LEAVE the Conservative Party and save your country!

Comments

-

Given it's a theory we can work in an idealised world. In an idealised world, the party in question sets out how, mechanistically, taxes and expenditure respond to inflation levels.surrey_commuter said:

In reality I do not see how you would make govt spending counter cyclical unless you passed legislation that took it out of the hands of politicians.rick_chasey said:Yes. We've spoken a lot about MMT as it relates to debt, but not really as it relates to inflation. The rub is you can borrow whatever you want *if you use tax and gov't expenditure (i.e. higher taxes and or cutting gov't spending) mechanistically to cut inflation*

Right now with inflation booming you would be imposing a pay freeze across the public sector with a promise of making it up when the economy and inflation was sluggish

So if inflation is at x%, spending here will be at y and there z, and if inflation is at a%, spending will be at b here and c there. etc. All entirely predictable.

So then the political choice is not whether you do the MMT, but where the pain is felt, which is always a political decision anyway. The framework is in aggregate, and the political choice is how to divvy that up.0 -

The intervention I would be advocating in this case is to allow them to take out the cheaper mortgage and overrule the affordability check. Because the other option is them continuing to pay even more.surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

0 -

kingstongraham said:

The intervention I would be advocating in this case is to allow them to take out the cheaper mortgage and overrule the affordability check. Because the other option is them continuing to pay even more.surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

It sounds sensible, and doesn't involve spaffing billions of £s up the wall, so I can't see it gaining traction with the current government.0 -

so you are going to chose the interest rate that a foreign owned lender are going to charge for people deemed to be a poor risk.briantrumpet said:kingstongraham said:

The intervention I would be advocating in this case is to allow them to take out the cheaper mortgage and overrule the affordability check. Because the other option is them continuing to pay even more.surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

It sounds sensible, and doesn't involve spaffing billions of £s up the wall, so I can't see it gaining traction with the current government.

How would you feel if the Chinese Govt chose the rate UK lenders were going to charge to prop up their commercial property sector?0 -

No, I would allow the lender to choose the rate that they are willing to offer that customer. Currently the lender is not allowed to lend to that customer, so they are stuck on the SVR of the mortgage they had when the rules changed.surrey_commuter said:

so you are going to chose the interest rate that a foreign owned lender are going to charge for people deemed to be a poor risk.briantrumpet said:kingstongraham said:

The intervention I would be advocating in this case is to allow them to take out the cheaper mortgage and overrule the affordability check. Because the other option is them continuing to pay even more.surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

It sounds sensible, and doesn't involve spaffing billions of £s up the wall, so I can't see it gaining traction with the current government.

How would you feel if the Chinese Govt chose the rate UK lenders were going to charge to prop up their commercial property sector?

It's quite niche, but other than that, interest rates going up and people having less money as a result is design, not fault.0 -

is this the rule that they can only lend out a % of their book at ratios greater than 4.5?kingstongraham said:

No, I would allow the lender to choose the rate that they are willing to offer that customer. Currently the lender is not allowed to lend to that customer, so they are stuck on the SVR of the mortgage they had when the rules changed.surrey_commuter said:

so you are going to chose the interest rate that a foreign owned lender are going to charge for people deemed to be a poor risk.briantrumpet said:kingstongraham said:

The intervention I would be advocating in this case is to allow them to take out the cheaper mortgage and overrule the affordability check. Because the other option is them continuing to pay even more.surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

It sounds sensible, and doesn't involve spaffing billions of £s up the wall, so I can't see it gaining traction with the current government.

How would you feel if the Chinese Govt chose the rate UK lenders were going to charge to prop up their commercial property sector?

It's quite niche, but other than that, interest rates going up and people having less money as a result is design, not fault.

I am all more de-regulation but if an organisation is too big to fail then they have to be reined in.

0 -

I don't think many people were banking on everything increasing dramatically at the same time though.briantrumpet said:surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

Quite. "Interest rates may rise". I'm not sure what warnings must be given when mortgage offers are made, but surely there's an inherent and obvious risk when rates were under 2%, even if it's not spelt out in black and white.

I don't think the govt should bail out the mortgage market. At the same time interest rates seem to be a crude and ineffective tool, raising them doesn't magic away the war in Ukraine or build loads of nuclear power stations (or whatever your choice for low running cost electricity is).

