2024 UK politics - now with Labour in charge

Comments

-

Initially I thought it would need international agreement, but the more i think about it, the less I think that is the case, though international agreement would help.

Starbucks (one of the very guilty parties) aren't going to pull out of the UK because of it as they have invested too much here. Likewise Amazon who have built a lot of infrastructure here.

Obviously the rate charged on turnover is going to be less than the rate charged on profit.

0 -

I'd go back to the pre-LTA regime for self-provision (no change to auto enrolment) and change from there if helpful to population-level retirement savings, in a process independent from the need to raise more tax revenue, for which income tax is by far the best way of raising tax fairly.

0 -

You mentioned a multiple (or percentage) of earnings as being the maximum you could pay in, IIRC.

So someone earning £20,000 pa would have a lower annual allowance than someone earning say £60,000 pa.

Pre A-Day in 2006 contributions fell into one of 8 regimes and were restricted to a percentage of earnings. The annual allowance was then introduced in 2006 giving an absolute figure of upto to the lower of your annual earnings or the annual allowance.

0 -

Your proposal of 20% of earnings, which is less than the current limit of 100% (up to £60k).

0 -

Ooh, a tax debate. Haven't had one of those for a long time 😊 Ironically I've been too busy on multinational tax affairs to reply this morning...

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Agree with your second paragraph that these rises are decided by people who haven't got much of a clue about running a business.

On your first paragraph, that is just plain wrong. Here is a link to the latest HMRC report on the 'tax gap' - which is the difference between what amount of tax would be paid in a perfect world (from an HMRC perspective where everyone paid what was due etc) and what is actually collected:-

