Paradise Papers (& Panama Papers)

Comments

-

Let me clarify.mamba80 wrote:Stevo 666 wrote:

Nice rant, and conveniently free of fact or evidence. Your point is what?mamba80 wrote:No it fcuking well isnt and you know it. utterly simplistic,you yourself have said that banks wont move many workers as London offers soooo much more.. schools, culture, history, dining, 5% tax or close a few loop holes wont make londons millionaires suddenly move to Frankfurt... brexit might though!

You have to be self employed to be vat registered and have a decent turn-over, not open to the vast majority who r on PAYE regardless, when my mate tried to get his KTM450 as a business purchase as he used it to travel about the lanes to price jobs, he was told no chance as a enduro bike is clearly a leisure purchase! just like a jet!

many poorer people dont get back a cent in working benefits as they dont have kids or pay rent.

So you re found out and then standard retort..... come on it s getting boring.

Are you denying that for the vast majority on PAYE claiming back VAT is nt an option? or that to be VAT registered your vat taxable turn over is 85k in any 12month period...... or that living at home and having no children means no working benefits......

Your early post (posts?) were the one free of facts or evidence.

You stated that it needs to be one set of rules for all. There is.

Anyone can set up a small business and register for VAT. The only difference there is facts and circumstances, not rules. Like anyone in business, Hamilton can reclaim VAT on business purchases, the only difference is that he has made a high value purchase. Principle is the same. The only real question is whether his declared % business/private use split is reasonable.

There are a few million UK VAT registrations and anyone can register voluntarily regardless of turnover. Although as mentioned above, LH has not avoided any UK VAT "I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Fine words. Nothing will really happen. Wasn't David Cameron banging on about increasing transparency in offshore finance when he was PM?TheBigBean wrote:Rick Chasey wrote:So article in FT suggesting pressure from NGOs, regulators & media means overseas territories are likely fo make moves to improve their transparency.

No bad thing, right?

Broadly, but it needs to respect civil liberties and not try to force legislation from one specific country on to all the others in the way that FATCA does.Ecrasez l’infame0 -

TheBigBean wrote:Rick Chasey wrote:So article in FT suggesting pressure from NGOs, regulators & media means overseas territories are likely fo make moves to improve their transparency.

No bad thing, right?

Broadly, but it needs to respect civil liberties and not try to force legislation from one specific country on to all the others in the way that FATCA does.

Fair.

Meanwhile, UK offshore havens are a target in Brexit talks...0 -

There are also studies like this from the IMF http://www.imf.org/external/np/pp/eng/2014/050914.pdf

that suggest that tax haven noticeably harm developing nations.0 -

Stevo 666 wrote:

Let me clarify.mamba80 wrote:Stevo 666 wrote:

Nice rant, and conveniently free of fact or evidence. Your point is what?mamba80 wrote:No it fcuking well isnt and you know it. utterly simplistic,you yourself have said that banks wont move many workers as London offers soooo much more.. schools, culture, history, dining, 5% tax or close a few loop holes wont make londons millionaires suddenly move to Frankfurt... brexit might though!

You have to be self employed to be vat registered and have a decent turn-over, not open to the vast majority who r on PAYE regardless, when my mate tried to get his KTM450 as a business purchase as he used it to travel about the lanes to price jobs, he was told no chance as a enduro bike is clearly a leisure purchase! just like a jet!

many poorer people dont get back a cent in working benefits as they dont have kids or pay rent.

So you re found out and then standard retort..... come on it s getting boring.

Are you denying that for the vast majority on PAYE claiming back VAT is nt an option? or that to be VAT registered your vat taxable turn over is 85k in any 12month period...... or that living at home and having no children means no working benefits......

Your early post (posts?) were the one free of facts or evidence.

You stated that it needs to be one set of rules for all. There is.

Anyone can set up a small business and register for VAT. The only difference there is facts and circumstances, not rules. Like anyone in business, Hamilton can reclaim VAT on business purchases, the only difference is that he has made a high value purchase. Principle is the same. The only real question is whether his declared % business/private use split is reasonable.

