2024 UK politics - now with Labour in charge

Comments

-

Was it previously the case that you could die and your beneficiaries would pay no tax in lieu of the income tax avoided and no tax for inheritance either?

0 -

If the pension owner died aged over 75, then income tax would be payable by the inheritor when it is paid out.

If under 75, then no income tax or inheritance tax.

New system, just adds inheritance tax to this, so if the pension owner dies aged 75 or over, then both inheritance tax and income tax payable.

0 -

Are there a million private jet flights in the UK each year? Genuine question.

0 -

Agreed. But all parties produce manifestos, so it's not unreasonable even as an academic exercise to assess the extent of non-compliance.

0 -

Still feels wrong. The inheritor should just get a pension which is taxable when they draw it.

0 -

Nothing like it -that's actually the increase from all the changes to the air passenger duty, so no. My mistake.

1 -

Google reckons it's a 10th of that, which tallies with my gut feel if you work out a per day number.

Eyeballing it looks like apd is a relative bargain on private jets compared to first and business. But maybe I was scan reading poorly.

1 -

Not really - if there has been tax relief on the way in, then there should be tax paid on the way out, but it should also be subject to inheritance tax in the same way as any other asset (that has not been subject to tax relief when bought).

I think it still feels weird that it is treated differently either side of 75 though.

0 -

Yes, that is what I meant. Taxed out plus inheritance tax, but I could accept it remaining behind a tax wall as opposed to instant income tax. It feels ridiculous that someone under 75 could have bequeathed untaxed income with no income tax or inheritance tax.

0 -

i never understood the 75 threshold either

was it an attempt to give surviving spouse (or other heirs) a bit extra if their partner snuffed it beforehand?

or a measure that was introduced when they figured most of the electorate wouldn't be leaving much in this form, making it an easy tax grab without too much oinking from the express, mail etc.

i suspect the latter

my bike - faster than god's and twice as shiny0 -

Credit to Stevo, he told you all.

2 -

Everyone knew taxes were going up. The only question was which ones.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

I actually like the differential between draught and shop bought beer. I like the idea of pubs being a place where people can go and meet friends and for me that should be encouraged. They are part of our culture - I'd have gone further with bigger cuts offset by bigger rises.

Drinking at home is much cheaper anyway and generally doesn't have the same benefits. I drink more alcohol in pubs than I do at home so it benefits me slightly too.

