LEAVE the Conservative Party and save your country!

Comments

-

I bought my first place in 1988 just after Miras was dropped. I'm saying my place - went halves with a mate so we could get into the housing ladder as I couldn't afford one on my own."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

-

No tax relief. It went Spring 1988.rick_chasey said:

What was your tax relief? I'd imagine on 18% interest it was material.Dorset_Boy said:Miras went in 1988.

15% was a low interest rate in 1989. It was more like 18-19%.

Graduate salaries in 1987/88 were about £8,000 pa in London (outside of banking).

2 bedroom flat close south circular in Forset Hill, Brockley, Catford, Lewisham area was around £80,000. Hardly expensive areas of London at the time.

So with a 5% deposit, monthly mortgage cost was £1,153 pm over a 25 year term.

So more than the annual salary of a graduate, or if buying as two people then just under £580 pm, or around £6,950 pa! Not much disposable income left there....!

So about the same as the repayment costs on a £275,000 property over most of the last 14 years.

It is clearly harder to raise the deposit now, but the debt servicing costs haven't been relatively higher until very recently. So the issue has been getting on the ladder in the first place.0 -

I read it was abolished in 1999...Dorset_Boy said:

No tax relief. It went Spring 1988.rick_chasey said:

What was your tax relief? I'd imagine on 18% interest it was material.Dorset_Boy said:Miras went in 1988.

15% was a low interest rate in 1989. It was more like 18-19%.

Graduate salaries in 1987/88 were about £8,000 pa in London (outside of banking).

2 bedroom flat close south circular in Forset Hill, Brockley, Catford, Lewisham area was around £80,000. Hardly expensive areas of London at the time.

So with a 5% deposit, monthly mortgage cost was £1,153 pm over a 25 year term.

So more than the annual salary of a graduate, or if buying as two people then just under £580 pm, or around £6,950 pa! Not much disposable income left there....!

So about the same as the repayment costs on a £275,000 property over most of the last 14 years.

It is clearly harder to raise the deposit now, but the debt servicing costs haven't been relatively higher until very recently. So the issue has been getting on the ladder in the first place.

https://www.theguardian.com/uk/1999/mar/10/budget1999.budget30 -

you used to be able to get MIRAS x2 which Lawson crashed the market when restricting to x1 in 1990. This was capped at £30k which was left to wither on the vine until GB scrapped it in 2000 to barely a wimper.rick_chasey said:

What was your tax relief? I'd imagine on 18% interest it was material.Dorset_Boy said:Miras went in 1988.

15% was a low interest rate in 1989. It was more like 18-19%.

Graduate salaries in 1987/88 were about £8,000 pa in London (outside of banking).

2 bedroom flat close south circular in Forset Hill, Brockley, Catford, Lewisham area was around £80,000. Hardly expensive areas of London at the time.

So with a 5% deposit, monthly mortgage cost was £1,153 pm over a 25 year term.

So more than the annual salary of a graduate, or if buying as two people then just under £580 pm, or around £6,950 pa! Not much disposable income left there....!

So about the same as the repayment costs on a £275,000 property over most of the last 14 years.

It is clearly harder to raise the deposit now, but the debt servicing costs haven't been relatively higher until very recently. So the issue has been getting on the ladder in the first place.

I would argue that all MIRAS did was inflatethe market (like stamp duty hols) so borrowers were no better off. I think for your argument it is a red herring.0 -

I was sure it was announced in '88 Budget with a date two years hence that it would be x1 per roperty notper person. This created a huge boom which left mates/couples stuck in properties they could not sell for close to a decade.Dorset_Boy said:

No tax relief. It went Spring 1988.rick_chasey said:

What was your tax relief? I'd imagine on 18% interest it was material.Dorset_Boy said:Miras went in 1988.

15% was a low interest rate in 1989. It was more like 18-19%.

Graduate salaries in 1987/88 were about £8,000 pa in London (outside of banking).

2 bedroom flat close south circular in Forset Hill, Brockley, Catford, Lewisham area was around £80,000. Hardly expensive areas of London at the time.