There are a few million UK VAT registrations and anyone can register voluntarily regardless of turnover. Although as mentioned above, LH has not avoided any UK VAT

Unless he has, because his "business" in the IOM wasn't "in business". And that company didn't declare his business/personal use correctly when importing it to the UK.

Or am I wrong? I'm sure it will get investigated now, anyway.0 -

Beat me to it.Pross wrote:Mr Goo wrote:

Who was that judge?Stevo 666 wrote:As a judge has said recently in a tax case, morality has no place in this court room.[/color]

Murder is morally wrong. Is he or are you now saying that we should just throw ethics and morals out the window and live in an anarchic and chaotic state. Most of our basic laws have a basis traced back to the 10 commandments, which if you ignore the fact they came from a religious text, are actually a set of rules to live by a decent set of ethics and morals. So I think that answer from your judge is b0ll0x.

I think you have a fundamental misunderstanding of how the legal system in this country works. Laws are not made in the courtroom or by judges. As you say, laws reflect the morals and ethics (of the time, which are subject to change - see issues such as homosexuality, adultery, abortion etc.) but this is done in Parliament. You then have a legal system that determines whether there are reasonable grounds to suspect someone broke those laws in which case they go to court and a jury determines if the evidence supports the belief that they have broken said law. That decision should be taken purely on the facts and the details of the law as written. If, at the courtroom stage, jurors start using their own morals and ethics (prejudice) in making their decisions then there is a real risk of a miscarriage of justice. For example, imagine a jury sitting in on case where a father has beaten up a man for having a consensual / legal sexual relationship with his son. The evidence and facts of the case show that an assault was undertaken but the members of the jury are all homophobic and don't believe a man should have sex with another man, they therefore justify the assault as upholding their morals and ethics and find the assailant not guilty. Therefore, the judge is right - once a case reaches court morals should not be considered as the law has already taken them into account.

The same applies with the tax system, it's a straightforward case of whether tax laws have been broken or not. There will obviously be some technical argument regarding interpretation of the law (as there often is in legal cases) but ultimately the verdict should be made on whether the law has definitively been broken (whether intentionally or not). I think I'm right that in more complex financial cases now the decision is made my judges rather than a jury but could be wrong on that. Presumably this is because most of us would struggle to understand the complexities and be prone to making judgement on moral or ethical grounds.

As BB also says, there is a degree of interpretation as part of the law are subjective. But ultimately morals don't come into it from a court room perspective. Until then we have people like you complaining about things that are legal. I refer Goo back to my first post..."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

No.KingstonGraham wrote:Pross wrote:Yep, it's basically a balance of whether you would be able to reclaim more VAT than you have to pay (plus some additional work). So potentially a chance for the self-employed 'little man' to avoid tax

Surely if you can reclaim more VAT than you have to pay, then you are doing something wrong?

For example you could be a business whose main activity is exports to other businesses based overseas. You can reclaim your VAT on costs but do not charge VAT on the cross border sales."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

The only fluff is from people who think that their moral opinion on a subject they know little about trumps the law of the land.Matthewfalle wrote:PBlakeney wrote:

Right. An extreme example to make a point. A point better made than Rick's above.TheBigBean wrote:PBlakeney wrote:

Please give a concise summary then or I'll interpret it as I wish.Rick Chasey wrote:PBlakeney wrote:

In summary, some people are better off than others.Rick Chasey wrote:It's more that because the cost of everything else doesn't rise, earning more is still an advantage.

Bluntly having 50% taken of £300k vs 20% of 50k still leaves the £300k person with significant more purchasing power.

The difference in life for earnings between £15k-£30k is significantly bigger than the difference between £1m and £2m, right?

Twas ever thus. And always will be. I'll stack shelves for £300k at 50% if that's your solution.

That's not really the summary is it?

You need a basic amount of money to survive. Each extra pound you earn is needed incrementally less. Someone who has £10bn pounds would struggle to argue that they needed another £1b.

