2024 UK politics - now with Labour in charge

Comments

-

It's not for me decide that, but HMRC are quite capable of paying close attention of this type to individual cases in other areas of tax. May be practical to say that anything below a certain value for any given taxpayer is exempt regardless and focus on the larger ones.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

It can be plannable if you're not unlucky enough to die before you expect to. But the point here is more around not forcing the break up of businesses.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

No skin in the game whatsoever.

But I can spot a flawed tax policy when I see one.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Is that not what life insurance is for? Also given farming is hard physical and relatively dangerous work, planning for succession is just something any responsible person needs to do.

From some very crude sums, it doesn't look as though it forces the break up of a business any more than any other capital intensive business with a tax bill. As has been argued already, the use of farmland for tax planning/investment seems to have an inflationary effect on land values, dragging smaller farms above the threshold.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Possibly. Its easier not to go forward with a flawed tax policy.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

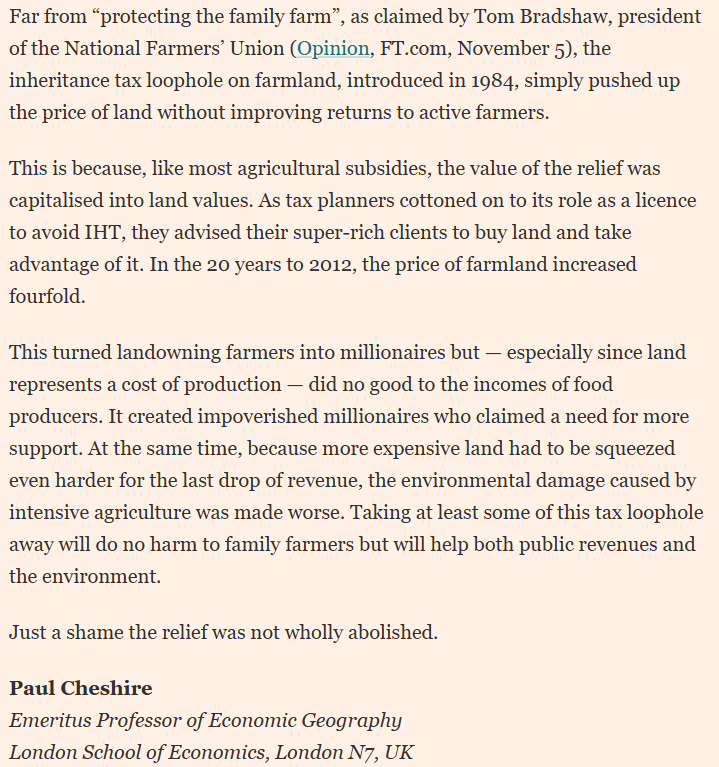

Isn't the flawed tax policy the one that encouraged a load of millionaires to buy farming land and push up prices so that they can avoid paying inheritance tax?

0 -

Succinctly put.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Obviously you can't, you're suggesting removing IHT for farmers without a clue how you are going to tell a farmer from anybody who just happens to own a farm. That's a flawed policy.

0 -

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Hence my suggestion above to modify the policy to combat IHT avoidance while not hitting regular farms.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

As mentioned above, it's not me making the policy. However I suggested an approach which is in line with HMRC line in other subjective anti avoidance matters as a starting point.

It's better than the leftiebollox 'soak the farmers' approach that you appear to have lazily accepted because you have no ideas of your own.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

It's not soak the farmers. It's put the farmers on the same basis as everyone else, so that their main resource isn't co-opted as a tax free savings facility. I guess the other option is to abolish IHT altogether, but then what instead? It probably needs an implementation period like any significant change.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

'Flawed tax policies' include the ones with a sensible intention but with 'creative workaround solutions' that keep tax planning experts in business and undermine the intention of the policies. Trying to define 'a genuine working farmer' would seem to be one of those, and which would keep lawyers in work too. I'm sure that with his £600m at stake, Dyson would spend a decent chunk of money to demonstrate that he is a 'working farmer'.

Keeping it simple, with a sensible monetary cap (I might argue that £1-3m is too low, £600m definitely too high), seems clear enough for people to plan for. And it still leaves options open for sensible succession planning to minimise/eliminate costs, as they do for all other large businesses.

0 -

IIRC* back in the 90s/early 00s a hotel chain owner died leaving an entire estate of £85. I'm sure Stevo will approve. Farmers could learn a lot from that.

*I tried a Google search to no avail.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

-

It's your policy, please explain how you would make it work. A sound policy won't leave loopholes, how will you close the gaping loophole in your policy?

At the end of the day the tax relief on land has created a problem and Labour are being responsible in removing it. There will be losers as a result, but the cause is allowing the relief in the first place, not the removal of it now. For balance from one of your favourite papers from last year:

For those that don't want to negotiate the paywall a big takeaway from the article is this paragraph:

"The Telegraph and 50 Conservative MPs are campaigning to abolish inheritance tax."

0 -

I didn't really follow the detail of the IHT changes re farming at the time of the budget, but re "At the end of the day the tax relief on land has created a problem and Labour are being responsible in removing it" was there anything in the budget speech about addressing inflated land values?

The non-biased (i.e. non-Telegraph) headlines were focused on the tax-raising potential and generic "My my offspring's retirement planning has been ruined" stories rather than anything about wider benefits from lower land values from what I recall. Though I could just not have been paying enough attention!

