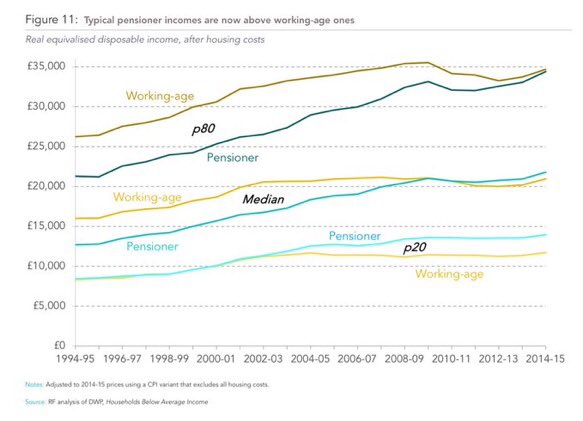

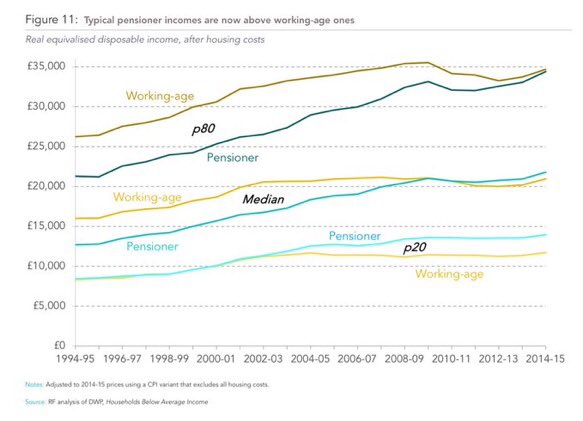

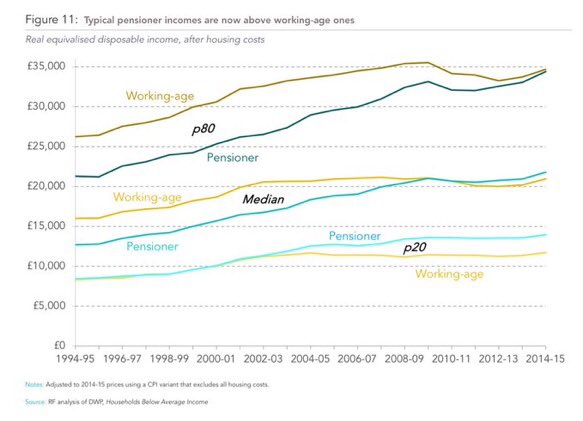

pensioners average income vs working age family income

rick_chasey

Posts: 75,660

For the first time, and after counting housing costs, “the median pensioner income is now above its working-age equivalent.”

https://twitter.com/TorstenBell/status/ ... 3291833344

I suspect this is unsustainable.

But then, I'm a generation snowflake, so whatevs.

https://twitter.com/TorstenBell/status/ ... 3291833344

I suspect this is unsustainable.

But then, I'm a generation snowflake, so whatevs.

0

Comments

-

Isn't that based on pensioners are taking a pension and still working, hence income is higher than average.Rick Chasey wrote:For the first time, and after counting housing costs, “the median pensioner income is now above its working-age equivalent.”

https://twitter.com/TorstenBell/status/ ... 3291833344

I suspect this is unsustainable.

But then, I'm a generation snowflake, so whatevs.

Unless of course it's skewed by public sector final salary pension, that are way to generous.All lies and jest..still a man hears what he wants to hear and disregards the rest....0 -

Are investments also factored in this? Shares, second house rented out etc.

If so, I'm trying to figure out where the 'dividends' actually come from, and does that make the poorer person worse off.

The older I get, the better I was.0 -

Guardian: "this relates to those who have an occupational pension, own their home and may also be still be earning!"

“The main driver of pensioner income growth has been the arrival of successive new waves of pensioners, who are more likely to work, own their home and have generous private pension wealth than any previous generation,”

Not that sure there's a story here is there?All lies and jest..still a man hears what he wants to hear and disregards the rest....0 -

bianchimoon wrote:Guardian: "this relates to those who have an occupational pension, own their home and may also be still be earning!"

