Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

Never said I knew. It's in the realm of a realistic outcome at the moment.surrey_commuter said:

How do you "know" this bank is going to collapse? as only a relative handful of people could know this are you sure you should be sharing very market sensitive information?rick_chasey said:

Here we go.

Officially a “bank of systemic importance” ie too big to fail, so let’s see.

Don’t think it’ll be anywhere as bad as Lehman but hardly good either

I mean, the CEO issuing a statement that "we're well capitalised and don't have liquidity problems" on a Saturday and that being news suggests things aren't all that.

CDS spreads are highest since the crash and at various moments have been higher than the crash - Swiss Gov't seriously considering a bail out etc.

Their PB business is basically non-existent now as they've had to cut all their risk lines to nothing, similar story on the lev fin desk.

This wouldn't be problematic in and of itself but that was the bulk of the CS business AFAIK.

0 -

so at risk rather than "en route to going bust"rick_chasey said:

Never said I knew. It's in the realm of a realistic outcome at the moment.surrey_commuter said:

How do you "know" this bank is going to collapse? as only a relative handful of people could know this are you sure you should be sharing very market sensitive information?rick_chasey said:

Here we go.

Officially a “bank of systemic importance” ie too big to fail, so let’s see.

Don’t think it’ll be anywhere as bad as Lehman but hardly good either

I mean, the CEO issuing a statement that "we're well capitalised and don't have liquidity problems" on a Saturday and that being news suggests things aren't all that.

CDS spreads are highest since the crash and at various moments have been higher than the crash - Swiss Gov't seriously considering a bail out etc.

Their PB business is basically non-existent now as they've had to cut all their risk lines to nothing, similar story on the lev fin desk.

This wouldn't be problematic in and of itself but that was the bulk of the CS business AFAIK.

you may or may not be right but surely the share price would have fallen 90% rather than 9% if the market thought it was going to fail?0 -

rick_chasey said:

Here we go.

Officially a “bank of systemic importance” ie too big to fail, so let’s see.

Don’t think it’ll be anywhere as bad as Lehman but hardly good either

Gotta love that graph. Where's zero on the Y axis?0 -

That is the best yetbriantrumpet said:rick_chasey said:

Here we go.

Officially a “bank of systemic importance” ie too big to fail, so let’s see.

Don’t think it’ll be anywhere as bad as Lehman but hardly good either

Gotta love that graph. Where's zero on the Y axis?0 -

Yeah it seems to have stabilised today.surrey_commuter said:

so at risk rather than "en route to going bust"rick_chasey said:

Never said I knew. It's in the realm of a realistic outcome at the moment.surrey_commuter said:

How do you "know" this bank is going to collapse? as only a relative handful of people could know this are you sure you should be sharing very market sensitive information?rick_chasey said:

Here we go.

Officially a “bank of systemic importance” ie too big to fail, so let’s see.

Don’t think it’ll be anywhere as bad as Lehman but hardly good either

I mean, the CEO issuing a statement that "we're well capitalised and don't have liquidity problems" on a Saturday and that being news suggests things aren't all that.

CDS spreads are highest since the crash and at various moments have been higher than the crash - Swiss Gov't seriously considering a bail out etc.

Their PB business is basically non-existent now as they've had to cut all their risk lines to nothing, similar story on the lev fin desk.

This wouldn't be problematic in and of itself but that was the bulk of the CS business AFAIK.

you may or may not be right but surely the share price would have fallen 90% rather than 9% if the market thought it was going to fail?

I am a professional gossip and CS falling over is very much the gossip.

0 -

I mean if Jim Cramer is saying it’s over it’s by definition not over

0 -

Had my pension trustee hat on this morning for a meeting with the financial advisors.

The reckon nobody is saying anything but the BofE intervened to save the LDI Funds not the pension funds as they could not cover the gap between the markets moving and their clients posting more collateral.

Probably as a result of this they are reducing their leverage ratios whcih means we have to pony up another £25m or let our hedge % fall.1 -

Waffle

Yep, still waiting for those twenty likes!focuszing723 said:

The rest is waffle.0 -

Historic Norms.0

-

Right, you lot have wasted too much of my time as it is. Ain't no time to play...0

-

https://www.validusrm.com/2022/10/18/the-autumn-of-dangers/They (i.e. markets) continue to function well, and we have not seen the signs of deleveraging of the kind that sometimes occurs in an environment of tighter monetary policy.

