Paradise Papers (& Panama Papers)

Comments

-

Matthewfalle wrote:TheBigBean wrote:john80 wrote:TheBigBean wrote:I think there are two places where HMRC should challenge this if the laws are in place. One is on transfer to the Mauritius company - why is that a tax deductible expense? What service has the company provided? Isn't it simply a dividend? Secondly, and much harder, loans which cannot be repaid, and have no intention of being repaid should be subject to tax.

I think there key to all of this is seeing what if any purpose the transaction performs other than saving tax. If it has no logic other than this then it is questionable.

The HMRC can't see the whole transaction without someone leaking it which is why I said they should be challenging the ones they can see.

Err - they can. They have Access to company accounts and I think off hand that trust accounts have to be produced when requested - you can see from companies house or company accounts who does what and who is receiving what, so it's not difficult to see what is happening.

If only beneficial ownership was that easy. Have you checked out the reporting requirements for small islands or Panama?0 -

Stevo 666 wrote:

It is a turnover based tax, but ultimately falls on the end consumer, non VAT registered traders or VAT exempt businesses such as banks.Surrey Commuter wrote:my answer was partly tongue in cheek to suggest the complexity of the issue. However my understanding of VAT is that it is anything but a tax on turnover.

Surely it is a value added tax hence why the likes of Amazon, Google and Facebook don't get hit by it.0 -

TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:john80 wrote:TheBigBean wrote:I think there are two places where HMRC should challenge this if the laws are in place. One is on transfer to the Mauritius company - why is that a tax deductible expense? What service has the company provided? Isn't it simply a dividend? Secondly, and much harder, loans which cannot be repaid, and have no intention of being repaid should be subject to tax.

I think there key to all of this is seeing what if any purpose the transaction performs other than saving tax. If it has no logic other than this then it is questionable.

The HMRC can't see the whole transaction without someone leaking it which is why I said they should be challenging the ones they can see.

Err - they can. They have Access to company accounts and I think off hand that trust accounts have to be produced when requested - you can see from companies house or company accounts who does what and who is receiving what, so it's not difficult to see what is happening.

If only beneficial ownership was that easy. Have you checked out the reporting requirements for small islands or Panama?

Yes - generally are they compliant with FATFA or similar or they won't be used by the like of (in this case Appleby) or any of the other large banks or law firms as it puts too much reputational risk onto them.

It also makes transferring any money in or out of them a nightmare so they are getting used less and less.

Beneficial ownership is fairly simple to work out - it's only when you go for a massive structure that is multi layered and inter jurisdictional that it gets tricky but not impossible.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Stevo 666 wrote:

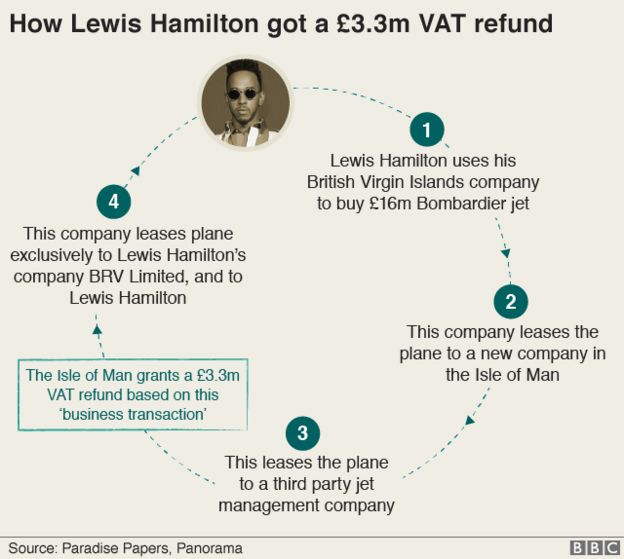

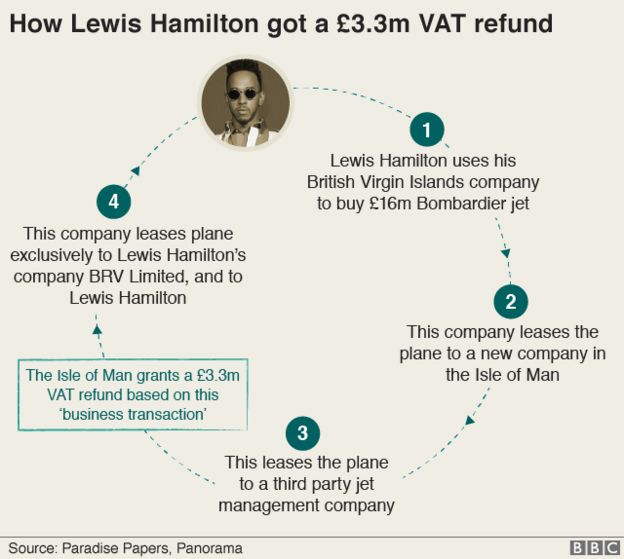

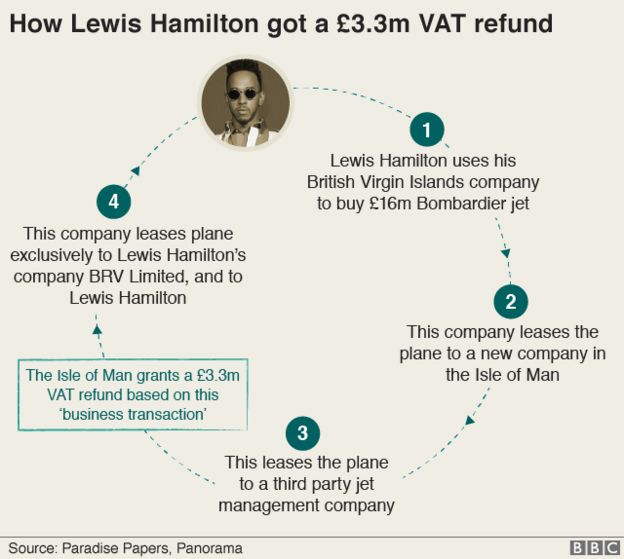

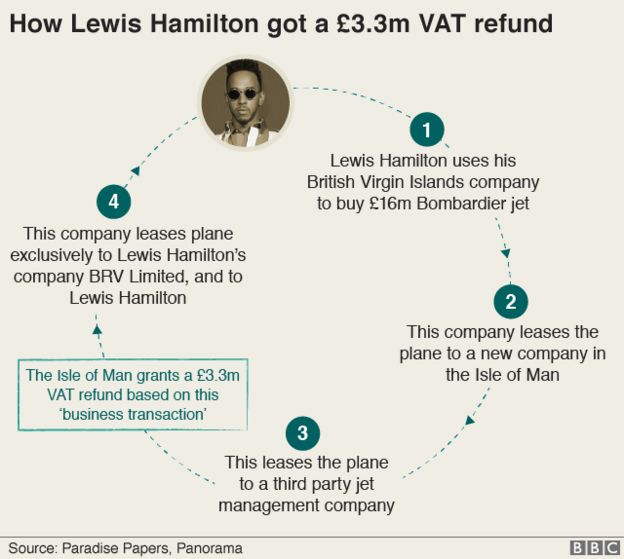

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.Always be yourself, unless you can be Aaron Rodgers....Then always be Aaron Rodgers.0 -

It is a turnover based tax. Where the value add bit comes in is that a company charges VAT on its sales but gets a credit for the VAT on its cost of sales. It pays the difference to the govt - the diff being the value add.Surrey Commuter wrote:Stevo 666 wrote:

It is a turnover based tax, but ultimately falls on the end consumer, non VAT registered traders or VAT exempt businesses such as banks.Surrey Commuter wrote:my answer was partly tongue in cheek to suggest the complexity of the issue. However my understanding of VAT is that it is anything but a tax on turnover.

Surely it is a value added tax hence why the likes of Amazon, Google and Facebook don't get hit by it.

Not sure where you get the bit about the US tech cos not 'getting hit'."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

It's not a fiddle. It's called effective tax planning.

You've just paid £25 million for a private jet. Why the hell are you going to register it in the U.K. and then pay VAT on top and then have to deal with an outdated registry unlinke the one in the Isle of Man and the Channel Islands that have been specifically set up to assist UHNW with these sorts of things?

What is HM Gov going to close a door on - being able to register your plane or yacht where you want to?

Please don't mention res non doms to Goo - his head will explode.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

I thought you didn't read the news?

