LEAVE the Conservative Party and save your country!

Comments

-

The notion that government debt does not influence other areas is quite a big one.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Servicing costs are currently falling as the cost of refinancing existing debt is lower, think of it as re-mortgaging at a lower rate. Of course when you you remortgage they will stress test your ability to pay at higher interest rates. Rick’s (and mainstream economic argument) is that you don’ t need to worry about higher rates.pblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

Rick - can you confirm why we should not worry about higher rates0 -

pblakeney said:

We are already in a financial crisis, only borrowing is keeping it behind a veil.surrey_commuter said:

My prediction is ten years from now in the aftermath of the next financial crisis.kingstongraham said:There's a huge risk in not spending money to keep things afloat.

We are going to be increasing that deficit for quite a while, or let the veil slip and wake up to how bad it is.

I agree that borrowing is required just now to keep afloat but we started with a leaky boat and they don't resolve themselves.

I take your point but for me the financial crisis brought on by excessive debt will be the one after and will be brutal - think Greek levels of spending cuts.

If you know any (seriously) rich Greeks they are totally untouched by it.0 -

Fair point, I suppose we shouldn't complain if it's people like Rick who end up picking up the tab rather than uspblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

There will be breaking point somewhere, as clearly it cannot go on indefinitely. People need to think longer term here."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

It's all a little academic at the moment. Regardless of of the rosette, our and every other government is already borrowing in quantities that mean it will still be being paid off well into our grandchildren's working lives or beyond. The decisions have already been taken. I don't see why this is really any different to me paying off WW2 loans or the abolition of slavery. The best any of us can hope for is that the amount blown on non-existent PPE supplies and the like is kept to a minimum.Stevo_666 said:

Fair point, I suppose we shouldn't complain if it's people like Rick who end up picking up the tab rather than uspblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

There will be breaking point somewhere, as clearly it cannot go on indefinitely. People need to think longer term here.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

40 year unlinked bonds are going for well under inflation... why does anyone here know more then the market participants?surrey_commuter said:

Servicing costs are currently falling as the cost of refinancing existing debt is lower, think of it as re-mortgaging at a lower rate. Of course when you you remortgage they will stress test your ability to pay at higher interest rates. Rick’s (and mainstream economic argument) is that you don’ t need to worry about higher rates.pblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

Rick - can you confirm why we should not worry about higher rates

And Stevo - its about the cost of debt servicing vs cost of not propping up economy in downturn.

As per my previous post0 -

As I am sure you know most debt is not dates anywhere near that long. There is demand because of pension liabilities.rick_chasey said:

40 year unlinked bonds are going for well under inflation... why does anyone here know more then the market participants?surrey_commuter said:

Servicing costs are currently falling as the cost of refinancing existing debt is lower, think of it as re-mortgaging at a lower rate. Of course when you you remortgage they will stress test your ability to pay at higher interest rates. Rick’s (and mainstream economic argument) is that you don’ t need to worry about higher rates.pblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

Rick - can you confirm why we should not worry about higher rates

And Stevo - its about the cost of debt servicing vs cost of not propping up economy in downturn.

As per my previous post

You will never persuade me it is not a colossal annual gamble with only one eventual outcome.1 -

Do you know the average loan life of all UK gilts? I can't find it by googling and I don't have the energy to work it out myself.surrey_commuter said:

As I am sure you know most debt is not dates anywhere near that long. There is demand because of pension liabilities.rick_chasey said:

40 year unlinked bonds are going for well under inflation... why does anyone here know more then the market participants?surrey_commuter said:

Servicing costs are currently falling as the cost of refinancing existing debt is lower, think of it as re-mortgaging at a lower rate. Of course when you you remortgage they will stress test your ability to pay at higher interest rates. Rick’s (and mainstream economic argument) is that you don’ t need to worry about higher rates.pblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

Rick - can you confirm why we should not worry about higher rates

And Stevo - its about the cost of debt servicing vs cost of not propping up economy in downturn.

