Paradise Papers (& Panama Papers)

Comments

-

Rick Chasey wrote:Matthewfalle wrote:Rick Chasey wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

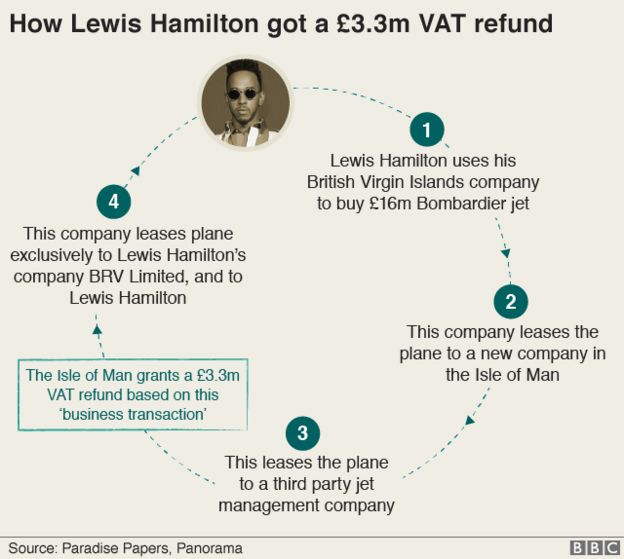

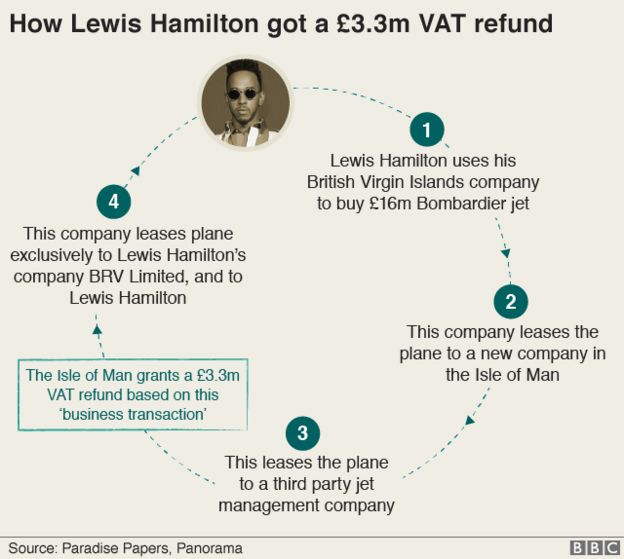

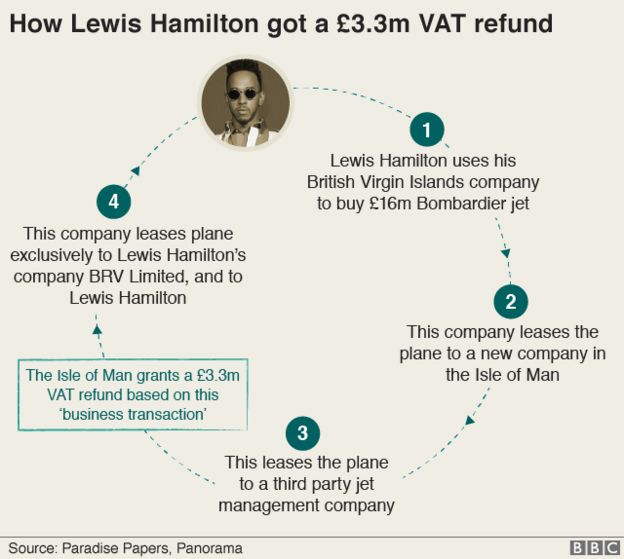

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

http://www.bbc.co.uk/news/uk-41886607

The crux is here, but the article's relatively detailed.

You do wonder if Corbyn was tipped off, given he was banging about Isle of Man private jets in the last PMQs.

Seems a relatively simple structure - he'll have all costs sorted out via a third party company held at the same registered office, funds will flow up from him, across to the necessary entity.

No biggie really - can't really understand why people are so shocked.

I think most people feel he ought to have paid vat on it.

Especially for what is literally a luxury.

It’s not how the business/personal vat law was intended, right?

Quite odd if you are actually surprised why people don’t like it.

I suspect some of those people who are appalled by LH's jet are quite happy to pay cash in hand for that new loft extension, though.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I’m sure some of them aren’t that type too. Nor does it make either of them better. (Arguably it’s still up the the builder to pay his tax, mind).

