Macroeconomics, the economy, inflation etc. *likely to be very dull*

Comments

-

So this is what I mean when I make my post modern arguments.surrey_commuter said:

And whilst it was a very expensive lesson at least people learned that they should not rely on growth devaluing debt and to budget for rate rise over the duration of long term debtTheBigBean said:

One and the same to me. The market and regulation failed because economists had solved the problem - there would be no more busts. As a result people didn't need to worry about risk in the same way which led to the collective failure.surrey_commuter said:

I would count GFC as a market (or regulatory) failure rather than one of economic/financial orthodoxyTheBigBean said:

Yes, that was the economic dream that culminated in the GFC. Back in the real world crises happen. Sometimes they are even self-imposed.surrey_commuter said:

I was thinking of not creating a crisisTheBigBean said:

Isn't it rewritten after every crisis?surrey_commuter said:

can you elaborate?focuszing723 said:I still cannot believe the naivety/stupidity of the vast majority of economic/financial so say experts.

I give up. I'm willing to give Mars a try, beam me up Scotty.

To me economic/financial orthodoxy has been proved on the money with Brexit and now this.

You will always find an outlier trying to sell a book or get on TV but that would be like condemning all scientists because some deny climate change

The lesson is in not going for demand side expansionary policies in the middle of double digit inflation and monetary tightening.0 -

All's fine. The UK is going to be bought up by foreign investors. Taking Back Control. Yessirree! It's in the Telegraph, so must be fine & dandy.

https://www.telegraph.co.uk/business/2022/09/27/sterling-sell-off-generational-opportunity-buying-uk-assets/Yet the panic over Truss has put Italy and the euro on the back burner. “We are lucky,” Olivier Blanchard, former chief economist at the IMF, told the Financial Times, “that the UK is not in the euro…Otherwise, we would be facing another euro crisis.”

Even so, given historic trading parameters, it seems overwhelmingly likely that we are already well into the last 10pc of the devaluation. To think otherwise is to believe that things have changed fundamentally – that the pound has essentially taken on the characteristics of an emerging market currency.

Such a case is admittedly not hard to make. Alongside record peacetime levels of public debt, we have massive structural deficits in both the current account and the public finances, which, in the short term at least, Kwasi Kwarteng’s giveaway “fiscal statement” will only exacerbate.

Even Italy, long viewed – completely wrongly in my view – as a basket case, doesn't have this twin deficit problem. Were it not for spiralling imported energy costs, it would still enjoy a substantial current account surplus. Moreover, if we aggregate all Italian debt, private as well as public, Italy’s overall debt position doesn't look so bad, and certainly a good deal better than Britain’s.

The other change is Brexit, which has made trade with the UK's biggest market – the EU – more complicated and costly. Most economists continue to take the view that this has fundamentally harmed the country’s long term growth potential. Add all these perceived negatives together, and there is more than enough there to justify the sterling sell-off of the past few days.0 -

I probably ought not to be laughing at the meltdown. But how could I not...?

https://www.telegraph.co.uk/business/2022/09/27/imf-urges-truss-reverse-top-rate-tax-cut-extraordinary-attack/The International Monetary Fund has urged Liz Truss to reverse the decision to abolish the top rate of income tax, in a highly unusual attack on the economic policy of a G7 country.

The world’s lender of last resort heaped pressure on Ms Truss and the Chancellor, as it urged Kwasi Kwarteng to use his fiscal plan in November to change course.

The IMF said it is “closely monitoring recent economic developments in the UK and are engaged with the authorities" and warned that the fiscal stimulus risks undermining the Bank of England’s efforts to curb inflation.

A spokesman for the Washington DC-based organisation said Mr Kwarteng's announcement in November would “present an early opportunity for the UK government to consider ways to provide support that is more targeted and reevaluate the tax measures, especially those that benefit high income earners”.

It is an extremely rare intervention by the IMF on a developed country’s economic policy.

On Tuesday night, it drew an angry reaction from senior Tories. Lord Frost, the former Brexit minister and an ally of Ms Truss, told The Daily Telegraph: "The IMF has consistently advocated highly conventional economic policies. It is following this approach that has produced years of slow growth and weak productivity.