0 -

Jezyboy said:

I don't think many people were banking on everything increasing dramatically at the same time though.briantrumpet said:surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

Quite. "Interest rates may rise". I'm not sure what warnings must be given when mortgage offers are made, but surely there's an inherent and obvious risk when rates were under 2%, even if it's not spelt out in black and white.

I don't think the govt should bail out the mortgage market. At the same time interest rates seem to be a crude and ineffective tool, raising them doesn't magic away the war in Ukraine or build loads of nuclear power stations (or whatever your choice for low running cost electricity is).

Not disagreeing with that, but making the biggest financial commitment of your life should be done with extremely careful risk assessment, including understanding that the time when to be most careful is when everything seems to be going well and not imagining that the shît will ever hit the fan again. But Sod's Law is a thing for good reason.0 -

Likewise, not sure how it is fair to those who will have to stump up to fund the imprudent financial decisions of others.surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

The last 25 years have rewarded people who did not do this.briantrumpet said:Jezyboy said:

I don't think many people were banking on everything increasing dramatically at the same time though.briantrumpet said:surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

Quite. "Interest rates may rise". I'm not sure what warnings must be given when mortgage offers are made, but surely there's an inherent and obvious risk when rates were under 2%, even if it's not spelt out in black and white.

I don't think the govt should bail out the mortgage market. At the same time interest rates seem to be a crude and ineffective tool, raising them doesn't magic away the war in Ukraine or build loads of nuclear power stations (or whatever your choice for low running cost electricity is).

Not disagreeing with that, but making the biggest financial commitment of your life should be done with extremely careful risk assessment, including understanding that the time when to be most careful is when everything seems to be going well and not imagining that the shît will ever hit the fan again. But Sod's Law is a thing for good reason.2 -

Quite. "Interest rates may rise". I'm not sure what warnings must be given when mortgage offers are made, but surely there's an inherent and obvious risk when rates were under 2%, even if it's not spelt out in black and white.

I would assume most understood the risk but hoped/felt it would never happen. Either because they couldn't afford to buy a house without easy credit or they were just blasé about it and assumed they were cossetted by the apparent safety of low interest rates for the foreseeable future.

Going through the mortgage process myself at present, it does seem that greater due diligence on behalf of lenders is in play. If you are in any way a risk there is no chance of them lending to you. Judging by the number of house deals falling through, people are also realising that they really cannot afford it at present, particularly if there are any further shocks to the market.0 -

Meh I guess the nature of risk is that risky behaviour will be rewarded at times.TheBigBean said:

The last 25 years have rewarded people who did not do this.briantrumpet said:Jezyboy said:

I don't think many people were banking on everything increasing dramatically at the same time though.briantrumpet said:surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

Quite. "Interest rates may rise". I'm not sure what warnings must be given when mortgage offers are made, but surely there's an inherent and obvious risk when rates were under 2%, even if it's not spelt out in black and white.

I don't think the govt should bail out the mortgage market. At the same time interest rates seem to be a crude and ineffective tool, raising them doesn't magic away the war in Ukraine or build loads of nuclear power stations (or whatever your choice for low running cost electricity is).

Not disagreeing with that, but making the biggest financial commitment of your life should be done with extremely careful risk assessment, including understanding that the time when to be most careful is when everything seems to be going well and not imagining that the shît will ever hit the fan again. But Sod's Law is a thing for good reason.0 -

But the other side of that coin is they have to accept the consequences when things don't go according to their wishesJezyboy said:

Meh I guess the nature of risk is that risky behaviour will be rewarded at times.TheBigBean said:

The last 25 years have rewarded people who did not do this.briantrumpet said:Jezyboy said:

I don't think many people were banking on everything increasing dramatically at the same time though.briantrumpet said:surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

Quite. "Interest rates may rise". I'm not sure what warnings must be given when mortgage offers are made, but surely there's an inherent and obvious risk when rates were under 2%, even if it's not spelt out in black and white.

I don't think the govt should bail out the mortgage market. At the same time interest rates seem to be a crude and ineffective tool, raising them doesn't magic away the war in Ukraine or build loads of nuclear power stations (or whatever your choice for low running cost electricity is).

