2024 Election thread

Comments

-

So who’s going to pay for all the pensions and care if you don’t have immigration? How do you solve that demographic problem?

0 -

The youngsters can work 3 jobs. Also earns them enough for a house. Win win!

- Genesis Croix de Fer

- Dolan Tuono0 -

I thought this was a debate about housing problems?

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Tackling problems in isolation is a sure way to unintended consequences

- Genesis Croix de Fer

- Dolan Tuono0 -

Remind me which party gave more student dependent visas than their much touted total immigration target of 100,000?

0 -

What was it like before the premier league started RC? Say during the oil crisis or when interest rates were 14%? I can't help but think you are singling out a golden generation and have a fat lip because you aren't in it. But Britain was inhabited before the Boomers, you know.

1 -

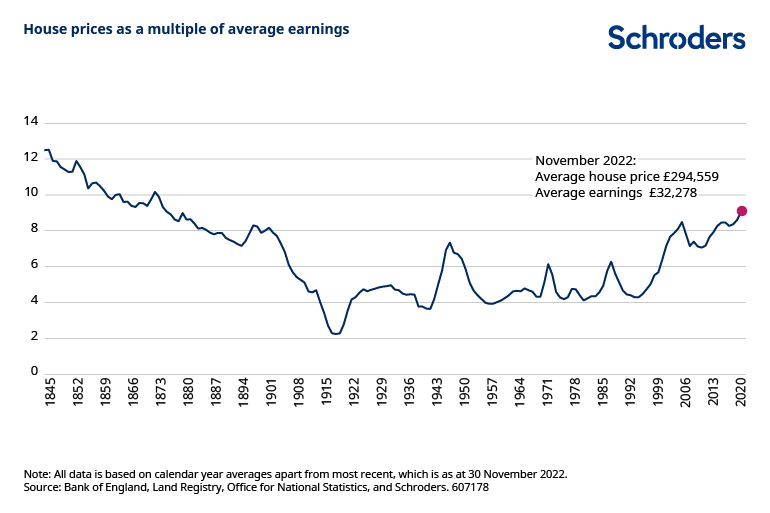

How’s 175 years?

so it’s worst house price to wage ratio for the last hundred and thirty years or so

0 -

The carousel keeps spinning.

0 -

If you'd quoted more of the article:

The elephant in the room here is interest rates. A Bank of England working paper concluded that nearly all of the rise in average house prices relative to incomes between 1985 and 2018 can be seen as a result of “a sustained, dramatic, and consistently unexpected, decline in real interest rates as measured by the yield on medium-term index-linked gilts”[1]. The Bank doesn’t rule out other factors, but concludes that they have had more of a short term impact. It furthermore concludes that: “An unexpected and persistent increase in the medium-term real interest rate of 1 percentage point from its level as at end 2018 could ultimately generate a fall in real house prices (over a period of many years) of just under 20%.” The recent sharp rise in mortgage rates highlight this risk. House prices may have been high relative to incomes in recent years, but low interest rates kept mortgage payments relatively affordable, even for those borrowing large amounts. The challenge hasn’t been the monthly payments, but getting hold of the deposit. With mortgage rates shooting up, that era is now behind us.

0 -

Yeah 2022 innit 😉

high prices forces everyone to borrow more which means when rates rise the actual cost of the borrowing rises much faster. It amplifies the effect of the rate rises.

An extra 1% on £300,000 is a much bigger increase in servicing costs than 1% on 50,000.

Obviously younger people are entering the market later and so are levering up much more to enter as the prices are higher.

Clearly the earlier you have joined the ladder, the lower your costs will always be, as, regional variations aside, the cost in housing is mitigated by the rise in price of your own property.

That is the age privilege.

If you look at this: https://ifs.org.uk/publications/housing-costs-and-income-inequality-uk

There’s a lot on proportion of money spent on housing.

UK on average spends more on housing costs as a proportion than any other OECD country.

0 -

I don’t know quite why everyone wants to argue it’s not as bad as the data says.

Is it guilt? Do you not believe it and if so why not?

0 -

Right now the combination of rates and prices is fairly dire. But by the end of the year it'll be less remarkable.