0 -

It looks like Labour might again have politically naive not to more carefully laid the groundwork with messaging about how they "were addressing the problem in the farming industry of artificially inflated land values" with the change in IHT. It's no surprise that the RW press has gone after this as a 'war on farmers', and Labour should have done their best to spike that charge, and to make sure that the point at which IHT kicks in was set at a realistic headline level.

1 -

The "messaging" was really the focus of my point above. Were inflated land values on Labour's radar, or just being able to demonstrate that they were taking a harder line via tweaks to the IHT regime on "rich people not paying their fair share"?

0 -

There was no messaging about inflated land values.

The assumption being made is that if agricultural land is less attractive as an investment with IHT benefits post the changes, demand will fall and therefore values will fall too.

People seem to be forgetting the reason Business Property Relief was introduced in 1976 (by a Labour Government btw), with Agricultural Relief following 8 years later.

I have stated a few times how you could hit the landlord land owners without hitting the working farm landowners.

0 -

Business and Agricultural Property Relief were introduced with good intentions, but those original reasons have been supplanted by a perceived need to get investment in property and land. The inevitable result of this has been to drive up prices which has negatively affected the very people that the policies were introduced to help. It is rather like how any government incentives supposed to help first time buyers has only resulted in inflating the price of those properties and making it even harder for first time buyers to get on the property ladder.

It has now become a vehicle for protecting assets for the very much much more than something to protect small businesses, something had to be done about it. At least the current government has had the balls to do it.

0 -

Given there was (per DB) no messaging around addressing this issue, do you think the government actually intended it, or is there simply a happy "after-the-fact" benefit that can be retrospectively used to justify a simple tax increase?

Seems odd that a government would fail to mention such a benefit (i.e. cheaper land prices for "real" farmers => lower food prices) if achieving such a benefit was its intention.

0 -

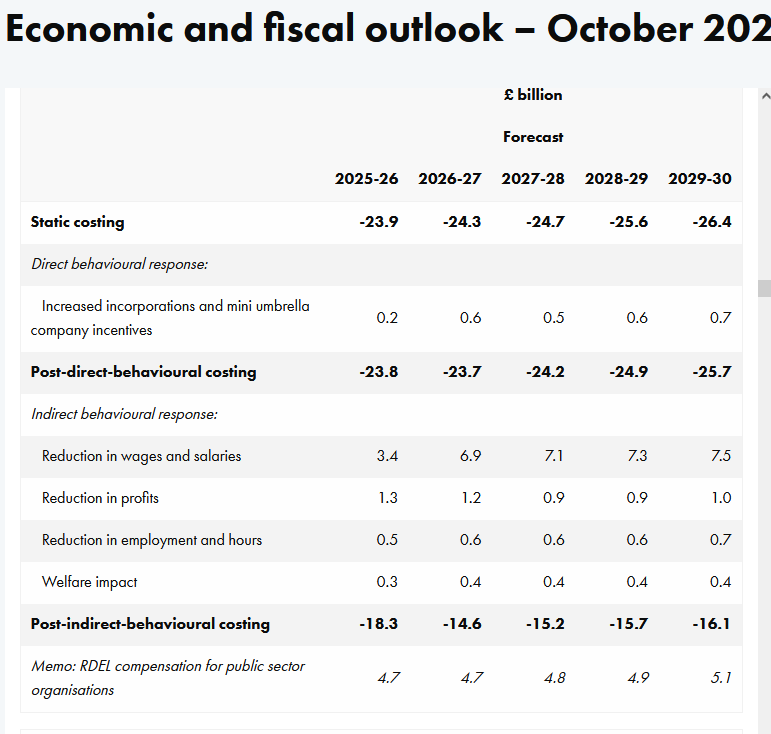

Apparently (no source) of the £25bn raised by increasing employer NI, a decent chunk of it comes from the government due public sector employees.

0 -

As I already said above. Set a high threshold so its only the 'big players' who you disapprove of who might get caught, then have a sensible set of tests for those cases over the limit, such as:

- Is the taxpayers main business farming?

- Are they actively involved in the running and management of the farm/land purchased?

- Is the land being used for agricultural activity of just left alone or fallow/if so what proportion is being used?

- Have they purchased other assets involved in the running of the farm (vehicles, agricultural supplies etc)

- How long has the farm/land been owned (may predate the time when the rules applied)?

This is not fundamentally different from the anti avoidance tests in other areas where it is necessary to determine the main purpose of a transaction or series of transactions. Or the verious tests to determine whether a taxpayer is trading for tax purposes. Typically the taxpayer needs to demonstrate these things so not that difficult from a HMRC perspective - they mainly need to make the judgment.

Now let's hear if you have a better idea. Or for that matter, any idea at all.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

I suspect that they did not intend to pick a fight with farmers and it is naivety to some extent.

However, as governments in countries such as France, Netherlands and Germany (and indeed the EU) have found out to their cost, it is generally not a good idea to **** off farmers.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Some people think it should be. Lefties, surprisingly...

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]1 -

Are you sure?

I thought the increase doesn't apply to most of the public sector.

0 -

Seems to be correct. £5bn reduction in the gain from compensation paid to public sector employers. Also, a lot lost due to behavioural changes, so actually the gain the for the government is a lot less than stated at around £11bn-£14bn.

0 -

Public sector employers still have to pay the going rate of employers NICs but get an amount added onto what they are allowed to spend so that they don't go over budget (that's the RDEL compensation)

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

The Lord giveth and the Lord taketh away.

0