BREXIT - Is This Really Still Rumbling On? 😴

Comments

-

Here you go RJS.Stevo_666 said:

Fair point, as at least then we would be comparing actuals with actuals rather than actuals with extrapolated forecasts.Jeremy.89 said:

You don't have to look at predictions though. We can look at actual data from similar economies, and the UKs performance against that.

However, comparing to another country is not comparing apples with apples as other countries, even'similar' ones, have numerous other factors affecting their own economic performance which will muddy the picture alongside the obvious difference of the UK (Brexited) vs other countries (not Brexited). Add to that point's such as being different phases of the economic cycle etc and a proper comparison becomes very unreliable.

We will also have endless selective use of stats (which countries to compare to, which period to use etc, what currency to use - as was done on here very recently) by both sides to prove their point that it was or wasn't harmful."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

If we have moved up in the rankings, then it's straightforward to say there's at least been no negative impact though, right? That's what the expectation must be from those in power who are driving this forward.0

-

Sorry, no detectable negative impact.0

-

Of course both are complex systems, but, as I said, just because forecasts (and especially longer-range predictions) are inherently difficult and inaccurate is not a reason for not doing them at all... that way, continuing ignorance lies.Stevo_666 said:

Thanks for agreeing - and getting back to my original point (weather was just a more relatable comparison for someone who doesn't deal much in economics) - if you can't accurately forecast the weather in 10 months time, you can't accurately forecast our theoretical economic state if we never left in 10 years time.briantrumpet said:It can't tell us the forecast for 20 November - but it might help us know what sorts of winter weather patterns we'll be having in a several years' time.

Same principles apply as both are complex systems, as mentioned above.0 -

1 -

And I still think "we're not exactly the same as them" is a cop out. We're not looking for an exact comparison; just a broad assessment of whether it has worked out positively or negatively, using a variety of metrics.Stevo_666 said:

I've already covered that point in reply to KG - can't be more than a couple of pages back on this thread.rjsterry said:

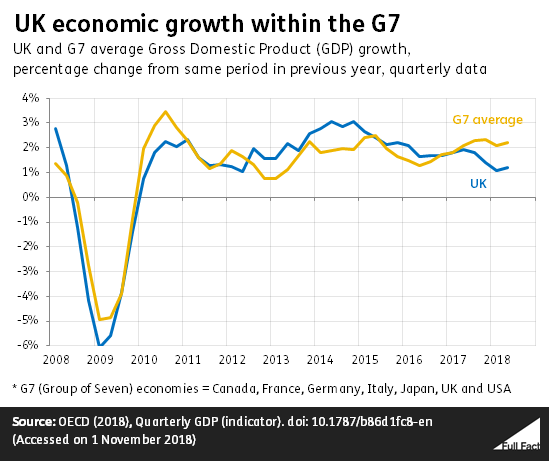

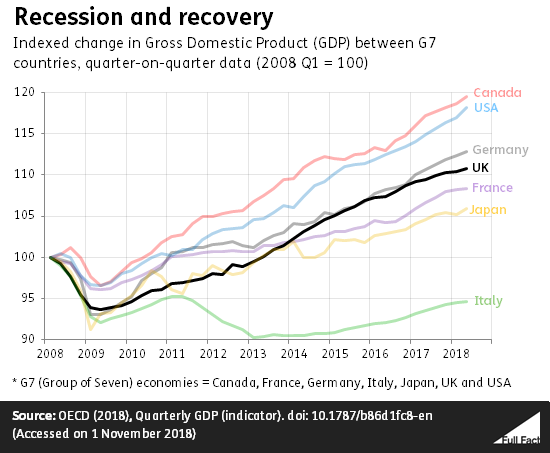

Or look at where we are relative to our peers. Which is what that article was doing. The G7 as a whole didn't have a particularly good 3 years but the UK did a bit worse. In your 2030 scenario we can carry out the same exercise. It won't necessarily give a precise answer, but you should be able to see whether we climbed or slipped down the various rankings.Stevo_666 said:

Not exactly how I was coming at it.kingstongraham said:

I didn't think this (as suggested from page 1354) was about the future, but was about looking back from the future at alternative (modelled) paths that could have been taken with different decisions based on assumptions from the performance of other countries. In the absence of alternative universes, it would have some value in determining at that point whether it was a sound decision and help in making future decisions.Stevo_666 said:

Given the percentages and timescales they are unlikely to notice. That's before you consider there is no alternative timeline to compare to (I.e. no way they can see what it would have been like had we not left) - hence no reference point.surrey_commuter said:

The pleasantness of their surprise would be inversely proportionate to their understanding of compound growthStevo_666 said:

Looking at your point from the other angle, people may be pleasantly surprised at how little negative effect leaving the EU has on them. Contrary to the sort of scenarios put forward in here.thecycleclinic said:FTA agreements dont create alot of growth. The deal with the eu through membership gives a decent boost still only worth 1% or so of gdp I believe. It may be more but less than ones thinks. a gooddealwitht the usa will add maybe 0.2% to gdp. Not to besniffes at but nothing to get excited about either. Most of us wont notice. Trade with the rest of world is even less significant. Trade deals already exist with many coj tries through the eu so bilateral deals will be merely replacing existing deals but perhaps not on the same terms perhaps not as favourable for the u.k

If the point of leaving the eu is trade deals then the public are going to be disappointed at how little difference they make to public.

I am envisaging a point in the future (say 2030) where we are trying to work out the impact of Brexit. The actual position is clear enough but the only way to estimate the comparative situation (i.e. if we had never left) in 2030 is to go back to the periods just before Brexit, look at the trends up to that date and base the estimates on those.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Two thirds of the countries these charts are comparing the UK to are still getting a large amount of fake growth via huge amounts of QE money.TheBlueBean said:

These type of comparisons are pointless when two thirds of the constituents are creating faux growth1 -

They're not pointless; you just need to understand what you are looking at and what it means. All that QE is propping up your pension.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

For those in doubt: it's pretty obvious that Stevo understands neither modelling nor chaos.0

-

The main criticism of QE was that it depressed the yield curve in the future and therefore reduced pension income annuities when they were taken out. Presumably you are arguing that stocks and shares are riding high because of the QE and that this compensates for the reduced yields? I think QE is criticised by economists as well.rjsterry said:They're not pointless; you just need to understand what you are looking at and what it means. All that QE is propping up your pension.

0 -

That may be true, but it would be better to assert why you do not believe that there is chaos in economics.drhaggis said:For those in doubt: it's pretty obvious that Stevo understands neither modelling nor chaos.

0 -

It was more a comment on Coopster's complete dismissal of the data. Of course QE has had an impact and has its unwanted side effects. That doesn't mean the data on the graphs is "fake".1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

In other Brexit newsPhil Hogan, the former Irish minister who is now trade commissioner in Brussels overseeing the next stage of the Brexit negotiations, told the Irish Independent: “There certainly will be trade-offs, particularly at the end of the negotiations. The EU will be seeking concessions on fishery access and the UK will very probably be seeking concessions on financial services.”

He hasn't been listening to Carney then who is recommending the UK does not do a deal on financial services.0 -

It's creating a illusion that there is more growth than their actually is. QE is a buyer of bonds so that money that would have purchased those bonds now has to buy something else. Keep going further down the purchasing chain chain and eventually it causes GDP increasesrjsterry said:It was more a comment on Coopster's complete dismissal of the data. Of course QE has had an impact and has its unwanted side effects. That doesn't mean the data on the graphs is "fake".

0 -

Agreed. But knowing that to be the case and knowing that most of the G7 have been at it (and even the ones that haven't will still be affected by it), we can bear that in mind. If you subtracted QE inputs from those graphs, they'd all drop a bit but their relative positions (which is what we are interested in) might still be quite similar.coopster_the_1st said:

It's creating a illusion that there is more growth than their actually is. QE is a buyer of bonds so that money that would have purchased those bonds now has to buy something else. Keep going further down the purchasing chain chain and eventually it causes GDP increasesrjsterry said:It was more a comment on Coopster's complete dismissal of the data. Of course QE has had an impact and has its unwanted side effects. That doesn't mean the data on the graphs is "fake".

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

No cop out - a clear case of not comparing apples with apples.rjsterry said:

And I still think "we're not exactly the same as them" is a cop out. We're not looking for an exact comparison; just a broad assessment of whether it has worked out positively or negatively, using a variety of metrics.Stevo_666 said:

I've already covered that point in reply to KG - can't be more than a couple of pages back on this thread.rjsterry said:

Or look at where we are relative to our peers. Which is what that article was doing. The G7 as a whole didn't have a particularly good 3 years but the UK did a bit worse. In your 2030 scenario we can carry out the same exercise. It won't necessarily give a precise answer, but you should be able to see whether we climbed or slipped down the various rankings.Stevo_666 said:

Not exactly how I was coming at it.kingstongraham said:

I didn't think this (as suggested from page 1354) was about the future, but was about looking back from the future at alternative (modelled) paths that could have been taken with different decisions based on assumptions from the performance of other countries. In the absence of alternative universes, it would have some value in determining at that point whether it was a sound decision and help in making future decisions.Stevo_666 said:

Given the percentages and timescales they are unlikely to notice. That's before you consider there is no alternative timeline to compare to (I.e. no way they can see what it would have been like had we not left) - hence no reference point.surrey_commuter said:

The pleasantness of their surprise would be inversely proportionate to their understanding of compound growthStevo_666 said:

Looking at your point from the other angle, people may be pleasantly surprised at how little negative effect leaving the EU has on them. Contrary to the sort of scenarios put forward in here.thecycleclinic said:FTA agreements dont create alot of growth. The deal with the eu through membership gives a decent boost still only worth 1% or so of gdp I believe. It may be more but less than ones thinks. a gooddealwitht the usa will add maybe 0.2% to gdp. Not to besniffes at but nothing to get excited about either. Most of us wont notice. Trade with the rest of world is even less significant. Trade deals already exist with many coj tries through the eu so bilateral deals will be merely replacing existing deals but perhaps not on the same terms perhaps not as favourable for the u.k

If the point of leaving the eu is trade deals then the public are going to be disappointed at how little difference they make to public.

I am envisaging a point in the future (say 2030) where we are trying to work out the impact of Brexit. The actual position is clear enough but the only way to estimate the comparative situation (i.e. if we had never left) in 2030 is to go back to the periods just before Brexit, look at the trends up to that date and base the estimates on those.

Different countries have different factors affecting their performance and you cannot split them all out within the overall performance - so to get a comparison that isolates the impact of Brexit is not possible."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Please explain why, oh Oracle of Scotland.drhaggis said:For those in doubt: it's pretty obvious that Stevo understands neither modelling nor chaos.

How's the chip on your shoulder these days btw? "I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

I haven't said nobody should try. I am explaining the real life limitations.briantrumpet said:

Of course both are complex systems, but, as I said, just because forecasts (and especially longer-range predictions) are inherently difficult and inaccurate is not a reason for not doing them at all... that way, continuing ignorance lies.Stevo_666 said:

Thanks for agreeing - and getting back to my original point (weather was just a more relatable comparison for someone who doesn't deal much in economics) - if you can't accurately forecast the weather in 10 months time, you can't accurately forecast our theoretical economic state if we never left in 10 years time.briantrumpet said:It can't tell us the forecast for 20 November - but it might help us know what sorts of winter weather patterns we'll be having in a several years' time.

Same principles apply as both are complex systems, as mentioned above."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Let's wait for a reasoned response from Haggis boy.....TheBlueBean said:

That may be true, but it would be better to assert why you do not believe that there is chaos in economics.drhaggis said:For those in doubt: it's pretty obvious that Stevo understands neither modelling nor chaos.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

-

I’ve posted an article from the FT about 5 times which shows how accurate the pre ref Brexit forecasts were.TheBlueBean said:

That may be true, but it would be better to assert why you do not believe that there is chaos in economics.drhaggis said:For those in doubt: it's pretty obvious that Stevo understands neither modelling nor chaos.

All the serious organisations were correct within a small margin of error.0 -

Like I said, we are looking for broad assessments not pin-point accuracy. Stretching the orchard metaphor, we might be comparing apples with quinces and pears, but if there's a bumper crop of quinces and pears and just a few shrivelled apples, the problem wasn't the weather or whether the gardener was doing a good job. That immediately narrows down the possible causes to a subset that exclusively apply to apples. It might still not be Brexitrot, but most will settle for more-likely-than-not.Stevo_666 said:

No cop out - a clear case of not comparing apples with apples.rjsterry said:

And I still think "we're not exactly the same as them" is a cop out. We're not looking for an exact comparison; just a broad assessment of whether it has worked out positively or negatively, using a variety of metrics.Stevo_666 said:

I've already covered that point in reply to KG - can't be more than a couple of pages back on this thread.rjsterry said:

Or look at where we are relative to our peers. Which is what that article was doing. The G7 as a whole didn't have a particularly good 3 years but the UK did a bit worse. In your 2030 scenario we can carry out the same exercise. It won't necessarily give a precise answer, but you should be able to see whether we climbed or slipped down the various rankings.Stevo_666 said:

Not exactly how I was coming at it.kingstongraham said:

I didn't think this (as suggested from page 1354) was about the future, but was about looking back from the future at alternative (modelled) paths that could have been taken with different decisions based on assumptions from the performance of other countries. In the absence of alternative universes, it would have some value in determining at that point whether it was a sound decision and help in making future decisions.Stevo_666 said:

Given the percentages and timescales they are unlikely to notice. That's before you consider there is no alternative timeline to compare to (I.e. no way they can see what it would have been like had we not left) - hence no reference point.surrey_commuter said:

The pleasantness of their surprise would be inversely proportionate to their understanding of compound growthStevo_666 said:

Looking at your point from the other angle, people may be pleasantly surprised at how little negative effect leaving the EU has on them. Contrary to the sort of scenarios put forward in here.thecycleclinic said:FTA agreements dont create alot of growth. The deal with the eu through membership gives a decent boost still only worth 1% or so of gdp I believe. It may be more but less than ones thinks. a gooddealwitht the usa will add maybe 0.2% to gdp. Not to besniffes at but nothing to get excited about either. Most of us wont notice. Trade with the rest of world is even less significant. Trade deals already exist with many coj tries through the eu so bilateral deals will be merely replacing existing deals but perhaps not on the same terms perhaps not as favourable for the u.k

If the point of leaving the eu is trade deals then the public are going to be disappointed at how little difference they make to public.

I am envisaging a point in the future (say 2030) where we are trying to work out the impact of Brexit. The actual position is clear enough but the only way to estimate the comparative situation (i.e. if we had never left) in 2030 is to go back to the periods just before Brexit, look at the trends up to that date and base the estimates on those.

Different countries have different factors affecting their performance and you cannot split them all out within the overall performance - so to get a comparison that isolates the impact of Brexit is not possible.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I never said I believed there is no chaos in economics. After all, chaos emerges readily from seemingly simple systes (e.g. a double pendulum) or the baker's map. It seems to me quite reasonable that if you have any sort of complex model constructed without "due care & attention", chaotic regimes will exist.

Having said that, Stevo doesn't understand either chaos or modelling because he constantly regurgitates "butterfly effect" without any further thought. Yeah, sure, solutions diverge exponentially, but conservation laws will restrict the available phase-space to the solutions and dynamical systems tend to have stability regions (attractors, limit cycles).

He then goes on to fallaciously compare the weather on 2020/11/20 (For the record: It'll be hot and sunny, with a 26 C maximum, but a nippy 10 C at night. In Adrar, Algeria) with the economic progression that has known performance markers. SC correctly points out that he's mixing a single solution prediction with ensemble averages. Ensemble averages for which we have more information (we didn't know about Gillets Jaunes back in 2016, did we?). And how does Stevo reply? Predictably, butterfly effect.

Quod erat demonstrandum.

The chip is doing rather well, by the way, judging by its growth rate. I call it Ben.

PS: Stevo, the Solar system is also chaotic. Tell me now you don't believe in modelling its evolution. Some people even do it without, gasp, symplectic integrators.0 -

Over what period?rick_chasey said:

I’ve posted an article from the FT about 5 times which shows how accurate the pre ref Brexit forecasts were.TheBlueBean said:

That may be true, but it would be better to assert why you do not believe that there is chaos in economics.drhaggis said:For those in doubt: it's pretty obvious that Stevo understands neither modelling nor chaos.

All the serious organisations were correct within a small margin of error.

It's worth pointing out that we haven't actually left yet, so what scenario were they actually forecasting?"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

You are assuming too much and then compounding the error by trying to be a smartarse. Just because I haven't gone into the detail of 'the butterfly effect' does not mean there is no further thought behind it. However if you understand the butterfly effect then it should be self evident what the consequences are.drhaggis said:I never said I believed there is no chaos in economics. After all, chaos emerges readily from seemingly simple systes (e.g. a double pendulum) or the baker's map. It seems to me quite reasonable that if you have any sort of complex model constructed without "due care & attention", chaotic regimes will exist.

Having said that, Stevo doesn't understand either chaos or modelling because he constantly regurgitates "butterfly effect" without any further thought. Yeah, sure, solutions diverge exponentially, but conservation laws will restrict the available phase-space to the solutions and dynamical systems tend to have stability regions (attractors, limit cycles).

He then goes on to fallaciously compare the weather on 2020/11/20 (For the record: It'll be hot and sunny, with a 26 C maximum, but a nippy 10 C at night. In Adrar, Algeria) with the economic progression that has known performance markers. SC correctly points out that he's mixing a single solution prediction with ensemble averages. Ensemble averages for which we have more information (we didn't know about Gillets Jaunes back in 2016, did we?). And how does Stevo reply? Predictably, butterfly effect.

Quod erat demonstrandum.

The chip is doing rather well, by the way, judging by its growth rate. I call it Ben.