As per my previous post

You will never persuade me it is not a colossal annual gamble with only one eventual outcome.0 -

Longer than most countries but the markets beyond 10 years are not that deep. I only know this because that is why we use the yield curve on 10 year gilts.TheBigBean said:

Do you know the average loan life of all UK gilts? I can't find it by googling and I don't have the energy to work it out myself.surrey_commuter said:

As I am sure you know most debt is not dates anywhere near that long. There is demand because of pension liabilities.rick_chasey said:

40 year unlinked bonds are going for well under inflation... why does anyone here know more then the market participants?surrey_commuter said:

Servicing costs are currently falling as the cost of refinancing existing debt is lower, think of it as re-mortgaging at a lower rate. Of course when you you remortgage they will stress test your ability to pay at higher interest rates. Rick’s (and mainstream economic argument) is that you don’ t need to worry about higher rates.pblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

Rick - can you confirm why we should not worry about higher rates

And Stevo - its about the cost of debt servicing vs cost of not propping up economy in downturn.

As per my previous post

You will never persuade me it is not a colossal annual gamble with only one eventual outcome.

Pension funds would happily buy longer dated gilts to match their liabilities. There must be a reason why they are not issued in greater numbers - possibly the premium required?

Edited to add redemptions average £70-80bn per annum0 -

According to you - some of us have other views.rick_chasey said:

40 year unlinked bonds are going for well under inflation... why does anyone here know more then the market participants?surrey_commuter said:

Servicing costs are currently falling as the cost of refinancing existing debt is lower, think of it as re-mortgaging at a lower rate. Of course when you you remortgage they will stress test your ability to pay at higher interest rates. Rick’s (and mainstream economic argument) is that you don’ t need to worry about higher rates.pblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

Rick - can you confirm why we should not worry about higher rates

And Stevo - its about the cost of debt servicing vs cost of not propping up economy in downturn.

As per my previous post

See my posts above. It cannot continue indefinitely - if you thinkmit can you are wrong - it is simply another one your Ponzi schemes like the ever increasing population idea."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

You can't change the past but why repeat this into the future when the eventual and logical outcome is known? Unless you are being short termist or short sighted as Rick appears to be on this issue.rjsterry said:

It's all a little academic at the moment. Regardless of of the rosette, our and every other government is already borrowing in quantities that mean it will still be being paid off well into our grandchildren's working lives or beyond. The decisions have already been taken. I don't see why this is really any different to me paying off WW2 loans or the abolition of slavery. The best any of us can hope for is that the amount blown on non-existent PPE supplies and the like is kept to a minimum.Stevo_666 said:

Fair point, I suppose we shouldn't complain if it's people like Rick who end up picking up the tab rather than uspblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

There will be breaking point somewhere, as clearly it cannot go on indefinitely. People need to think longer term here."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

It's not a question of whether you or I think it's a good or bad idea, the borrowing commitments stretching into the future are already there. We are not remotely done with Covid or Brexit fallout, so that's the most likely reason for further borrowing, whether it's direct health spending, customs infrastructure, some extended form of job support or a massive increase in unemployment benefit payments. Then of course there is HS2, the tunnel under Stonehenge and + all the other road building; the 'levelling up'; all state aid we are going to give those tech startups. All of it decades-long commitments, so a bit late to be fretting about how long all this extra borrowing is going to last. And most of this was in the 2019 manifesto. I know you keep saying what was the alternative, but if you are that averse to long term borrowing why on earth did you vote for them?Stevo_666 said:

You can't change the past but why repeat this into the future when the eventual and logical outcome is known? Unless you are being short termist or short sighted as Rick appears to be on this issue.rjsterry said:

It's all a little academic at the moment. Regardless of of the rosette, our and every other government is already borrowing in quantities that mean it will still be being paid off well into our grandchildren's working lives or beyond. The decisions have already been taken. I don't see why this is really any different to me paying off WW2 loans or the abolition of slavery. The best any of us can hope for is that the amount blown on non-existent PPE supplies and the like is kept to a minimum.Stevo_666 said:

Fair point, I suppose we shouldn't complain if it's people like Rick who end up picking up the tab rather than uspblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

There will be breaking point somewhere, as clearly it cannot go on indefinitely. People need to think longer term here.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Thing is - the govt will end up paying the money anyway via the dole and associated problems.