"The only way forward for Britain is lower taxes, spending restraint, and significant economic reform. Liz Truss and Kwasi Kwarteng are rightly focused on delivering this and they should tune out the criticism from those who are still in the intellectual world of Gordon Brown."

Lord F**king Frost, that world-renowned economist, whose magic touch is a guarantee of success with everything he does...0 -

focuszing723 said:

0

0 -

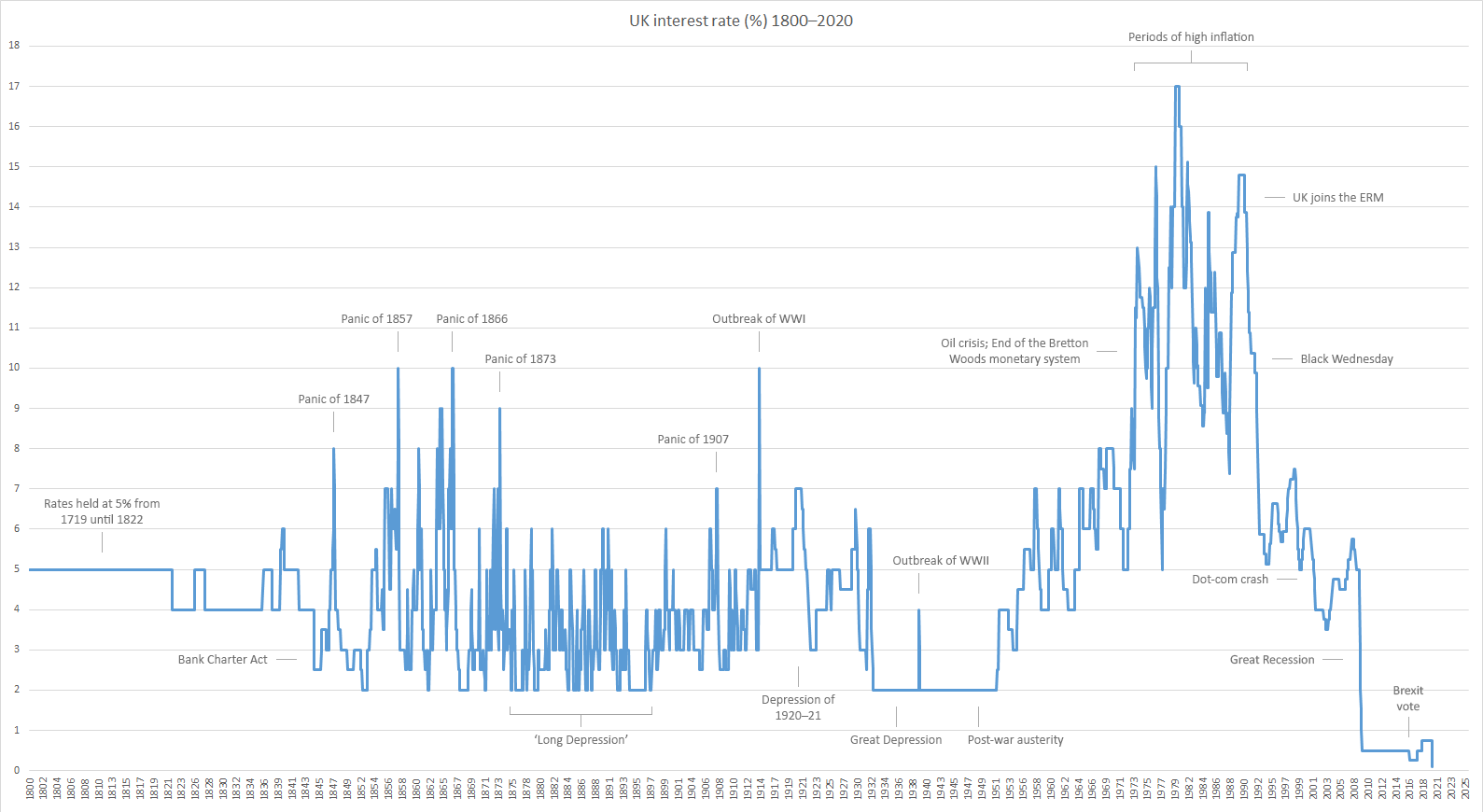

No explanation is required, just look at the graph, waffle is irrelevant.0

-

I can see that the IMF has some interest in the overall fiscal package and its impact on inflation and exchange rates, given that sterling is a key currency in the global financial system. But it really has no right to be commenting on specific tax cuts and the degree of targeting of financial support, as these are matters for the UK political system to address at the next GE. Poverty in the UK and it implications for those affected is clearly a "bad thing" but is not in itself a risk to the global financial system, which is the IMF's concern.briantrumpet said:I probably ought not to be laughing at the meltdown. But how could I not...?

https://www.telegraph.co.uk/business/2022/09/27/imf-urges-truss-reverse-top-rate-tax-cut-extraordinary-attack/The International Monetary Fund has urged Liz Truss to reverse the decision to abolish the top rate of income tax, in a highly unusual attack on the economic policy of a G7 country.

The world’s lender of last resort heaped pressure on Ms Truss and the Chancellor, as it urged Kwasi Kwarteng to use his fiscal plan in November to change course.

The IMF said it is “closely monitoring recent economic developments in the UK and are engaged with the authorities" and warned that the fiscal stimulus risks undermining the Bank of England’s efforts to curb inflation.

A spokesman for the Washington DC-based organisation said Mr Kwarteng's announcement in November would “present an early opportunity for the UK government to consider ways to provide support that is more targeted and reevaluate the tax measures, especially those that benefit high income earners”.

It is an extremely rare intervention by the IMF on a developed country’s economic policy.

On Tuesday night, it drew an angry reaction from senior Tories. Lord Frost, the former Brexit minister and an ally of Ms Truss, told The Daily Telegraph: "The IMF has consistently advocated highly conventional economic policies. It is following this approach that has produced years of slow growth and weak productivity.

