BREXIT - Is This Really Still Rumbling On? 😴

Comments

-

Stevo 666 wrote:

OK, here is link that demonstrates the point:rjsterry wrote:TheBigBean wrote:rjsterry wrote:Perhaps as you say, TBB needs to come back on this one.

Do I? On what, and would it serve any point?rjsterry wrote:I see the point that Brexit offers an opportunity for regulatory divergence in FS, which could make things easier for the City.

The City is better regulated than most of the other EU countries. Brexit could offer the opportunity to insist on a level playing field.

Sorry, I've probably lost the thread of who was making which argument, so maybe that should be directed at Stevo. I think it was Stevo who suggested that our FS dominance could be used as leverage in future negotiations (assuming there are some either before or after 31/10). RC asked for a specific example and I think you suggested English Law. I can see that that offers potential advantages but I still don't see where the leverage is.

https://www.bba.org.uk/wp-content/uploads/2016/12/webversion-BQB-3-1.pdf

Page 7.

Overall the main point is the ability of EU institutions to access to finance from - and sell into - the very large UK FS market, as mentioned before. They don't want to lose that Clearly there are also impacts on the UK, but I am highlighting as requested the impact on EU based institutions.

Anyone who thinks that the relatively lightweight financial centres in the EU can just step in and offer the range of services, access to capital and pricing of that capital that The City of London can offer is being a bit optimistic in my view.

Would it be practical to source the capital and services in NYC?0 -

bobmcstuff wrote:

Boris' pledges on Northern infrastructure spending is very welcome and something the previous government should have done IMO. Not that I have much faith on his ability to deliver.

It's a tiny fraction of what the EU gave to the North though.

So the North loses again and the even more when Johnson doesn't deliver.0 -

Where is this money to be found? The Brexit 'dividend' is not a significant amount in the scale of things.0

-

350m a week wont go far on the extra housing benefit and dole money payments alone. By the time the top rate of tax is cut, that'll be it, pizsed away like north sea oil.Robert88 wrote:Where is this money to be found? The Brexit 'dividend' is not a significant amount in the scale of things.0 -

Possibly, as New York is possibly the most direct competitor to London. Although I am not sure why Brexit would precipitate a move of business from one non-EU financial centre to another?Surrey Commuter wrote:Stevo 666 wrote:

OK, here is link that demonstrates the point:rjsterry wrote:TheBigBean wrote:rjsterry wrote:Perhaps as you say, TBB needs to come back on this one.

Do I? On what, and would it serve any point?rjsterry wrote:I see the point that Brexit offers an opportunity for regulatory divergence in FS, which could make things easier for the City.

The City is better regulated than most of the other EU countries. Brexit could offer the opportunity to insist on a level playing field.

Sorry, I've probably lost the thread of who was making which argument, so maybe that should be directed at Stevo. I think it was Stevo who suggested that our FS dominance could be used as leverage in future negotiations (assuming there are some either before or after 31/10). RC asked for a specific example and I think you suggested English Law. I can see that that offers potential advantages but I still don't see where the leverage is.

https://www.bba.org.uk/wp-content/uploads/2016/12/webversion-BQB-3-1.pdf

Page 7.

Overall the main point is the ability of EU institutions to access to finance from - and sell into - the very large UK FS market, as mentioned before. They don't want to lose that Clearly there are also impacts on the UK, but I am highlighting as requested the impact on EU based institutions.

Anyone who thinks that the relatively lightweight financial centres in the EU can just step in and offer the range of services, access to capital and pricing of that capital that The City of London can offer is being a bit optimistic in my view.

Would it be practical to source the capital and services in NYC?

Potentially over zealous EU regulation and taxes would have done that, although post Brexit there is less potential for that to happen."I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

When Labour hiked the top rate to 50% just before they were chucked out of power back in 2010, the impact on the tax take was pretty much nothing per HMRCs own figures. So dropping the rate back to 40% or raising the threshold should not have a material detrimental impact on tax revenues. Less avoidance, more incentive to make money etc. There are advantages to 'Singapore on Thames'darkhairedlord wrote:

350m a week wont go far on the extra housing benefit and dole money payments alone. By the time the top rate of tax is cut, that'll be it, pizsed away like north sea oil.Robert88 wrote:Where is this money to be found? The Brexit 'dividend' is not a significant amount in the scale of things. "I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

darkhairedlord wrote:

350m a week wont go far on the extra housing benefit and dole money payments alone. By the time the top rate of tax is cut, that'll be it, pizsed away like north sea oil.Robert88 wrote:Where is this money to be found? The Brexit 'dividend' is not a significant amount in the scale of things.