So with a 5% deposit, monthly mortgage cost was £1,153 pm over a 25 year term.

So more than the annual salary of a graduate, or if buying as two people then just under £580 pm, or around £6,950 pa! Not much disposable income left there....!

So about the same as the repayment costs on a £275,000 property over most of the last 14 years.

It is clearly harder to raise the deposit now, but the debt servicing costs haven't been relatively higher until very recently. So the issue has been getting on the ladder in the first place.

Feel free to ask me why I remember this so well 35 years later0 -

I might have mis-remebered given it was 35 years ago, but doesn't change the point that servicing a mortgage was expensive then. That Monty Python sketch upthread is still relevant...."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

-

Double MIRAS was removed in the Spring 1988 budget, effective from 1st August 1988 for new borrowers.rick_chasey said:

I read it was abolished in 1999...Dorset_Boy said:

No tax relief. It went Spring 1988.rick_chasey said:

What was your tax relief? I'd imagine on 18% interest it was material.Dorset_Boy said:Miras went in 1988.

15% was a low interest rate in 1989. It was more like 18-19%.

Graduate salaries in 1987/88 were about £8,000 pa in London (outside of banking).

2 bedroom flat close south circular in Forset Hill, Brockley, Catford, Lewisham area was around £80,000. Hardly expensive areas of London at the time.

So with a 5% deposit, monthly mortgage cost was £1,153 pm over a 25 year term.

So more than the annual salary of a graduate, or if buying as two people then just under £580 pm, or around £6,950 pa! Not much disposable income left there....!

So about the same as the repayment costs on a £275,000 property over most of the last 14 years.

It is clearly harder to raise the deposit now, but the debt servicing costs haven't been relatively higher until very recently. So the issue has been getting on the ladder in the first place.

https://www.theguardian.com/uk/1999/mar/10/budget1999.budget3

https://en.wikipedia.org/wiki/Mortgage_interest_relief_at_source#:~:text=MIRAS was completely abolished in,advisers when selling endowment mortgages.

I can't recall how it would have worked, but there followed 4-5 years of at best stagnation in house prices following the removal of double MIRAS, at worst a lot of negative equity - Bradley Stoke on the edge of Bristol was re-christened Sadly Broke by 1992.

Our mortage offer was at 9% pa interest, and within a year we were paying 18%.0 -

You ignored it.Stevo_666 said:

Why do you assume that?kingstongraham said:

So you’ve no interest in the overall tax burden.Stevo_666 said:

Lower than in 1988 for an equivalent amount of income.kingstongraham said:

So you didn't like the tax burden in 1989. How's it looking now?Stevo_666 said:

Yep, so a rate 15% higher and a threshold £25k lower than today. As I was saying...kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

0 -

No, I just answered your question.kingstongraham said:

You ignored it.Stevo_666 said:

Why do you assume that?kingstongraham said:

So you’ve no interest in the overall tax burden.Stevo_666 said:

Lower than in 1988 for an equivalent amount of income.kingstongraham said:

So you didn't like the tax burden in 1989. How's it looking now?Stevo_666 said:

Yep, so a rate 15% higher and a threshold £25k lower than today. As I was saying...kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Now that I have made you aware I was referring to the overall tax burden, would you try answering it again?Stevo_666 said:

No, I just answered your question.kingstongraham said:

You ignored it.Stevo_666 said:

Why do you assume that?kingstongraham said:

So you’ve no interest in the overall tax burden.Stevo_666 said:

Lower than in 1988 for an equivalent amount of income.kingstongraham said:

So you didn't like the tax burden in 1989. How's it looking now?Stevo_666 said:

Yep, so a rate 15% higher and a threshold £25k lower than today. As I was saying...kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

0 -

Of course. I think it could and should be lower, as you already know. But there's no harm repeating myselfkingstongraham said:

Now that I have made you aware I was referring to the overall tax burden, would you try answering it again?Stevo_666 said:

No, I just answered your question.kingstongraham said:

You ignored it.Stevo_666 said:

Why do you assume that?kingstongraham said:

So you’ve no interest in the overall tax burden.Stevo_666 said:

Lower than in 1988 for an equivalent amount of income.kingstongraham said:

So you didn't like the tax burden in 1989. How's it looking now?Stevo_666 said:

Yep, so a rate 15% higher and a threshold £25k lower than today. As I was saying...kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

How does it compare to the late 80s?Stevo_666 said:

Of course. I think it could and should be lower, as you already know. But there's no harm repeating myselfkingstongraham said:

Now that I have made you aware I was referring to the overall tax burden, would you try answering it again?Stevo_666 said:

No, I just answered your question.kingstongraham said:

You ignored it.Stevo_666 said:

Why do you assume that?kingstongraham said:

So you’ve no interest in the overall tax burden.Stevo_666 said:

Lower than in 1988 for an equivalent amount of income.kingstongraham said:

So you didn't like the tax burden in 1989. How's it looking now?Stevo_666 said:

Yep, so a rate 15% higher and a threshold £25k lower than today. As I was saying...kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

0

0 -

So you managed all that and manage those payments on a single income. I know you're probably earning well above average but presumably have quite significant costs associated with travelling to work. How did you manage to do it when your mates cant? I know it isn't easy to get going, even in these parts with relatively cheaper housing it is difficult for a lot of younger people, but I suspect in many cases those who can't afford it are also living a less frugal lifestyle than those with similar household incomes that do get on the ladder.rick_chasey said:

Only 2 of my mates have mortgages (the rest all rent...35yr olds), one is a bigshot city lawyer and so is his wife so they don't worry about that and the other's missus inherited a material 6 figure sum, so neither are that worried about that stuff > this is pretty standard for 30 somethings who have mortgages. A big proportion will have inherited money.surrey_commuter said:

I was assuming a monthly increase of £1k a month. I was more interested in hearing a straw poll of whether your peers know what is coming, how long it will last and if they will be able to cope.rick_chasey said:

lol, you mean up to £1400-1500 a month. plus the equity payments.surrey_commuter said:

As a sensible chap I am sure you will be fine when that goes up £1k a month but assuming your peers are in the same boat are they aware of the tsunami heading their way and will they be able to coperick_chasey said:And don't forget:

https://en.wikipedia.org/wiki/Mortgage_interest_relief_at_source

I could do with tax relief on the £600-700 a month I'm spending on interest.

Or put another way did lenders test affordability at 2% or 5%?

I can afford a tripling of the interest payments if needed, though clearly not desirable. Plus I've built up enough cushion through overpayments that I can draw down on that for around about 18 months if rates triple, so I have been very conservative (plus I managed to save enough that even after the deposit I have a safety cushion).

I'm locked into 1.9% until Jan 2025 so I might miss the worst of it.0 -

I'm tight as f*ck and I out-earn them (and my missus did too when she earned).

You know what they say about the Dutch (me) and yorkshire folk (my wife).

Deep pockets, short arms.

I basically live like I'm on about 1/3rd of what I am as I loathe spending money. It almost physically hurts me. You'll see on the buying threads I'll think about buying something for months and months before I buy anything. Only took me 4 years to buy myself a cycling computer.

Edit: I also met my now wife when I was at uni so I could also live in a one bed on two incomes which saves a lot of money in London when you're renting.0 -

Not sure, but it's not national quiz Stevo day, so go look it up...kingstongraham said:

How does it compare to the late 80s?Stevo_666 said:

Of course. I think it could and should be lower, as you already know. But there's no harm repeating myselfkingstongraham said:

Now that I have made you aware I was referring to the overall tax burden, would you try answering it again?Stevo_666 said:

No, I just answered your question.kingstongraham said:

You ignored it.Stevo_666 said:

Why do you assume that?kingstongraham said:

So you’ve no interest in the overall tax burden.Stevo_666 said:

Lower than in 1988 for an equivalent amount of income.kingstongraham said:

So you didn't like the tax burden in 1989. How's it looking now?Stevo_666 said:

Yep, so a rate 15% higher and a threshold £25k lower than today. As I was saying...kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

If you can afford enough to save up for an £x0,000 deposit whilst renting (which typically costs as much as a mortgage) you can afford to overpay when you've got said mortgage and aren't having to save.

