LEAVE the Conservative Party and save your country!

Comments

-

Dividend taxes also going up.0

-

I guess the rona bill needs to be paid for, though it's questionable timing.

Green shoots of recovery, Brexit still filtering through, whack up the taxes.

Eek0 -

Isn't calling it a 1.25% rise a bit disingenuous when it's a 1.25% rise for both employers and employees?0

-

You really don't want them to do what they did after the last crash!rick_chasey said:I guess the rona bill needs to be paid for, though it's questionable timing.

Green shoots of recovery, Brexit still filtering through, whack up the taxes.

Eek0 -

I do wish politicians would stop visiting care homes in a pandemic for photo opportunity.

I would be spitting blood if they did that in a care home of a relative.

I've not been able to see a relative of mine for 5 weeks because of multiple rounds of corona cases, which means relatives can't visit for the entire week after the case is found.2 -

Nobody told them that game of Connect 4 was won quite a while ago, and a few times. Maybe they just like making patterns.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.0 -

Who do you think won? I'm guessing yellow, because she clearly just doesn't care about the rules regarding one piece each per go.pblakeney said:Nobody told them that game of Connect 4 was won quite a while ago, and a few times. Maybe they just like making patterns.

0 -

One of the stupider aspects of Johnson's plan is that by putting it on employer NIC he will actually make it more expensive to employ care staff. And those staff will see a drop in take home pay.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Also ni comes out of ebitda, as it's a cost not a tax.rjsterry said:One of the stupider aspects of Johnson's plan is that by putting it on employer NIC he will actually make it more expensive to employ care staff. And those staff will see a drop in take home pay.

0 -

A cap will be introduced on care costs from October 2023 of £86,000 over a person's lifetime.

All people with assets worth less than £20,000 will then have their care fully covered by the state, and those who have between £20,000 and £100,000 in assets will see their care costs subsidised.

Does 2.5% per worker actually cover this? The £86k cap in particular sounds expensive.- Genesis Croix de Fer

- Dolan Tuono0 -

TINO has got the top marginal rate of tax on income up to an eye watering 63.25%1

-

Javid admitted in the interview that they don't know when social care can expect to feel the benefit of the new taxes as it is also funding the attempt to deal with the vast NHS backlog.1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

Anyone thinking this will be ring fenced is naive to say the least.rjsterry said:Javid admitted in the interview that they don't know when social care can expect to feel the benefit of the new taxes as it is also funding the attempt to deal with the vast NHS backlog.

The money is simply being put into the pot.The above may be fact, or fiction, I may be serious, I may be jesting.

I am not sure. You have no chance.Veronese68 wrote:PB is the most sensible person on here.1 -

85% of this over the next three years goes to the NHS, 15% to social care.0

-

-

https://www.theguardian.com/environment/2021/sep/08/audit-office-blames-uk-government-for-botched-15bn-green-homes-scheme

A “botched” scheme to insulate England’s draughty homes collapsed after six months because officials rushed its design, put in place an undeliverable timetable, and failed to heed industry warnings, Whitehall’s spending watchdog has found.

The National Audit Office (NAO) blamed the government for scuppering the opportunity to help households to improve the energy efficiency of their homes, reduce carbon emissions, and create tens of thousands of jobs by rushing the flagship scheme.

Sound familiar?0 -

I wonder if there could possibly be a link between underfunded social care and an overburdened NHS.rjsterry said:Javid admitted in the interview that they don't know when social care can expect to feel the benefit of the new taxes as it is also funding the attempt to deal with the vast NHS backlog.

0 -

I do think the idea of just being the smartest and/or the hardest working being enough to make you successful is now a dream and not reality, nowadays.0 -

Whilst employer's NI is a ridiculous concept, it is not really sensible to include it in the employee's calculations as the employee has no right to receive that money. The "on costs" associated with employment are higher than people think.rick_chasey said:

I do think the idea of just being the smartest and/or the hardest working being enough to make you successful is now a dream and not reality, nowadays.0 -

How should it be expressed so the "tax due because of employing someone each month" calculations are not distorted by it being a bit hidden?TheBigBean said:

Whilst employer's NI is a ridiculous concept, it is not really sensible to include it in the employee's calculations as the employee has no right to receive that money. The "on costs" associated with employment are higher than people think.rick_chasey said:

I do think the idea of just being the smartest and/or the hardest working being enough to make you successful is now a dream and not reality, nowadays.

