2024 UK politics - now with Labour in charge

Comments

-

Freezing the threshold is actually a good idea. It spreads the pain of tax-raising initiatives, which long term, is the only way to reliably generate significantly more tax in % terms. (Whether this is by thresholds, higher rates or VAT is largely irrelevant to the fact that many shoulders, not just the broad ones have to bear the burden.)

0 -

I'm afraid to say that I think Labour have fallen slightly into the Trusstrap of trying to do too much too soon.

To make it worse, having dithered for 4 months, all they've announced is tax and spend. That's easy. They now need to follow up extremely quickly with some meaningful reforms - i.e. actual policies - or it will unravel for them.

0 -

I think for all the focus on the tax breaks, IMO the key issue is more around MW. The major problem with most people on the left (and is fairly obvious from my posting history I am one of them) when it comes to economic policy is that they think it is just a case of increasing wages to level up inequality. Of course that helps, but it is based on the premise that higher wages equals greater spending power which leads to more money circulating and a stronger economy. The first problem is that businesses have to grow in line with the wage costs to cover them which doesn't often happen. You are then also reliant on wages rising in line with increased costs of living otherwise you are just caught in a cycle of ever increasing costs which eventually stagnates wages again.

The real issue (again IMO) is the UK's poor productivity, and as FA alludes to, this requires proper policy to address. Long term we need an actual targeted plan to build key sectors and an associated skills plan starting in schools to develop the workforce to maintain these sectors. We need a proper housing and infrastructure plan so businesses can be located in the right parts of the country and people can afford to work and travel to them. I would suggest we also need to massively rethink our working practices to make people more efficient and actually more satisfied in their work to perform better.

Technology is also a big issue. There is plenty of technological advancements, but unless you are a huge business with a large R&D or investment budget, you can't access it. I could add 2 or 3 new machines into production which would probably increase turnover by 20-25% and mean I could employ more people, but I don't have a six figure investment sum to buy them.

0 -

That didn't take long 😊

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Well, at least the markets don't seem to have been spooked in the same way, so, my guess is that they want to get the start of the 'reset' out of the way early, so people will notice the difference in things like the NHS & schools by the time of the next election.

0 -

Also the growth forecasts don't look great. There appears to be a bit of a splurge induced 'sugar rush' in the short term but then falls back again to a pretty mediocre level - certainly not in line with the rhetoric about growth, but probably to be expected given the impact on growth of the extra tax on businesses.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Yes, I see this as piling as much pain early so that they can offer some fig leaves in 4 years' time.

The markets were spooked slightly I think, because borrowing rates went up and growth forecasts went down.

The latter is in the realms of reading tea leaves, and for all I know the former has already self corrected.

0 -

Well the Tories still have to demonstrate some common sense re leader for the next GE and tack to the centre rather than to the right of Farage before the ducks will start lining up. So don't count your chickens!

0 -

They are taking their sweet time about policy making that's for sure. All of the spending is a bucket with a hole in it without some sensible thinking on what they are spending it on.

The big gap, as the Lib Dems are pointing out, is on social care.

I'm really starting to worry that this lot are a bit amateurish, which means we have no serious politicans at all, because the Tories are still way way worse.

0 -

Showing no signs of that at present. No real acceptance or even a desire to examine why they got trounced at the GE. Still largely preoccupied with appeasing the right of the party and neither Badenoch or Jenrick will tack centre.

0 -

Interesting that the triple lock is kept, the big tax increases being on NI and no changes to anything major on pension allowances - is literally the only thing affecting most pensioners the winter fuel thing? Makes that move look very weird.

Along with not increasing fuel duty, they've been very careful in the budget not to pick fights with the groups most effective at lobbying, but I bet they don't appreciate it.

0 -

Agreed. But 5 years is a long time in this game.

0 -

They didn't even add NI to for those of retirement age who are still working.

0 -

It's all just a bit meh for me. We all knew taxes were going up (regardless of who won the election) and as far as effect expectations went this is leaning towards the benign level.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Agree, things can change. My fear is that they have been heading this way since May was ousted and if anything they have slowly got worse over the last 5 years. There really needs to be a major power shift in the party and I don't see where that is coming from.

The argument will be made that if Jenrick/Badenoch fail then they will be usurped and a moderate is likely to replace them. The prolem is that the right of the party, people like John Hayes, Braverman, Kruger etc. are all ideological and like Corbyn on the left, they care more about being in charge of the party rather than winning an election. Unless someone can come along and oust them as per Starmer and the Corbynista's, I don't see much changing within the Tory ranks. They needed Cleverly in charge to start that process but I think they have missed out and it won't be a short or even medium term fix now.

0 -

The other elephants in the room are public sector pensions amd the sheer size of the state IMO. But I don't expect them to tackle either.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Just read a piece about how the Inheritance Tax on pensions is due to work - talk about complicated. The executors are going to have a whole load of extra work to do which they will struggle to understand.