“The main driver of pensioner income growth has been the arrival of successive new waves of pensioners, who are more likely to work, own their home and have generous private pension wealth than any previous generation,”

Not that sure there's a story here is there?

There is, as this generation (and to a lesser extent the next one) that has this wealth is likely to be the aberration. The increase in house prices means that the generation now in their 30s are less likely to be able to own their own home, and at the same time have enough to build up a nice pension, and less likely to have got large growth in their pension pot. If in addition, there are then universal benefits for a growing number of pensioners, paid for by a relatively smaller number of working age people, it's not sustainable.0 -

You have to add relatively high public sector pensions into the equation as to why it won't be sustainableKingstonGraham wrote:bianchimoon wrote:Guardian: "this relates to those who have an occupational pension, own their home and may also be still be earning!"

“The main driver of pensioner income growth has been the arrival of successive new waves of pensioners, who are more likely to work, own their home and have generous private pension wealth than any previous generation,”

Not that sure there's a story here is there?

There is, as this generation (and to a lesser extent the next one) that has this wealth is likely to be the aberration. The increase in house prices means that the generation now in their 30s are less likely to be able to own their own home, and at the same time have enough to build up a nice pension, and less likely to have got large growth in their pension pot. If in addition, there are then universal benefits for a growing number of pensioners, paid for by a relatively smaller number of working age people, it's not sustainable.All lies and jest..still a man hears what he wants to hear and disregards the rest....0 -

bianchimoon wrote:Guardian: "this relates to those who have an occupational pension, own their home and may also be still be earning!"

“The main driver of pensioner income growth has been the arrival of successive new waves of pensioners, who are more likely to work, own their home and have generous private pension wealth than any previous generation,”

Not that sure there's a story here is there?

story could be to stop treating all pensioner as if they are all skint and to stop offering universal benefits.0 -

I don't think it is only public sector pensions that are a problem (although they are a large looming problem). Newly formed companies with no final salary pensions to pay will have a growing competitive advantage over older companies with that legacy.0

-

True, but the public sector rather than the private sector pensions is a major area of concern as to how that is paid for going forwardKingstonGraham wrote:I don't think it is only public sector pensions that are a problem (although they are a large looming problem). Newly formed companies with no final salary pensions to pay will have a growing competitive advantage over older companies with that legacy.All lies and jest..still a man hears what he wants to hear and disregards the rest....0 -

KingstonGraham wrote:

There is, as this generation (and to a lesser extent the next one) that has this wealth is likely to be the aberration. The increase in house prices means that the generation now in their 30s are less likely to be able to own their own home, and at the same time have enough to build up a nice pension, and less likely to have got large growth in their pension pot. If in addition, there are then universal benefits for a growing number of pensioners, paid for by a relatively smaller number of working age people, it's not sustainable.

Yes if my wife and I had had to buy our modest semi at current prices and pay off say 50k each in student debt we'd be looking at easily another £250k to pay off, that's a lot of extra debt.[Castle Donington Ladies FC - going up in '22]0 -

bianchimoon wrote:

True, but the public sector rather than the private sector pensions is a major area of concern as to how that is paid for going forwardKingstonGraham wrote:I don't think it is only public sector pensions that are a problem (although they are a large looming problem). Newly formed companies with no final salary pensions to pay will have a growing competitive advantage over older companies with that legacy.

Until/unless companies start defaulting on their pension obligations in large numbers.0 -

I really do feel sorry for the relatively younger generation, no forward planning by successive governments, student loans, housing shortages, really should be a government priority to flatten the financial bump the next generation of workers will hit.DeVlaeminck wrote:KingstonGraham wrote:

There is, as this generation (and to a lesser extent the next one) that has this wealth is likely to be the aberration. The increase in house prices means that the generation now in their 30s are less likely to be able to own their own home, and at the same time have enough to build up a nice pension, and less likely to have got large growth in their pension pot. If in addition, there are then universal benefits for a growing number of pensioners, paid for by a relatively smaller number of working age people, it's not sustainable.

