Public debt - how much is too much?

rick_chasey

Posts: 75,660

Comments

-

That's one aspect.

Underlying strength of the economy

Education & Skill sets of the population

Tax environment and how it compares with the geographical neighbours

Population growth

Legacy issues towards uncapped liability. Healthcare, pensions, welfare payments

Of course we all know less debt is preferable as legacy debt incurred when economies are growing is one thing, servicing the debt when market forces realign is another thing altogether.

But it underlines the short term game politicians play. Good governance and a low public debt never won an election but leveraging that position to make short term gains will. The note from the labour minister stating there was no money left was an extreme example of this. “Give a man a fish and feed him for a day. Teach a man to fish and feed him for a lifetime. Teach a man to cycle and he will realize fishing is stupid and boring”

“Give a man a fish and feed him for a day. Teach a man to fish and feed him for a lifetime. Teach a man to cycle and he will realize fishing is stupid and boring”

Desmond Tutu0 -

The difference between the UK and Norway....

Norway is a Socalist state that produces 99% of its electricity from hydropower and invested it's revenue from oil and gas into Schools, hospitals, etc.

UK is capitalist. Totally dependant on fossil fuels like a crack addict and all the revenue from oil and gas goes to some privatised company CEO. Also, the bankers make money from loans/debt. It makes me laugh when people go on about our nation debt, it's what our entire economy is based on, you'll have to change the system to get rid of the debt."The Prince of Wales is now the King of France" - Calton Kirby0 -

Slowmart wrote:That's one aspect.

Underlying strength of the economy

Education & Skill sets of the population

Tax environment and how it compares with the geographical neighbours

Population growth

Legacy issues towards uncapped liability. Healthcare, pensions, welfare payments

Of course we all know less debt is preferable as legacy debt incurred when economies are growing is one thing, servicing the debt when market forces realign is another thing altogether.

But it underlines the short term game politicians play. Good governance and a low public debt never won an election but leveraging that position to make short term gains will. The note from the labour minister stating there was no money left was an extreme example of this.

Disagree, Cameron just won an election on cutting debt and Osborne is, right now, cutting budgets to departments right now, local gov will take the hit and that ll knock on to ed and health.

and our skills shortage will just grow an grow, as we continually dont invest in education, or rather state education and as the ruling elite dont use that sector, it wont change.

Dont see what was basically a joke by an embittered and stupid ex minster is anything to do with public debt and political gain, infact exact opposite.0 -

ben@31 wrote:The difference between the UK and Norway....

.

Norway has a population of just over 5 million. London is in excess of 8.5 million.

Which leaves massive headroom from their pool of natural resources which helps derive an annual income of $294 billion with an expenditure of $230 billion.

Access to low cost energy is a massive boost to their vibrant private sector

The outcome of the improved quality of life is better understood if you look at the mechanics of the country rather than the political or economic system.“Give a man a fish and feed him for a day. Teach a man to fish and feed him for a lifetime. Teach a man to cycle and he will realize fishing is stupid and boring”

Desmond Tutu0 -

mamba80 wrote:Slowmart wrote:That's one aspect.

Underlying strength of the economy

Education & Skill sets of the population

Tax environment and how it compares with the geographical neighbours

Population growth

Legacy issues towards uncapped liability. Healthcare, pensions, welfare payments

Of course we all know less debt is preferable as legacy debt incurred when economies are growing is one thing, servicing the debt when market forces realign is another thing altogether.

But it underlines the short term game politicians play. Good governance and a low public debt never won an election but leveraging that position to make short term gains will. The note from the labour minister stating there was no money left was an extreme example of this.

Disagree, Cameron just won an election on cutting debt and Osborne is, right now, cutting budgets to departments right now, local gov will take the hit and that ll knock on to ed and health.

and our skills shortage will just grow an grow, as we continually dont invest in education, or rather state education and as the ruling elite dont use that sector, it wont change.

Dont see what was basically a joke by an embittered and stupid ex minster is anything to do with public debt and political gain, infact exact opposite.

Cameron won because Ed came across as a privileged socialist who hasn't done a proper days work in his life. How could he connect with the population? He also came across as a knob. End of. The choice of the least poo covered end of a stick where both ends were covered .

I agree with the education side but your missing the point of the thread? I was touching on the circular aspects and short termism of collective governments who spend today for the flowing government to deal with. Legacy debt and how much public debt is too much?