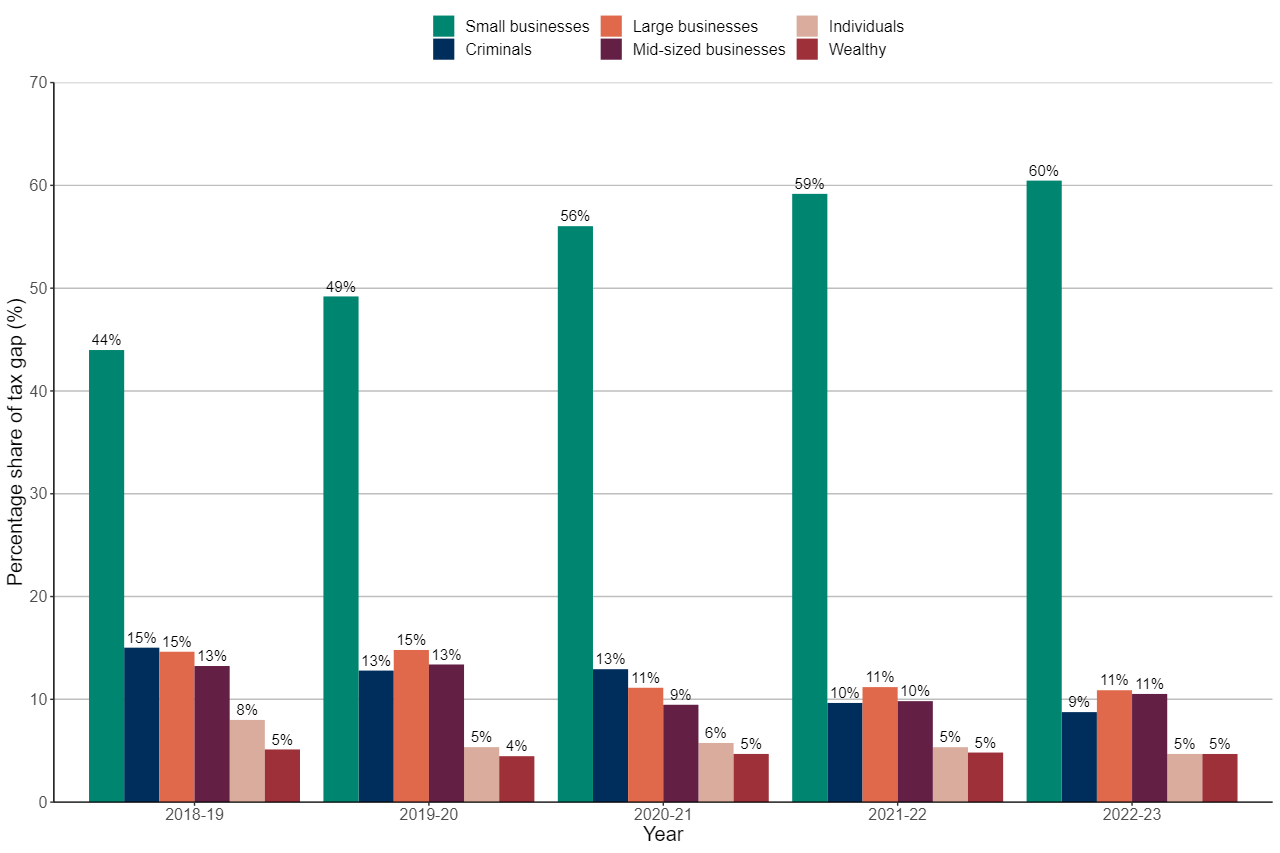

The graph above splits the gap by customer type and small businesses (presumably ones like yours*) account for the large majority of the tax gap - 60% of the total and more than 5X that due to large businesses.

* For info, HMRC defines small and medium business as follows "A small business has less than 50 employees and a turnover of less than £10m. A medium business has less than 250 employees and turnover under £50m."

Also, can you fill us in on who you think gets to decide what is 'fair'?

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]1 -

That's rather a different question than the point DB made about loans between subsidiaries.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

The transfer pricing and thin capitalisation regs have been around and pretty effective for years to counter that and the more recent OECD Global minimum tax rules have made meant that corporate tax havens are effectively a thing of the past.

Taxing on turnover sounds all very well but low margin businesses would have a major problem with that. That's the main reason that it generally does not happen.

As for taxing multinationals like domestic companies I don't get that, as a multinational is just a group of various domestic companies spread across several countries with common ultimate ownership. How do you see that working?

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

It already is - see my post above. I have international anti-avoidance coming out of my ears.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

I've addressed that one separately.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]1 -

Those figures are addressing a completely different topic. MG said that the methods in question (whatever they are) were legal, so there wouldn't be any tax gap created by them.

0 -

So HMRC think that small busiesses only pay 40% of the tax they should be paying. Where do they think the small businesses are hiding their profits? I'm sure those of us running small businesses would love to know the answer.

0 -

Hmm, really not sure that's right.

Starbucks, as a prime example, have been exposed for manipulating their profits in different countries through the use of 'loans' between their trading entities in different countries. These 'loans' have ensured minimal declared profits in certain countries (UK being one), and increased profits in another.

They are not the only multi-national exposed for doing that.

0 -

Avoidance is legal - just not what HMRC likes - and so is part of the tax gap. You're thinking about tax evasion (which is illegal and also part of the tax gap.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

No, they account for 60% of the total tax shortfall.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Payment in cash probably covers a lot of that.

1985 Mercian King of Mercia - work in progress (Hah! Who am I kidding?)

Pinnacle Monzonite

Part of the anti-growth coalition0 -

The Starbucks case was around royalty payments. Which were found to be arms length as Starbucks won the court case. It was also found that the royalties paid to one of their Netherlands group companies were not given selective treatment in that country. So what they were doing was not just legal but priced and tax appropriately in line with EU principles - despite much bleating from likes of the Guardian and others who didn't like the outcome.

"I spent most of my money on birds, booze and fast cars: the rest of it I just squandered." [George Best]0 -

Interesting, thanks.

What kinds of legal things would be included in the shortfall for small businesses?

0 -

Ignore that - here's a breakdown of the tax gap, and only 4% of it is avoidance. Another 10% is legal interpretation differences.