Not disagreeing with that, but making the biggest financial commitment of your life should be done with extremely careful risk assessment, including understanding that the time when to be most careful is when everything seems to be going well and not imagining that the shît will ever hit the fan again. But Sod's Law is a thing for good reason.1 -

Except it is often different people.surrey_commuter said:

But the other side of that coin is they have to accept the consequences when things don't go according to their wishesJezyboy said:

Meh I guess the nature of risk is that risky behaviour will be rewarded at times.TheBigBean said:

The last 25 years have rewarded people who did not do this.briantrumpet said:Jezyboy said:

I don't think many people were banking on everything increasing dramatically at the same time though.briantrumpet said:surrey_commuter said:

It is genuinely making my head hurt trying to understand why I would be asked to help somebody pay their mortgage because they made a bad decisionkingstongraham said:It would be fair to intervene to do something for people stuck on SVRs from years ago who are told they can't remortgage to a cheaper deal because they now fail affordability rules.

Quite. "Interest rates may rise". I'm not sure what warnings must be given when mortgage offers are made, but surely there's an inherent and obvious risk when rates were under 2%, even if it's not spelt out in black and white.

I don't think the govt should bail out the mortgage market. At the same time interest rates seem to be a crude and ineffective tool, raising them doesn't magic away the war in Ukraine or build loads of nuclear power stations (or whatever your choice for low running cost electricity is).

Not disagreeing with that, but making the biggest financial commitment of your life should be done with extremely careful risk assessment, including understanding that the time when to be most careful is when everything seems to be going well and not imagining that the shît will ever hit the fan again. But Sod's Law is a thing for good reason.0 -