That is white and black. We are agreed that this is a grey subject. Everyone has different opinions as to where grey turns to black. Some think it is where the legal lines are drawn, some where their opinion thinks it should be.

19 pages of fluff and nonsense.

Hey - don't go calling my stuff fluff and nonsense.

Do you know how often I banged my head against the wall whilst writing that stuff?"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

You're wrong.KingstonGraham wrote:Stevo 666 wrote:

Let me clarify.mamba80 wrote:Stevo 666 wrote:

Nice rant, and conveniently free of fact or evidence. Your point is what?mamba80 wrote:No it fcuking well isnt and you know it. utterly simplistic,you yourself have said that banks wont move many workers as London offers soooo much more.. schools, culture, history, dining, 5% tax or close a few loop holes wont make londons millionaires suddenly move to Frankfurt... brexit might though!

You have to be self employed to be vat registered and have a decent turn-over, not open to the vast majority who r on PAYE regardless, when my mate tried to get his KTM450 as a business purchase as he used it to travel about the lanes to price jobs, he was told no chance as a enduro bike is clearly a leisure purchase! just like a jet!

many poorer people dont get back a cent in working benefits as they dont have kids or pay rent.

So you re found out and then standard retort..... come on it s getting boring.

Are you denying that for the vast majority on PAYE claiming back VAT is nt an option? or that to be VAT registered your vat taxable turn over is 85k in any 12month period...... or that living at home and having no children means no working benefits......

Your early post (posts?) were the one free of facts or evidence.

You stated that it needs to be one set of rules for all. There is.

Anyone can set up a small business and register for VAT. The only difference there is facts and circumstances, not rules. Like anyone in business, Hamilton can reclaim VAT on business purchases, the only difference is that he has made a high value purchase. Principle is the same. The only real question is whether his declared % business/private use split is reasonable.

There are a few million UK VAT registrations and anyone can register voluntarily regardless of turnover. Although as mentioned above, LH has not avoided any UK VAT

Unless he has, because his "business" in the IOM wasn't "in business". And that company didn't declare his business/personal use correctly when importing it to the UK.

Or am I wrong? I'm sure it will get investigated now, anyway.

IOM runs its own tax affairs and is responsible for gathering its own revenues (tax) and its own spending. If LH has avoided anything, it is to the detriment of the IOM. The impact on the UK exchequer is nil. Also he didn't import it into the UK (and fyi he isn't UK resident himself).

That aside, what was his declared personal/private split declared compared to the actual?

If he has done something wrong, it's up to the IOM tax authority to investigate. Although they signed off on the transaction in the first place."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Quite a few tax havens would still be developing if they hadn't put an attractive tax regime in place. Ever heard of tax competition? Most countries do it - just look at where CT rates have been going in the majority of countries - but the big boys complain when the smaller players go further than they do, and win.Rick Chasey wrote:There are also studies like this from the IMF http://www.imf.org/external/np/pp/eng/2014/050914.pdf

that suggest that tax haven noticeably harm developing nations."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

-

Ah, the old "it makes no difference whether I do it or not, someone's going to do it" argument. But then this isn't about morals, is it?Stevo 666 wrote:

Quite a few tax havens would still be developing if they hadn't put an attractive tax regime in place. Ever heard of tax competition? Most countries do it - just look at where CT rates have been going in the majority of countries - but the big boys complain when the smaller players go further than they do, and win.Rick Chasey wrote:There are also studies like this from the IMF http://www.imf.org/external/np/pp/eng/2014/050914.pdf

that suggest that tax haven noticeably harm developing nations. Ecrasez l’infame0

Ecrasez l’infame0 -

With regards to tax havens, how do they actually generate revenue for providing government services and running their country? Also, would making it harder for them to exist mean that a decline in the wealth of that country and its people? For example, the IoM became a 'tax haven' in the 80s due to a decline in tourism, agriculture and fishing leaving them with a damaged economy and the island now relies heavily on the financial services industry. If it no longer offered a favourable tax environment where would people find work?