0 -

No view at all, but the employer's NI is tax deductible, so a profit making company would get a reduced CT bill from the increase.kingstongraham said:

How should it be expressed so the "tax due because of employing someone each month" calculations are not distorted by it being a bit hidden?TheBigBean said:

Whilst employer's NI is a ridiculous concept, it is not really sensible to include it in the employee's calculations as the employee has no right to receive that money. The "on costs" associated with employment are higher than people think.rick_chasey said:

I do think the idea of just being the smartest and/or the hardest working being enough to make you successful is now a dream and not reality, nowadays.0 -

They would get the same reduction if they paid it to the employee in the absence of employer's ni. Even if it were then taxed.TheBigBean said:

No view at all, but the employer's NI is tax deductible, so a profit making company would get a reduced CT bill from the increase.kingstongraham said:

How should it be expressed so the "tax due because of employing someone each month" calculations are not distorted by it being a bit hidden?TheBigBean said:

Whilst employer's NI is a ridiculous concept, it is not really sensible to include it in the employee's calculations as the employee has no right to receive that money. The "on costs" associated with employment are higher than people think.rick_chasey said:

I do think the idea of just being the smartest and/or the hardest working being enough to make you successful is now a dream and not reality, nowadays.0 -

Yes, they would, but that is not how it currently works. Is anyone expecting a pay cut due to the employer's increase?kingstongraham said:

They would get the same reduction if they paid it to the employee in the absence of employer's ni. Even if it were then taxed.TheBigBean said:

No view at all, but the employer's NI is tax deductible, so a profit making company would get a reduced CT bill from the increase.kingstongraham said:

How should it be expressed so the "tax due because of employing someone each month" calculations are not distorted by it being a bit hidden?TheBigBean said:

Whilst employer's NI is a ridiculous concept, it is not really sensible to include it in the employee's calculations as the employee has no right to receive that money. The "on costs" associated with employment are higher than people think.rick_chasey said:

I do think the idea of just being the smartest and/or the hardest working being enough to make you successful is now a dream and not reality, nowadays.0 -

If a business is to hit the same profit targets, there will need to be cuts somewhere. Any expected pay rises for next year will take this into account.TheBigBean said:

Yes, they would, but that is not how it currently works. Is anyone expecting a pay cut due to the employer's increase?kingstongraham said:

They would get the same reduction if they paid it to the employee in the absence of employer's ni. Even if it were then taxed.TheBigBean said:

No view at all, but the employer's NI is tax deductible, so a profit making company would get a reduced CT bill from the increase.kingstongraham said:

How should it be expressed so the "tax due because of employing someone each month" calculations are not distorted by it being a bit hidden?TheBigBean said:

Whilst employer's NI is a ridiculous concept, it is not really sensible to include it in the employee's calculations as the employee has no right to receive that money. The "on costs" associated with employment are higher than people think.rick_chasey said:

I do think the idea of just being the smartest and/or the hardest working being enough to make you successful is now a dream and not reality, nowadays.0 -

Because in three years time nobody is going to defund the NHS so they will just double this new tax to sort out social care.rick_chasey said:Yeah why didn’t they just say it’s for the increased NHS costs cos of rona

Do we know when this new cap and collar policy will be introduced?1 -

If the argument is that social care is inefficient then it needs to be nationalised. If this is not the case then why should those that use it not pay for it if they have any assets. Why should their inheritance pass onto the next generation. There was the case of a women whose mother was likely to need expensive and long lasting dementia care. The complaint was she was going to have to move out of the family home that was owned by her mother. It did make me question why the mother did not sell the house to the daughter before she became incapable. The next question is why the daughter when the mother goes into care does not get a job and rent her own place. Maybe I am in the minority in thinking that my parents assets are theirs and suitable for their care should they require it with the state picking up the tab when this is gone.0

-

an entirely reasonable viewpoint but you would really have to draw up a list of afflictions that will be self funded. I think you would get consensus for self-inflicted but that would exclude dementia.john80 said:If the argument is that social care is inefficient then it needs to be nationalised. If this is not the case then why should those that use it not pay for it if they have any assets. Why should their inheritance pass onto the next generation. There was the case of a women whose mother was likely to need expensive and long lasting dementia care. The complaint was she was going to have to move out of the family home that was owned by her mother. It did make me question why the mother did not sell the house to the daughter before she became incapable. The next question is why the daughter when the mother goes into care does not get a job and rent her own place. Maybe I am in the minority in thinking that my parents assets are theirs and suitable for their care should they require it with the state picking up the tab when this is gone.

