FIRE - Financial Independence Retire Early

Is it just me getting annoyed by the hype of this movement?

They say things like the following:

*) in order to retire you need a pension pot 25 times your annual living expenses. I was almost tempted to agree with this. But with no mention of housing (paid off? or renting? or living on a friends sofa?) isn't it an empty statement...?

*) If you live frugally for the first 7-8yr of your career, you can save/invest enough such that you can retire even if you have "normal" earnings. Absolute nonsense. Maybe if you score a double on a Champions League final, but if so you probably don't have "normal" earnings. If you disagree, example with hard numbers, please.

*) A couple claim they live on 20k/yr (each? or combined?) and managed in a year 3 leisure trips on different continents. Do you believe this? I don't. Btw, housing paid off or what? Again, without details is a very empty statement.

Sounds arrogant to me.

https://www.bbc.com/reel/video/p09qwdp6/playing-with-fire-how-to-quit-work-and-retire-in-your-30s

Comments

-

Never heard of it before so not been getting annoyed.

0 -

To answer your first point, then a sustainable level of withdrawal from an investment pot, whereby you will never run out of money is around 3.75% , so a pot 25 times your required annual outgoings is about right.

However to build up such a put by your 30s is highly unlikely for almost all the population. (Exceptions being some pro-atheletes, entertainers and influencers)

1 -

Agree 100%

0 -

#1. Sounds about right for a couple, see #3. I'd assume those retiring have paid off their mortgage and without debt.

#2. Bollocks.

#3. Entirely feasible if each and have paid off their mortgage and without debt.

The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

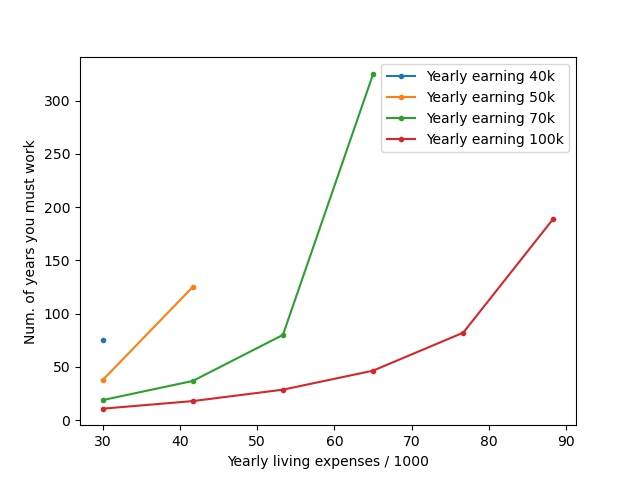

OK here we go, I did a little math myself based on the assumption you need a pension pot 25x your yearly living cost (this assumption I find reasonable)

So if you average 50k/yr earning (after tax, that is), so orange line, but you live on only 30k/yr (good luck with that, including housing and kids of course), you only need to work 37yr.

And if you earn average 70k/yr (green line), spend 30k/yr, you only need to work 30yr

If you start work at 25....

import numpy as np

import matplotlib.pyplot as plt

earn = np.array([40000,50000,70000,100000])

plt.close('all')

plt.figure()

for j in range(len(earn)):

minimum = 30000

spend = np.linspace(minimum,earn[-1],int((earn[-1]-minimum)/10000))

print(spend)

N = np.zeros(len(spend))

for k in range(len(N)):

ssave = earn[j]-spend[k]

if ssave<0:

print('******************')

if ssave>0:

N[k] = 25*spend[k]/ssave

plt.plot(spend[N>0]/1000,N[N>0],'.-',label='Yearly earning '+format(int(earn[j]/1000))+'k')

plt.legend()

plt.ylabel('Num. of years you must work')

plt.xlabel('Yearly living expenses / 1000')

plt.show()

0 -

Look on the lemonfool.co.uk forum, there is a Retirement Investing (inc FIRE) section. I find that forum useful in general. (It is the successor to the closed down motleyfool.

1 -

Getting triggered by people getting their financial shizzle together seems a bit strange.