* The use of the word country above has been used to cover dependencies, overseas territories and the like that have autonomy before any pedants chirp up.0 -

Stevo 666 wrote:

Quite a few tax havens would still be developing if they hadn't put an attractive tax regime in place. Ever heard of tax competition? Most countries do it - just look at where CT rates have been going in the majority of countries - but the big boys complain when the smaller players go further than they do, and win.Rick Chasey wrote:There are also studies like this from the IMF http://www.imf.org/external/np/pp/eng/2014/050914.pdf

that suggest that tax haven noticeably harm developing nations.

May I suggest you should join the Tax Payers' Alliance? They are big on tax competition and just lurv the tax havens.

I bet they have good tea parties as well.0 -

Pross wrote:With regards to tax havens, how do they actually generate revenue for providing government services and running their country? Also, would making it harder for them to exist mean that a decline in the wealth of that country and its people? For example, the IoM became a 'tax haven' in the 80s due to a decline in tourism, agriculture and fishing leaving them with a damaged economy and the island now relies heavily on the financial services industry. If it no longer offered a favourable tax environment where would people find work?

* The use of the word country above has been used to cover dependencies, overseas territories and the like that have autonomy before any pedants chirp up.

I think it varies, either by collecting a small percentage of the money going through each company, or a fixed amount from each company, or by requiring that companies offer certain services e.g. a receptionist that will answer the phone etc. which creates jobs.0 -

Pross wrote:With regards to tax havens, how do they actually generate revenue for providing government services and running their country? Also, would making it harder for them to exist mean that a decline in the wealth of that country and its people? For example, the IoM became a 'tax haven' in the 80s due to a decline in tourism, agriculture and fishing leaving them with a damaged economy and the island now relies heavily on the financial services industry. If it no longer offered a favourable tax environment where would people find work?

* The use of the word country above has been used to cover dependencies, overseas territories and the like that have autonomy before any pedants chirp up.

there was a program on the BVI the other day, apparently they ve poor public services and their income relies heavily on tourism.

So a population of 23k and one public 44 bed hospital, most people dont get free healthcare either, so the private sector is growing......

So its done them a world of good.0 -

Pross wrote:With regards to tax havens, how do they actually generate revenue for providing government services and running their country? Also, would making it harder for them to exist mean that a decline in the wealth of that country and its people? For example, the IoM became a 'tax haven' in the 80s due to a decline in tourism, agriculture and fishing leaving them with a damaged economy and the island now relies heavily on the financial services industry. If it no longer offered a favourable tax environment where would people find work?

* The use of the word country above has been used to cover dependencies, overseas territories and the like that have autonomy before any pedants chirp up.

i'll answer this one as I know a bit about tax havens but first of all I'd be interested to read what people think a tax haven is and how they operate.Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

5% of billions is more than 30% of millions.Pross wrote:With regards to tax havens, how do they actually generate revenue for providing government services and running their country? Also, would making it harder for them to exist mean that a decline in the wealth of that country and its people? For example, the IoM became a 'tax haven' in the 80s due to a decline in tourism, agriculture and fishing leaving them with a damaged economy and the island now relies heavily on the financial services industry. If it no longer offered a favourable tax environment where would people find work?

* The use of the word country above has been used to cover dependencies, overseas territories and the like that have autonomy before any pedants chirp up.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Stevo 666 wrote:

You're wrong.KingstonGraham wrote:Stevo 666 wrote:

Let me clarify.mamba80 wrote:Stevo 666 wrote:

Nice rant, and conveniently free of fact or evidence. Your point is what?mamba80 wrote:No it fcuking well isnt and you know it. utterly simplistic,you yourself have said that banks wont move many workers as London offers soooo much more.. schools, culture, history, dining, 5% tax or close a few loop holes wont make londons millionaires suddenly move to Frankfurt... brexit might though!