"The only way forward for Britain is lower taxes, spending restraint, and significant economic reform. Liz Truss and Kwasi Kwarteng are rightly focused on delivering this and they should tune out the criticism from those who are still in the intellectual world of Gordon Brown."

Lord F**king Frost, that world-renowned economist, whose magic touch is a guarantee of success with everything he does...

Notwithstanding that above, Frost should just f*** off. He's an unelected mediocrity (and I think that is being charitable) who would be rightly slated by the anti-EU media here if he'd been (un)elected to the European Commission.

0 -

Bahaha. It's fine when the shoe's on the other foot, criticising developing countries, but when it's Britain it's not cool?wallace_and_gromit said:

I can see that the IMF has some interest in the overall fiscal package and its impact on inflation and exchange rates, given that sterling is a key currency in the global financial system. But it really has no right to be commenting on specific tax cuts and the degree of targeting of financial support, as these are matters for the UK political system to address at the next GE. Poverty in the UK and it implications for those affected is clearly a "bad thing" but is not in itself a risk to the global financial system, which is the IMF's concern.briantrumpet said:I probably ought not to be laughing at the meltdown. But how could I not...?

https://www.telegraph.co.uk/business/2022/09/27/imf-urges-truss-reverse-top-rate-tax-cut-extraordinary-attack/The International Monetary Fund has urged Liz Truss to reverse the decision to abolish the top rate of income tax, in a highly unusual attack on the economic policy of a G7 country.

The world’s lender of last resort heaped pressure on Ms Truss and the Chancellor, as it urged Kwasi Kwarteng to use his fiscal plan in November to change course.

The IMF said it is “closely monitoring recent economic developments in the UK and are engaged with the authorities" and warned that the fiscal stimulus risks undermining the Bank of England’s efforts to curb inflation.

A spokesman for the Washington DC-based organisation said Mr Kwarteng's announcement in November would “present an early opportunity for the UK government to consider ways to provide support that is more targeted and reevaluate the tax measures, especially those that benefit high income earners”.

It is an extremely rare intervention by the IMF on a developed country’s economic policy.