The general defence of “well you use your ISA, is the same as dodging £3m vat on a private jet” kinda misses the point of what ISAs and vat were designed for.

One is to encourage people to save.

The other is using the fact businesses don’t pay vat (because they want to encourage spending on investment).

One is how it was designed, the other wasn’t.

Now fine I’m sure it’s above board, but we can all see what’s happened here.

Tax has a social utility, and we’ve seen a good 7-8 years of austerity and cuts, so it’s quite easy to see how it can be galling that someone didn’t pay £3m on a technicality.0 -

Rick Chasey wrote:I’m sure some of them aren’t that type too. Nor does it make either of them better. (Arguably it’s still up the the builder to pay his tax, mind).

The general defence of “well you use your ISA, is the same as dodging £3m vat on a private jet” kinda misses the point of what ISAs and vat were designed for.

One is to encourage people to save.

The other is using the fact businesses don’t pay vat (because they want to encourage spending on investment).

One is how it was designed, the other wasn’t.

Now fine I’m sure it’s above board, but we can all see what’s happened here.

Tax has a social utility, and we’ve seen a good 7-8 years of austerity and cuts, so it’s quite easy to see how it can be galling that someone didn’t pay £3m on a technicality.

It's not a technicality - it's efficient tax planning.

You wouldn't budget for a new build on your bicycle without working out the best price: that is exactly what these dudes do.

If you get the chance to save the VAT on your new eTap groupset you'd do it - that's exactly what he's done here.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

mamba80 wrote:....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.

They should plan their major purchases better then.

Shocked you can't see that.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Matthewfalle wrote:Rick Chasey wrote:I’m sure some of them aren’t that type too. Nor does it make either of them better. (Arguably it’s still up the the builder to pay his tax, mind).

The general defence of “well you use your ISA, is the same as dodging £3m vat on a private jet” kinda misses the point of what ISAs and vat were designed for.

One is to encourage people to save.

The other is using the fact businesses don’t pay vat (because they want to encourage spending on investment).

One is how it was designed, the other wasn’t.

Now fine I’m sure it’s above board, but we can all see what’s happened here.

Tax has a social utility, and we’ve seen a good 7-8 years of austerity and cuts, so it’s quite easy to see how it can be galling that someone didn’t pay £3m on a technicality.

It's not a technicality - it's efficient tax planning.

You wouldn't budget for a new build on your bicycle without working out the best price: that is exactly what these dudes do.

If you get the chance to save the VAT on your new eTap groupset you'd do it - that's exactly what he's done here.

Look. It’s now how the business exemption on VAT was intended, is it?

Lewis buying a private jet by setting himself up as a business to avoid vat, when he’s clearly the only user and he uses it like it’s his personal jet, isn’t in the spirit of what the law is for?

And it’s not the same as shopping around for the best priced bike is it? Because that wouldn’t mean I avoid paying VAT.0 -

Beggars belief people struggle see that people using their wealth as leverage to reduce their tax significantly against the spirit of the taxes they’re avoiding is not optimal for society.0

-

If it does not exist they should get a law that fines people ten times the amount they dodged. This specific case is obviously taking the p1ss.0

-

Surrey Commuter wrote:If it does not exist they should get a law that fines people ten times the amount they dodged. This specific case is obviously taking the p1ss.

Yeah, great idea. Biggly good idea.

They haven't dodged anything - they have just planned effectively. It's the same principal as me buying acar in Germany using my work stuff to get it discounted and tax free then bringing it back here - is that dodging VAT and so should I be fined 10 time the amount?

Or you buying some bike parts when you are on holiday and therefore not paying VAT on them - the minute you come back into the UK you have to pay HMRC 10 times what you saved.

Great idea. One of the best. Hat,Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Rick Chasey wrote:Beggars belief people struggle see that people using their wealth as leverage to reduce their tax significantly against the spirit of the taxes they’re avoiding is not optimal for society.

But Rick - it's exactly what you would do if you had the money.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Rick Chasey wrote:Matthewfalle wrote:Rick Chasey wrote:I’m sure some of them aren’t that type too. Nor does it make either of them better. (Arguably it’s still up the the builder to pay his tax, mind).

The general defence of “well you use your ISA, is the same as dodging £3m vat on a private jet” kinda misses the point of what ISAs and vat were designed for.

One is to encourage people to save.

The other is using the fact businesses don’t pay vat (because they want to encourage spending on investment).

One is how it was designed, the other wasn’t.

Now fine I’m sure it’s above board, but we can all see what’s happened here.