The calculation is obviously predicated on furlough etc being time limited and the longer it goes the less sustainable it becomes - but the idea that it feels too much isn’t helpful - it’s about what the numbers are saying and what else the govt can do to reduce the need for lockdowns - like test & trace etc0 -

I think the deets are available in excel form on the treasury site but you’ll have to do the calcs yourselfTheBigBean said:

Do you know the average loan life of all UK gilts? I can't find it by googling and I don't have the energy to work it out myself.surrey_commuter said:

As I am sure you know most debt is not dates anywhere near that long. There is demand because of pension liabilities.rick_chasey said:

40 year unlinked bonds are going for well under inflation... why does anyone here know more then the market participants?surrey_commuter said:

Servicing costs are currently falling as the cost of refinancing existing debt is lower, think of it as re-mortgaging at a lower rate. Of course when you you remortgage they will stress test your ability to pay at higher interest rates. Rick’s (and mainstream economic argument) is that you don’ t need to worry about higher rates.pblakeney said:

But the deficit is rising, so the cost of servicing it is rising.rick_chasey said:

permanent deficit is ok if the cost of servicing isn't rising, right?surrey_commuter said:kingstongraham said:There's a huge risk in not spending money to keep things afloat.

Strangely that is the one thing we are all agreed on. My argument is that we now live in a world of permanent budget deficits which means we start each crisis in an increasingly worse position.

In less than 20 years we have gone from Govt’s balancing the books over the lifetime of a Parliament to a position this Feb where after a decade of deficits Boris set out plans to borrow £60bn.

Maybe we should have a poll on what year we all think annual borrowing will fall below £100bn.

My prediction is ten years from now in the aftermath of the next financial crisis.

I would moderate off the back of that, not some arbitrary feeling that the deficit is "big" or not because the numbers seem large.

There will be a breaking point somewhere. Didn't you used to complain about passing the problems of today onto the young and future generations?

Rick - can you confirm why we should not worry about higher rates

And Stevo - its about the cost of debt servicing vs cost of not propping up economy in downturn.

As per my previous post

You will never persuade me it is not a colossal annual gamble with only one eventual outcome.0 -