On Tuesday night, it drew an angry reaction from senior Tories. Lord Frost, the former Brexit minister and an ally of Ms Truss, told The Daily Telegraph: "The IMF has consistently advocated highly conventional economic policies. It is following this approach that has produced years of slow growth and weak productivity.

"The only way forward for Britain is lower taxes, spending restraint, and significant economic reform. Liz Truss and Kwasi Kwarteng are rightly focused on delivering this and they should tune out the criticism from those who are still in the intellectual world of Gordon Brown."

Lord F**king Frost, that world-renowned economist, whose magic touch is a guarantee of success with everything he does...

Notwithstanding that above, Frost should just f*** off. He's an unelected mediocrity (and I think that is being charitable) who would be rightly slated by the anti-EU media here if he'd been (un)elected to the European Commission.

Come off it.0 -

This sound about right?0 -

I don't generally read IMF pronouncements, but as a rule, they should keep out of what are domestic political matters until they are providing a bailout, when they can impose whatever terms they see fit.rick_chasey said:

Bahaha. It's fine when the shoe's on the other foot, criticising developing countries, but when it's Britain it's not cool?wallace_and_gromit said:

I can see that the IMF has some interest in the overall fiscal package and its impact on inflation and exchange rates, given that sterling is a key currency in the global financial system. But it really has no right to be commenting on specific tax cuts and the degree of targeting of financial support, as these are matters for the UK political system to address at the next GE. Poverty in the UK and it implications for those affected is clearly a "bad thing" but is not in itself a risk to the global financial system, which is the IMF's concern.briantrumpet said:I probably ought not to be laughing at the meltdown. But how could I not...?

https://www.telegraph.co.uk/business/2022/09/27/imf-urges-truss-reverse-top-rate-tax-cut-extraordinary-attack/The International Monetary Fund has urged Liz Truss to reverse the decision to abolish the top rate of income tax, in a highly unusual attack on the economic policy of a G7 country.

The world’s lender of last resort heaped pressure on Ms Truss and the Chancellor, as it urged Kwasi Kwarteng to use his fiscal plan in November to change course.

The IMF said it is “closely monitoring recent economic developments in the UK and are engaged with the authorities" and warned that the fiscal stimulus risks undermining the Bank of England’s efforts to curb inflation.

A spokesman for the Washington DC-based organisation said Mr Kwarteng's announcement in November would “present an early opportunity for the UK government to consider ways to provide support that is more targeted and reevaluate the tax measures, especially those that benefit high income earners”.

It is an extremely rare intervention by the IMF on a developed country’s economic policy.

On Tuesday night, it drew an angry reaction from senior Tories. Lord Frost, the former Brexit minister and an ally of Ms Truss, told The Daily Telegraph: "The IMF has consistently advocated highly conventional economic policies. It is following this approach that has produced years of slow growth and weak productivity.

"The only way forward for Britain is lower taxes, spending restraint, and significant economic reform. Liz Truss and Kwasi Kwarteng are rightly focused on delivering this and they should tune out the criticism from those who are still in the intellectual world of Gordon Brown."

Lord F**king Frost, that world-renowned economist, whose magic touch is a guarantee of success with everything he does...

Notwithstanding that above, Frost should just f*** off. He's an unelected mediocrity (and I think that is being charitable) who would be rightly slated by the anti-EU media here if he'd been (un)elected to the European Commission.

Come off it.

Per its own website, the purpose of the IMF is: "Promote international monetary co-operation, facilitate international trade, foster sustainable economic growth, make resources available to members experiencing balance of payments difficulties, prevent and assist with recovery from international financial crises."

So f*** all to do with whether the top rate of tax is 45% or 40% or whether the energy price cap is available to high earners.

Edit - Just to clarify - I actually agree with what the IMF says re "distributional" matters; it's just not its place to say such things as the IMF. (Though individuals at the IMF can of course have their own personal views.)0 -

“..foster sustainable economic growth” and possibly “experiencing balance of payments difficulties”

There’s the bit that’s relevant.

