LEAVE the Conservative Party and save your country!

Comments

-

Historically the only big spending was on military campaigns, which can generally be seen as attempts to control trade. The UK wouldn't have been able to expand its empire and extract all those resources without the initial spending on wars to establish maritime dominance. I'm pretty sure the Napoleonic wars qualify as a decade or so of budget deficit. Another example: in the 1890s the government was lobbied to expand the empire to relieve the saturated market for UK manufacturing => expansion into Africa => Boer War. There is obviously a big change with the introduction of the welfare state, but broadly spending on that has been fairly steady as a percentage of gdp since the 1940s. The swings in and out of deficit would seem to be more a reflection of the performance of the economy (and hence tax receipts) rather than background spending decisions. There was an obvious spike in the deficit to pay for the bailouts in 2008, but the deficit had then reduced back down to <1% prior to the 2019 budget spending commitments and Covid. Whether the country can get its economy back in gear in a way that reduces that deficit is I suspect a problem for the next prime minister.surrey_commuter said:

It was the extraction of resources that drove the GDP growth.rjsterry said:

Borrowing was at roughly £1bn in 1815, 200% of gdp. By the end of the century, gdp had quadrupled, reducing the same debt to 50% of gdp. Actual debt to gdp in 1900 was about 30%, so while undoubtedly the massive transfers of wealth out of India and the rest of the empire contributed, economic growth did the lion's share of that reduction versus gdp. The other interesting graph is interest rates over the long term - while there is short term fluctuation, the trend is clearly downward. We might come unstuck at some point in the future, but I am not convinced today's politicians are any worse gamblers than their forebears.surrey_commuter said:

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

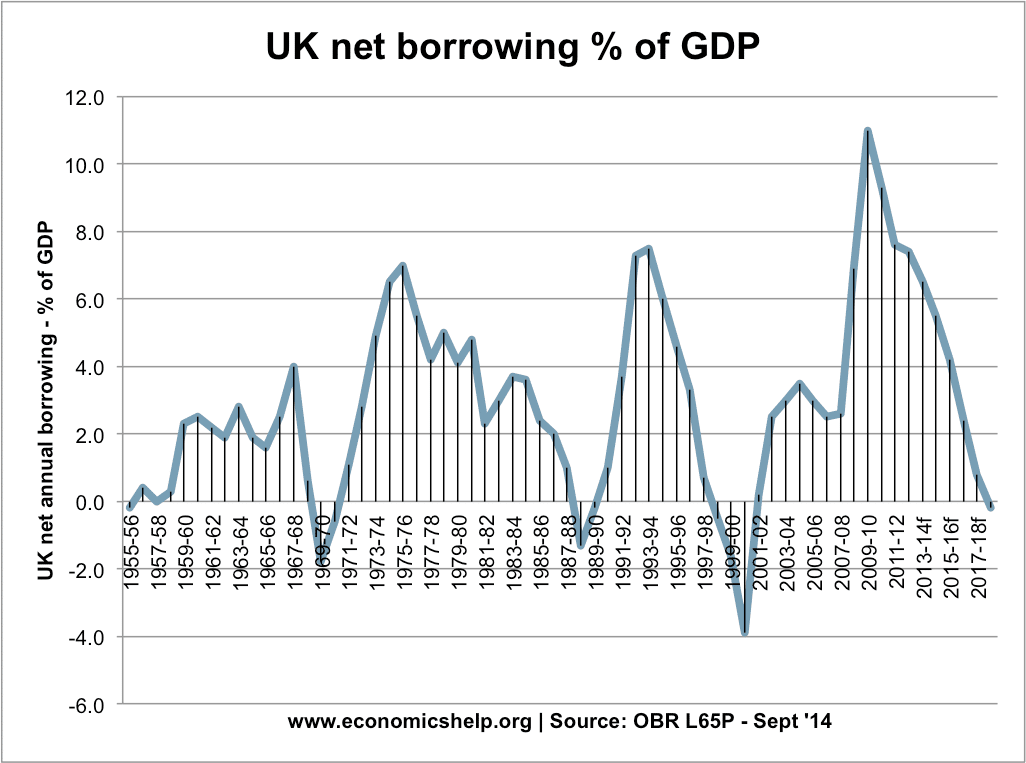

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.

In the same way our parents would have mortgaged themselves to the hilt in the 70s confident that in 5 years time their income would have doubled so making the debt insignificant. Now it would take the term of the mortgage to achieve the same income growth.