And anyway, of course they are going to say it's a fiddle because it causes better headlines than "boring accountant says to register plane in the Isle of Man".Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

What about non doms?Matthewfalle wrote:

Please don't mention res non doms to Goo - his head will explode. Do you mean the bit about how they only pay UK tax on their UK source income? Or something more 'murky'? "I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

Do you mean the bit about how they only pay UK tax on their UK source income? Or something more 'murky'? "I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Matthewfalle wrote:TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:john80 wrote:TheBigBean wrote:I think there are two places where HMRC should challenge this if the laws are in place. One is on transfer to the Mauritius company - why is that a tax deductible expense? What service has the company provided? Isn't it simply a dividend? Secondly, and much harder, loans which cannot be repaid, and have no intention of being repaid should be subject to tax.

I think there key to all of this is seeing what if any purpose the transaction performs other than saving tax. If it has no logic other than this then it is questionable.

The HMRC can't see the whole transaction without someone leaking it which is why I said they should be challenging the ones they can see.

Err - they can. They have Access to company accounts and I think off hand that trust accounts have to be produced when requested - you can see from companies house or company accounts who does what and who is receiving what, so it's not difficult to see what is happening.

If only beneficial ownership was that easy. Have you checked out the reporting requirements for small islands or Panama?

Yes - generally are they compliant with FATFA or similar or they won't be used by the like of (in this case Appleby) or any of the other large banks or law firms as it puts too much reputational risk onto them.

It also makes transferring any money in or out of them a nightmare so they are getting used less and less.

Beneficial ownership is fairly simple to work out - it's only when you go for a massive structure that is multi layered and inter jurisdictional that it gets tricky but not impossible.

The Federation of Associations of Teachers of French in Australia?0 -

Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

Presumably you also work to the premise that if your client’s business ends up in the papers because of your advice you’ve f@cked up too.

Aka the daily mail test ”would you be comfortable with whatever you’re doing being on the front page of they mail ”0 -

What clients? As I've said before (including on this thread), I don't have clients - I don't work for an advisory firm.Rick Chasey wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

Presumably you also work to the premise that if your client’s business ends up in the papers because of your advice you’ve f@cked up too.

Aka the daily mail test ”would you be comfortable with whatever you’re doing being on the front page of they mail ”

Reputational risk is a factor for any corporate but I do my job for my Group very effectively without having to go anywhere near the sort of stuff that gets companies in the papers. So not really an issue for me.

Sure, there's always the risk that some inadequately informed, indignant NGO will mistakenly kick up about something they don't understand but to be honest this is usually the sort of simplistic crap where they get a calculator out and try to work out the effective rate of UK tax for a large multinational then start screaming when the number is below the headline tax rate :roll: But they're fixated on stuff that is more visible like the big US tech firms and High Street names."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:Matthewfalle wrote:TheBigBean wrote:john80 wrote:TheBigBean wrote:I think there are two places where HMRC should challenge this if the laws are in place. One is on transfer to the Mauritius company - why is that a tax deductible expense? What service has the company provided? Isn't it simply a dividend? Secondly, and much harder, loans which cannot be repaid, and have no intention of being repaid should be subject to tax.

I think there key to all of this is seeing what if any purpose the transaction performs other than saving tax. If it has no logic other than this then it is questionable.

The HMRC can't see the whole transaction without someone leaking it which is why I said they should be challenging the ones they can see.

Err - they can. They have Access to company accounts and I think off hand that trust accounts have to be produced when requested - you can see from companies house or company accounts who does what and who is receiving what, so it's not difficult to see what is happening.

If only beneficial ownership was that easy. Have you checked out the reporting requirements for small islands or Panama?

Yes - generally are they compliant with FATFA or similar or they won't be used by the like of (in this case Appleby) or any of the other large banks or law firms as it puts too much reputational risk onto them.

It also makes transferring any money in or out of them a nightmare so they are getting used less and less.

Beneficial ownership is fairly simple to work out - it's only when you go for a massive structure that is multi layered and inter jurisdictional that it gets tricky but not impossible.

The Federation of Associations of Teachers of French in Australia?

My bad - FATCA. This, innit. https://tax.thomsonreuters.com/fatca-cr ... crs-fatca/

Apols.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Why ain't he? Is it coz he is black?Matthewfalle wrote:The indignantly of saying "now LH will be used as a high profile example yada yada" makes it sound like it'll be an outrage against a national hero (which he ain't, by the way).

Anyway, as you were, back OT.0 -

Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

http://www.bbc.co.uk/news/uk-41886607

The crux is here, but the article's relatively detailed.