Anyway - the problem is basic economics - not enough houses for the people that want them. If the barriers for entry were smaller for one group, it will just price another out of the market, until more houses are built or the population falls dramatically0 -

super_davo said:

If you can afford enough to save up for an £x0,000 deposit whilst renting (which typically costs as much as a mortgage) you can afford to overpay when you've got said mortgage and aren't having to save.

Anyway - the problem is basic economics - not enough houses for the people that want them. If the barriers for entry were smaller for one group, it will just price another out of the market, until more houses are built or the population falls dramatically

Yes to both.

(but since I'm conservative, I made the minimum payments to be about half to 2/3rds of what I could afford when I took it out, in case sh!t hits the fan.)0 -

Unfortunately that is also the sacrifice that is needed to get on the housing ladder. I wasn't on great money when I bought my first place and when our first child came along a year later I ended up getting a second job to help cover things. Affording a house has never been easy, certainly in my adult life. Prior to my generation it seemed to be much more commonplace for people to live in the family home until they got married and bought a place of their own. These days, more younger people go off to University and then never really return home so there is a higher demand on housing from younger, often single, people as well.rick_chasey said:I'm tight as f*ck and I out-earn them (and my missus did too when she earned).

You know what they say about the Dutch (me) and yorkshire folk (my wife).

Deep pockets, short arms.

I basically live like I'm on about 1/3rd of what I am as I loathe spending money. It almost physically hurts me. You'll see on the buying threads I'll think about buying something for months and months before I buy anything. Only took me 4 years to buy myself a cycling computer.0 -

-

31% of GDP in 1988-9Stevo_666 said:

Not sure, but it's not national quiz Stevo day, so go look it up...kingstongraham said:

How does it compare to the late 80s?Stevo_666 said:

Of course. I think it could and should be lower, as you already know. But there's no harm repeating myselfkingstongraham said:

Now that I have made you aware I was referring to the overall tax burden, would you try answering it again?Stevo_666 said:

No, I just answered your question.kingstongraham said:

You ignored it.Stevo_666 said:

Why do you assume that?kingstongraham said:

So you’ve no interest in the overall tax burden.Stevo_666 said:

Lower than in 1988 for an equivalent amount of income.kingstongraham said:

So you didn't like the tax burden in 1989. How's it looking now?Stevo_666 said:

Yep, so a rate 15% higher and a threshold £25k lower than today. As I was saying...kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

35% of GDP in 2021-2

Forecast with current government plans to be 37% in 2027-8.

Taxes are higher now than they were at the time when you thought young people would be horrified to hear about them.0 -

We were talking about taxes borne by that demographic, whereas your figures include taxes on everyone and on businesses.kingstongraham said:

31% of GDP in 1988-9Stevo_666 said:

Not sure, but it's not national quiz Stevo day, so go look it up...kingstongraham said:

How does it compare to the late 80s?Stevo_666 said:

Of course. I think it could and should be lower, as you already know. But there's no harm repeating myselfkingstongraham said:

Now that I have made you aware I was referring to the overall tax burden, would you try answering it again?Stevo_666 said:

No, I just answered your question.kingstongraham said:

You ignored it.Stevo_666 said:

Why do you assume that?kingstongraham said:

So you’ve no interest in the overall tax burden.Stevo_666 said:

Lower than in 1988 for an equivalent amount of income.kingstongraham said:

So you didn't like the tax burden in 1989. How's it looking now?Stevo_666 said:

Yep, so a rate 15% higher and a threshold £25k lower than today. As I was saying...kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

35% of GDP in 2021-2

Forecast with current government plans to be 37% in 2027-8.

Taxes are higher now than they were at the time when you thought young people would be horrified to hear about them."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Re affordability of housing, another consideration is expectations. They were just so much lower in the late 80s / early 90s.