Not to mention it was never 350m anyway.

And the brexit dividend is a negative.

But somehow money is being promised to push this ridiculous plan through.0 -

Stevo 666 wrote:

Possibly, as New York is possibly the most direct competitor to London. Although I am not sure why Brexit would precipitate a move of business from one non-EU financial centre to another?Surrey Commuter wrote:Stevo 666 wrote:

OK, here is link that demonstrates the point:rjsterry wrote:TheBigBean wrote:rjsterry wrote:Perhaps as you say, TBB needs to come back on this one.

Do I? On what, and would it serve any point?rjsterry wrote:I see the point that Brexit offers an opportunity for regulatory divergence in FS, which could make things easier for the City.

The City is better regulated than most of the other EU countries. Brexit could offer the opportunity to insist on a level playing field.

Sorry, I've probably lost the thread of who was making which argument, so maybe that should be directed at Stevo. I think it was Stevo who suggested that our FS dominance could be used as leverage in future negotiations (assuming there are some either before or after 31/10). RC asked for a specific example and I think you suggested English Law. I can see that that offers potential advantages but I still don't see where the leverage is.

https://www.bba.org.uk/wp-content/uploads/2016/12/webversion-BQB-3-1.pdf

Page 7.

Overall the main point is the ability of EU institutions to access to finance from - and sell into - the very large UK FS market, as mentioned before. They don't want to lose that Clearly there are also impacts on the UK, but I am highlighting as requested the impact on EU based institutions.

Anyone who thinks that the relatively lightweight financial centres in the EU can just step in and offer the range of services, access to capital and pricing of that capital that The City of London can offer is being a bit optimistic in my view.

Would it be practical to source the capital and services in NYC?

Potentially over zealous EU regulation and taxes would have done that, although post Brexit there is less potential for that to happen.

If the UK overplayed it’s hand using the City as leverage then the alternative would be NYC rather than an EU financial centre. This obviously reduces our leverage.

Anyway the German carmakers must be about to make their move.0 -

bobmcstuff wrote:

Presumably much of the public spending would manifest in jobs, no?morstar wrote:rjsterry wrote:orraloon wrote:What relevance is all this blether about London based financial services upside / downside to the hard core gullible leave voters of Stoke, Sunderland and sh1tholes like that?

It pays for their public spending.

Firstly, a lot probably don't care. If anything, some of them want others to suffer as they do.

Secondly, the assumption that they want public spending rather than jobs is a viewpoint. (I'm not excusing the fact that some of them could mobilise and get work but conversely, it is the job of government to facilitate productivity).

Boris' pledges on Northern infrastructure spending is very welcome and something the previous government should have done IMO. Not that I have much faith on his ability to deliver.

No, his pledges on Northern infrastructure spending are not welcome because it they are just blatent lies to dupe the demonstrably gullible electorate. He will fail to deliver but tell us he has and we'll believe him because we are stupid. Very, very stupid.Faster than a tent.......0 -

Tom Peck makes a good point.

"pound is at its lowest level agaisnt the dollar since 1985, and the country is closer to breaking up than ever before.

Just trying to think what the country's most venerable newspapers would be saying if it were, say, Labour's fault, rather than their own".0 -

Surrey Commuter wrote:Stevo 666 wrote:

Possibly, as New York is possibly the most direct competitor to London. Although I am not sure why Brexit would precipitate a move of business from one non-EU financial centre to another?Surrey Commuter wrote:Stevo 666 wrote:

OK, here is link that demonstrates the point:rjsterry wrote:TheBigBean wrote:rjsterry wrote:Perhaps as you say, TBB needs to come back on this one.