Tax has a social utility, and we’ve seen a good 7-8 years of austerity and cuts, so it’s quite easy to see how it can be galling that someone didn’t pay £3m on a technicality.

It's not a technicality - it's efficient tax planning.

You wouldn't budget for a new build on your bicycle without working out the best price: that is exactly what these dudes do.

If you get the chance to save the VAT on your new eTap groupset you'd do it - that's exactly what he's done here.

Look. It’s now how the business exemption on VAT was intended, is it?

Lewis buying a private jet by setting himself up as a business to avoid vat, when he’s clearly the only user and he uses it like it’s his personal jet, isn’t in the spirit of what the law is for?

And it’s not the same as shopping around for the best priced bike is it? Because that wouldn’t mean I avoid paying VAT.

How do you know it's not chartered out? Loads of these are because they are so darn expensive to run.

It's just efficiencies.

Anyhow, I thought you worked in finance? It's what you have intimated in the past.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Matthewfalle wrote:Surrey Commuter wrote:If it does not exist they should get a law that fines people ten times the amount they dodged. This specific case is obviously taking the p1ss.

Yeah, great idea. Biggly good idea.

They haven't dodged anything - they have just planned effectively. It's the same principal as me buying acar in Germany using my work stuff to get it discounted and tax free then bringing it back here - is that dodging VAT and so should I be fined 10 time the amount?

Or you buying some bike parts when you are on holiday and therefore not paying VAT on them - the minute you come back into the UK you have to pay HMRC 10 times what you saved.

Great idea. One of the best. Hat,

If I bought them in the EU I would be paying VAT if I bought outside the EU there are clearly defined limits on what I am allowed to bring back duty free.

I would argue that setting up different companies for the sole purpose of avoiding paying tax goes far beyond efficient planning. Also it is not exclusively for private use.0 -

Surrey Commuter wrote:Matthewfalle wrote:Surrey Commuter wrote:If it does not exist they should get a law that fines people ten times the amount they dodged. This specific case is obviously taking the p1ss.

Yeah, great idea. Biggly good idea.

They haven't dodged anything - they have just planned effectively. It's the same principal as me buying acar in Germany using my work stuff to get it discounted and tax free then bringing it back here - is that dodging VAT and so should I be fined 10 time the amount?

Or you buying some bike parts when you are on holiday and therefore not paying VAT on them - the minute you come back into the UK you have to pay HMRC 10 times what you saved.

Great idea. One of the best. Hat,

If I bought them in the EU I would be paying VAT if I bought outside the EU there are clearly defined limits on what I am allowed to bring back duty free.

I would argue that setting up different companies for the sole purpose of avoiding paying tax goes far beyond efficient planning. Also it is not exclusively for private use.

And you stick rigidly every time to the limits? Really, truly, deeply? Blimey.

Yes - the whole point is that it wasn't for private use.

I think (and this isn't just aimed at you) that the major point over all this is that the general populace likes a bit of outrage, has a lot of jealousy and just doesn't really understand what this stuff is all about.

It's not very complicated (although bankers like to try and make out that it is) but it is incredibly, incredibly boring (much like bankers themselves).Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Matthewfalle wrote:TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:john80 wrote:TheBigBean wrote:I think there are two places where HMRC should challenge this if the laws are in place. One is on transfer to the Mauritius company - why is that a tax deductible expense? What service has the company provided? Isn't it simply a dividend? Secondly, and much harder, loans which cannot be repaid, and have no intention of being repaid should be subject to tax.

I think there key to all of this is seeing what if any purpose the transaction performs other than saving tax. If it has no logic other than this then it is questionable.

The HMRC can't see the whole transaction without someone leaking it which is why I said they should be challenging the ones they can see.

Err - they can. They have Access to company accounts and I think off hand that trust accounts have to be produced when requested - you can see from companies house or company accounts who does what and who is receiving what, so it's not difficult to see what is happening.

If only beneficial ownership was that easy. Have you checked out the reporting requirements for small islands or Panama?

Yes - generally are they compliant with FATFA or similar or they won't be used by the like of (in this case Appleby) or any of the other large banks or law firms as it puts too much reputational risk onto them.

It also makes transferring any money in or out of them a nightmare so they are getting used less and less.

Beneficial ownership is fairly simple to work out - it's only when you go for a massive structure that is multi layered and inter jurisdictional that it gets tricky but not impossible.

The Federation of Associations of Teachers of French in Australia?

My bad - FATCA. This, innit. https://tax.thomsonreuters.com/fatca-cr ... crs-fatca/

Apols.

