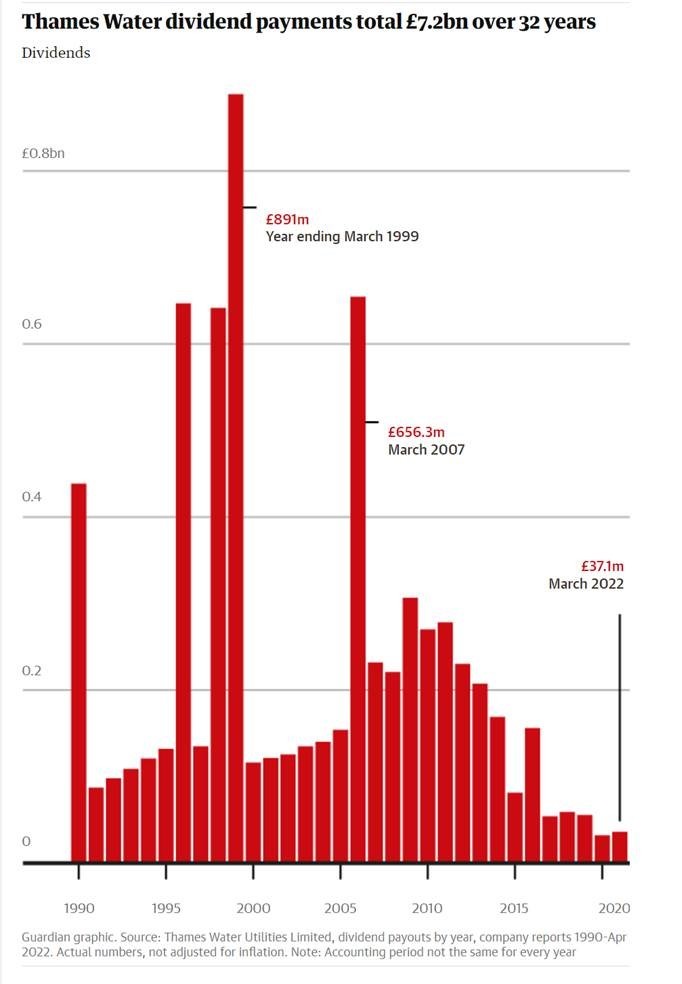

Dividends are immaterial compared to the debt they have racked up and no external dividends have been paid in the last 5 years. Looks more like a badly run company than evil capitalist shareholders bleeding the company dry.

Sometimes you need to take the siren voices of leftìevollox with a pinch of salt (I realise that's not easy for some 😉)

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

What's the material difference between paying out tens of millions in dividends to internal or external investors?

- Genesis Croix de Fer

- Dolan Tuono0 -

-

One is to the parent company within the same group, the other one isn't. Just stating the facts. However let's put the dividends into perspective: Thames Water has debts of £14 billion and dividends over the last 5 years are a little over 1% of that. So explain to me how those dividends are material to the financial problems of the company.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Given the fairly vital nature of their service, one might think that running up destabilising debts of that size should be something that was tackled a bit sooner.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Daily Torrygraph has some opinions on the matter.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

depends what period the 14bn debt was incurred over

if it wasn't the last 5 years then you'd be either liar or delusional

my bike - faster than god's and twice as shiny0 -

-

That doesn't address my point, which was how the dividends paid in the last 5 years amounting to 1% could have a material impact on its current financial position.

And as I've said above, it looks like a badly run company.

Has anyone ever advised you RTFQ before spouting off? 😉

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Yep, as mentioned above, looks like a badly run company. I haven't delved into the detail and luckily they don't cover my area (unlike sungod, who is understandably in a bad mood).

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Any reason you are only looking at the last 5 years?

0 -

The past 5 years are insignificant compared to the plundering by Macquarie 2006-17, load the debt pull the cash and F off as the storm brews over the horizon. Capitalism at its finest.

0 -

Thames Water don't seem to be the only one with fairly extreme debt servicing costs...

0 -

Debt they’ve “racked up”. The policy has been to load the company up with debt to extract returns.

that’s not on Thames water but on the PE owners.

0 -

I'm not sure "oh it's just a badly run company" is the great argument that you seem to think it is.

0 -

I suspect that Stevo's argument won't stop most people being (at least) cynical. The longer history of these privatised utilities suggest that one way or another the general public has been systematically ripped off. I think that "Oops!" won't hold water.

0 -

It's an observation based on what I can see. If they were well run they wouldn't be in financial trouble. Do you disagree with that?

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

More recent years are probably more relevant.

What time horizon would you prefer and why?

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

The owners they have pretty good say in how the business is run given they can appoint the directors, make shareholders resolutions instructing the board/company what to do. As I'm sure you know.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Yes and they did that in a way to extract dividend at the expense of longer term stability and social utility.

Bluntly, the investors loaded it up with debt it now can’t afford because of rising interest rates.

That the investors are unwilling to step in to find the £500m hole suggests that this model over ownership is not serving Thames water customers aka the public. It is not like it is possible for their customers are able to switch.

0