I would be amazed if politicians of yesteryear ran deficits for decade after decade as this phenomenon only started under Gordon Brown and has rapidly accelerated1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Which Tory borrowing rules? Thatcher's government ran a deficit for most of the '80s and Major only ran a surplus briefly before diving back into deficit as soon as the early' '90s recession bit. Cameron significantly reduced the deficit.surrey_commuter said:

Blair’s first term was a promise to stick to Tory borrowing rules. Look at your chart and guess when the 2nd term started.Jezyboy said:

This would suggest that Gordon can't really take the claim for the fashion of chancellors running endless deficits...

Worrying about borrowing at the moment is a little bizzare to me. It's clearly going to be bad news and I imagine that there will be more bad news incoming.

Your chart is dated 2014 so dates after that are forecasts, would be interesting to overlay that with reality1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I think we are agreeing that those were one off events after which successive Govt’s repaired the national finances right up until Blair’s second term when balancing the books was replaced by borrowing less than the rate of growth. Post GFC the deficit never fell to less than 1%, it bottomed out at 1.5% in 2018 and rose in 2019 to 2% with Boris pushing it to 3% on the grounds that the extra was all investment. In both of those years growth was 1.4%, in other words our attempt at debt reduction failed.rjsterry said:

Historically the only big spending was on military campaigns, which can generally be seen as attempts to control trade. The UK wouldn't have been able to expand its empire and extract all those resources without the initial spending on wars to establish maritime dominance. I'm pretty sure the Napoleonic wars qualify as a decade or so of budget deficit. Another example: in the 1890s the government was lobbied to expand the empire to relieve the saturated market for UK manufacturing => expansion into Africa => Boer War. There is obviously a big change with the introduction of the welfare state, but broadly spending on that has been fairly steady as a percentage of gdp since the 1940s. The swings in and out of deficit would seem to be more a reflection of the performance of the economy (and hence tax receipts) rather than background spending decisions. There was an obvious spike in the deficit to pay for the bailouts in 2008, but the deficit had then reduced back down to <1% prior to the 2019 budget spending commitments and Covid. Whether the country can get its economy back in gear in a way that reduces that deficit is I suspect a problem for the next prime minister. </p>surrey_commuter said:

It was the extraction of resources that drove the GDP growth.rjsterry said:

Borrowing was at roughly £1bn in 1815, 200% of gdp. By the end of the century, gdp had quadrupled, reducing the same debt to 50% of gdp. Actual debt to gdp in 1900 was about 30%, so while undoubtedly the massive transfers of wealth out of India and the rest of the empire contributed, economic growth did the lion's share of that reduction versus gdp. The other interesting graph is interest rates over the long term - while there is short term fluctuation, the trend is clearly downward. We might come unstuck at some point in the future, but I am not convinced today's politicians are any worse gamblers than their forebears.surrey_commuter said:

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.

In the same way our parents would have mortgaged themselves to the hilt in the 70s confident that in 5 years time their income would have doubled so making the debt insignificant. Now it would take the term of the mortgage to achieve the same income growth.

I would be amazed if politicians of yesteryear ran deficits for decade after decade as this phenomenon only started under Gordon Brown and has rapidly accelerated

Now, as I predicted, we are going into the next crisi with a leaky boat. Let’s assume this year we borrow another £200bn and make it £400bn for the year getting us to 115%. Should we pencil in £300bn next year, another £200bn the year after then £100bn the year after. I make that 145% and we need to make some hard decisions to get down from £100bn. How about putting up the basic rate of tax by 20%? Public sector salaries, pensions and benefits come to about £400bn but it seems a bit harsh to cut that 25%. So how about putting tax up 10% and cutting all salaries, pensions and benefits by 10%?