0 -

You are right Stevo and make a fair point. I would say though (and I am sure you know this already) that the largest reason for the tax gap is failure to take reasonable care and general error, so I would suspect a significant proportion of the gap applicable to small businesses is poor but not fraudulent accounting practice.

As you rightly suggest there is tax avoidance and tax evasion. I am referring specifically to the practices of multinationals who operate a deliberate practice of legal tax avoidance. When using the word fair, I mean more in terms of morally justifiable. I am thinking along the lines of the examples outlined below.

Some might say it is splitting hairs, but I think there is a difference in billions lost in revenue due to poor accounting and genuine error, which can be rectified with good guidance, and billions lost due to legal avoidance.

0 -

Meh it has the strong stink of a slightly convoluted way of reducing the companies tax burden, and one that is only open to multi nationals.

0 -

Thanks. I answered my own question shortly after posting and re-wrote my response. You were quick off the mark!

1 -

On Starbucks and their loans etc between their different companies, courtesy of www.taxwatchuk.org. It may be legal but it is avoidance and a prime example of what multi-nationals do, and hence why the need to tax them on turnover not profit declared in the country:

Starbucks UK

Starbucks was a name that became synonymous with tax avoidance after Tom Bergin at Reuters revealed the low tax payments the company had been making in an article published in 2012. Tom and his colleagues had noticed that although the accounts of Starbucks in the UK stated that the company had not made a profit since the chain first opened in the UK in 1998, senior company officers had been regularly telling investors that the UK market was profitable for the group. Over that period, Starbucks in the UK had paid a small amount of tax despite its losses, mainly because some costs were not deductible for corporation tax purposes.

The reason for the difference between the losses shown in the UK accounts, and the statements made by senior managers, was in payments the UK company had to make to other Starbucks companies for coffee, the use of the Starbucks brand and interest on loans the company had taken out from other Starbucks companies.

A glance at this year’s UK accounts (2018) shows that little has changed. The UK company, Starbucks Coffee UK, continues to make a loss and the company paid £4m in tax due to the fact that it could not count some of its losses against corporation tax.

As before, the story being told in the accounts seems difficult to believe. In 2018, Starbucks filings in the US tell us that globally the company made a 15% profit on every cup of coffee they sold. The UK accounts tell us that selling Starbucks Coffee in the UK continues to be unprofitable. Make of that what you will.

0 -

I think this is a very theoretical risk. The issue with the lower paid and pension provision is lack of contributions, not being constrained by contribution limits. This was the reason for auto-enrollment.

0 -

The original Tom Bergin article: https://www.reuters.com/article/economy/special-report-how-starbucks-avoids-uk-taxes-idUSDEE89E07A/

0 -

I think the 40% is the proportion of the total tax gap that arises from the small business sector.

0 -

Isn't the problem here that "avoidance" means all things to all men?

The HMRC definition is along the lines of using a scheme that is set up solely to reduce tax. There was a high profile one involving making loans to loss-making film productions a few years ago. AFAIK, these have been largely stamped out.

The mainstream media seem to define avoidance at a personal level as having any kind of income not taxed at the highest rate of income tax (with particular ire aimed at anyone in the private sector who has a large pension pot) and at a corporate level as any legal corporate structure that results in a lower average rate of tax than they have plucked out of the air as being "fair".

Lunatics have started included long-standing corporate taxation rules - e.g. capital allowances on investments - in their definition of "corporate welfare" / "avoidance".

0 -

Yes, someone else pointed that out too.

I suspect HMRC don't want shareholder directors to pay themselves a low wage and high dividends and that forms a chunk to their tax gap. I struggle to see how else small companies add to the tax gap.

There are also far, far more small companies than large ones.

0 -

What percentage of total potential tax revenue do they cover though? A quick search suggests that 61% of employees are in SMEs, others will be in public sector employment etc. so is the graph simply reflecting that? (genuine question).

0 -

Unless I'm missing something, your proposal would reduce the maximum amount of tax relief available to all those earning under £270k and massively increase it for those earning over £300k pa.

0