You have to be self employed to be vat registered and have a decent turn-over, not open to the vast majority who r on PAYE regardless, when my mate tried to get his KTM450 as a business purchase as he used it to travel about the lanes to price jobs, he was told no chance as a enduro bike is clearly a leisure purchase! just like a jet!

many poorer people dont get back a cent in working benefits as they dont have kids or pay rent.

So you re found out and then standard retort..... come on it s getting boring.

Are you denying that for the vast majority on PAYE claiming back VAT is nt an option? or that to be VAT registered your vat taxable turn over is 85k in any 12month period...... or that living at home and having no children means no working benefits......

Your early post (posts?) were the one free of facts or evidence.

You stated that it needs to be one set of rules for all. There is.

Anyone can set up a small business and register for VAT. The only difference there is facts and circumstances, not rules. Like anyone in business, Hamilton can reclaim VAT on business purchases, the only difference is that he has made a high value purchase. Principle is the same. The only real question is whether his declared % business/private use split is reasonable.

There are a few million UK VAT registrations and anyone can register voluntarily regardless of turnover. Although as mentioned above, LH has not avoided any UK VAT

Unless he has, because his "business" in the IOM wasn't "in business". And that company didn't declare his business/personal use correctly when importing it to the UK.

Or am I wrong? I'm sure it will get investigated now, anyway.

IOM runs its own tax affairs and is responsible for gathering its own revenues (tax) and its own spending. If LH has avoided anything, it is to the detriment of the IOM. The impact on the UK exchequer is nil. Also he didn't import it into the UK (and fyi he isn't UK resident himself).

That aside, what was his declared personal/private split declared compared to the actual?

If he has done something wrong, it's up to the IOM tax authority to investigate. Although they signed off on the transaction in the first place.

Fair enough. It's only an indirect effect on the UK (and any other government inside the customs union that he could have imported it into). Understood.

Why is it IOM that seems to have this arrangement then? Surely he could just as easily have set up a genuine leasing business in England, and still claimed the VAT back.

Apparently, the charter contracts say 33% for personal use.0 -

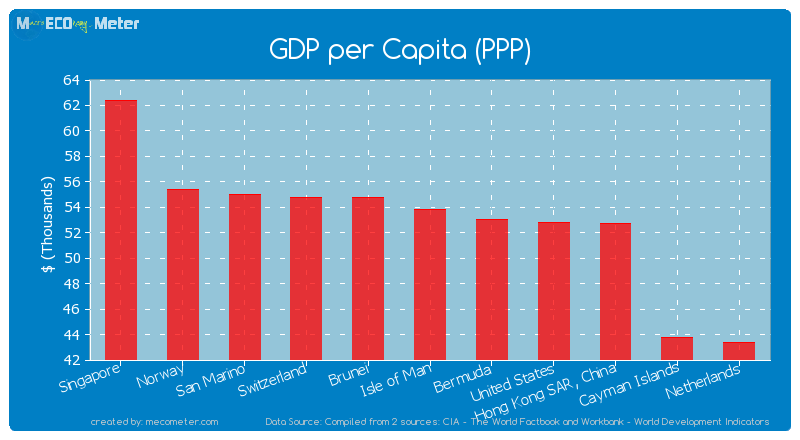

As I say, it works if you look at some of the economic stats.Robert88 wrote:Stevo 666 wrote:

Quite a few tax havens would still be developing if they hadn't put an attractive tax regime in place. Ever heard of tax competition? Most countries do it - just look at where CT rates have been going in the majority of countries - but the big boys complain when the smaller players go further than they do, and win.Rick Chasey wrote:There are also studies like this from the IMF http://www.imf.org/external/np/pp/eng/2014/050914.pdf

that suggest that tax haven noticeably harm developing nations.

May I suggest you should join the Tax Payers' Alliance? They are big on tax competition and just lurv the tax havens.

I bet they have good tea parties as well."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Let's have a look at a few of them shall we.mamba80 wrote:Pross wrote:With regards to tax havens, how do they actually generate revenue for providing government services and running their country? Also, would making it harder for them to exist mean that a decline in the wealth of that country and its people? For example, the IoM became a 'tax haven' in the 80s due to a decline in tourism, agriculture and fishing leaving them with a damaged economy and the island now relies heavily on the financial services industry. If it no longer offered a favourable tax environment where would people find work?