The note was symbolic of that attitude.......nothing more.“Give a man a fish and feed him for a day. Teach a man to fish and feed him for a lifetime. Teach a man to cycle and he will realize fishing is stupid and boring”

Desmond Tutu0 -

Alright, since you lot seem to struggle to read.The IMF's economists reckon that if a government could choose between having high or low debt today, then all else equal they would (and should) choose the latter. After all, when debt is high governments have to impose unpleasant taxes to fund spending on debt-interest payments. These taxes are a drag on the economy.

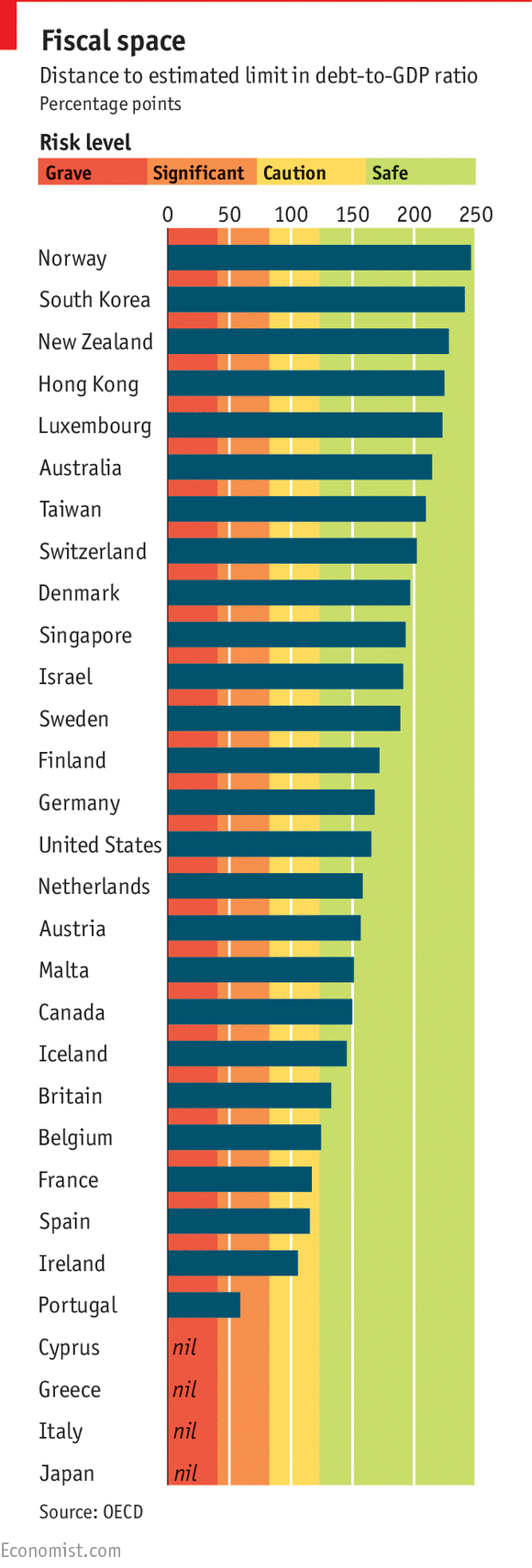

andBut when a government is faced with a high debt load, is it better to impose austerity and pay it down, or take advantage of low interest rates to invest? The answer depends on the amount of “fiscal space” a government enjoys. This concept refers to the distance between a government’s debt-to-GDP ratio and an “upper limit”, calculated by Moody’s, a ratings agency, beyond which action would have to be taken to avoid default. Based on this measure, countries can be grouped into categories depending on how far their debt is from their upper threshold: safe (green), caution (yellow), significant risk (amber) and grave risk (red). It is a decent measure of how vulnerable a government’s finances are to a shock.

and finally.For those countries with no headroom (in the red or amber zone on the chart), the IMF’s paper is not much use: they need to take action to reduce their borrowing levels. But for countries well into the green zone (of which America is a star performer and Britain is a somewhat marginal case), the IMF’s analysis has a clear message: don’t worry about your debt.0 -

And re Norway.

Being a country of 5.5m and coming across enormous amounts of Oil & Gas has a fair bit to do with it.

What's different to some countries is the way that energy windfall has been managed - i.e. not put into tax breaks, thrown into a massive sovereign wealth fund & smart investment in infrastructure & training.0