Do I? On what, and would it serve any point?rjsterry wrote:I see the point that Brexit offers an opportunity for regulatory divergence in FS, which could make things easier for the City.

The City is better regulated than most of the other EU countries. Brexit could offer the opportunity to insist on a level playing field.

Sorry, I've probably lost the thread of who was making which argument, so maybe that should be directed at Stevo. I think it was Stevo who suggested that our FS dominance could be used as leverage in future negotiations (assuming there are some either before or after 31/10). RC asked for a specific example and I think you suggested English Law. I can see that that offers potential advantages but I still don't see where the leverage is.

https://www.bba.org.uk/wp-content/uploads/2016/12/webversion-BQB-3-1.pdf

Page 7.

Overall the main point is the ability of EU institutions to access to finance from - and sell into - the very large UK FS market, as mentioned before. They don't want to lose that Clearly there are also impacts on the UK, but I am highlighting as requested the impact on EU based institutions.

Anyone who thinks that the relatively lightweight financial centres in the EU can just step in and offer the range of services, access to capital and pricing of that capital that The City of London can offer is being a bit optimistic in my view.

Would it be practical to source the capital and services in NYC?

Potentially over zealous EU regulation and taxes would have done that, although post Brexit there is less potential for that to happen.

If the UK overplayed it’s hand using the City as leverage then the alternative would be NYC rather than an EU financial centre. This obviously reduces our leverage.

Anyway the German carmakers must be about to make their move.

Moreover we will have just given up the thing which distinguishes us from NYC.

I'm not sure I'm convinced by the argument that the EU will need access to the City, so will agree some alternative to passporting. The same has been argued about our access to the SM for goods and we have thumbed our nose at it.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

I don't see infalibility in the UK financial markets:

endowments

LIBOR rigging,

PPI

Woodford

Std Chartered trading iranian oil

defined pension fund liquidity

RBS Bailout

ditto other British banks

The board structure of the Santander family business

VAT carousel

Liverpool v Norwich last weekend

shortage of NHS dentists

(..sorry, I started to read the Daily Mail just then)

all of these have affected me - maybe not Libor.0 -

Lagrange wrote:I don't see infalibility in the UK financial markets:

endowments

LIBOR rigging,

PPI

Woodford

Std Chartered trading iranian oil

defined pension fund liquidity

RBS Bailout

ditto other British banks

The board structure of the Santander family business

VAT carousel

Liverpool v Norwich last weekend

shortage of NHS dentists

(..sorry, I started to read the Daily Mail just then)

all of these have affected me - maybe not Libor.

If only we'd set up our own Sovereign Wealth Fund when we first had North Sea Oil coming ashore.

Instead of using the revenue to fund tax cuts for those that didn't need tax cuts but rather thought they did. They'll need them even less now.

Who needs a

when you can have a 0

0 -

rjsterry wrote:

Moreover we will have just given up the thing which distinguishes us from NYC.

Brexit is going to result in the UK adopting NYC timezone?0 -

TheBigBean wrote:rjsterry wrote:

Moreover we will have just given up one of the things which distinguishes us from NYC.

Brexit is going to result in the UK adopting NYC timezone?

Better? 1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Lagrange wrote:I don't see infalibility in the UK financial markets:

endowments

LIBOR rigging,

PPI

Woodford

Std Chartered trading iranian oil

defined pension fund liquidity

RBS Bailout

ditto other British banks

The board structure of the Santander family business

VAT carousel

Liverpool v Norwich last weekend

shortage of NHS dentists

(..sorry, I started to read the Daily Mail just then)

all of these have affected me - maybe not Libor.

I think you have to take some personal responsibility for any exposure to Woodford0 -

rjsterry wrote:TheBigBean wrote:rjsterry wrote:

Moreover we will have just given up one of the things which distinguishes us from NYC.

Brexit is going to result in the UK adopting NYC timezone?

Better?

Yes., but timezone is probably more important than membership of the EU.0 -

TheBigBean wrote:rjsterry wrote:TheBigBean wrote:rjsterry wrote:

Moreover we will have just given up one of the things which distinguishes us from NYC.

Brexit is going to result in the UK adopting NYC timezone?

Better?

Yes., but timezone is probably more important than membership of the EU.