Since most of the early FIRE starters seem to be US based, I looked for UK exponents. The Escape Artist is a great place to start, although I'll take a look at the lemon fool.

Even if the full on principles aren't for you there's a lot of inclusive debate within the UK FIRE community and much to learn.

================================

Cake is just weakness entering the body0 -

The guy with kids seemed pretty switched on.

The guy who's selling his book is a bit of an outlier surely.

0 -

I am planning to retire in 5 years, 10 years ahead of statepension.

Income should be around 14k plus about 30k cash to burn over a period of 10 years until state pension kicks in. There will also be a lump sum, which most likely will be used to settle any oustanding mortgage and/or any shortfall when we move somewhere nicer.

It’s not a lot of money to live off, but I decided yo choose life

left the forum March 20233 -

Interesting, thanks for sharing.

Apologies if I'm nosy....

14k/yr gross or net?

And is this for the two of you, or your partner will have some other income?

0 -

14k gross, net will be very similar, I presume. This is just me. My wife has a pension pot, so she can decide how much she wants to withdraw, mine is a defined benefits pension.

left the forum March 20230 -

OK, thanks.

0 -

@pep.fermi In the UK the first £12,570 of income is not subject to tax. There is then a savings allowance of £1,000 for interest received on savings account.

0 -

Yes I knew but thanks nonetheless for pointing it out.

0 -

But to put things into context, had I started paying into my pension at 27, which is average in my sector, instead of 32, I could probably retire at 55 or at 57 with a much healthier pot. So, it is possible to retire early with a rather average salary… if you want to retire earlier than 55 (or 57 for you) then you are looking at other schemes than pensions obviously. You need to luck out with early life investments and you need a bit of help in the form of inheritance.

Personally, I see retirement as a way to choose where to live and when to work, rather than a way to play golf every day. Some people might not even need to retire in order to achieve that, you just need a fully flexible remote job.

left the forum March 20230 -

Thanks for the discussion.

Just to say:

I didn't start the thread with "I'd like to retire early, can someone please help by sharing their experience.....?" Which is more the question you seem to be answering and absolutely fine and thanks for that.

I'm more like "I'm annoyed by the hype of this FIRE thingy that claim to be feasible / realistic instead it is simply not. You also annoyed, guys?"

These FIRE guys either A) do not present hard numbers, or B) present very unrealistic numbers.

Cheers,

0 -

I think it is simple and realistic to retire early if you are focussed in that direction.

If people didn’t get embroiled in car finance and all sorts of other useless expenses, but instead they put money in a pension fund… if they didn’t proliferate and fill the planet with more baby consumers and then spend a fortune to look after and raise them, it is indeed very achievable by almost anyone.

The simplest thing to do is to invest any excess of 50k in pension products, that avoids paying 40% of it in tax. Most people with a decent job will get to 50k before the age of 40, so there is plenty of time to build a sizeable pot out of money that would otherwise go to the exchequer.

That means if you are a train driver on 60k, on top of your employer pension, you should invest 10k every year in your retirement… do that at the age of 40 and by 55 you will have around 250k just from that extra. That is a pension in itself

left the forum March 20230 -

"… if they didn’t proliferate and fill the planet with more baby consumers and then spend a fortune to look after and raise them, it is indeed very achievable by almost anyone."

That's quite some take, especially when discussing retirement where the "baby consumers" are paying the way for the previous generation once they enter the workplace let alone wiping their arses and providing their medical care. Also, very few people are lucky enough to have access to the sort of define benefit scheme you will be enjoying. I've been paying into a pension scheme for nearly 35 years and there's no way the pot is going to be close to an amount I can live on while I'm still in my 50s.

0 -

Retiring early is a selfish choice, so what happens to the country when I am gone is not my concern. If everyone retired early… it would not be sustainable, but luckily there is no shortage of folks who like fast cars and babies, so I can live off their struggles.

As for defined benefits, they are not better schemes, they simply force you to save more. For example, the NHS pension forces you to put aside almost 30% of your salary every month, whereas the University one is around 20%.

Most defined contributions schemes put aside less… but

1) it is up to you to decide if your priority is cash now or pension later

2) you can always contribute more

The reason people do not do it is typically because they want a family and therefore a bigger house and they cannot afford to and/or they have unrealistic expectations about the lifestyle they should have.