* The use of the word country above has been used to cover dependencies, overseas territories and the like that have autonomy before any pedants chirp up.

there was a program on the BVI the other day, apparently they ve poor public services and their income relies heavily on tourism.

So a population of 23k and one public 44 bed hospital, most people dont get free healthcare either, so the private sector is growing......

So its done them a world of good.

From the point of view of the individual territories concerned, it seems to be rather effective. There does seem to be a good correlation between competitive tax rates and prosperity, especially where the alternative for some of these small countries was not great - agriculture, tourism etc.

If you were a relatively unprosperous small country with the option to attract significantly more wealth by going down this route, would you just ignore it and say 'Nah, I'll be poor but at least I won't have these moral do-gooders in high tax countries slagging me off'?"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

What is the GDP of the IOM? If it was mega bucks and given that it is part of the UK, if I was prime minister, I would tax the f*ckers to within an inch of their lives in a one off hit, the 3 legged w@nkers. Let them build the cake up cake for another 10 years and do it again.

I mean what would they do to stop me, raise an army?

You see my point.

If not, how much are they directly contributing to HMRC in the grand scheme of things? That's the bottom line. Why should inhabitants of the IOM/Jersey/Guernsey have very favourable tax rates and the rest of the UK have to compete on a different playing field?seanoconn - gruagach craic!0 -

Pinno wrote:What is the GDP of the IOM? If it was mega bucks and given that it is part of the UK, if I was prime minister, I would tax the f*ckers to within an inch of their lives in a one off hit, the 3 legged w@nkers. Let them build the cake up cake for another 10 years and do it again.

I mean what would they do to stop me, raise an army?

You see my point.

If not, how much are they directly contributing to HMRC in the grand scheme of things? That's the bottom line. Why should inhabitants of the IOM/Jersey/Guernsey have very favourable tax rates and the rest of the UK have to compete on a different playing field?

Because jersey and guernsey aren't part of the uk and don't want to be and have all the stuff I posted about them earlier going for them and the uk doesn't.

Why should they have to put up with the detritus of the uk?Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

https://tradingeconomics.com/isle-of-man/gdp-per-capitaPinno wrote:What is the GDP of the IOM? If it was mega bucks and given that it is part of the UK, if I was prime minister, I would tax the f*ckers to within an inch of their lives in a one off hit, the 3 legged w@nkers. Let them build the cake up cake for another 10 years and do it again.

I mean what would they do to stop me, raise an army?

You see my point.

If not, how much are they directly contributing to HMRC in the grand scheme of things? That's the bottom line. Why should inhabitants of the IOM/Jersey/Guernsey have very favourable tax rates and the rest of the UK have to compete on a different playing field?

See what a consistent low tax policy can do for your economy?

I'd see your point if they were part of the UK. Unfortunately there is one small problem with your little plan..."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Yeah, like that Irish GDP growth.

Funny how no-one feels particularly well off in Ireland.

https://www.irishtimes.com/business/eco ... -1.27221700 -

Stevo 666 wrote:

https://tradingeconomics.com/isle-of-man/gdp-per-capitaPinno wrote:What is the GDP of the IOM? If it was mega bucks and given that it is part of the UK, if I was prime minister, I would tax the f*ckers to within an inch of their lives in a one off hit, the 3 legged w@nkers. Let them build the cake up cake for another 10 years and do it again.

I mean what would they do to stop me, raise an army?

You see my point.

If not, how much are they directly contributing to HMRC in the grand scheme of things? That's the bottom line. Why should inhabitants of the IOM/Jersey/Guernsey have very favourable tax rates and the rest of the UK have to compete on a different playing field?

See what a consistent low tax policy can do for your economy?

I'd see your point if they were part of the UK. Unfortunately there is one small problem with your little plan...

