Today's discussion about the news

Comments

-

Once more so we can agree to disagree.

Israel does not have to rise to the provocation to the extent that it is.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

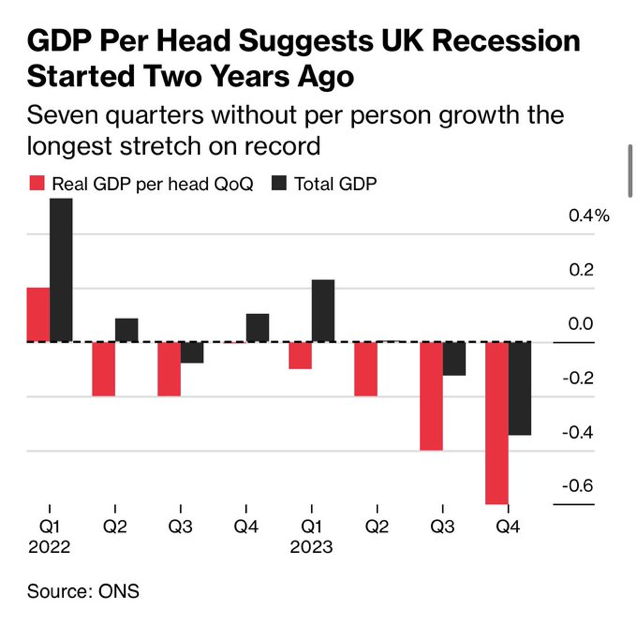

Officially in recession (although we may already be back out).

1 -

We already knew that. Financial reporting by definition always lags behind the current status.

Anyway, it is fairly meaningless as +/-0.3% is hardly noticeable. Being constantly sh!t is though.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.1 -

I mean literally everyone is walking around repeating the same conversation.

"How's business?"

"Not too bad.... bit quiet though"

"Yeah, same here"

We were just waiting for official confirmation.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

("Breeeexiiiit..." Whispered quietly.)

0 -

Higher interest rates say "Hello".

0 -

Which is why I used the word 'officially'.

0 -

Yeah, wasn't a dig. Point was mostly that things are generally a bit sh!t.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Wasn't this kind of what the raise in interest rates was meant to do (reduce inflation by slowing down the economy) and given the UK had pretty lukewarm growth figures when the rates started to go up...

0 -

I said at the time that increasing interest rates was the wrong tool for worldwide inflation. Still don't get it.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

I think for various boring reasons that I don't quite understand, the BofE can't go too far out of step with what the Fed do.

0 -

Who could have predicted that antisemitism comes in more than one colour of rosette?

0 -

It's pretty much the only tool in the central bank toolbox though.

It works for demand led inflation, but doesn't work for supply side inflation. Initially this round of inflation was supply side, but that has eased and is now more demand side.

Problem is that central bankers aren't very good at their job and tend to raise rates too far, or cut them too slowly.

(Not a surprise given f'wits like Andrew Bailey head up such central banks)

0 -

True, and it is down to the impact on the currency.

0 -

Exactly. Punishing the British public would achieve nothing as it wasn’t demand driven. The choice was use the only tool heavy, light, or not at all.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Well not really. They can turn the taps on or off, or put the plug in or out.

Is the issue not that they did QE for too long and then also wait to raise rates for too long? And are now doing QT at a bad time?

0 -

Well, yes. Everything. Obviously something that I should understand but don’t, or they are muppets. At best, simply want to be seen to be doing something, anything.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

I don't understand it either. But it's worrying that 5 of them had three opinions between them.

0 -

Can't help feeling that this is the Home Office deliberately being hostile and ignoring the courts.

A woman is facing deportation, and being separated from her husband and 10-year-old son, despite a court ruling that the family has the right to live together in the UK. Malwattege Peiris has been told by the Home Office to leave the UK despite the court ruling in her favour and correspondence from the Home Office confirming this decision.

0 -

-

^ thas oL cuz of immigrunts In bOAts, innit...!..

0 -

Oopsie! No, I'm not picking up the figurative baton again. 😉

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

There you go, the solution isn't build more houses, it's WFH and move to East Bumfuk.

0 -

Although some suggest that Rick needs to get his skates on and trade up to his dream home pronto before it becomes too expensive:

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Yeah well the earnings need to improve too.

ONs numbers so hopefully no quibbles about the measuring.

0 -

The measure of recession isn't GDP per head though is it? Not querying the statistics and it has been obvious for ages what the reality is but using a different definition of what constitutes a recession seems a bit pointless.

0 -

This guy?

0 -

I've long argued that productivity, aka real wages, is the real measure for things.

Actual GDP is helpful for understanding the international standings, geopolitics etc, as bigger GDPs can support bigger militaries and are bigger markets, etc, but to evaluate prosperity, real wages or GDP per head is what counts.

0 -

For context of how poor the performance is:

https://www.newstatesman.com/comment/2024/02/this-isnt-a-mild-recession

Wages, adjusted for inflation, ended 2023 at roughly the same level as in early 2008. Fifteen years of no real pay growth is something Britain has not experienced in the 250 years since the Industrial Revolution.

GDP per head – a far better measure of people’s actual economic experience – has fallen for the last seven quarters, the longest continual decline since modern records began in 1955. It fell by 0.7 per cent across 2023 as a whole, even while the economy eked out some tepid growth, and is down by 1.7 per cent since early 2022.

0 -

Is that from the Daily Mash?

0