When I started work, having one foreign holiday a year was considered good. Low cost airlines and other things that make travel so easy these days just didn't exist for the masses. Last year, Junior W&G #1 went on 5 overseas jollies - all self-funded - and she was a first year undergrad at the time.

Likewise, when I was at school, at a fairly standard local comp, when kids passed their driving tests, they still walked, cycled or got the bus to school as even 2 car families were not that common. Nowadays, at our kids' school, another fairly standard local comp, I'd say half the kids who passed their tests then had access to a car to get to school as the three car family had expanded in numbers. (The economics of this are definitely aided by the cost of a 6th form bus pass!)

And when I was at Bath, there were kids from some seriously well off families, but the bragging about parents' houses was limited to the size of pool at the family home. In Younger W&G #1's social group at Durham, demographically broadly equivalent to Bath one might assume, the bragging is about the quality of the pool etc. in the family's alpine holiday home etc.

Youngsters expect so much more these days I think (and tbh, there is so much more desirable stuff and things out there now) and are thus likely to be more disappointed than earlier generations that were brought up to expect less when they move from living a 6th form / student lifestyle supported by M&D to being self-sufficient0 -

If you think a holiday is the difference between a deposit and not you’re underestimating how cheap holidays are and how expensive deposits need to be .

And people are buying homes later and later in their lives and are having kids later and later, and that is primarily a cost issue. We're at a historic high for a century for how many grown ups live with their parents.0 -

They were just examples of how expectations are different now. And dashed higher expectations => higher propensity to complain and think that you have it uniquely bad.rick_chasey said:If you think a holiday is the difference between a deposit and not you’re underestimating how cheap holidays are and how expensive deposits need to be .

And people are buying homes later and later in their lives and are having kids later and later, and that is primarily a cost issue. We're at a historic high for a century for how many grown ups live with their parents.

I'm not saying buying a house etc. is no harder now than it used to be. Just that in the Dark Ages, there were challenges relating to affordability too. Mass unemployment => lots of repossessions, which is a social ill that the youngsters of today don't have to worry about so much.

If you're after understanding, perhaps you need to "give a little to get a little". However, if you want an argument with a bunch of over 50s who remember what life was like when you were in short trousers / a snotty teenager then carry on!

1 -

I know. I just think the misunderstanding for what it is like now is what’s informed the lack of policy to address it.

The fact the tories are only now realise they’ve “ignored” millennials, who are now in their 30s and 40s, 10, 13years into Tory rul, goes to show that.

They think the same way. “Oh we managed” and thinking it’s the same issue when it isn’t.

Nor is it fwiw exclusive to the UK, though in the UK it is more acute due to fewer homes being built0 -

A cynic would suggest too many landlords in government.Stevo_666 said:

Good luck. Wonder why this hasn't been done already at any time in the last couple of decades?rick_chasey said:

Get rid of the greenbelt and loosen up house planning rules so nimbys can't object to reasonable stuff and incentivise housebuilders to build houses where people will buy them.Stevo_666 said:

You've explained it over and over again, that we know. We await the magical solution.rick_chasey said:

If only wages rose at the same rate as house prices eh?kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

I mean, what about "house prices rising faster than wages" makes you think houses cost the same as they used to?

It's just so f*cking moronic having to explain the same sh!t over and over.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I'm not keen on the proposal and I'm not a landlord. Urban planning like they have in North America is thoroughly depressing.rjsterry said:

A cynic would suggest too many landlords in government.Stevo_666 said:

Good luck. Wonder why this hasn't been done already at any time in the last couple of decades?rick_chasey said:

Get rid of the greenbelt and loosen up house planning rules so nimbys can't object to reasonable stuff and incentivise housebuilders to build houses where people will buy them.Stevo_666 said:

You've explained it over and over again, that we know. We await the magical solution.rick_chasey said:

If only wages rose at the same rate as house prices eh?kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

I mean, what about "house prices rising faster than wages" makes you think houses cost the same as they used to?