If they want to afford their physical protection by us, or use of the NHS when required and not have to apply for visa's to travel to the UK mainland, or get direct help and aid from us if a storm/tidal wave were to hit them... [add scenario of your choice] then they should be part of the UK domestic tax arrangements. This, all under the umbrella of the Queen as head of state. How does that work?seanoconn - gruagach craic!0 -

Rick Chasey wrote:Yeah, like that Irish GDP growth.

Funny how no-one feels particularly well off in Ireland.

https://www.irishtimes.com/business/eco ... -1.2722170

Surprisingly I believe that London is also a tax haven, provided you are not a British citizen and live in the UK. Very handy for Russian oligarchs!0 -

Stevo 666 wrote:

https://tradingeconomics.com/isle-of-man/gdp-per-capitaPinno wrote:What is the GDP of the IOM? If it was mega bucks and given that it is part of the UK, if I was prime minister, I would tax the f*ckers to within an inch of their lives in a one off hit, the 3 legged w@nkers. Let them build the cake up cake for another 10 years and do it again.

I mean what would they do to stop me, raise an army?

You see my point.

If not, how much are they directly contributing to HMRC in the grand scheme of things? That's the bottom line. Why should inhabitants of the IOM/Jersey/Guernsey have very favourable tax rates and the rest of the UK have to compete on a different playing field?

See what a consistent low tax policy can do for your economy?

I'd see your point if they were part of the UK. Unfortunately there is one small problem with your little plan...

many eu countries with higher tax regimes than UK, have better GDP figures.......

https://tradingeconomics.com/country-li ... ent=europe0 -

Robert88 wrote:Rick Chasey wrote:Yeah, like that Irish GDP growth.

Funny how no-one feels particularly well off in Ireland.

https://www.irishtimes.com/business/eco ... -1.2722170

Surprisingly I believe that London is also a tax haven, provided you are not a British citizen and live in the UK. Very handy for Russian oligarchs!

NNNNNNNOOOOOOOOOOOOOOOOOO!!!,!,!,!!!!!

PLease don't bring residency and domiciliary rules into this - it'll phuck with their minds, especially Rick's.

Anyhow, does no one want to know about tax havens are all you happy with what they are/how they work/what it's like to live thee/how they make their money?Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0 -

Pinno wrote:Stevo 666 wrote:

https://tradingeconomics.com/isle-of-man/gdp-per-capitaPinno wrote:What is the GDP of the IOM? If it was mega bucks and given that it is part of the UK, if I was prime minister, I would tax the f*ckers to within an inch of their lives in a one off hit, the 3 legged w@nkers. Let them build the cake up cake for another 10 years and do it again.

I mean what would they do to stop me, raise an army?

You see my point.

If not, how much are they directly contributing to HMRC in the grand scheme of things? That's the bottom line. Why should inhabitants of the IOM/Jersey/Guernsey have very favourable tax rates and the rest of the UK have to compete on a different playing field?

See what a consistent low tax policy can do for your economy?

I'd see your point if they were part of the UK. Unfortunately there is one small problem with your little plan...

If they want to afford their physical protection by us, or use of the NHS when required and not have to apply for visa's to travel to the UK mainland, or get direct help and aid from us if a storm/tidal wave were to hit them... [add scenario of your choice] then they should be part of the UK domestic tax arrangements. This, all under the umbrella of the Queen as head of state. How does that work?

Apart from the NHS thing which they don't really need as the health care systems aren't plucked like the NHS, they don't really use the UK for any of what you have mentioned. They're pretty self sufficient being massively financed first world islands.

You do know where they are and what they are like don't you?

Why should they be part of the domestic U.K. Tax set up? You seem to be avoiding this question Pinno my learns friend. Sort of Rick tactic....Postby team47b » Sun Jun 28, 2015 11:53 am

De Sisti wrote:

This is one of the silliest threads I've come across.

Recognition at last Matthew, well done!, a justified honour smithy21 wrote:

smithy21 wrote:

He's right you know.0