0 -

Deleted - Duplicate.0

-

...add on a touch of "a stitch in time.."rick_chasey said:“..foster sustainable economic growth” and possibly “experiencing balance of payments difficulties”

There’s the bit that’s relevant.

By the time they are involved it is already too late.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

I get it, Brits aren't used to international criticism for their politics.

This is what the big international institutions do. That's why you get people like Bolsonaro or Orban or Erdogen getting sh!tty with the West when they do populist but economically stupid things and get told off.

That's the kind of company this kind of economic behaviour normally has. That should tell you that this is not a good way to run things.

It's of course the fat end of the wedge of the fantasy thinking that led to people declaring Brexit would be an economic success.

0 -

The UK doesn't actually have balance of payments difficulties. The currency is fully floating and the payments always balance, via the exchange rate. (Clearly this isn't "pain free" as there are inflationary impacts as a result.) The IMF gets involved to help countries that are experiencing genuine balance of payments issues arising from fixed exchange rate mechanism or de facto fixed exchange rate mechanisms via targeting - for example - the USD.rick_chasey said:“..foster sustainable economic growth” and possibly “experiencing balance of payments difficulties”

There’s the bit that’s relevant.

The Truss/Kwarteng tax package may or may not promote growth, but the real issue domestically here is the "fairness" angle rather than sustainability. (No-one actually knows yet whether the measures will be beneficial to growth over any particular timescale.)

But most importantly, if growth and balance of payments are causing concern to the IMF, they would presumably have mentioned them in their announcement yesterday, which they didn't.

They specifically mentioned the undesirability of monetary and fiscal policy working at cross-purposes (fair comment, as this affects the exchange rate and feeds into global financial stability via sterling being a reserve currency) and the impact on inequality of tax cuts for high earners, which per my comments above, are matters solely for the UK political system to address. It may be that the "will of the people" is enhanced inequality. Stranger things have been voted for recently.

0 -

he Truss/Kwarteng tax package may or may not promote growth, but the real issue domestically here is the "fairness" angle rather than sustainability. (No-one actually knows yet whether the measures will be beneficial to growth over any particular timescale.)

I think we have a pretty good idea and that's been reflected in the market reaction. This is the same head-in-the-sand nonsense that landed us with a stupid Brexit.

The "fairness" as you call it has a direct impact on growth.

Inequality has an impact on growth and sustainability. That is part of the puzzle.0 -

an explanation is required for why it is out of datefocuszing723 said:No explanation is required, just look at the graph, waffle is irrelevant.

0 -

Try and see the IMF as apolitical as they really have no dog in that fight.wallace_and_gromit said:

The UK doesn't actually have balance of payments difficulties. The currency is fully floating and the payments always balance, via the exchange rate. (Clearly this isn't "pain free" as there are inflationary impacts as a result.) The IMF gets involved to help countries that are experiencing genuine balance of payments issues arising from fixed exchange rate mechanism or de facto fixed exchange rate mechanisms via targeting - for example - the USD.rick_chasey said:“..foster sustainable economic growth” and possibly “experiencing balance of payments difficulties”

There’s the bit that’s relevant.

The Truss/Kwarteng tax package may or may not promote growth, but the real issue domestically here is the "fairness" angle rather than sustainability. (No-one actually knows yet whether the measures will be beneficial to growth over any particular timescale.)

But most importantly, if growth and balance of payments are causing concern to the IMF, they would presumably have mentioned them in their announcement yesterday, which they didn't.

They specifically mentioned the undesirability of monetary and fiscal policy working at cross-purposes (fair comment, as this affects the exchange rate and feeds into global financial stability via sterling being a reserve currency) and the impact on inequality of tax cuts for high earners, which per my comments above, are matters solely for the UK political system to address. It may be that the "will of the people" is enhanced inequality. Stranger things have been voted for recently.

There point is that if you had £45bn to promote economic growth then you would not give tax cuts to the richest individuals.

They also point out that monetary and fiscal policy is pulling in opposite directions.