Why?Faster than a tent.......0 -

Rolf F wrote:TheBigBean wrote:rjsterry wrote:TheBigBean wrote:rjsterry wrote:

Moreover we will have just given up one of the things which distinguishes us from NYC.

Brexit is going to result in the UK adopting NYC timezone?

Better?

Yes., but timezone is probably more important than membership of the EU.

Why?

In the morning in Europe everyone is asleep in the US which is not very helpful when you are trying to do business.0 -

TheBigBean wrote:rjsterry wrote:

Moreover we will have just given up the thing which distinguishes us from NYC.

Brexit is going to result in the UK adopting NYC timezone?

Yes, and we don't have a Trump Tower to house the criminal elite. Yet.0 -

TheBigBean wrote:Rolf F wrote:TheBigBean wrote:rjsterry wrote:TheBigBean wrote:rjsterry wrote:

Moreover we will have just given up one of the things which distinguishes us from NYC.

Brexit is going to result in the UK adopting NYC timezone?

Better?

Yes., but timezone is probably more important than membership of the EU.

Why?

In the morning in Europe everyone is asleep in the US which is not very helpful when you are trying to do business.

Is it not partly a combination of the two factors, i.e., it might end up being better to do business somewhere on a European timezone which is also in the EU. Frankfurt or whatever.

In any case I work with people in the US and far east all the time, you just have to get up early/stay up late... If you were doing it permanently you could just put people on shifts, it wouldn't be that problematic. I suppose there would be some back office functions which needed to be in the actual location but I don't see why the decision makers couldn't be elsewhere?

Anyway... I am sure London has some advantages which aren't affected by Brexit.0 -

Surrey Commuter wrote:Lagrange wrote:I don't see infalibility in the UK financial markets:

endowments

LIBOR rigging,

PPI

Woodford

Std Chartered trading iranian oil

defined pension fund liquidity

RBS Bailout

ditto other British banks

The board structure of the Santander family business

VAT carousel

Liverpool v Norwich last weekend

shortage of NHS dentists

(..sorry, I started to read the Daily Mail just then)

all of these have affected me - maybe not Libor.

I think you have to take some personal responsibility for any exposure to Woodford

Saves the regulator and HL taking any responsibility. I think it is all gambling but I think this was a loaded dice - having huge sums invested in unlisted companies. 0

I think it is all gambling but I think this was a loaded dice - having huge sums invested in unlisted companies. 0 -