It is always a choice.

left the forum March 20232 -

Bottom line is just what I said above.

Look at your gross pay, anything above 50k should go into pension funds/schemes.

It is mindboggling to think that someone, rather than putting aside 10k per year, would give 4 to the exchequer and spend the remaining 6 in stuff that will be worthless in a matter of a few years if not months.

Think about it… it is utter madness to not contribute as much as it makes fiscal sense!

left the forum March 20231 -

I have both types of pension, DB is significantly better relative to the contributions. It's the reason there are so few left, they are generally unsustainable.

0 -

well, those ones no longer exist. Final salary schemes are a thing of the past and now more or less you get what you pay in, so they are not terribly different from a defined contribution… the point is that most people don’t even know how much they pay and their employer pay, or they think that 10% contributions is a good figure (it’s not).

If you want to retire early, you should probably aim towards 25%, between employer and employee contributions… and if your employer only puts 5%, then maybe that salary is not as good as it seems.

There is unfortunately too much ignorance around pensions

left the forum March 20230 -

NHS pension contributions are no where near 30% of a members pay. The max is 12.5% for earnings over £62,925 pa.

Contributions start at 5.2%.

The University Scheme is 6.1% pa

1 -

I find interesting that you have such strong and negative opinion about people making life choices different than yours. I'm closer to you than to others, but I don't think those who prefer to retire later so they can drive a bigger car are doing anything wrong. Or having children. Or whatever. Their life their choice.

Yes, I agree there is much ignorance (on pensions, and on maths, and on many other life-essential things) and this is extrremely bad. So people "make choices" they are not even aware of. Disaster.

Beside, can one live with 50k/yr gross? With no inheritance, a non-earning spouse, children, and normal housing cost near a big city...?

1 -

Not to mention, 50k gross is a massive salary to many people...

2 -

That is incorrect, as it only considers the employee portion of the contribution.

The employer also contributes 24% for the NHS and 14% for the University scheme

left the forum March 20230 -

I am not judging, I am just saying that if you want to retire early, you need to make life choices in that direction.

Buying expensive cars, having children and buying houses you cannot afford are choices that go in the opposite direction. They are life choices, I decided not to do any of those things. I don't have great respect for those wasting money they don't have on JLR products, that's all...

Can you live with 50k gross? Well, you should be able to and if your partner also has 50K gross, then you should be very comfortable. Obviously if that salary is related to a job in the City, then you need to look for something else or for more money.

Anywhere else in the country, you should be more than OK.

Remember, everything is a choice...

left the forum March 20230 -

I think the language you chose to use was definitely judgemental. You seemed to be sneering at people who feel other things are part of having a fulfilling life. Whilst I'd love to retire early I wouldn't want to do it at the price of living a miserly life or not having the (mainly) joyful experience of raising children.

0 -

This is what you said Ugo, which is ipatently incorect:

As for defined benefits, they are not better schemes, they simply force you to save more. For example, the NHS pension forces you to put aside almost 30% of your salary every month, whereas the University one is around 20%.

You are not sacrificing any salary to get the employer contribution. The employer contribution is not part of your salary. Opt out of the scheme and your salary will not change. You are putting aside 6.1% (not 20%) of your salary to get a gold plated scheme.

If DB schemes weren't considered better in general, then why is it so difficult to transfer out of one?

The liability under a DB scheme falls with te sponsoring employer - they are the ones having to make up any shortfalls in funding.

For a DC scheme, that liability falls with the member. Sure DC has more flexibility, but carries far more risk for the member.

0 -

Guys, thanks to everyone for the discussion.

But can we please go back the question I started with: how realistic do you see this FIRE thingy?

Are you also annoyed by it?

Are you also annoyed by the fact that FIRE advocates tend to not present examples with hard numbers, realistic numbers?

Start work at 19, earn 80k/yr, live on 10k/yr so you can happily retire in your 30s.... is it just me feeling offended when such a message is presented as no big deal? OK, I exagerated, on purpose, but still....

0