The tenor of replies is just because people are countering your hyperbole.

0 -

-

I'm not feeling in the slight bit guilty for how sustained low interest rates have skewed the housing market (along with an overly-restrictive planning regime). I took my chance with a 5-year fix at 8.5% in 1992, with the hope that at some stage interest rates would go up. (And I was in the fortunate sitation of buying when repossessions were high as a result of loads of people not being able to afford their mortgages - see, the pain isn't exclusive to 2023.)

When mortgages were cheap, I was concerned that house price inflation would be the result of people finding massive mortgages affordable, and lo and behold, it came to pass. I was also concerned that people en masse were over-extending, and that a 1-2% increase in interest rates would being about pain. And so it came to pass.

Was there anything I could have done to change the situation? No. Am I concerned about how young people can afford the cost of housing, yes.

0 -

-

There’s a reason that in 1997 the most common young adult living arrangement was in a couple with children and now it’s living with your parents.

That has huge ramifications on all sorts and needs to be sorted out. It’s quite frustrating trying to prove that it is indeed a problem over and over again.

Can we accept it is, and move on to debating the solutions?

0 -

Now you're being silly. No-one's saying the situation shouldn't be improved, but the levers to do that aren't in our hands, and they never were.

0 -

Right now? I can believe that. But it's transient.

0 -

It's largely due to deposits, from what I can tell from younger colleagues and children of friends. Not cost once you've bought.

0 -

House prices vs average wages misses the third important component - cost of debt servicing.

Borrowing was effectively free from 2009 to 2022. The issue was raising the deposit to get on the ladder, but once on, the debt costs were compariatively low historically.

We've now had a rapid normalisation of interest rates. That's obviously going to cause issues for existing borrowers coming off their 1.5% fixes.

The omission of the cost of servicing the debt from Rick's hyperbole is possibly one reason for the pushback. Getting your first mortgage offer at 9% pa and paying 17% pa 12 months later was no walk in the park, coupled for many people with significant negative equity.

0 -

And though no consolation, when I first bought, rates were 5.5%, but I only needed a 5% deposit, but could have got a 100% mortgage if I wanted higher repayments. Would've taken about 3 more years to get to 20%. The financial crash came about 6m later...

0 -

Missing the point. (and the usual fact-free comment from someone with no expertise in subject). Ability to buy is not the issue: there are just not enough houses for the population. As mentioned previously, if KCs can't find somewhere affordable to rent, you know there's a problem.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I mean you might not agree, but the chairman of NatWest probably has some expertise in the subject.

0 -

Having been part of a team that placed a chairman of another bank, I would be surprised if they have any idea how the other half live.

0 -

I wouldn’t call it “free”.

Locked in at 1.9%, my mortgage payment each month are still c. 50% equity 50% interest.

Nor, as the stats show, were many current young adults able to capitalise on said cheap money, as the necessary deposits required were exorbitant, especially given the cost of renting. Hence living with your parents is now the most common living arrangement for under 35s.

ffs stop denying it’s worse than in living memory. It just is, and all the stats show that. Just accept it.

If living was so cheap why is living with your parents the most common arrangement for under 35s? For the first time in records

0 -

What makes for a less frustrating discussion is agreeing it’s a problem that needs to be solved and discussing the solutions. Of which presumably there are many.

It’s such a deep and chronic feature of all our lives, both physically and financially, that it ought to be a priority for every government.

0 -

Locked in at 1.9%, my mortgage payment each month are still c. 50% equity 50% interest.

Err, you're on a repayment mortgage, probably less than 10 years in, so you're doing pretty well if you're already on a 50:50 split.

0 -

6 years in. Yea but let’s not pretend the £hundreds of pounds walking out the door every month to pay the interest is “free” as you put it.

0 -

?

I'm only 5 years in but my repayments are over 50% on capital. It's because rates are low.

The ratio will change dramatically when I have to re-mortgage in July.

- Genesis Croix de Fer

- Dolan Tuono0 -

The responses on this thread demonstrate why it is not a priority for the government.

- Genesis Croix de Fer

- Dolan Tuono1