Bankers again

Frank the tank

Posts: 6,553

Fcukin' 'ell never mind locking them up. Will we ever know how much this scam involving Barclays and who knows which other banks has and still possibly costing ORDINARY PEOPLE.

These b@st@rds need rooting out prosecuting,locking up and EVERY SINGLE HA'PENNY paid back plus compensation. It's an absolute disgrace.

These b@st@rds need rooting out prosecuting,locking up and EVERY SINGLE HA'PENNY paid back plus compensation. It's an absolute disgrace.

Tail end Charlie

The above post may contain traces of sarcasm or/and bullsh*t.

The above post may contain traces of sarcasm or/and bullsh*t.

0

Comments

-

And they should bring back national service whilst they're at it!!

;-)0 -

Stocks need putting up at Canary Wharf, bunch of fcukin' rats.0

-

Like noone here works in financial industries...0

-

Still can't work out why no-one is being prosecuted for fraud on this one. I was never one for jumping on the banker's bonus band wagon but this is far worse.0

-

ShutUpLegs wrote:Like noone here works in financial industries...

Fair few do over the commuter way.

Some people on here even spend all day talking to the very people in question.

It's pretty bad.

Problem is, as much as people want to vilify them, and don't get me wrong, it's not ethical - these things are so abstract and intangible that it's difficult to associate LIBOR rate fidling to theft or anything genuinely awful.

I bet 99% of us hadn't even heard of the LIBOR untill yesterday, and I bet most of us (me included) don't actually know what it means day to day.

From my position I can't help but think that this particular thing has happened almost on a daily basis - though I have no proof of that. I wasn't surprised to see that 20 banks are being investigated. This is just the first shoe to drop.

Putting them in cuffs would be token.

There needs to be more surveillance of all financial instruments and trading if this is to stop. I'm not sure that's practical at the moment.0 -

Pross wrote:Still can't work out why no-one is being prosecuted for fraud on this one. I was never one for jumping on the banker's bonus band wagon but this is far worse.

They're still trying to work out who did what first.

Doing traders for fraud is tougher than doing Avon Barksdale for drugs and it's very lengthy and costly.

Anyone who gets don't will be token at best.

This is all stuff from before the crash too.0 -

I blame Wiggle.0

-

And they're all Nazis0

-

From how it's being broadcast (that's what I have to go by) what has gone off would have resulted in people being overcharged on mortgages/loans and it would also have had a big effect on people trying to run businesses big/small.

It was say they can expect a raft of civil suits coming from the USA. I just hope that EVERYONE will get some form of recompence and not just big organisations that can afford the legal battles.Tail end Charlie

The above post may contain traces of sarcasm or/and bullsh*t.0 -

Yossie wrote:And they're all Nazis

No they're not.

At least people knew where they stood with the Nazis. The bankers will f**K anyone over. :evil:Tail end Charlie

The above post may contain traces of sarcasm or/and bullsh*t.0 -

Pross wrote:Still can't work out why no-one is being prosecuted for fraud on this one. I was never one for jumping on the banker's bonus band wagon but this is far worse.

Might be that someone went to school with someone else and thought that he was a "jolly decent chap", or perhaps he admits that he was an "absolute bounder" but happened to be in the same house ( pronounced 'hise'), don't you know.

Ok, it's stereotyping to the extreme, but as the 'ordinary bloke' I can't help feeling that a lot of people are p1ssing in the same pot.

The older I get, the better I was.0 -

Capt Slog wrote:Pross wrote:Still can't work out why no-one is being prosecuted for fraud on this one. I was never one for jumping on the banker's bonus band wagon but this is far worse.

Might be that someone went to school with someone else and thought that he was a "jolly decent chap", or perhaps he admits that he was an "absolute bounder" but happened to be in the same house ( pronounced 'hise'), don't you know.

Ok, it's stereotyping to the extreme, but as the 'ordinary bloke' I can't help feeling that a lot of people are p1ssing in the same pot.

I hope you're not suggesting there is some kind of "old boys" network going off......................in this country?..........In banking?.................among the upper echelons?

PERISH THE THOUGHT "SLOG".............Now throw another bankrupt on the fire.Tail end Charlie

The above post may contain traces of sarcasm or/and bullsh*t.0 -

Frank the tank wrote:

I hope you're not suggesting there is some kind of "old boys" network going off......................in this country?..........In banking?.................among the upper echelons?

PERISH THE THOUGHT "SLOG".............Now throw another bankrupt on the fire.

Hmm, you think I might be onto something?

Whatever is going on, I'll bet they know nowt about "dotty huckna"

The older I get, the better I was.0 -

Sadly a big chunk of our economy is based around these thieving scumbags and if we piss them off too much they''ll up sticks and go somewhere with much much less regulation.

That's a scary possibility!0 -

TheEnglishman wrote:Sadly a big chunk of our economy is based around these thieving scumbags and if we wee-wee them off too much they''ll up sticks and go somewhere with much much less regulation.

That's a scary possibility!

The Isle of Man?

The older I get, the better I was.0 -

TheEnglishman wrote:Sadly a big chunk of our economy is based around these thieving scumbags and if we wee-wee them off too much they''ll up sticks and go somewhere with much much less regulation.

That's a scary possibility!

They said that when the 50p rate was introduced.