Yes if my wife and I had had to buy our modest semi at current prices and pay off say 50k each in student debt we'd be looking at easily another £250k to pay off, that's a lot of extra debt. PS I'm out of that category so relatively lucky, really don't know how people can pay off student debts, save for a pension and buy / rent houses All lies and jest..still a man hears what he wants to hear and disregards the rest....0

PS I'm out of that category so relatively lucky, really don't know how people can pay off student debts, save for a pension and buy / rent houses All lies and jest..still a man hears what he wants to hear and disregards the rest....0 -

defaulting or revisit and make realistic sustainable payments? Certainly getting final salary pensions and winter fuel allowance, buss pass, TV licence etc can't be right or fair.KingstonGraham wrote:bianchimoon wrote:

True, but the public sector rather than the private sector pensions is a major area of concern as to how that is paid for going forwardKingstonGraham wrote:I don't think it is only public sector pensions that are a problem (although they are a large looming problem). Newly formed companies with no final salary pensions to pay will have a growing competitive advantage over older companies with that legacy.

Until/unless companies start defaulting on their pension obligations in large numbers.All lies and jest..still a man hears what he wants to hear and disregards the rest....0 -

bianchimoon wrote:

defaulting or revisit and make realistic sustainable payments? Certainly getting final salary pensions and winter fuel allowance, buss pass, TV licence etc can't be right or fair.

They will be due to go in a few years.

I know this because this because it will be about the time when I retire and this has been the story of my life.

The older I get, the better I was.0 -

Rick Chasey wrote:But then, I'm a generation snowflake, so whatevs.

Thank you for breaking the first rule of fight club and bringing this term to my attention, I will be using it often my isetta is a 300cc bike0

my isetta is a 300cc bike0 -

Some people earn more than others.

Must be a slow news day. Maybe Trump will do something...The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Capt Slog wrote:bianchimoon wrote:

defaulting or revisit and make realistic sustainable payments? Certainly getting final salary pensions and winter fuel allowance, buss pass, TV licence etc can't be right or fair.

They will be due to go in a few years.

I know this because this because it will be about the time when I retire and this has been the story of my life.

Me too. Through successive company reorganisations and mergers I've skilfully failed to qualify for any long service awards while those with less service have. I was too young by a couple of months to remain in the final salary pension scheme so was moved into a DC scheme (age discrimination anyone?) Older colleagues with full service are now retiring on virtually the same money they got when working; I'll be lucky to make half that. Our first 2 mortgages were low cost endowments which failed to produce the returns we were promised; we had some compensation but I'm sure we're still seriously out of pocket. And just as we started to become more comfortable financially and I had a small inheritance, the bottom fell out of the financial world so our savings are earning three fifths of f@ck all, and the shares I acquired in BT, Lloyds and Barclays are worth a fraction of what they were.

So it stands to reason that just as I reach the relevant qualifying age, each universal benefit will be whipped out from under me too.0 -

You've just read my life out loud!!!keef66 wrote:Capt Slog wrote:bianchimoon wrote:

defaulting or revisit and make realistic sustainable payments? Certainly getting final salary pensions and winter fuel allowance, buss pass, TV licence etc can't be right or fair.

They will be due to go in a few years.

I know this because this because it will be about the time when I retire and this has been the story of my life.

Me too. Through successive company reorganisations and mergers I've skilfully failed to qualify for any long service awards while those with less service have. I was too young by a couple of months to remain in the final salary pension scheme so was moved into a DC scheme (age discrimination anyone?) Older colleagues with full service are now retiring on virtually the same money they got when working; I'll be lucky to make half that. Our first 2 mortgages were low cost endowments which failed to produce the returns we were promised; we had some compensation but I'm sure we're still seriously out of pocket. And just as we started to become more comfortable financially and I had a small inheritance, the bottom fell out of the financial world so our savings are earning three fifths of f@ck all, and the shares I acquired in BT, Lloyds and Barclays are worth a fraction of what they were.

So it stands to reason that just as I reach the relevant qualifying age, each universal benefit will be whipped out from under me too. All lies and jest..still a man hears what he wants to hear and disregards the rest....0

All lies and jest..still a man hears what he wants to hear and disregards the rest....0 -

PBlakeney wrote:Some people earn more than others.

Must be a slow news day. Maybe Trump will do something...

Probably, and distract from non-dramatic but important things onto dramatic but not important things.0 -

Yes i must confess to being a beneficiary. Civil service pension, wifes teachers pension both at 60, state pension at 65, mortgage paid. 2 x lump sums and a normous legacy sitting in our account. 2x part time jobs. More money than we know what to do with. And free prescriptions, bus passes and winter fuel payment.