If the markets believe in economic orthodoxy then it becomes self fulfilling1 -

I'm not sure you're right there. That's one of the opposition attacks on it, but the main problems people are facing (and worrying about) are increased mortgage rates, increased inflation etc, all linked to the "sustainability" of the policy.wallace_and_gromit said:

The Truss/Kwarteng tax package may or may not promote growth, but the real issue domestically here is the "fairness" angle rather than sustainability.

The fact they have prioritised tax cuts for high earners rather than keeping the country's finances on a sustainable footing just makes the attack easy. And it shows their utter political incompetence.0 -

I am a long way from being an expert (and he graph is sh1t) but I am going to say nokingstongraham said:

TBB is the bond market expert so I expect he is very busy right now0 -

I don't understand what's happened today.

Does it cost more money?0 -

@TheBigBean can you tell us if there is a difference between QE and "intervening in the bond market"?

as you know I (like many) thought they were using QE to get new issues away, this just looks like a more blatant version0 -

No the bank is paying out of its reserves, so it's not 'printing' the money.surrey_commuter said:@TheBigBean can you tell us if there is a difference between QE and "intervening in the bond market"?

as you know I (like many) thought they were using QE to get new issues away, this just looks like a more blatant version

Presumably as all the collateral calls for pension funds was going to make a whole bunch of them fall over.

https://bondvigilantes.com/blog/2022/09/collateral-calls/

0 -

TBB is the expert but bond prices rising in the secondary market will not cost the Govt more money. Confusingly bonds pay a coupon so the % is determined by the price you pay for the bond.kingstongraham said:I don't understand what's happened today.

Does it cost more money?

My guess is that they were worried about selling new bonds so have renamed QE to take some supply out of the market.

It will reassure the markets as they will now think that somebody with a brain is close enough to the powers that be to make an impact0 -

The interest on them is more. They are valuing that additional interest and presenting it as a cost.kingstongraham said:I don't understand what's happened today.

Does it cost more money?0 -

I'm not sure what "intervening in the bond market" is a reference to, but QE and the unwinding of it involves buying and selling gilts.surrey_commuter said:@TheBigBean can you tell us if there is a difference between QE and "intervening in the bond market"?

as you know I (like many) thought they were using QE to get new issues away, this just looks like a more blatant version0 -

That post is about the delay; that was the auction that was supposed to have happened but didn't because the queen wouldn't have wanted it or somethingTheBigBean said:

The interest on them is more. They are valuing that additional interest and presenting it as a cost.kingstongraham said:I don't understand what's happened today.

Does it cost more money?0 -

I'd moved on to the bank buying long dated bonds today.rick_chasey said:

That post is about the delay; that was the auction that was supposed to have happened but didn't because the queen wouldn't have wanted it or somethingTheBigBean said:

The interest on them is more. They are valuing that additional interest and presenting it as a cost.kingstongraham said:I don't understand what's happened today.

Does it cost more money?

That's more qe?0 -

BofE is buying 30 year bonds but is not calling it QETheBigBean said:

I'm not sure what "intervening in the bond market" is a reference to, but QE and the unwinding of it involves buying and selling gilts.surrey_commuter said:@TheBigBean can you tell us if there is a difference between QE and "intervening in the bond market"?

as you know I (like many) thought they were using QE to get new issues away, this just looks like a more blatant version0 -

can't call it QE as last week they announced they were reversing QE to tighten monetary policykingstongraham said:

I'd moved on to the bank buying long dated bonds today.rick_chasey said:

That post is about the delay; that was the auction that was supposed to have happened but didn't because the queen wouldn't have wanted it or somethingTheBigBean said:

The interest on them is more. They are valuing that additional interest and presenting it as a cost.kingstongraham said:I don't understand what's happened today.

Does it cost more money?

That's more qe?

I get told off for saying that covid QE was just the Govt buying it's own debt to keep prices down.0 -

The delayed resulted in a higher interest rate. KG asked how £5bn was no longer £5bn.rick_chasey said:

That post is about the delay; that was the auction that was supposed to have happened but didn't because the queen wouldn't have wanted it or somethingTheBigBean said:

The interest on them is more. They are valuing that additional interest and presenting it as a cost.kingstongraham said:I don't understand what's happened today.

Does it cost more money?0