Are you from the US? Institutions only need report on US citizens to the IRS. That doesn't help HMRC with Brits. The proof of this is that if all this was public knowledge there wouldn't need to be a leak.0 -

All uk banks have disclosure requirements for tax residency as well. HMRC knows everything about you because your bank has disclosed it.

FATCA is a right pain to have to deal with, however the IRS are the worst - they have more powers than the po-po and will, if they want, destroy your life for years, which is why you must employ an accountant who does everything efficiently.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:john80 wrote:TheBigBean wrote:I think there are two places where HMRC should challenge this if the laws are in place. One is on transfer to the Mauritius company - why is that a tax deductible expense? What service has the company provided? Isn't it simply a dividend? Secondly, and much harder, loans which cannot be repaid, and have no intention of being repaid should be subject to tax.

I think there key to all of this is seeing what if any purpose the transaction performs other than saving tax. If it has no logic other than this then it is questionable.

The HMRC can't see the whole transaction without someone leaking it which is why I said they should be challenging the ones they can see.

Err - they can. They have Access to company accounts and I think off hand that trust accounts have to be produced when requested - you can see from companies house or company accounts who does what and who is receiving what, so it's not difficult to see what is happening.

If only beneficial ownership was that easy. Have you checked out the reporting requirements for small islands or Panama?

Yes - generally are they compliant with FATFA or similar or they won't be used by the like of (in this case Appleby) or any of the other large banks or law firms as it puts too much reputational risk onto them.

It also makes transferring any money in or out of them a nightmare so they are getting used less and less.

Beneficial ownership is fairly simple to work out - it's only when you go for a massive structure that is multi layered and inter jurisdictional that it gets tricky but not impossible.

The Federation of Associations of Teachers of French in Australia?

My bad - FATCA. This, innit. https://tax.thomsonreuters.com/fatca-cr ... crs-fatca/

Apols.

Are you from the US? Institutions only need report on US citizens to the IRS. That doesn't help HMRC with Brits. The proof of this is that if all this was public knowledge there wouldn't need to be a leak.

Essentially it is public knowledge - people know that there are rich people and that there are these structures - you just phone p someone and they will sort it for you.

It's not exactly rocket science. Just put one and one together.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

rjsterry wrote:

I suspect some of those people who are appalled by LH's jet are quite happy to pay cash in hand for that new loft extension, though.

You ve completely missed the point, the avg joe doing or receiving cash in hand jobs is breaking the law and will will be fined if caught, also the vast majority will know they are breaking the law.

LH got back his VAT perfectly legally, i agree, on a purchase used for leisure.... how come?

oh and i m not appalled, nothing the super rich do shock me any more, just what MF writes lol!0 -

Matthewfalle wrote:All uk banks have disclosure requirements for tax residency as well. HMRC knows everything about you because your bank has disclosed it.

FATCA is a right pain to have to deal with, however the IRS are the worst - they have more powers than the po-po and will, if they want, destroy your life for years, which is why you must employ an accountant who does everything efficiently.

Mauritius doesn't need to disclose anything to HMRC which was my opening point that you seem to want to disagree with.

FATCA is a pain which is why some banks stopped dealing with US citizens. Not all that relevant though unless you are from the US.0 -

TheBigBean wrote:Matthewfalle wrote:All uk banks have disclosure requirements for tax residency as well. HMRC knows everything about you because your bank has disclosed it.

FATCA is a right pain to have to deal with, however the IRS are the worst - they have more powers than the po-po and will, if they want, destroy your life for years, which is why you must employ an accountant who does everything efficiently.

Mauritius doesn't need to disclose anything to HMRC which was my opening point that you seem to want to disagree with.

FATCA is a pain which is why some banks stopped dealing with US citizens. Not all that relevant though unless you are from the US.

It does if it is dealing with a UK institution. It's the UK sides requirements and if they don't then they can't deal with the Mauritian institution.

It's a catch all.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Rick Chasey wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

http://www.bbc.co.uk/news/uk-41886607

The crux is here, but the article's relatively detailed.

You do wonder if Corbyn was tipped off, given he was banging about Isle of Man private jets in the last PMQs.

I suppose the following model would be too complicated.

Buy a jet - use the jet.

Much better all round to use a number of shell could companies. Why use one company when you can use multiple companies other than for tax avoidance purposes.0 -

Matthewfalle wrote:Surrey Commuter wrote:Matthewfalle wrote:Surrey Commuter wrote:If it does not exist they should get a law that fines people ten times the amount they dodged. This specific case is obviously taking the p1ss.