US Treasury Secretary, Janet Yellen October 11th, 2022

We are worried about a loss of adequate liquidity in the market

US Treasury Secretary, Janet Yellen October 12th, 20220 -

0 -

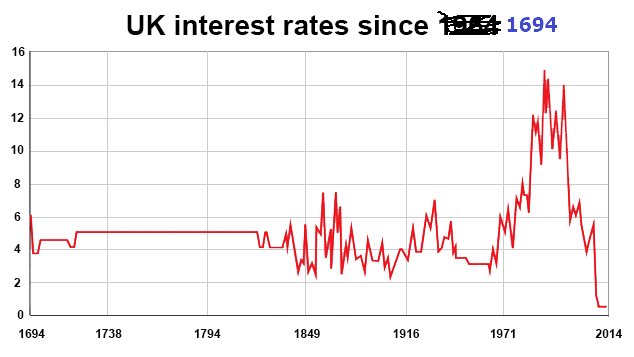

Genuine question -as your point is that interest rates will return to the historic norm why don't you use an updated chart which would show the start of that return?focuszing723 said: 0

0 -

Genuine question -as your point is that interest rates will return to the historic norm why don't you use an updated chart which would show the start of that return?focuszing723 said: 0

0 -

No, don't want to.surrey_commuter said:

Genuine question -as your point is that interest rates will return to the historic norm why don't you use an updated chart which would show the start of that return?focuszing723 said: 0

0 -

0 -

The rest is .w.a.f.f.l.e.0

-

have you forgotten your original point?focuszing723 said:The rest is .w.a.f.f.l.e.

0 -

TheBigBean said:

Are you quite forgetful by nature?focuszing723 said:

To remind myself near zero interest rates are not the historic norm.TheBigBean said:

Why do you keep posting this?focuszing723 said:focuszing723 said: 0

0 -

focuszing723 said:

I don't want to see normal people who just want a home get caught up in negative equity.

0 -

Bit late for that.focuszing723 said:focuszing723 said:I don't want to see normal people who just want a home get caught up in negative equity.

0 -

Tell you, the zero rate fallacy is fvcking disgrace. All those fvckin so say experts, LOL.

It's not funny though.0 -

I posted that last year.rick_chasey said:

Bit late for that.focuszing723 said:focuszing723 said:I don't want to see normal people who just want a home get caught up in negative equity.

0 -

December 2021.0

-

Christ!0

-

0

-

Rates don't have to come up. It's not like some physical law.

You can keep them low all you want. It's simply a question of whether that's a good idea. I think plenty of mortgages would have been taken out on the understanding that rates were likely to rise, what wouldn't have been factored is the double whammy of absolutely incredible inflation.0 -

Meh, I bet half the population are oblivious with their heads glued to their lcd noggin watching tiktok clips.0

-

This morning the BBC hosted a current Tory leadership contender and the leader of the opposition on Sunday with Laura Kuenssberg. Yet the most insightful comments came from one of the panel members: Lord Mervyn King, former governor of the Bank of England between 2003 and 2013. Asked by Kuenssberg about the narrative that’s doing the rounds with some Truss supporters – that markets ‘bullied’ Truss out of her plans and out of office – King offered up a robust response and a clear explanation of what had gone so badly wrong:

Markets are not in charge. Governments and central banks are. Markets respond to the announcements made by government and central banks. And central banks have lost control of inflation, government lost control of the public finance; not surprising that markets respond to that.

I think all central banks in the west, interestingly, made the same mistake. And during Covid, when the economy was actually contracting because of lockdown, central banks decided it was a good time to print a lot of money. That was a mistake. That led to inflation. We had too much money chasing too few goods. And the result was inflation. That was predictable. It was predicted, and it happened. So that’s one problem we have to try to get out of. But the public finances both in the United States and the United Kingdom were not put on a sustainable track. And markets responded to that.

King’s comments succinctly tapped into several important factors that led to the mini-Budget blow-up and the economic crisis we’re in. He noted the extent to which this is an international story: that the UK is not the only country experiencing higher interest rates or borrowing costs, as the economic climate is changing for everyone (albeit it’s happened faster in Britain, with far more international attention).

https://www.spectator.co.uk/article/mervyn-king-said-the-unsayable-about-britain-s-economy/0 -

https://www.youtube.com/watch?v=pXAYNppypVI

https://www.youtube.com/watch?v=pXAYNppypVI