PS: Stevo, the Solar system is also chaotic. Tell me now you don't believe in modelling its evolution. Some people even do it without, gasp, symplectic integrators."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

The UK ceased QE years ago so the monthly stimulus will no longer show up.rjsterry said:

Agreed. But knowing that to be the case and knowing that most of the G7 have been at it (and even the ones that haven't will still be affected by it), we can bear that in mind. If you subtracted QE inputs from those graphs, they'd all drop a bit but their relative positions (which is what we are interested in) might still be quite similar.coopster_the_1st said:

It's creating a illusion that there is more growth than their actually is. QE is a buyer of bonds so that money that would have purchased those bonds now has to buy something else. Keep going further down the purchasing chain chain and eventually it causes GDP increasesrjsterry said:It was more a comment on Coopster's complete dismissal of the data. Of course QE has had an impact and has its unwanted side effects. That doesn't mean the data on the graphs is "fake".

France, Germany & Italy via the ECB, and Japan are still getting monthly QE stimulus.

The graph you posted is not representing a level playing field with two thirds of your comparison countries still gaining artificial stimulus. As this has never occurred before it invalidates the comparison as it means you are comparing apples with pears.

0 -

According to what I can find the last tranche of BoE QE was August 2016 - £60bn of gilts + £10bn corporate bonds. ECB stopped in December 2018. The Fed in October 2014, but recently considered restarting their programme; Japan: December 2017. I'll have to look back on a bigger screen to see if those events match the graph.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Oh, you really don’t understand macro economic modelling.Stevo_666 said:

You definitely are - as mentioned above, one is an input variable into the other.briantrumpet said:

Nope, I'm not mixing up the two, though of course the two are related: the sort of weather patterns we're seeing now (e.g. Australia) are the result of, and have been predicted by the climate change scientists.Stevo_666 said:

Brian you are mixing up two different things and trying to equate the two.briantrumpet said:

You neatly overlook the climate science point... i.e., what is happening has been predicted.Stevo_666 said:

The weather forecasting example backs up my point very well - specifically that accurate longer term forecasts are not possible. Thanks for raising that one Brian.

And, of course, they still do do longer range forecasts, even if the results are variable. That's rather different from your "don't bother" suggestion.

While it can be predicted that large amounts of greenhouse gases continuously present in the atmosphere will tend to increase temperature, can you let me know what the weather will be like on, say, 20th November this year? You can't, can you.

And I never said dont bother, I just said that reasonably accurate long term forecasts of the type I mention are not possible.

Same applies for long term economic forecasts for the good reasons given above.

Somewhere in the middle is what the Met Office call long-range predictions, and that is very much part of their remit. https://www.metoffice.gov.uk/research/climate/seasonal-to-decadal/long-range/user-guide

"As a result, the forecast is useful to assess likelihood and risk, but not for warning of definite events." The sort of thing you might do for an economy...

So, about the weather on 20th November? Any predictions? Same point applies for what our GDP might be in 10 years time if we had never left the EU. You simply don't know.

0 -

You think that GDP growth is a matter of opinion yet confidently state that UK ceased QE years ago.coopster_the_1st said:

The UK ceased QE years ago so the monthly stimulus will no longer show up.rjsterry said:

Agreed. But knowing that to be the case and knowing that most of the G7 have been at it (and even the ones that haven't will still be affected by it), we can bear that in mind. If you subtracted QE inputs from those graphs, they'd all drop a bit but their relative positions (which is what we are interested in) might still be quite similar.coopster_the_1st said:

It's creating a illusion that there is more growth than their actually is. QE is a buyer of bonds so that money that would have purchased those bonds now has to buy something else. Keep going further down the purchasing chain chain and eventually it causes GDP increasesrjsterry said:It was more a comment on Coopster's complete dismissal of the data. Of course QE has had an impact and has its unwanted side effects. That doesn't mean the data on the graphs is "fake".

France, Germany & Italy via the ECB, and Japan are still getting monthly QE stimulus.

The graph you posted is not representing a level playing field with two thirds of your comparison countries still gaining artificial stimulus. As this has never occurred before it invalidates the comparison as it means you are comparing apples with pears.

This leaves us two possibilities

1) QE really did cease years ago ago and that nobody noticed and Carey did not tell anybody

2) You are a thicko

0 -

rjsterry said:

According to what I can find the last tranche of BoE QE was August 2016. ECB stopped in December 2018. The Fed in October 2014, but recently considered restarting their programme; Japan: December 2017. I'll have to look back on a bigger screen to see if those events match the graph.

They may have stopped adding to the problem but they have certainly not commenced unwinding their position. Having dug their hole they have no idea how to exit it0