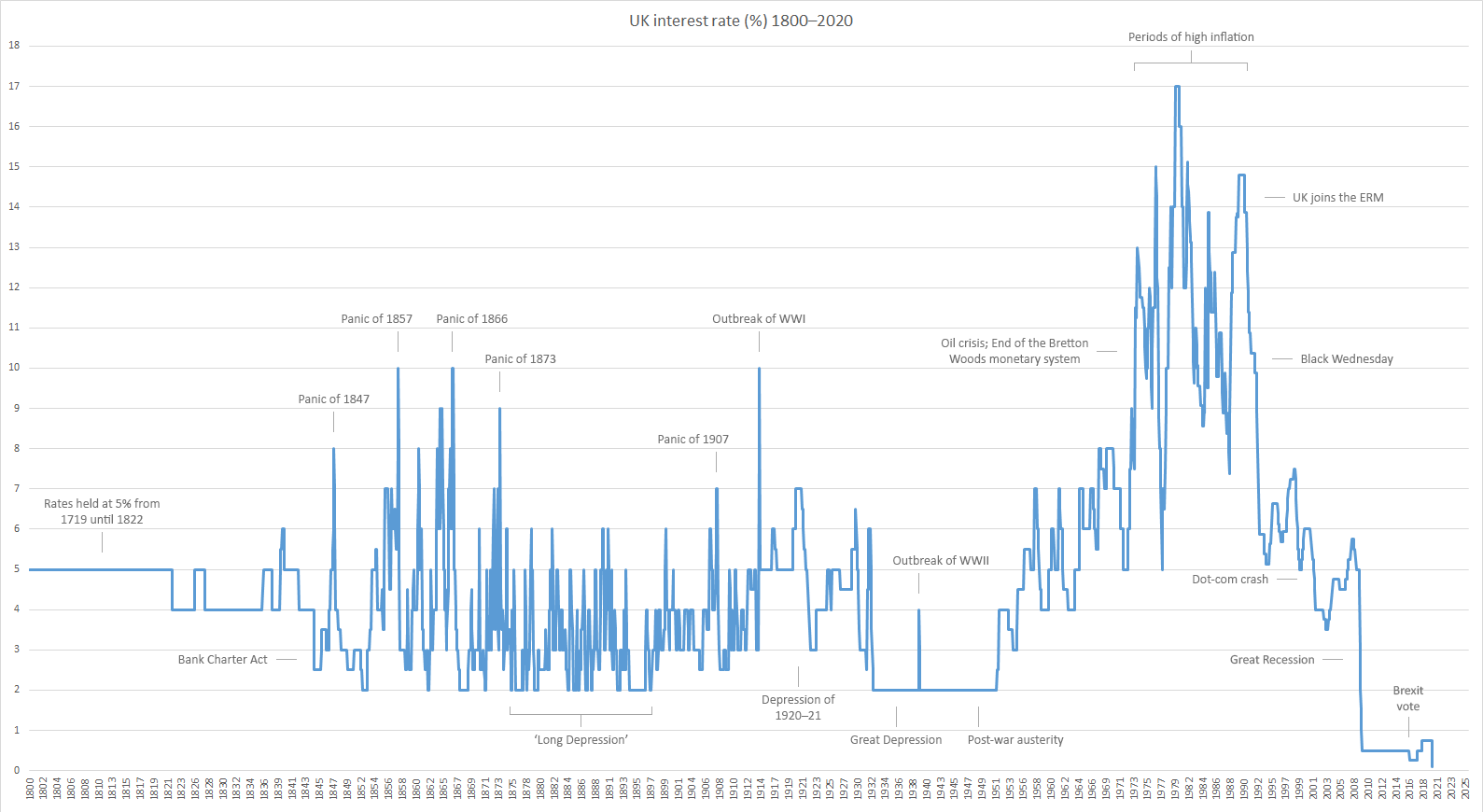

Look that fooker in the x and y and tell me that the blissful weren't going to get a right royal kick in the tackle.focuszing723 said:

And I was right about AI too and Musk's greatness.

0 -

Basically you lot are lucky when I turn up.0

-

At the bottom rung of the ladder it's worth taking risks because the alternative is renting which then gets you nothing. If you buy then rates & prices go the wrong way you may lose your deposit, but in most cases the loss would be no more than spending another year or so renting.

If you're moving up the ladder and mortgaging yourselves up to the eyeballs in order to do so, then that's basically playing high stakes casino. Yes it will have paid off in many cases for the last 20 years but if you're in this group you'll likely be old enough to remember the late 80s/90s and Black Wednesday and 15% interest so if you still took the risk....0 -

briantrumpet said:

And then a Tory government minister not pushing back on the BS, and conflating it with gender identity. Just extraordinary.

0 -

I see the meme has moved on from accusing people of identifying as attack helicopters.

0 -

Looks like Rishi might not achieve his goal of lowering inflation...0

-

Based on this, I think it might be OK.Jezyboy said:Looks like Rishi might not achieve his goal of lowering inflation...

0 -

I think even his broken clock might be right once a year.kingstongraham said:

Based on this, I think it might be OK.Jezyboy said:Looks like Rishi might not achieve his goal of lowering inflation...

2 -

Frank Luntz is a focus group specialist. If he's right the Conservatives should call an ambulance.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I genuinely have no idea how they can turn things around.rjsterry said:

Frank Luntz is a focus group specialist. If he's right the Conservatives should call an ambulance.

I think Sunak has proven to be a steadying influence but hasn’t really done anything to show direction. Too scared to upset any of the factions.

He’s indulging Braverman whilst the Bojo fan club throws shit at the party from outside.

The party seems more desperate to cling onto ‘red wall’ voters than its more traditional support.0 -

morstar said:

I genuinely have no idea how they can turn things around.rjsterry said:

Frank Luntz is a focus group specialist. If he's right the Conservatives should call an ambulance.

I think Sunak has proven to be a steadying influence but hasn’t really done anything to show direction. Too scared to upset any of the factions.

He’s indulging Braverman whilst the Bojo fan club throws censored at the party from outside.

The party seems more desperate to cling onto ‘red wall’ voters than its more traditional support.

Sunak is a utter disappointment... although I want the Tories to lose for the reasons I've mentioned before, I'd have liked him to have pointed the party in a better direction.... but he's squandered any chance of breaking with the legacy of Johnson and his mendacious incompetence. He comes across as unable to talk in anything but soundbites, can't answer simple questions with a relevant straight answer, won't stand up to the loons, and simply comes across as very shallow and insincere. Unlike Johnson, he's not going to be able to con the voters that the Tories have any answer to the problems they've created.0 -

-

rick_chasey said:

What did you expect of a populist brexiter who’s only success was make the money printer go brrr

Well, he wasn't Johnson, for a start. Well, for a finish too, I guess. Probably not the best qualification, I'll admit.0 -

If the chaps here are right and house prices tank, Tories are going to get annihilated.

Part of me wants them to be blamed for the global rise in interest rates like they pinned the GFC on labour but then that would also annoy me for the same reason0 -

Interest rates aren't risings! They are getting back to historic norms!

It was was just a matter of when. ZIRP was insanity, 99% of so say experts insane and negligent with it.

What should Banks be? Institutions to lend Business to grow.

What should the original Buildings Societies stayed as (not convert to banks)? Institutions to lend people money to buy a home to live in.0 -

of course, if the gov't taxed the sh!t out of everyone, there wouldn't be a need to make borrowing more expensive and it'd help bring down the deficit, but anyway.0