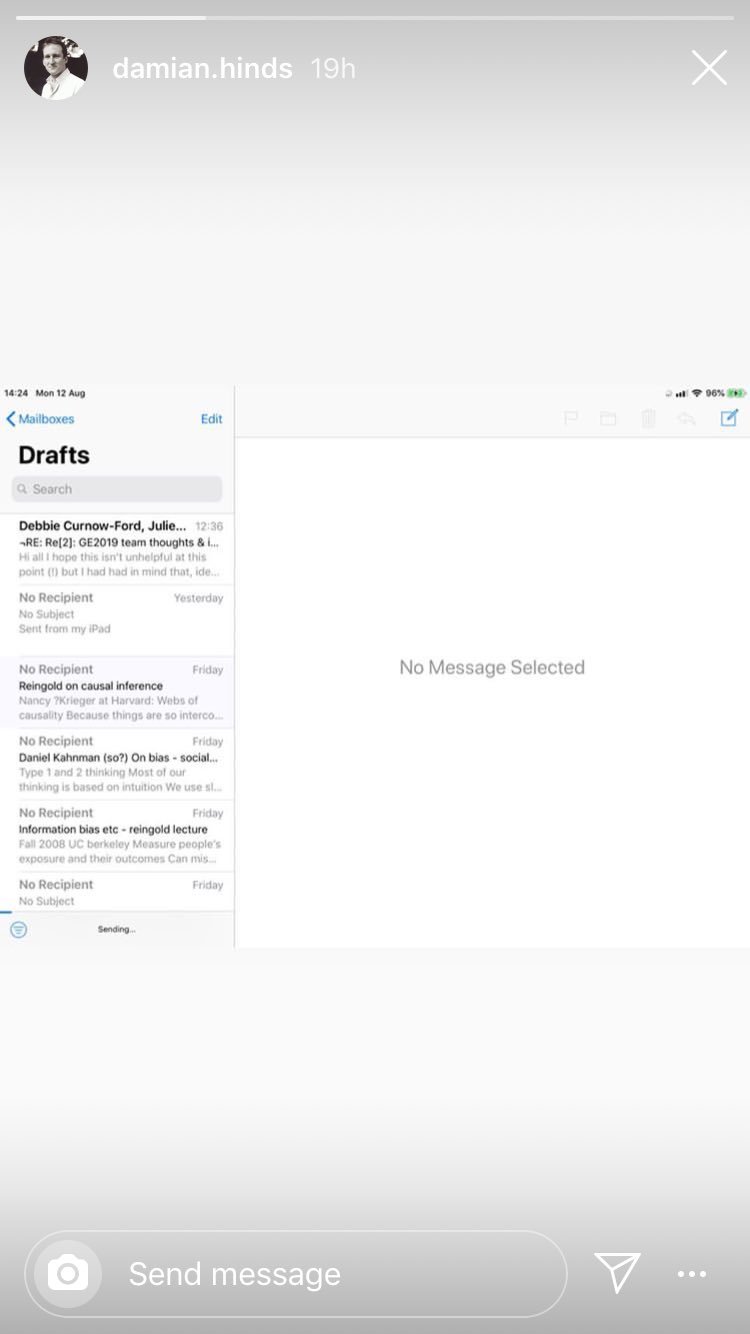

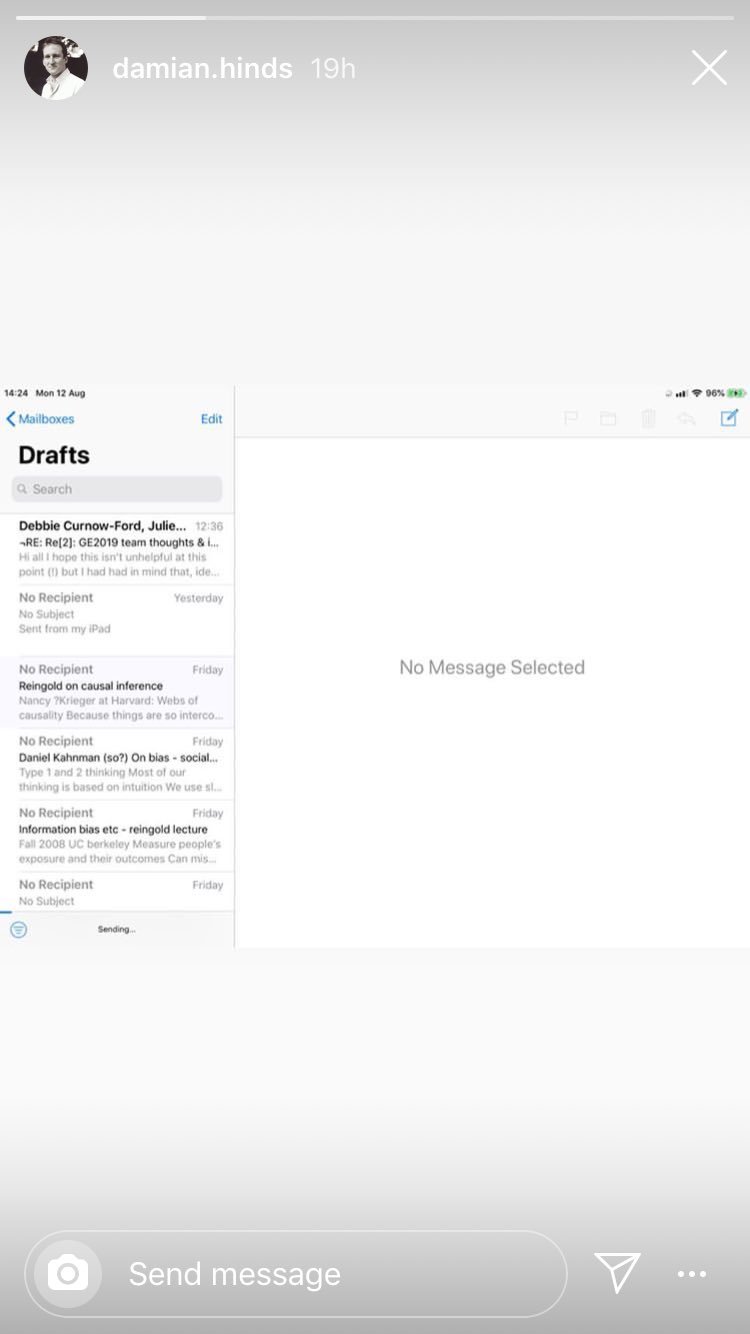

Damian Hinds accidentally posted a picture of his inbox from yesterday which show's an email titled "GE2019 team"

0

0 -

As if we needed that to be confirmed.Rick Chasey wrote:Damian Hinds accidentally posted a picture of his inbox from yesterday which show's an email titled "GE2019 team" 1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

“Accidentally”?

The above may be fact, or fiction, I may be serious, I may be jesting.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Rick Chasey wrote:Damian Hinds accidentally posted a picture of his inbox from yesterday which show's an email titled "GE2019 team"

Fake information? Why post a picture of your inbox?

Or..

maybe there is also a GE2020 team

Or..

the 2019 team is just a team put together in 2019 to deal with a GE any time.

Or..0 -

Rick Chasey wrote:Damian Hinds accidentally posted a picture of his inbox from yesterday which show's an email titled "GE2019 team"

I like how the visible content, in 18 words, completely fails to say anything at all.

Of course, that might be deliberate but then BoJo hasn't actually said anything meaningful as PM at all so far so it might just be endemic.

PS how do you "accidentally" post a picture of your inbox?Faster than a tent.......0 -

Rolf F wrote:Rick Chasey wrote:Damian Hinds accidentally posted a picture of his inbox from yesterday which show's an email titled "GE2019 team"

I like how the visible content, in 18 words, completely fails to say anything at all.

Of course, that might be deliberate but then BoJo hasn't actually said anything meaningful as PM at all so far so it might just be endemic.

PS how do you "accidentally" post a picture of your inbox?

Screenshot shortcut which then opens up share to shortcut. Phone left unlocked in pocket. Easy enough to do.You live and learn. At any rate, you live0 -

Jez mon wrote:Rolf F wrote:Rick Chasey wrote:Damian Hinds accidentally posted a picture of his inbox from yesterday which show's an email titled "GE2019 team"