You do wonder if Corbyn was tipped off, given he was banging about Isle of Man private jets in the last PMQs.0 -

Underneath it all it's a private use VAT issue.

Better write an indignant letter to the IOM government. Actually dont bother because its on Panorama now so they'll get plenty."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

And as I said above, tends to be more about high net worth individuals rather than big bad multinationals."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

-

Rick Chasey wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

http://www.bbc.co.uk/news/uk-41886607

The crux is here, but the article's relatively detailed.

You do wonder if Corbyn was tipped off, given he was banging about Isle of Man private jets in the last PMQs.

Seems a relatively simple structure - he'll have all costs sorted out via a third party company held at the same registered office, funds will flow up from him, across to the necessary entity.

No biggie really - can't really understand why people are so shocked.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.0

-

Watching this on Panorama. Before it started my opinion was on the lines of if it's legal it's not a problem (much like when people talk about 'grey areas' in doping). When they were talking about the IoM plane 'scam' that view was reinforced, I really don't see an issue if the IoM Government has decided that's the system they want. However, once they started talking about the various people 'giving away' their money to companies in Mauritius - who then appoint them to advise on how to 'invest' that money which invariably seemed to be in providing houses, cars and luxurious items for their own use - I was amazed if that could possibly be legal tax avoidance. Surely that is tax evasion that just hadn't been uncovered until now? Maybe I'm just too naive in financial matters but it just seems so blatant it can't even be considered a loophole can it?0

-

mamba80 wrote:....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.

And finally, succinctly put. High net worth individuals and corporations can circumvent paying VAT.

Have a think about that Stevo. That's VAT money that should be going towards running essential services :- NHS, GPs, state schools, the armed services, the police, the coastguard, roads (that we continually beef about as cyclists). Need I go on?Always be yourself, unless you can be Aaron Rodgers....Then always be Aaron Rodgers.0 -

Mr Goo wrote:mamba80 wrote:....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.

And finally, succinctly put. High net worth individuals and corporations can circumvent paying VAT.

Have a think about that Stevo. That's VAT money that should be going towards running essential services :- NHS, GPs, state schools, the armed services, the police, the coastguard, roads (that we continually beef about as cyclists). Need I go on?

Stevo doesnt use any of those, so its not anything he cares about.0 -

Mr Goo wrote:mamba80 wrote:....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.

And finally, succinctly put. High net worth individuals and corporations can circumvent paying VAT.

Have a think about that Stevo. That's VAT money that should be going towards running essential services :- NHS, GPs, state schools, the armed services, the police, the coastguard, roads (that we continually beef about as cyclists). Need I go on?

So all the indignant on here, what would you do with the people you have deemed to have transgressed? Prosecute them for tax evasion contrary to what? Issue them a tax bill in accordance to which regulation? By all means if they have contravened any Act or regulation, but if they haven't, all that can be done is to look at ways to tighten up the system and move on.0 -

Matthewfalle wrote:Rick Chasey wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

http://www.bbc.co.uk/news/uk-41886607

The crux is here, but the article's relatively detailed.

You do wonder if Corbyn was tipped off, given he was banging about Isle of Man private jets in the last PMQs.

Seems a relatively simple structure - he'll have all costs sorted out via a third party company held at the same registered office, funds will flow up from him, across to the necessary entity.

No biggie really - can't really understand why people are so shocked.

I think most people feel he ought to have paid vat on it.

Especially for what is literally a luxury.

It’s not how the business/personal vat law was intended, right?

Quite odd if you are actually surprised why people don’t like it.0 -

How much VAT he should pay or not pay depends on the percentage of business v personal use. A question of fact.Rick Chasey wrote:Matthewfalle wrote:Rick Chasey wrote:Stevo 666 wrote:

Is it really. As you've read the papers you can explain to me how it works then.Mr Goo wrote:Stevo 666 wrote:

What are you talking about Goo?Mr Goo wrote:The Isle of Man has approx 1000 private jets in its civil registry. Some of them unable to actually land on the island!!! Now Lewis Hamilton will be used as a high profile example of a tax dodger using an 'M' plate for his jet. HM Gov needs to close the door on this and kick it out.

It's a VAT/import tax fiddle to register a bizjet in the IoM. Read the news.

As a someone who does tax for a living I know that one of the places you don't look if you want an accurate and informed view on tax and tax 'fiddles' is the papers.

http://www.bbc.co.uk/news/uk-41886607

The crux is here, but the article's relatively detailed.