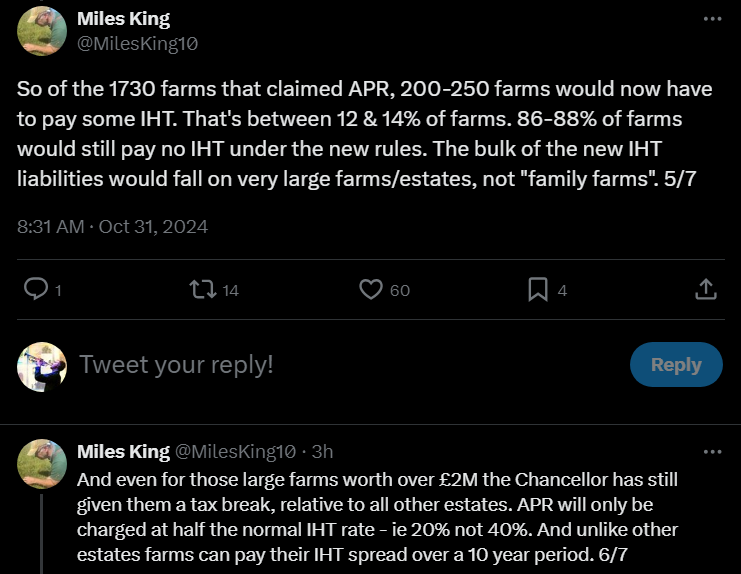

The IHT on farms is really bad news and won't raise very much in the big scheme of things, but will put a lot of small farms out of business. That'll please Rick no doubt, but have a negative impact on rural communities when the big corporate farms take over and there is minimal interaction with the community.

Interesting that the OBR could not substantiate the alleged £22 bn black hole, or get anywhere near to that sort of figure.

0 -

I noticed that the same commentators were simultaneously deriding OBR forecasts as finger in the air guesses and using them to bash the budget as anti-growth. I'm not sure they can have it both ways.

The OBR forecasts also don't factor in the proposed planning reforms, which is probably the biggest single change Labour can make.

It's pretty ironic that the planning system - which is as Old Labour, managed economy as it gets (hey let's centralise control of *all* development!) has become such a Conservative brand.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

The IHT change on farms isn't quite as cataclysmic as it sounds, because the 7 year rule applies. I don't think that many farms will be handed over to the family without having thought about it first. Its going to be a cruel blow where it does, though.

The reason IHT is so hated is because when it applies - at a time of grief. It would make more sense to me, if popularity is your thing as a politician, to tax those assets at a different time, such as capital gains.

0 -

Agreed though I think the rightwards-tacking started some time before May was ousted, given the sheer number of remainer Tory MPs who felt compelled to enthusiastically embrace Brexit rather than simply accepting it.

0 -

Want to throw granny out of her home do you?

0 -

A big elephant is that average earners don't pay much income tax in the UK vs those peer countries.

Another one is the extent of worklessness, either through choice or ill health (of self or relative who needs care).

Also brewing in the background is the "Covid Generation" of kids for whom school has become something to do when there's nothing more enticing on offer. How "productive" will this generation be, one wonders.

0 -

A lot of farmers are tenants though, so it won't make much difference to them. Farm land may even become cheaper as a result as there will be less competition to buy land from those trying to avoid IHT.

0 -

Also no incentives to solve the lack of kids. Not sure VAT on private schools will help with that.

0 -

-

88 hectacres is apparently the average farm size and average farm land value is around £22,250 per hectare, and then add the value of the buildings and agricultural tied accomodation and you come out at well over £2 million per average farm.

With regards to Bean's point abount tenant farms, what if the landlord has to sell of some of the tenant farmer's land to pay the IHT bill?

It really is a petty and pointless change that will bring in not a great deal in the big scheme of things, but will cause a lot of problems for those impacted.

0 -

The value of the farming business and the value of the land asset are separate, so if you are a tennant farmer this policy change makes no difference.

The reason most family owned farms will not attract IHT is that most family owned farms will be handed over more than 7 years before the death of the current owner. All that leaves is the farm house, which may or may not already be occupied by the successor within the family, in which case there's a fair market rate rent issue to be addressed, or an eventual IHT issue. I don't see why farmers homes should be any different to anyone else's in that basis.

If there is no successor within a family, the farm is sold and attracts CGT, which is fair enough.

0 -

And that 12-14% number will drop radically once the new policy kicks in, because people will know they can't use the exemption.

0 -

To play devil's advocate: surely if the farms are being run as genuine businesses, then they just do what a normal business would do, and pass it onto the working generation at a sensible age, thus (hopefully) avoiding IHT completely. However, if it's just a way of avoiding IHT (a la Clarkson), then isn't it a sensible policy, as it should reduce the demand for land for tax-planning reasons, and make it cheaper for genuine farming businesses to buy?

The value of land to a farming business is not in the value of the land, per se, but in its earning potential, so a reduction in its value would reduce the barriers to entry to new farming businesses.

0 -

Yep, I read somewhere (IFS I think) that our average earners pay less tax than in comparable countries, so if we want better services then its time for average earners to step up to the plate and pay more...although Labour couldn't really do that given the they had promised not to increase.

Worklessness is also a big one, but no easy solutions.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]1