Yeah, great idea. Biggly good idea.

They haven't dodged anything - they have just planned effectively. It's the same principal as me buying acar in Germany using my work stuff to get it discounted and tax free then bringing it back here - is that dodging VAT and so should I be fined 10 time the amount?

Or you buying some bike parts when you are on holiday and therefore not paying VAT on them - the minute you come back into the UK you have to pay HMRC 10 times what you saved.

Great idea. One of the best. Hat,

If I bought them in the EU I would be paying VAT if I bought outside the EU there are clearly defined limits on what I am allowed to bring back duty free.

I would argue that setting up different companies for the sole purpose of avoiding paying tax goes far beyond efficient planning. Also it is not exclusively for private use.

And you stick rigidly every time to the limits? Really, truly, deeply? Blimey.

Yes - the whole point is that it wasn't for private use.

I think (and this isn't just aimed at you) that the major point over all this is that the general populace likes a bit of outrage, has a lot of jealousy and just doesn't really understand what this stuff is all about.

It's not very complicated (although bankers like to try and make out that it is) but it is incredibly, incredibly boring (much like bankers themselves).

I never commented on how much I bring back - I just said I knew what the limits are.

I don't know enough about Lewis Hamilton to be jealous. I had no idea he had a private jet until last night

I would change the law so that anybody caught fiddling their tax pays a disproportionately large fine. This is intended as a deterrent.0 -

Rick Chasey wrote:I’m sure some of them aren’t that type too. Nor does it make either of them better. (Arguably it’s still up the the builder to pay his tax, mind).

The general defence of “well you use your ISA, is the same as dodging £3m vat on a private jet” kinda misses the point of what ISAs and vat were designed for.

One is to encourage people to save.

The other is using the fact businesses don’t pay vat (because they want to encourage spending on investment).

One is how it was designed, the other wasn’t.

Now fine I’m sure it’s above board, but we can all see what’s happened here.

Tax has a social utility, and we’ve seen a good 7-8 years of austerity and cuts, so it’s quite easy to see how it can be galling that someone didn’t pay £3m on a technicality.

Sure, LH is taking advantage of an opportunity not available to those on more conventional incomes. He has lots of opportunities not available to you or me. I think people are being less than honest with themselves when they are outraged at this, but quite happy to ask tradesmen to commit VAT fraud for their benefit. At least what LH is doing is legal. Legislation always has holes in it, and people will exploit those holes. Equally, there's nothing wrong with closing those holes up if the government decides "that's not what they meant to happen".1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Transparency is the key here. If I or any other individual could within 1 hour find the format and ownership of any asset/company then a lot of avoidance would be reduced as what they were doing was transparent. Would Lewis Hamilton be arranging his life in this manner if every press conference focussed on private jets. Would Amazon continue with their arrangements if we did not buy stuff from them. People will always push the boundaries and this gets particularly out of hand if they don't think they will be scrutinised.0

-

john80 wrote:Transparency is the key here. If I or any other individual could within 1 hour find the format and ownership of any asset/company then a lot of avoidance would be reduced as what they were doing was transparent. Would Lewis Hamilton be arranging his life in this manner if every press conference focussed on private jets. Would Amazon continue with their arrangements if we did not buy stuff from them. People will always push the boundaries and this gets particularly out of hand if they don't think they will be scrutinised.

you can - its called Companies' House and takes 30 seconds.

it ain't rocket science.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

What Panorama apparently said was that that Hamilton intended to use the jet for personal use a third of the time, and his company use two thirds. So it should have been one third of a private jet, subject to VAT on import to the EU.

But Hamilton's IOM company leased the jet from Hamilton's British Virgin Island company, then leased it to a UK company, who leased it to Hamilton's Guernsey company. Hamilton then leased it from his company. So it's an entirely natural business flow from Hamilton to Hamilton to Hamilton, and eventually, to Hamilton.

In The Times: "The lawyers said that reducing taxes was not the motive."0 -

Matthewfalle wrote:john80 wrote:Transparency is the key here. If I or any other individual could within 1 hour find the format and ownership of any asset/company then a lot of avoidance would be reduced as what they were doing was transparent. Would Lewis Hamilton be arranging his life in this manner if every press conference focussed on private jets. Would Amazon continue with their arrangements if we did not buy stuff from them. People will always push the boundaries and this gets particularly out of hand if they don't think they will be scrutinised.

you can - its called Companies' House and takes 30 seconds.

it ain't rocket science.