Poor old no2 son cannot get a regular job for love nor money. Everything is low paid, no prospects or zero hours contract. Got to be something wrong. And as rick says, unsustainable...0 -

us oldies all expected to earn more than our parents and have a better standard of living and for the most part our expectation were met. There is nothing written in stone to say this should continue but maybe a decade of raging inflation would make everybody feel better off through devalued debts and nice pay rises.0

-

Is raging inflation renowned for making people feel better off?0

-

KingstonGraham wrote:Is raging inflation renowned for making people feel better off?

yes - so long as you aren't on a fixed income. The crucial word is of course "feel" and I had the proviso that pay was index linked.

Think about it - if your inflation/pay went up 15% per annum your salary would double in 5 years and your mortgage (other debts are available) would have halved in real terms.0 -

ahh the grand old days of inflation, 15% interest rates, endowment mortgages etc everyone of my generation could get on the housing ladder then, bring it back.. plus my savings will start earning money :twisted:All lies and jest..still a man hears what he wants to hear and disregards the rest....0

-

As long as you already have a mortgage. And your pay keeps pace with price rises.0

-

KingstonGraham wrote:As long as you already have a mortgage. And your pay keeps pace with price rises.

I am just throwing some economic theory around. In a perfect world it would be win/win but we do not live in a perfect world so would bound to be losers0 -

Surrey Commuter wrote:KingstonGraham wrote:As long as you already have a mortgage. And your pay keeps pace with price rises.

I am just throwing some economic theory around. In a perfect world it would be win/win but we do not live in a perfect world so would bound to be losers

The current situation wouldn't help younger earners because house prices have been inflated beyond them anyway, so the vast majority wouldn't have the debt to enjoy the inflation in the first place.

Appreciate I don't live in a cheap area, but house prices and rents around London are increasing faster than my wage does, and has been since I was working (and i don't earn badly, either for my industry, my age, or my education) - and that was where the work was when I graduated in '09.0 -

Retirement : - a word that will probably become obsolete from the Oxford English dictionary in a decade or so.Always be yourself, unless you can be Aaron Rodgers....Then always be Aaron Rodgers.0

-

Mr Goo wrote:Retirement : - a word that will probably become obsolete from the Oxford English dictionary in a decade or so.

Could always take on younger people from other parts of the world to help sustain the aged, who would chomp at the bit to have a higher earning potential in the UK.

Oh, wait, maybe not Goo. 0

0 -

Rick Chasey wrote:Mr Goo wrote:Retirement : - a word that will probably become obsolete from the Oxford English dictionary in a decade or so.

Could always take on younger people from other parts of the world to help sustain the aged, who would chomp at the bit to have a higher earning potential in the UK.

Oh, wait, maybe not Goo.

Let it go and try and have sensible dialogue without muck raking.Always be yourself, unless you can be Aaron Rodgers....Then always be Aaron Rodgers.0 -

Mr Goo wrote:Rick Chasey wrote:Mr Goo wrote:Retirement : - a word that will probably become obsolete from the Oxford English dictionary in a decade or so.

Could always take on younger people from other parts of the world to help sustain the aged, who would chomp at the bit to have a higher earning potential in the UK.

Oh, wait, maybe not Goo.

Let it go and try and have sensible dialogue without muck raking.

A study from the UN: Replacement Migration: Is It a Solution to Declining and Ageing?

http://www.un.org/esa/population/public ... ration.htm

On the UK specifically: http://www.un.org/esa/population/public ... ration.htmIn the absence of migration, the figures show that it would be necessary to raise the upper limit of the

working-age to 68.2 years to obtain a potential support ratio of 3.0 in 2050, and to about 72 years in order

to obtain in 2050 the same potential support ratio observed in 1995 in the United Kingdom, which was

4.1 persons of working age per each older person past working age. Increasing the activity rates of the

population, if it were possible, would only be a partial palliative to the decline in the support ratio due to

ageing. If the activity rates of all men and women aged 25 to 64 increased to 100 per cent by 2050, this

would make up for only 35 per cent of the loss in the active support ratio resulting from the ageing of the

population.

So you tell me if it's sensible to discuss it or not? :P0