You do wonder if Corbyn was tipped off, given he was banging about Isle of Man private jets in the last PMQs.

Seems a relatively simple structure - he'll have all costs sorted out via a third party company held at the same registered office, funds will flow up from him, across to the necessary entity.

No biggie really - can't really understand why people are so shocked.

I think most people feel he ought to have paid vat on it.

Especially for what is literally a luxury.

It’s not how the business/personal vat law was intended, right?

Quite odd if you are actually surprised why people don’t like it."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Another case of playing the man not the ball with no supporting evidence.mamba80 wrote:Mr Goo wrote:mamba80 wrote:....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.

And finally, succinctly put. High net worth individuals and corporations can circumvent paying VAT.

Have a think about that Stevo. That's VAT money that should be going towards running essential services :- NHS, GPs, state schools, the armed services, the police, the coastguard, roads (that we continually beef about as cyclists). Need I go on?

Stevo doesnt use any of those, so its not anything he cares about.

Leftiebollox again..."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Look at what I said in my first post on this thread. If you don't like the current set up, change the law.Mr Goo wrote:mamba80 wrote:....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.

And finally, succinctly put. High net worth individuals and corporations can circumvent paying VAT.

Have a think about that Stevo. That's VAT money that should be going towards running essential services :- NHS, GPs, state schools, the armed services, the police, the coastguard, roads (that we continually beef about as cyclists). Need I go on?

And so can criminals, small businesses etc. Look at the stats in the HMRC report that I linked earlier and see where a large part of the tax gap lies. You seem to have a bit of a chip on your shoulder about big business and the well off."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Stevo 666 wrote:

Look at what I said in my first post on this thread. If you don't like the current set up, change the law.Mr Goo wrote:mamba80 wrote:....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.

And finally, succinctly put. High net worth individuals and corporations can circumvent paying VAT.

Have a think about that Stevo. That's VAT money that should be going towards running essential services :- NHS, GPs, state schools, the armed services, the police, the coastguard, roads (that we continually beef about as cyclists). Need I go on?

Sure if the law allows it, it's no surprise that people take up the opportunity, and no amount of handwringing will stop people if there's a benefit. However, changing the law is a bit of a challenge for the average bod. You would need to devote a significant chunk of your life to wangling your way to the ears of enough of those that make the laws (some of whom would lose out from such a change) to make a difference. To give an idea of the motivation needed to achieve this, the two examples I can think of of a single person bringing about a change in the law involve that person losing their child.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Those loan type schemes have already been closed down, i.e they don't work.Pross wrote:Watching this on Panorama. Before it started my opinion was on the lines of if it's legal it's not a problem (much like when people talk about 'grey areas' in doping). When they were talking about the IoM plane 'scam' that view was reinforced, I really don't see an issue if the IoM Government has decided that's the system they want. However, once they started talking about the various people 'giving away' their money to companies in Mauritius - who then appoint them to advise on how to 'invest' that money which invariably seemed to be in providing houses, cars and luxurious items for their own use - I was amazed if that could possibly be legal tax avoidance. Surely that is tax evasion that just hadn't been uncovered until now? Maybe I'm just too naive in financial matters but it just seems so blatant it can't even be considered a loophole can it?"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

In reality its the gov't that is aimed at. Given the media storm that this has generated, expect anti avoidance regs soon.rjsterry wrote:Stevo 666 wrote:

Look at what I said in my first post on this thread. If you don't like the current set up, change the law.Mr Goo wrote:mamba80 wrote:....because (for the vast majority) they have to pay VAT and cant claim it back, shocked you cant see that.

And finally, succinctly put. High net worth individuals and corporations can circumvent paying VAT.

Have a think about that Stevo. That's VAT money that should be going towards running essential services :- NHS, GPs, state schools, the armed services, the police, the coastguard, roads (that we continually beef about as cyclists). Need I go on?

Sure if the law allows it, it's no surprise that people take up the opportunity, and no amount of handwringing will stop people if there's a benefit. However, changing the law is a bit of a challenge for the average bod. You would need to devote a significant chunk of your life to wangling your way to the ears of enough of those that make the laws (some of whom would lose out from such a change) to make a difference. To give an idea of the motivation needed to achieve this, the two examples I can think of of a single person bringing about a change in the law involve that person losing their child."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0