I'm happy to pay for this information, but even though it apparently takes only 30 seconds, there are very few people willing to do it. It's almost like it's not that easy.0 -

john80 wrote:Rick Chasey wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

http://www.bbc.co.uk/news/uk-41886607

The crux is here, but the article's relatively detailed.

You do wonder if Corbyn was tipped off, given he was banging about Isle of Man private jets in the last PMQs.

I suppose the following model would be too complicated.

Buy a jet - use the jet.

Much better all round to use a number of shell could companies. Why use one company when you can use multiple companies other than for tax avoidance purposes.

Purchasing loans through banks

Asset protection

Tax planning

Liability to LH

Liability to users

Liability to directors of company holding the asset

Costings

Estate planning

On ward sales

Usage

The list goes on..........

These structures aren't just for avoiding VAT but people can't see past that.

It's like holding a rental property in your own name - not a bloody chance I have any of mine in my own name. Madness. Same as LH as his jet. And his yacht will be in a diffent structure, and all his houses, and his car collection.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

TheBigBean wrote:Matthewfalle wrote:john80 wrote:Transparency is the key here. If I or any other individual could within 1 hour find the format and ownership of any asset/company then a lot of avoidance would be reduced as what they were doing was transparent. Would Lewis Hamilton be arranging his life in this manner if every press conference focussed on private jets. Would Amazon continue with their arrangements if we did not buy stuff from them. People will always push the boundaries and this gets particularly out of hand if they don't think they will be scrutinised.

you can - its called Companies' House and takes 30 seconds.

it ain't rocket science.

I'm happy to pay for this information, but even though it apparently takes only 30 seconds, there are very few people willing to do it. It's almost like it's not that easy.

Then they are either lazy or daunted by the bullllshit put out by bankers that it's all complicated and you need to be super clever in financial experience.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

KingstonGraham wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

What Panorama apparently said was that that Hamilton intended to use the jet for personal use a third of the time, and his company use two thirds. So it should have been one third of a private jet, subject to VAT on import to the EU.

But Hamilton's IOM company leased the jet from Hamilton's British Virgin Island company, then leased it to a UK company, who leased it to Hamilton's Guernsey company. Hamilton then leased it from his company. So it's an entirely natural business flow from Hamilton to Hamilton to Hamilton, and eventually, to Hamilton.

In The Times: "The lawyers said that reducing taxes was not the motive."

No it shouldn't as it either never entered the EU (he wouldn't have leased it to a UK company as that's plain daft - no one with with any money or common sense uses the UK for anything as it's pretty tat all round).

See post above for some reasonings behind the structure.

It's a very, very simple aircraft owning/funding/leasing structure. Simpler to do than paying your plumber cash in hand and gloating to your mates down the pub about it.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Matthewfalle wrote:KingstonGraham wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

What Panorama apparently said was that that Hamilton intended to use the jet for personal use a third of the time, and his company use two thirds. So it should have been one third of a private jet, subject to VAT on import to the EU.

But Hamilton's IOM company leased the jet from Hamilton's British Virgin Island company, then leased it to a UK company, who leased it to Hamilton's Guernsey company. Hamilton then leased it from his company. So it's an entirely natural business flow from Hamilton to Hamilton to Hamilton, and eventually, to Hamilton.

In The Times: "The lawyers said that reducing taxes was not the motive."

No it shouldn't as it either never entered the EU (he wouldn't have leased it to a UK company as that's plain daft - no one with with any money or common sense uses the UK for anything as it's pretty tat all round).

See post above for some reasonings behind the structure.

It's a very, very simple aircraft owning/funding/leasing structure. Simpler to do than paying your plumber cash in hand and gloating to your mates down the pub about it.

So every report saying that it was leased by Stealth (IOM) to a leasing company in Farnborough in order to make a profit and be "in business" is incorrect?

The company in IOM was set up with the expressed intention of chartering the aircraft to other clients, again, to make it a business, but amazingly, no other clients have ever chartered it.

I can understand having structures to hold assets for other reasons, but if he has set something up in such a way as it is not honest about its use or purpose, then there may be consequences when the authorities are alerted to it. If the IOM company was genuinely in business as an aircraft leasing company, then there's no problem, is there?0 -

Someone who has too much money to know what to do with it going to great lengths to ensure that he has even more money than he knows what to do with! Hard to know what I'd do in LHs position but surely there comes a point at which you can say you have enough not to be too desperate to save money that might otherwise go to the NHS or other places that the Daily Mail likes.Faster than a tent.......0