[Castle Donington Ladies FC - going up in '22]0 -

Just work for no particular reason

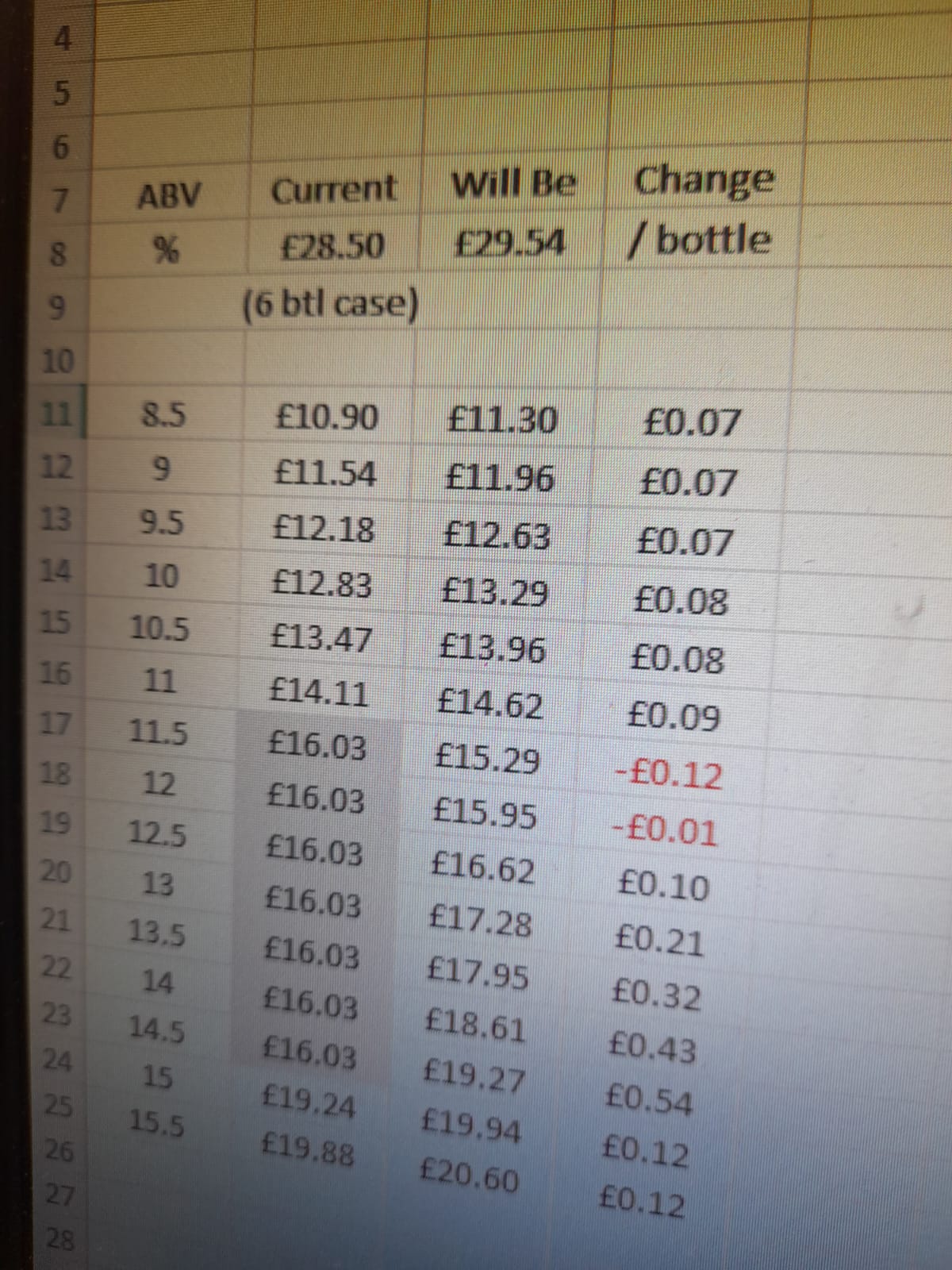

Stock up on your nice reds

“New York has the haircuts, London has the trousers, but Belfast has the reason!0 -

The 1p on beer really is the most obvious distraction, but it works a treat

Balls & Osborne on their podcast saying alcohol duty wasn't going up

“New York has the haircuts, London has the trousers, but Belfast has the reason!0 -

bubbly pretty neutral, tawny port maybe up a smidge, fine for me 😀

my bike - faster than god's and twice as shiny0 -

That's the idea. Encourage lower ABV drinking

“New York has the haircuts, London has the trousers, but Belfast has the reason!0 -

Unreasonable, no. Worthwhile, not so sure. What are you going to do? Five years later, the disappointment has been superseded by other deficiencies.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

75 has always been a transition age in pensions, from some old pensions having to be drawn by the 75th birthday, to the final 'Benefit Ctrystalisation Event', to the sudden taxation of beneficiaries drawdown. Where 75 came from I don't know though.

There needs to be clarity about how including pensions in the Inheritance Tax regime will actually work. It is likely to cause probate being needed on first death which will cause delays (and potential hardship) before the surviving spouse can access the fund, and then on second death, can the pension wrapper be preserved, and can the IHT be paid from other assets, or must the pension pot pay a share of the overall liability. And confirmation that the spousal exemption will apply.

0 -

It can stay in the pension - it doesn't have to be taken as one lump sum.

0 -

Embarrassing

0 -

Indeed. Although messing about with employer NI contributions is probably one Tory policy that Stevo wishes Labour weren't copying!

I think the truth is that it's a bit of a wasted opportunity. They probably still would have won a majority with pledge to only put a penny on the basic rate (or something along those lines). They've boxed themselves in and have now delivered a tax rise that is just about defensible next to the manifesto, but probably does more harm than raising income tax slightly.

0 -

I'll get the t shirt printed tomorrow. Although tbh it was a bit like predicting that the sun will rise in the morning.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]1 -

The employers NIC hike, minimum wage increase and forthcoming workers rights reforms is a fair old hit on businesses. Will be interesting to see what this does for growth.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]1 -

Good to see that the Telegraph is taking the analytical approach.

0 -

That is some seriously shonky caricature.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition1 -

Looks more like Anjelica Huston.

0 -

Agree re there being no practical benefits from such analysis, but the CakeStoppers discuss all sorts of political and economic issues to no practical effect. And as discussions quite often get heated (and sometimes lead to a "flounce") there's obviously something important at a psychological level about contributors being able to conclude that they were "right".

FWIW, the pre-budget discussions here and in the media have been useful for me. I wasn't really paying attention during the election campaign, having years ago decided that I was voting "Not Tory" for the foreseeable future, though I did note that the commitment to not increase so many taxes was likely to come back and bite them on the bottom.

The embarrassing nonsense relating to definitions of "worker" and the attempts by left-leaning media to justify it do make me more likely to return to the Tory fold sooner rather than later, as the blatantly disingenuous approach to communications, sophistry and sycophantic cheer-leading from the media was something I hope we'd left behind with the end of the Tory era. But clearly not! So if we're going to get that whether we vote left, right or centre, I might just as well vote right, and get an administration that more closely aligns with my economic views.

0 -

Re the changes to IHT and pensions, there was an interesting article by Baroness Altman in the Torygraph today. Her general gist was that it was a bad move, as it will disrupt retirement planning and thus be a general disincentive to long term savings, to the detriment of the nation as a whole. I'm not sure this really makes sense as an argument.

Whilst I'm a big fan of not changing the regime so that folk face a dramatically different regime at short notice close to retirement (e.g. overnight reduction to max TFLS "bad"; phased in reduction "good") surely no-one relies on an inherited pension pot as a serious part of their retirement planning. Whilst everyone always dies, there is no certainty whilst relatives are still healthy as to when they will "shuffle off", or how much expense there will have been on elderly care, so one simply cannot plan for an amount or a time re inheritances.

0 -

I quite like the bare-faced hypocrisy of it all

The increase in minimum wage is back to being a hit on business and freezing the threshold is now a stealth tax.

“New York has the haircuts, London has the trousers, but Belfast has the reason!0