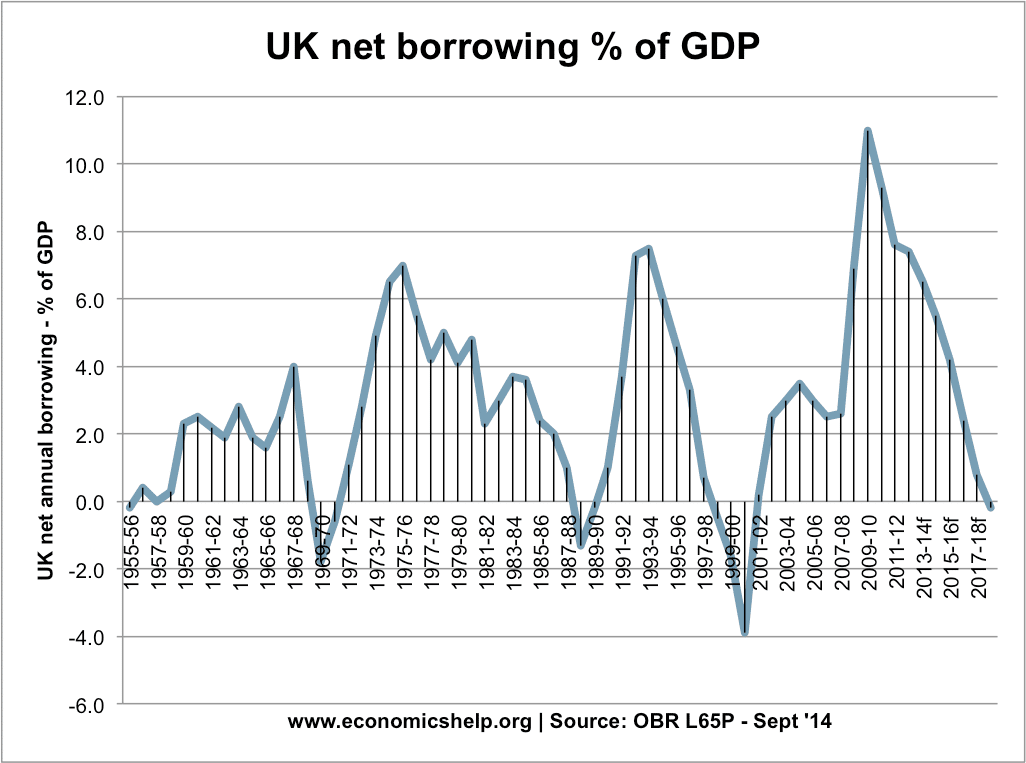

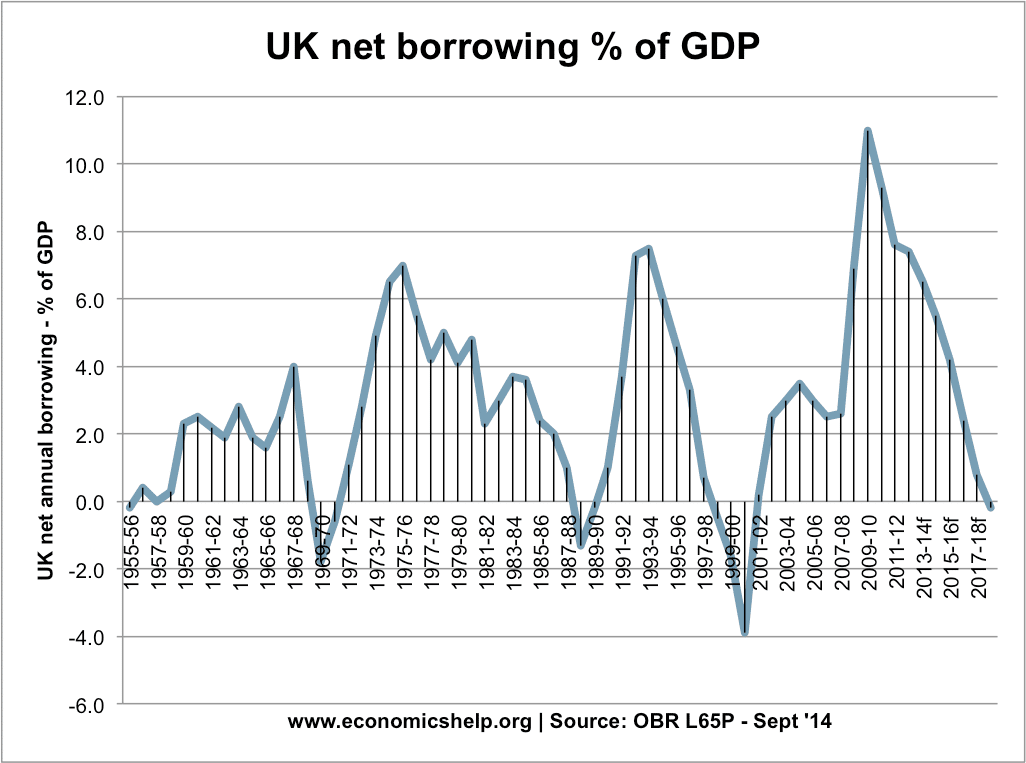

And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Total debt is now at level last seen in 1960 when growth was 6%. Anybody confident that we will be able to match that?rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

And that graph is wrong as it claims FY 2020 and has debt well below 100%.

Now roll forwards to 2024 and that graph will be at 150% and right up there is the top 10 debt highs with two world wars.0 -

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?0 -

Why does that matter?surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

2% compound growth on £2tr soon makes that an irrelevance0 -

-

I guess it distracts from the ideological hill of not extending free school meals for kids in families in poverty to out of school during rona.