Or shake the magic money tree and come up with some new fiscal rules that make it OK.0 -

-

No, we don't agree that they are one off events. They come around fairly regularly and are often initiated by our own government. I guess we are relatively fortunate that Iraq and Afghanistan 'only' cost £29bn. Not sure on the difference in the figures you are using; I'm reading from here https://www.ukpublicspending.co.uk/uk_national_deficit_analysis , but I'm not sure they dramatically alter either of our positions. My point is that the boat is almost always leaky. It's down to how quickly the next guy can row rather than how quickly he can bail. While cuts in public spending can be life changing at an individual level, it's tinkering around the edges at a national level and the scale required to make a big difference is not politically tenable.surrey_commuter said:

I think we are agreeing that those were one off events after which successive Govt’s repaired the national finances right up until Blair’s second term when balancing the books was replaced by borrowing less than the rate of growth. Post GFC the deficit never fell to less than 1%, it bottomed out at 1.5% in 2018 and rose in 2019 to 2% with Boris pushing it to 3% on the grounds that the extra was all investment. In both of those years growth was 1.4%, in other words our attempt at debt reduction failed.rjsterry said:

Historically the only big spending was on military campaigns, which can generally be seen as attempts to control trade. The UK wouldn't have been able to expand its empire and extract all those resources without the initial spending on wars to establish maritime dominance. I'm pretty sure the Napoleonic wars qualify as a decade or so of budget deficit. Another example: in the 1890s the government was lobbied to expand the empire to relieve the saturated market for UK manufacturing => expansion into Africa => Boer War. There is obviously a big change with the introduction of the welfare state, but broadly spending on that has been fairly steady as a percentage of gdp since the 1940s. The swings in and out of deficit would seem to be more a reflection of the performance of the economy (and hence tax receipts) rather than background spending decisions. There was an obvious spike in the deficit to pay for the bailouts in 2008, but the deficit had then reduced back down to <1% prior to the 2019 budget spending commitments and Covid. Whether the country can get its economy back in gear in a way that reduces that deficit is I suspect a problem for the next prime minister. </p>surrey_commuter said:

It was the extraction of resources that drove the GDP growth.rjsterry said:

Borrowing was at roughly £1bn in 1815, 200% of gdp. By the end of the century, gdp had quadrupled, reducing the same debt to 50% of gdp. Actual debt to gdp in 1900 was about 30%, so while undoubtedly the massive transfers of wealth out of India and the rest of the empire contributed, economic growth did the lion's share of that reduction versus gdp. The other interesting graph is interest rates over the long term - while there is short term fluctuation, the trend is clearly downward. We might come unstuck at some point in the future, but I am not convinced today's politicians are any worse gamblers than their forebears.surrey_commuter said:

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.

In the same way our parents would have mortgaged themselves to the hilt in the 70s confident that in 5 years time their income would have doubled so making the debt insignificant. Now it would take the term of the mortgage to achieve the same income growth.

I would be amazed if politicians of yesteryear ran deficits for decade after decade as this phenomenon only started under Gordon Brown and has rapidly accelerated

Now, as I predicted, we are going into the next crisi with a leaky boat. Let’s assume this year we borrow another £200bn and make it £400bn for the year getting us to 115%. Should we pencil in £300bn next year, another £200bn the year after then £100bn the year after. I make that 145% and we need to make some hard decisions to get down from £100bn. How about putting up the basic rate of tax by 20%? Public sector salaries, pensions and benefits come to about £400bn but it seems a bit harsh to cut that 25%. So how about putting tax up 10% and cutting all salaries, pensions and benefits by 10%?

Or shake the magic money tree and come up with some new fiscal rules that make it OK.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I think yours is excluding debt servicing costs, try ONS.rjsterry said:

No, we don't agree that they are one off events. They come around fairly regularly and are often initiated by our own government. I guess we are relatively fortunate that Iraq and Afghanistan 'only' cost £29bn. Not sure on the difference in the figures you are using; I'm reading from here https://www.ukpublicspending.co.uk/uk_national_deficit_analysis , but I'm not sure they dramatically alter either of our positions. My point is that the boat is almost always leaky. It's down to how quickly the next guy can row rather than how quickly he can bail. While cuts in public spending can be life changing at an individual level, it's tinkering around the edges at a national level and the scale required to make a big difference is not politically tenable.surrey_commuter said:

I think we are agreeing that those were one off events after which successive Govt’s repaired the national finances right up until Blair’s second term when balancing the books was replaced by borrowing less than the rate of growth. Post GFC the deficit never fell to less than 1%, it bottomed out at 1.5% in 2018 and rose in 2019 to 2% with Boris pushing it to 3% on the grounds that the extra was all investment. In both of those years growth was 1.4%, in other words our attempt at debt reduction failed.rjsterry said:

Historically the only big spending was on military campaigns, which can generally be seen as attempts to control trade. The UK wouldn't have been able to expand its empire and extract all those resources without the initial spending on wars to establish maritime dominance. I'm pretty sure the Napoleonic wars qualify as a decade or so of budget deficit. Another example: in the 1890s the government was lobbied to expand the empire to relieve the saturated market for UK manufacturing => expansion into Africa => Boer War. There is obviously a big change with the introduction of the welfare state, but broadly spending on that has been fairly steady as a percentage of gdp since the 1940s. The swings in and out of deficit would seem to be more a reflection of the performance of the economy (and hence tax receipts) rather than background spending decisions. There was an obvious spike in the deficit to pay for the bailouts in 2008, but the deficit had then reduced back down to <1% prior to the 2019 budget spending commitments and Covid. Whether the country can get its economy back in gear in a way that reduces that deficit is I suspect a problem for the next prime minister. </p>surrey_commuter said:

It was the extraction of resources that drove the GDP growth.rjsterry said:

Borrowing was at roughly £1bn in 1815, 200% of gdp. By the end of the century, gdp had quadrupled, reducing the same debt to 50% of gdp. Actual debt to gdp in 1900 was about 30%, so while undoubtedly the massive transfers of wealth out of India and the rest of the empire contributed, economic growth did the lion's share of that reduction versus gdp. The other interesting graph is interest rates over the long term - while there is short term fluctuation, the trend is clearly downward. We might come unstuck at some point in the future, but I am not convinced today's politicians are any worse gamblers than their forebears.surrey_commuter said:

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.

In the same way our parents would have mortgaged themselves to the hilt in the 70s confident that in 5 years time their income would have doubled so making the debt insignificant. Now it would take the term of the mortgage to achieve the same income growth.

I would be amazed if politicians of yesteryear ran deficits for decade after decade as this phenomenon only started under Gordon Brown and has rapidly accelerated

Now, as I predicted, we are going into the next crisi with a leaky boat. Let’s assume this year we borrow another £200bn and make it £400bn for the year getting us to 115%. Should we pencil in £300bn next year, another £200bn the year after then £100bn the year after. I make that 145% and we need to make some hard decisions to get down from £100bn. How about putting up the basic rate of tax by 20%? Public sector salaries, pensions and benefits come to about £400bn but it seems a bit harsh to cut that 25%. So how about putting tax up 10% and cutting all salaries, pensions and benefits by 10%?

Or shake the magic money tree and come up with some new fiscal rules that make it OK.

Not sure how you not count 3 events over 150 years as one off events. The chart also shows that we were reducing the debt.

Politicians like living beyond their means as it helps them get re-elected. Large scale cuts will be enforced by the markets.0 -

-

They're not one-off events if they happen every ~50 years at that scale and more frequently at a smaller scale. Yes politicians will often find a way to buy more votes, but slashing spending alone is not what got us out of those large deficits.surrey_commuter said:

I think yours is excluding debt servicing costs, try ONS.rjsterry said:

No, we don't agree that they are one off events. They come around fairly regularly and are often initiated by our own government. I guess we are relatively fortunate that Iraq and Afghanistan 'only' cost £29bn. Not sure on the difference in the figures you are using; I'm reading from here https://www.ukpublicspending.co.uk/uk_national_deficit_analysis , but I'm not sure they dramatically alter either of our positions. My point is that the boat is almost always leaky. It's down to how quickly the next guy can row rather than how quickly he can bail. While cuts in public spending can be life changing at an individual level, it's tinkering around the edges at a national level and the scale required to make a big difference is not politically tenable.surrey_commuter said:

I think we are agreeing that those were one off events after which successive Govt’s repaired the national finances right up until Blair’s second term when balancing the books was replaced by borrowing less than the rate of growth. Post GFC the deficit never fell to less than 1%, it bottomed out at 1.5% in 2018 and rose in 2019 to 2% with Boris pushing it to 3% on the grounds that the extra was all investment. In both of those years growth was 1.4%, in other words our attempt at debt reduction failed.rjsterry said:

Historically the only big spending was on military campaigns, which can generally be seen as attempts to control trade. The UK wouldn't have been able to expand its empire and extract all those resources without the initial spending on wars to establish maritime dominance. I'm pretty sure the Napoleonic wars qualify as a decade or so of budget deficit. Another example: in the 1890s the government was lobbied to expand the empire to relieve the saturated market for UK manufacturing => expansion into Africa => Boer War. There is obviously a big change with the introduction of the welfare state, but broadly spending on that has been fairly steady as a percentage of gdp since the 1940s. The swings in and out of deficit would seem to be more a reflection of the performance of the economy (and hence tax receipts) rather than background spending decisions. There was an obvious spike in the deficit to pay for the bailouts in 2008, but the deficit had then reduced back down to <1% prior to the 2019 budget spending commitments and Covid. Whether the country can get its economy back in gear in a way that reduces that deficit is I suspect a problem for the next prime minister. </p>surrey_commuter said:

It was the extraction of resources that drove the GDP growth.rjsterry said:

Borrowing was at roughly £1bn in 1815, 200% of gdp. By the end of the century, gdp had quadrupled, reducing the same debt to 50% of gdp. Actual debt to gdp in 1900 was about 30%, so while undoubtedly the massive transfers of wealth out of India and the rest of the empire contributed, economic growth did the lion's share of that reduction versus gdp. The other interesting graph is interest rates over the long term - while there is short term fluctuation, the trend is clearly downward. We might come unstuck at some point in the future, but I am not convinced today's politicians are any worse gamblers than their forebears.surrey_commuter said:

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.

In the same way our parents would have mortgaged themselves to the hilt in the 70s confident that in 5 years time their income would have doubled so making the debt insignificant. Now it would take the term of the mortgage to achieve the same income growth.

I would be amazed if politicians of yesteryear ran deficits for decade after decade as this phenomenon only started under Gordon Brown and has rapidly accelerated

Now, as I predicted, we are going into the next crisi with a leaky boat. Let’s assume this year we borrow another £200bn and make it £400bn for the year getting us to 115%. Should we pencil in £300bn next year, another £200bn the year after then £100bn the year after. I make that 145% and we need to make some hard decisions to get down from £100bn. How about putting up the basic rate of tax by 20%? Public sector salaries, pensions and benefits come to about £400bn but it seems a bit harsh to cut that 25%. So how about putting tax up 10% and cutting all salaries, pensions and benefits by 10%?

Or shake the magic money tree and come up with some new fiscal rules that make it OK.

Not sure how you not count 3 events over 150 years as one off events. The chart also shows that we were reducing the debt.

Politicians like living beyond their means as it helps them get re-elected. Large scale cuts will be enforced by the markets.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Yep they did not spend as much as possible. My belief is that the current crop will keep spending as much as possible until forced to stop. My guess is that will look like a £100bn adjustment, I also don’t believe that it is possible to significantly increase tax revenues which leaves you a Greek style cuts in public expenditure.rjsterry said:

They're not one-off events if they happen every ~50 years at that scale and more frequently at a smaller scale. Yes politicians will often find a way to buy more votes, but slashing spending alone is not what got us out of those large deficits.surrey_commuter said:

I think yours is excluding debt servicing costs, try ONS.rjsterry said:

No, we don't agree that they are one off events. They come around fairly regularly and are often initiated by our own government. I guess we are relatively fortunate that Iraq and Afghanistan 'only' cost £29bn. Not sure on the difference in the figures you are using; I'm reading from here https://www.ukpublicspending.co.uk/uk_national_deficit_analysis , but I'm not sure they dramatically alter either of our positions. My point is that the boat is almost always leaky. It's down to how quickly the next guy can row rather than how quickly he can bail. While cuts in public spending can be life changing at an individual level, it's tinkering around the edges at a national level and the scale required to make a big difference is not politically tenable.surrey_commuter said:

I think we are agreeing that those were one off events after which successive Govt’s repaired the national finances right up until Blair’s second term when balancing the books was replaced by borrowing less than the rate of growth. Post GFC the deficit never fell to less than 1%, it bottomed out at 1.5% in 2018 and rose in 2019 to 2% with Boris pushing it to 3% on the grounds that the extra was all investment. In both of those years growth was 1.4%, in other words our attempt at debt reduction failed.rjsterry said:

Historically the only big spending was on military campaigns, which can generally be seen as attempts to control trade. The UK wouldn't have been able to expand its empire and extract all those resources without the initial spending on wars to establish maritime dominance. I'm pretty sure the Napoleonic wars qualify as a decade or so of budget deficit. Another example: in the 1890s the government was lobbied to expand the empire to relieve the saturated market for UK manufacturing => expansion into Africa => Boer War. There is obviously a big change with the introduction of the welfare state, but broadly spending on that has been fairly steady as a percentage of gdp since the 1940s. The swings in and out of deficit would seem to be more a reflection of the performance of the economy (and hence tax receipts) rather than background spending decisions. There was an obvious spike in the deficit to pay for the bailouts in 2008, but the deficit had then reduced back down to <1% prior to the 2019 budget spending commitments and Covid. Whether the country can get its economy back in gear in a way that reduces that deficit is I suspect a problem for the next prime minister. </p>surrey_commuter said:

It was the extraction of resources that drove the GDP growth.rjsterry said:

Borrowing was at roughly £1bn in 1815, 200% of gdp. By the end of the century, gdp had quadrupled, reducing the same debt to 50% of gdp. Actual debt to gdp in 1900 was about 30%, so while undoubtedly the massive transfers of wealth out of India and the rest of the empire contributed, economic growth did the lion's share of that reduction versus gdp. The other interesting graph is interest rates over the long term - while there is short term fluctuation, the trend is clearly downward. We might come unstuck at some point in the future, but I am not convinced today's politicians are any worse gamblers than their forebears.surrey_commuter said:

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.

In the same way our parents would have mortgaged themselves to the hilt in the 70s confident that in 5 years time their income would have doubled so making the debt insignificant. Now it would take the term of the mortgage to achieve the same income growth.

I would be amazed if politicians of yesteryear ran deficits for decade after decade as this phenomenon only started under Gordon Brown and has rapidly accelerated

Now, as I predicted, we are going into the next crisi with a leaky boat. Let’s assume this year we borrow another £200bn and make it £400bn for the year getting us to 115%. Should we pencil in £300bn next year, another £200bn the year after then £100bn the year after. I make that 145% and we need to make some hard decisions to get down from £100bn. How about putting up the basic rate of tax by 20%? Public sector salaries, pensions and benefits come to about £400bn but it seems a bit harsh to cut that 25%. So how about putting tax up 10% and cutting all salaries, pensions and benefits by 10%?

Or shake the magic money tree and come up with some new fiscal rules that make it OK.

Not sure how you not count 3 events over 150 years as one off events. The chart also shows that we were reducing the debt.

Politicians like living beyond their means as it helps them get re-elected. Large scale cuts will be enforced by the markets.

The good news is that it is highly unlikely to be until after the next crisis.0 -

-

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative0 -

I don't see the problem. Both tweets highlight problems at both 'ends' of the tax debate. What this illustrates is you can't use the tax system alone to 'fix' social inequalities. I'd also add that completely removing large sections of the population from paying taxes also sends the message that contributing to society is something other people do, and sets up a divide. You can already see that and the attitudes it breeds in the North/South and England/Scotland divides.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I used to be a big fan of taking people out of income tax as it seemed pointless taking with one hand and giving back with another but increasingly I see it as causing problems.rjsterry said:

I don't see the problem. Both tweets highlight problems at both 'ends' of the tax debate. What this illustrates is you can't use the tax system alone to 'fix' social inequalities. I'd also add that completely removing large sections of the population from paying taxes also sends the message that contributing to society is something other people do, and sets up a divide. You can already see that and the attitudes it breeds in the North/South and England/Scotland divides.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

All this Northern stuff and C19 just seems to be an excuse to get the begging bowl out.0 -

If you split the country into those who pay tax and those who receive benefits then you are storing up trouble, grievance and entrenching inequality rather than alleviating it. You are also effectively subsidising employers.surrey_commuter said:

I used to be a big fan of taking people out of income tax as it seemed pointless taking with one hand and giving back with another but increasingly I see it as causing problems.rjsterry said:

I don't see the problem. Both tweets highlight problems at both 'ends' of the tax debate. What this illustrates is you can't use the tax system alone to 'fix' social inequalities. I'd also add that completely removing large sections of the population from paying taxes also sends the message that contributing to society is something other people do, and sets up a divide. You can already see that and the attitudes it breeds in the North/South and England/Scotland divides.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

All this Northern stuff and C19 just seems to be an excuse to get the begging bowl out.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

As I think I've said before it seems unreasonable to blame 'poor' parts of the country wanting additional support in the present day when they are generally the areas that were exploited to build the nations wealth during the industrial revolution (and oil boom in Scotland's case).surrey_commuter said:

I used to be a big fan of taking people out of income tax as it seemed pointless taking with one hand and giving back with another but increasingly I see it as causing problems.rjsterry said:

I don't see the problem. Both tweets highlight problems at both 'ends' of the tax debate. What this illustrates is you can't use the tax system alone to 'fix' social inequalities. I'd also add that completely removing large sections of the population from paying taxes also sends the message that contributing to society is something other people do, and sets up a divide. You can already see that and the attitudes it breeds in the North/South and England/Scotland divides.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

All this Northern stuff and C19 just seems to be an excuse to get the begging bowl out.0 -

You might say 'exploited: others might say 'invested in'.Pross said:

As I think I've said before it seems unreasonable to blame 'poor' parts of the country wanting additional support in the present day when they are generally the areas that were exploited to build the nations wealth during the industrial revolution (and oil boom in Scotland's case).surrey_commuter said:

I used to be a big fan of taking people out of income tax as it seemed pointless taking with one hand and giving back with another but increasingly I see it as causing problems.rjsterry said:

I don't see the problem. Both tweets highlight problems at both 'ends' of the tax debate. What this illustrates is you can't use the tax system alone to 'fix' social inequalities. I'd also add that completely removing large sections of the population from paying taxes also sends the message that contributing to society is something other people do, and sets up a divide. You can already see that and the attitudes it breeds in the North/South and England/Scotland divides.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

All this Northern stuff and C19 just seems to be an excuse to get the begging bowl out."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

They're hardly mutually exclusive.Stevo_666 said:

You might say 'exploited: others might say 'invested in'.Pross said:

As I think I've said before it seems unreasonable to blame 'poor' parts of the country wanting additional support in the present day when they are generally the areas that were exploited to build the nations wealth during the industrial revolution (and oil boom in Scotland's case).surrey_commuter said:

I used to be a big fan of taking people out of income tax as it seemed pointless taking with one hand and giving back with another but increasingly I see it as causing problems.rjsterry said:

I don't see the problem. Both tweets highlight problems at both 'ends' of the tax debate. What this illustrates is you can't use the tax system alone to 'fix' social inequalities. I'd also add that completely removing large sections of the population from paying taxes also sends the message that contributing to society is something other people do, and sets up a divide. You can already see that and the attitudes it breeds in the North/South and England/Scotland divides.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

All this Northern stuff and C19 just seems to be an excuse to get the begging bowl out.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution0 -

If you prefer no investment...rjsterry said:

They're hardly mutually exclusive.Stevo_666 said:

You might say 'exploited: others might say 'invested in'.Pross said:

As I think I've said before it seems unreasonable to blame 'poor' parts of the country wanting additional support in the present day when they are generally the areas that were exploited to build the nations wealth during the industrial revolution (and oil boom in Scotland's case).surrey_commuter said:

I used to be a big fan of taking people out of income tax as it seemed pointless taking with one hand and giving back with another but increasingly I see it as causing problems.rjsterry said:

I don't see the problem. Both tweets highlight problems at both 'ends' of the tax debate. What this illustrates is you can't use the tax system alone to 'fix' social inequalities. I'd also add that completely removing large sections of the population from paying taxes also sends the message that contributing to society is something other people do, and sets up a divide. You can already see that and the attitudes it breeds in the North/South and England/Scotland divides.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

All this Northern stuff and C19 just seems to be an excuse to get the begging bowl out."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

That’s not the jist. I just remembered you used the “wealthy pay more tax” argument in the past.Stevo_666 said:

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax.0 -

So what is it then, in your view?rick_chasey said:

That’s not the jist. I just remembered you used the “wealthy pay more tax” argument in the past.Stevo_666 said:

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

FWIW, I'm not convinced by the argument. Other areas also had plenty of heavy industry but had less of a monoculture and so have coped with the decline of, say, coal mining, much better. Some assistance in adapting from one predominant industry to another (or better others) is one thing, but just accepting that one area will indefinitely subsidise another as some sort of payback for hosting the industrial revolution is what leads to the problems mentioned above.Stevo_666 said:

If you prefer no investment...rjsterry said:

They're hardly mutually exclusive.Stevo_666 said:

You might say 'exploited: others might say 'invested in'.Pross said:

As I think I've said before it seems unreasonable to blame 'poor' parts of the country wanting additional support in the present day when they are generally the areas that were exploited to build the nations wealth during the industrial revolution (and oil boom in Scotland's case).surrey_commuter said:

I used to be a big fan of taking people out of income tax as it seemed pointless taking with one hand and giving back with another but increasingly I see it as causing problems.rjsterry said:

I don't see the problem. Both tweets highlight problems at both 'ends' of the tax debate. What this illustrates is you can't use the tax system alone to 'fix' social inequalities. I'd also add that completely removing large sections of the population from paying taxes also sends the message that contributing to society is something other people do, and sets up a divide. You can already see that and the attitudes it breeds in the North/South and England/Scotland divides.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

All this Northern stuff and C19 just seems to be an excuse to get the begging bowl out.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

How can than not be true?rick_chasey said:

That’s not the jist. I just remembered you used the “wealthy pay more tax” argument in the past.Stevo_666 said:

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax.

It is strange to use a measure of % of total tax. I think nobody should pay more than 20% tax but that could still mean that the top 10% pay 100% of income tax.0 -

It is certainly factually correct but it is never enough for people like Rick. (Well, maybe until he starts earning a decent whack and gets shafted).surrey_commuter said:

How can than not be true?rick_chasey said:

That’s not the jist. I just remembered you used the “wealthy pay more tax” argument in the past.Stevo_666 said:

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Why how much do you think I earn? 🤨Stevo_666 said:

It is certainly factually correct but it is never enough for people like Rick. (Well, maybe until he starts earning a decent whack and gets shafted).surrey_commuter said:

How can than not be true?rick_chasey said:

That’s not the jist. I just remembered you used the “wealthy pay more tax” argument in the past.Stevo_666 said:

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax.0 -

Not enough to start seeing the impact of what happens at the higher end of the pay scales. There are a few thresholds on the way up where people start to notice the difference.rick_chasey said:

Why how much do you think I earn? 🤨Stevo_666 said:

It is certainly factually correct but it is never enough for people like Rick. (Well, maybe until he starts earning a decent whack and gets shafted).surrey_commuter said:

How can than not be true?rick_chasey said:

That’s not the jist. I just remembered you used the “wealthy pay more tax” argument in the past.Stevo_666 said:

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax.

Also, you haven't explained what you think the Twitter bloke meant..."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

What would you consider to be the start of the higher end of the pay scales?Stevo_666 said:

Not enough to start seeing the impact of what happens at the higher end of the pay scales. There are a few thresholds on the way up where people start to notice the difference.rick_chasey said:

Why how much do you think I earn? 🤨Stevo_666 said:

It is certainly factually correct but it is never enough for people like Rick. (Well, maybe until he starts earning a decent whack and gets shafted).surrey_commuter said:

How can than not be true?rick_chasey said:

That’s not the jist. I just remembered you used the “wealthy pay more tax” argument in the past.Stevo_666 said:

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax.

Also, you haven't explained what you think the Twitter bloke meant...0 -

Presumably the noticeable steps are losing child benefit at £50k, losing personal allowance at £100k and losing pension benefits at £150k, by £210k they have all gone, so maybe £210k is start of the high end.kingstongraham said:

What would you consider to be the start of the higher end of the pay scales?Stevo_666 said:

Not enough to start seeing the impact of what happens at the higher end of the pay scales. There are a few thresholds on the way up where people start to notice the difference.rick_chasey said:

Why how much do you think I earn? 🤨Stevo_666 said:

It is certainly factually correct but it is never enough for people like Rick. (Well, maybe until he starts earning a decent whack and gets shafted).surrey_commuter said:

How can than not be true?rick_chasey said:

That’s not the jist. I just remembered you used the “wealthy pay more tax” argument in the past.Stevo_666 said:

It's a statement of the bleeding obvious. The jist seems to be 'but they're not paying enough' given that you posted it.rick_chasey said:

What do you think the guy is saying?Stevo_666 said:

Based on that tweet I can only assume that the author is not a tax professional.surrey_commuter said:

This is what I don’t get about Twitter, so tell me if I am wrongrick_chasey said:

Prageru tweets to say that income taxes are fairer than sales tax

Gabriel Zucman replies using words that imply he is disagreeing whilst posting up one supportive stat and one irrelevant one

Your comment on it is “quite” which if I did not know your opinions would be meaningless.

I think I have just explained it to myself. Quoting individual tweets is meaningless as they are part of an ongoing narrative

It’s a comment on wealth distribution

That said, Twatter is a poor medium for complex area like tax.

Also, you haven't explained what you think the Twitter bloke meant...0