Very very few left, and those that did probably would have anyway.0 -

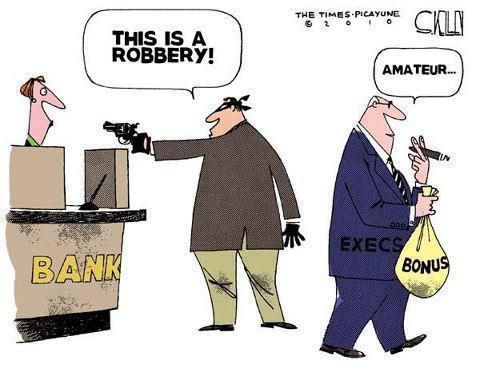

Says it all really.....

“You may think that; I couldn’t possibly comment!”

“You may think that; I couldn’t possibly comment!”

Wilier Cento Uno SR/Wilier Mortirolo/Specialized Roubaix Comp/Kona Hei Hei/Calibre Bossnut0 -

Capt Slog wrote:Frank the tank wrote:

I hope you're not suggesting there is some kind of "old boys" network going off......................in this country?..........In banking?.................among the upper echelons?

PERISH THE THOUGHT "SLOG".............Now throw another bankrupt on the fire.

Hmm, you think I might be onto something?

Whatever is going on, I'll bet they know nowt about "dotty huckna"

Seriously, are you local to my area?Tail end Charlie

The above post may contain traces of sarcasm or/and bullsh*t.0 -

Diamond has gone. His successor is likely to be a guy called Rich Ricci. I'm not making this up."That's it! You people have stood in my way long enough. I'm going to clown college! " - Homer0

-

MaxwellBygraves wrote:Diamond has gone. His successor is likely to be a guy called Rich Ricci. I'm not making this up.

For now though, it appears that Agius has returned to the fold to take over from Diamond, despite having stood down himself a few days ago. It's all getting a bit complicated, so I may stop following the Barclays saga on BBCi and opt for something simpler to unravel in order to give my brain a rest, e.g. string theory or trying to fathom out the Dirac Equation.

David"It is not enough merely to win; others must lose." - Gore Vidal0 -

Boy gets 6 months for stealing a bottle of water during the August riots and bankers get away with ruining the economy, making millions suffer and fixing things between themselves. We are taking the brunt of the recession as a direct result of financial hedonism and greed, yet the top 10% of earners are almost definately not experiencing any reduction of their standard of living.

String the bastards up. Saying that we have no idea what went on in the higher echelons (Rick C) is no excuse for a rampant lack of integrity at the highest possible level.

Someone also mentioned that they would up sticks and leave ?!? Thats like the pathetic tory argument which justifies the bonuses on account that you won't get the right pople in the job if you do not offer them these incentives. One major flaw in that argument: we do not have the right people in the job now which also suggests that we are not capable of putting the right people into the job with the right sense of responsibility and morality.seanoconn - gruagach craic!0 -

pinarello001 wrote:Thats like the pathetic tory argument which justifies the bonuses on account that you won't get the right pople in the job if you do not offer them these incentives. .

There was something on the tele that mentioned that of all the 'right people' only one left to work abroad - the rest accepted lower pay/bonuses.

To quote the great barry keefe

"Life is a sh1t sandwich - the more bread you've got the less sh1t you have to eat"The dissenter is every human being at those moments of his life when he resigns

momentarily from the herd and thinks for himself.0 -

Rick Chasey wrote:ShutUpLegs wrote:Like noone here works in financial industries...

Fair few do over the commuter way.

Some people on here even spend all day talking to the very people in question.

It's pretty bad.

Problem is, as much as people want to vilify them, and don't get me wrong, it's not ethical - these things are so abstract and intangible that it's difficult to associate LIBOR rate fidling to theft or anything genuinely awful.

I bet 99% of us hadn't even heard of the LIBOR untill yesterday, and I bet most of us (me included) don't actually know what it means day to day.

From my position I can't help but think that this particular thing has happened almost on a daily basis - though I have no proof of that. I wasn't surprised to see that 20 banks are being investigated. This is just the first shoe to drop.

Putting them in cuffs would be token.

There needs to be more surveillance of all financial instruments and trading if this is to stop. I'm not sure that's practical at the moment.

LIBOR - London Interbank Overnight Rate... You don't know what it is?! You work in the bloody Square Mile!Do not write below this line. Office use only.0 -

Rick Chasey wrote:TheEnglishman wrote:Sadly a big chunk of our economy is based around these thieving scumbags and if we wee-wee them off too much they''ll up sticks and go somewhere with much much less regulation.

That's a scary possibility!

They said that when the 50p rate was introduced.

Very very few left, and those that did probably would have anyway.

Many smaller players like hedge funds have already upped sticks to Geneva etc but it's much more difficult for an enormous supertanker operation like an investment bank, they employ thousands of people and rely on a complex network of service providors based in the vicinity... Much as they threaten and bleat about the 50p taxe rate it would take a lot more for them to actually shift all European operations out of London. For a start where would they go? Paris? Frankfurt? The French have implemented a 99c in the Euro tax rate (or something like that) for top earners and voted in a Socialist government. Both France and Germany have very strict and inflexible work regulations and unions, this makes them both unattractive.

Paris and Frankfurt are the nearest threats to London in terms of banking infrastructure and currently both of them combined do not add up to half the banking transactions that take place in London. Not to mention that London has the benefit for major US banks and institutions in that it's in an English speaking country. If banks want to do business in Europe, they're likely to stay in London. The biggest threat to London/Europe is the general decline of the economies of the western world and the relative increase in business in Asia. That will ultimately cause a general drift away from banking and finance in London towards centres like HK, Beijing and Singapore but this will be a fairly gradual process.Do not write below this line. Office use only.0