Tories could always enact policies to improve the chances of the poorest to make it themselves to begin with, but that aside it’s a big stand for less than a rounding error in cost0 -

-

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. I'd also argue that the apparent reduction in borrowing during the latter 19th century is actually the massive expansion of the UK economy during that period.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

2% growth may have been possible pre-Brexit but now is a distant dream.rick_chasey said:

Why does that matter?surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

2% compound growth on £2tr soon makes that an irrelevance

£100bn is 5% of GDP so not sure why that makes it an irrelevance0 -

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.0 -

fairly obvious it is to enrage the libsrick_chasey said:You do wonder what the priorities are

0

0 -

Borrowing was at roughly £1bn in 1815, 200% of gdp. By the end of the century, gdp had quadrupled, reducing the same debt to 50% of gdp. Actual debt to gdp in 1900 was about 30%, so while undoubtedly the massive transfers of wealth out of India and the rest of the empire contributed, economic growth did the lion's share of that reduction versus gdp. The other interesting graph is interest rates over the long term - while there is short term fluctuation, the trend is clearly downward. We might come unstuck at some point in the future, but I am not convinced today's politicians are any worse gamblers than their forebears.surrey_commuter said:

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

It was the extraction of resources that drove the GDP growth.rjsterry said:

Borrowing was at roughly £1bn in 1815, 200% of gdp. By the end of the century, gdp had quadrupled, reducing the same debt to 50% of gdp. Actual debt to gdp in 1900 was about 30%, so while undoubtedly the massive transfers of wealth out of India and the rest of the empire contributed, economic growth did the lion's share of that reduction versus gdp. The other interesting graph is interest rates over the long term - while there is short term fluctuation, the trend is clearly downward. We might come unstuck at some point in the future, but I am not convinced today's politicians are any worse gamblers than their forebears.surrey_commuter said:

I suspect the pre 1900 debt was paid back by the empire.rjsterry said:

All that pre-1900 borrowing was the cost of building an empire. Post-1900, it's the cost of attempting to defend it and then dismantling it, plus the establishment of the welfare state. Notwithstanding that Johnson is a conservative in name only (I saw an article comparing him to Castro the other day), I think you have a very rose-tinted view of our previous politicians. I suspect that the lenders had far more of an impact on when and how quickly the debt was repaid than whichever bunch were in power at the time. I think if we had already been that indebted at the start of WWI, history would have run a very different course. Bluntly we would not have put up much of a fight.surrey_commuter said:

I am becoming fixated by this graph and your OMG unprecedented comment.rjsterry said:And for the OMG-this-is-unprecedented crowd.

Turns out building an empire requires lots of borrowing, mostly paid off by asset stripping that empire.

The precedents on that graph are the Napoleonic wars followed by a century of debt reduction before two world wars and half a century of deficit reduction. Now we are inexorably heading towards 150% due to our politicians being self serving cvnts.

My argument is if had the same calibre of politicians in the 1800s then we would have gone into WW1 at 200% debt and come out of WW2 with 600%.

I asked a question further up that went unanswered.

When do you think we will next see a deficit under £100bn?

Looking at that graph (yes, of course it is missing most of 2020) I would guess that it will take between 50 and 150 years to pay off current borrowing. As for when we'll reduce our borrowing: when the lenders stop offering to extend.

Biggest (arguably only) leader is the BofE and I agree that borrowing will not be curtailed until the lenders demand it. Where we differ is that I believe that by then we will be fvcked as debt servicing costs will spiral out of control and we will see savage spending cuts to fund the £100bn+ costs.

In the same way our parents would have mortgaged themselves to the hilt in the 70s confident that in 5 years time their income would have doubled so making the debt insignificant. Now it would take the term of the mortgage to achieve the same income growth.

I would be amazed if politicians of yesteryear ran deficits for decade after decade as this phenomenon only started under Gordon Brown and has rapidly accelerated0 -

This would suggest that Gordon can't really take the claim for the fashion of chancellors running endless deficits...

Worrying about borrowing at the moment is a little bizzare to me. It's clearly going to be bad news and I imagine that there will be more bad news incoming.

0 -

Blair’s first term was a promise to stick to Tory borrowing rules. Look at your chart and guess when the 2nd term started.Jezyboy said:

This would suggest that Gordon can't really take the claim for the fashion of chancellors running endless deficits...

Worrying about borrowing at the moment is a little bizzare to me. It's clearly going to be bad news and I imagine that there will be more bad news incoming.

Your chart is dated 2014 so dates after that are forecasts, would be interesting to overlay that with reality0 -

Worrying is indeed futile.Jezyboy said:

Worrying about borrowing at the moment is a little bizzare to me. It's clearly going to be bad news and I imagine that there will be more bad news incoming.

Being aware of the impending doom and preparing for it is not.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0