[/img]

I like how the visible content, in 18 words, completely fails to say anything at all.

Of course, that might be deliberate but then BoJo hasn't actually said anything meaningful as PM at all so far so it might just be endemic.

PS how do you "accidentally" post a picture of your inbox?

Screenshot shortcut which then opens up share to shortcut. Phone left unlocked in pocket. Easy enough to do.

But you still have to deliberately screenshot your inbox in the first place surely? And obviously no Govt minister etc would have a phone that doesn't lock quickly because that would be blatantly idiotic and a serious security risk and the IT bods will have made sure that all phones lock pretty quickly wouldn't they?Faster than a tent.......0 -

Rolf F wrote:Jez mon wrote:Rolf F wrote:Rick Chasey wrote:Damian Hinds accidentally posted a picture of his inbox from yesterday which show's an email titled "GE2019 team"

[/img]

I like how the visible content, in 18 words, completely fails to say anything at all.

Of course, that might be deliberate but then BoJo hasn't actually said anything meaningful as PM at all so far so it might just be endemic.

PS how do you "accidentally" post a picture of your inbox?

Screenshot shortcut which then opens up share to shortcut. Phone left unlocked in pocket. Easy enough to do.

But you still have to deliberately screenshot your inbox in the first place surely? And obviously no Govt minister etc would have a phone that doesn't lock quickly because that would be blatantly idiotic and a serious security risk and the IT bods will have made sure that all phones lock pretty quickly wouldn't they?

It's from an iPad. And yes, I would absolutely expect a government minister to have an iPad with a long delay set on the screen lock. They're busy people who don't have time to be entering passcodes every five minutes. Never put down to deviousness what can be explained by stupidity.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0