It's just so f*cking moronic having to explain the same sh!t over and over.0 -

So is living with your parents aged 30TheBigBean said:

I'm not keen on the proposal and I'm not a landlord. Urban planning like they have in North America is thoroughly depressing.rjsterry said:

A cynic would suggest too many landlords in government.Stevo_666 said:

Good luck. Wonder why this hasn't been done already at any time in the last couple of decades?rick_chasey said:

Get rid of the greenbelt and loosen up house planning rules so nimbys can't object to reasonable stuff and incentivise housebuilders to build houses where people will buy them.Stevo_666 said:

You've explained it over and over again, that we know. We await the magical solution.rick_chasey said:

If only wages rose at the same rate as house prices eh?kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

I mean, what about "house prices rising faster than wages" makes you think houses cost the same as they used to?

It's just so f*cking moronic having to explain the same sh!t over and over.0 -

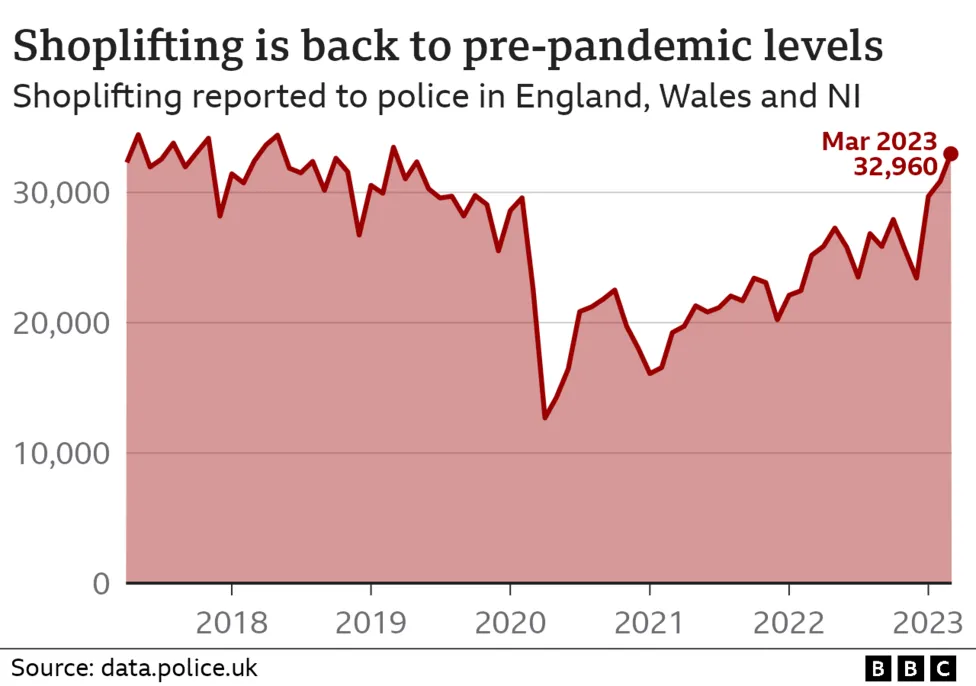

good to see the brexitories succeeding in driving recovery

my bike - faster than god's and twice as shiny0 -

Isn't that a choice people make to save money for a deposit? I know plenty of families who rent.rick_chasey said:

So is living with your parents aged 30TheBigBean said:

I'm not keen on the proposal and I'm not a landlord. Urban planning like they have in North America is thoroughly depressing.rjsterry said:

A cynic would suggest too many landlords in government.Stevo_666 said:

Good luck. Wonder why this hasn't been done already at any time in the last couple of decades?rick_chasey said:

Get rid of the greenbelt and loosen up house planning rules so nimbys can't object to reasonable stuff and incentivise housebuilders to build houses where people will buy them.Stevo_666 said:

You've explained it over and over again, that we know. We await the magical solution.rick_chasey said:

If only wages rose at the same rate as house prices eh?kingstongraham said:£41,200 in 1989 adjusted for inflation is £101,702 in 2023.

I mean, what about "house prices rising faster than wages" makes you think houses cost the same as they used to?

It's just so f*cking moronic having to explain the same sh!t over and over.0