0 -

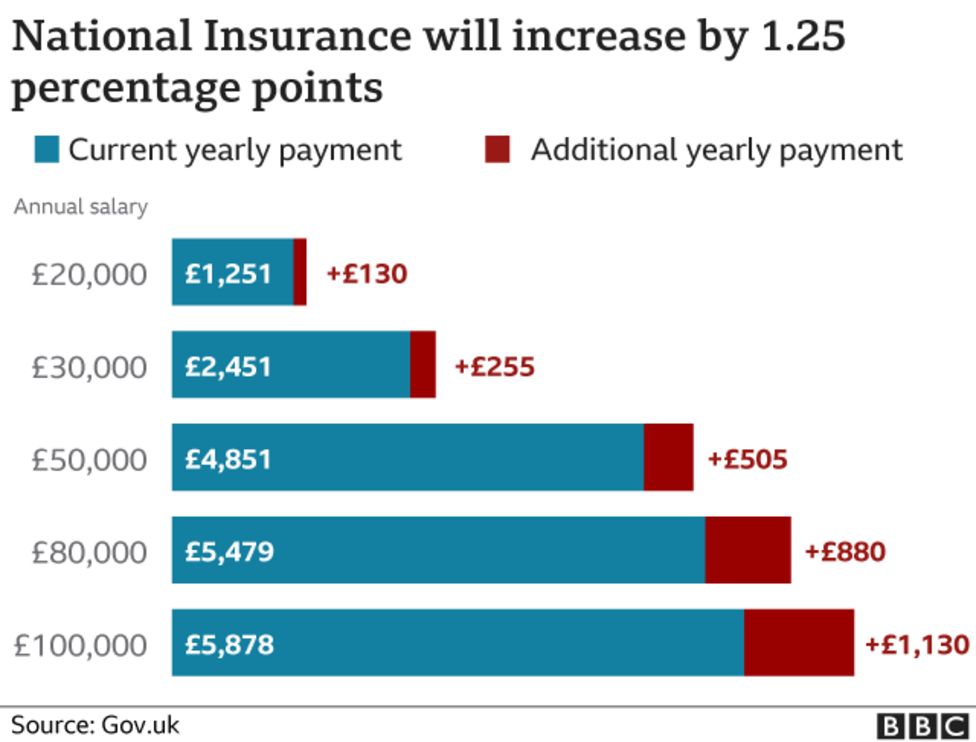

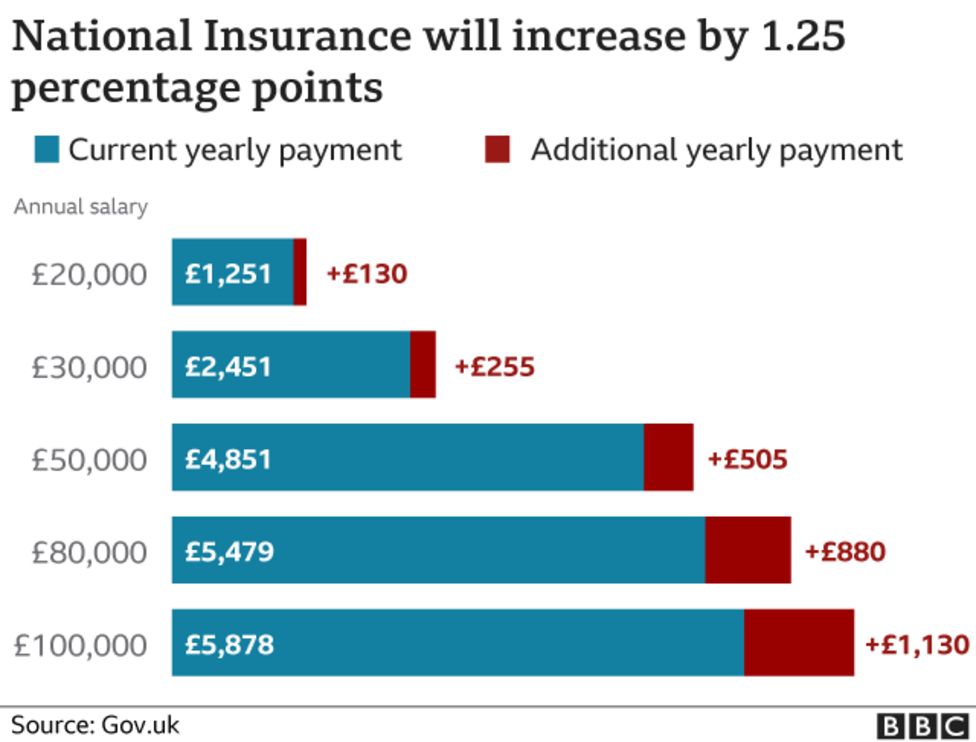

more to the point, as the chart below shows, the rise in ni ranges from c. 10% to c. 20% over the included rangekingstongraham said:Isn't calling it a 1.25% rise a bit disingenuous when it's a 1.25% rise for both employers and employees?

claiming it to be 1.25% is deliberate deception, as to be expected from johnson the liar and his cabal

my bike - faster than god's and twice as shiny0 -

I don't think you have understood.sungod said:

more to the point, as the chart below shows, the rise in ni ranges from c. 10% to c. 20% over the included rangekingstongraham said:Isn't calling it a 1.25% rise a bit disingenuous when it's a 1.25% rise for both employers and employees?

claiming it to be 1.25% is deliberate deception, as to be expected from johnson the liar and his cabal

It is a new 1.25% levy. There is nothing at all disingenious in stating it as that, because that is what it is. It is the way all tax changes are ever stated.

You don't say the basic rate of tax is 20% and the higher rate is a 100% increase.0